What is ChatGPT?

The next generation of artificial intelligence (AI) has reared its head. ChatGPT, developed by OpenAI, and released in November 2022, is the latest and most advanced system transforming work and sharing the future of technology.

One of the latest disruptors of the technology and communications sectors, ChatGPT, can go as far as passing exams, medical licensing, or university programs, which is why entrepreneurs, businesses, and industries are experimenting with this new technology. The hope is ChatGPT will boost productivity and streamline processes. With the ability to streamline communications and interact conversationally, ChatGPT performs a range of activities from writing to coding and provides dialogue formats, which allow for explaining complex topics, offering follow-up questions, admitting mistakes, and can reject requests. In the words of Elon Musk, “ChatGPT is scary good. We are not far from dangerously strong AI.” And while ChatGPT is not foolproof, it’s causing a stock market ruckus as investors race to see just how viable this investment will be.

Best AI Stocks to Buy: ChatGPT

Staying ahead of the competition in technology means forging a path through digital advancements. By way of machine learning and artificial intelligence, as tech revolutionizes industries by offering simplified, quicker, and cost-effective solutions, leveraging computers to mimic human intelligence offers competitive advantages that many businesses wish to seize.

The power of ChatGPT is still being developed and understood. As I referenced in AI Disrupts Industries: 3 Tech Stocks to Buy,

“AI technology can benefit from increased efficiency, cost savings, enhanced decision-making, scalability, competitive advantages, and improved customer experiences, making them more attractive to investors, customers, and employees. In addition to the underlying markets that keep expanding and are ripe for growth, the cross-selling of solutions, use of the cloud, and benefits provided by AI as best-in-class technology is becoming more deeply entrenched in its customer base and businesses.”

And while ChatGPT’s impact on industries requires more time to build, some of the potential risks facing the use of ChatGPT involve possible data branches, cybersecurity concerns, Ai lacking the human element – emotional intelligence – and ethics. Some instances of ChatGPT offer the ability to cheat academia, which poses concerns. And while these concerns are warranted, the tech and communications sectors, which have fallen from peaks, still offer stocks rated Strong Buys.

When investing in AI, the key is capitalizing on the extraordinary demand, finding top stocks with exposure to ChatGPT, and identifying whether the company’s underlying fundamentals are ripe for growth. Using SA’s quant metrics and factor grades, I selected a Top Communications Stock and a Top Tech Stock amid companies rolling out ChatGPT as potential winners. Two strong buy-rated stocks focused on ChatGPT, one whose business growth, paired with its company’s digital ad go-to-market capabilities and strategic partnership with Microsoft’s Bing search engine, make it an optimal buy for consideration. The second is at the core of powering ChatGPT by developing the leading-edge systems – the infrastructure – needed by generative AI like ChatGPT needing high-performance server and storage solutions.

1. Perion Network Ltd. (NASDAQ:PERI)

-

Market Capitalization: $1.54B

-

Quant Rating: Strong Buy

-

Quant Sector Rating (as of 5/15/23): 13 out of 252

-

Quant Industry Rating (as of 5/15/23): 2 out of 35

Israeli-American ad tech communications provider Perion Network offers digital solutions to capitalize on its three pillars: search, social, and display/CTV. With a diversified portfolio focused on capturing new users, engaging them, and convincing them that Perion’s focus on the future and technology offers competitive advantages, PERI’s use of Ai for website monetization helps source traffic in smart ways, and its unique platforms help protect it from the marketplace disruption.

Following consecutive, better-than-expected earnings results, Perion’s integration of generative artificial intelligence or generative AI used in creating text, media response prompts, and streamlining communication is a tech advancement that signals a significant advance in the user funnel and experience. The ability to generate high-quality text, images, and other content in a fraction of the time offers the ability to garner more users and respond to current users in anticipation of generating more growth and profits.

Perion Network Stock Growth & Profitability

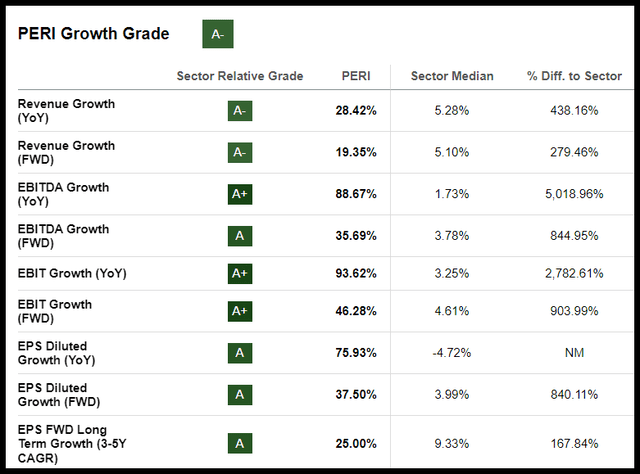

Perion Network has experienced stellar growth. As evidenced by 16 consecutive top-and-bottom-line earnings beats, the most recent earnings results included an EPS of $0.48, up by $0.07, and revenue of $145.15M beating by nearly 16% year-over-year and net profits up 45%, resulting in five Wallstreet analysts revising their estimates up over the last 90 days. Stellar factor grades, which rate a stock’s investment characteristics on a sector-relative basis, PERI’s growth grade is highlighted below, along with its primary growth drivers.

PERI stock showcases excellent growth grades, with A’s nearly all across the board.

PERI Stock Growth Grades (SA Premium)

In addition to revenue and EBITDA growth that is substantially above its sector peers, some of the growth drivers aiding the company include:

-

CodeFuel, aka Perion’s cash cow is Perion’s search technology division that generates nearly half of Perion’s revenues and profits by leveraging search, ads, shopping, and news for monetization.

-

Direct response search advertising

-

Retail Solutions

-

SORT® – Perion’s cookieless target advertising solution that connects with the audience at the exact point of seeing ads.

-

Video Platform – Using its Vidazoo concept, the goal is to market via video technology on a single platform.

-

iHUB – Proprietary tech optimization

Up more than 80% over the last year, PERI has benefited from demand, as advertisers are willing to spend more money to acquire customers. Margin expansion through PERI’s intelligent iHUB analyzes and optimizes trends for leverage to increase its customer footprint, and its differentiated growth drivers help target audiences from varying channels.

Perion Network Ltd. 1-year Trading Chart

Perion Network Ltd. (PERI) 1-year Trading Chart (SA Premium)

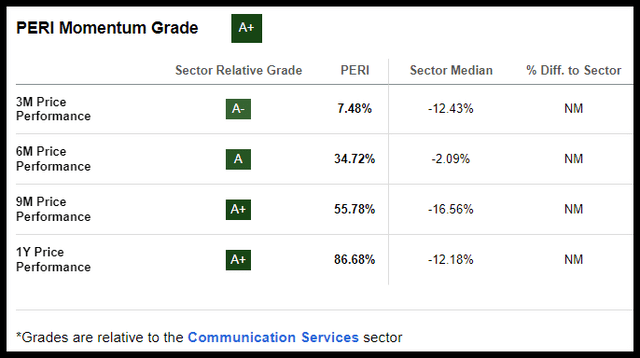

Substantially outperforming the S&P 500 and its sector peers, Perion’s share price has rallied and maintains bullish momentum. Boasting A+ momentum, whose nine-month price performance is +55%compared to the sector median -16%, this strong buy-rated stock at a discount is worth considering.

PERI Stock Valuation & Momentum

On a longer-term uptrend, PERI not only offers A+ Momentum, a significant positive quarterly price performance highlights that to outperform its peers, but the company’s valuation framework is also discounted.

PERI Stock Momentum (SA Premium)

Possessing a forward P/E ratio of 14.11x compared to the sector median of 18.72x and a forward PEG that’s a -68% discount to the sector, as demonstrated by the share price, +32% YTD and more than 80% over the last year, with a unique business model, continued innovation which include the latest ChatGPT implementation, shares are very attractive to investors that want to cash in on a growth opportunity while purchasing a stock at a discount.

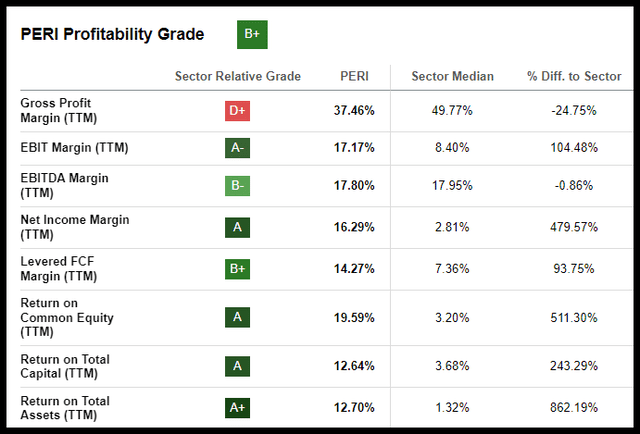

PERI Stock Profitability (SA Premium)

Although the company has experienced some headwinds, including a CEO replacement and challenging market conditions, PERI has adapted and is making strides by capitalizing on ChatGPT. With a 16% Net Income Margin (ttm), 19.59% ROE (ttm), ~13% ROC and ROA (ttm), as Perion Network CEO Doron Gerstel said during the Q4 2022 Earnings Call,

“ChatGPT is the number one technology story of the year…The advertising industry is on the cusp of a major transformation as advances in generative AI are set to revolutionize the way brands reach and engage with their target audience. This capability has the potential to dramatically streamline the advertising production process and open up new avenues for creative expression. With regard to search, our expectation is that ChatGPT will revolutionize Bing search capabilities by providing more advanced and intuitive search experiences for its users, better meeting their needs and expectations. We believe that such superior search results will increase advertiser spending and as a result, we expect to see a very positive impact on our search business.”

The addition of ChatGPT should aid the increase in customers’ ad spending, thus boosting Perion’s search business and repertoire. Although Microsoft Bing is only 3% of the global search market, according to Perion, if the trend of ChatGPT in collaboration with Bing is successful and even modest share gains occur, Perion, a small-cap stock, could be set to outperform the ad tech industry even further, continuing to reflect its strength of the business model, similar to one of my top-performing picks, Super Micro Computer Inc.

2. Super Micro Computer, Inc. (NASDAQ:SMCI)

-

Market Capitalization: $7.06B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 5/15/23): 6 out of 590

-

Quant Industry Ranking (as of 5/15/23): 1 out of 31

Super Micro Computers Inc., and its subsidiaries have done a tremendous job of capturing market share in the Ai industry, focused on its core of developing and manufacturing high-performance server and storage solutions for Ai and High-Performance Computer (HPC) workloads. These crucial server and storage solutions advancements are the key to powering ChatGPT. SMCI, which recently partnered with semiconductor behemoth NVIDIA (NVDA), announced a new AI development platform to accommodate high-performing GPUs to power the world’s fastest supercomputers. As Kingsley Park Research writes:

“Super Micro was at the center of a major AI tailwind driven by its extremely close relationship with Nvidia (NVDA). This tailwind has continued, with NVDA stock up dramatically and reports of AI server shortages in March as large enterprises and startups invest heavily in AI.”

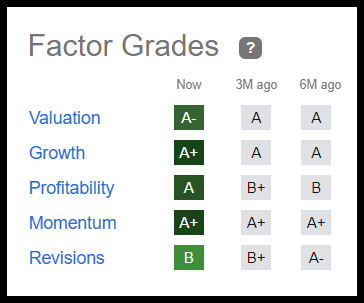

I very recently covered this stock because it is tremendous and has many tailwinds. As some investors argue that despite its bullish momentum and excellent metrics, the stock is trading near 52-week highs and may fall, I continue to be bullish for Super Micro. SMCI is strong on each of its collective metrics of valuation, growth, revisions, and profitability, an indication of a fast-growing and profitable IT company. Although the stock is +64% YTD and +162% over the last year, SMCI is extremely undervalued.

SMCI Factor Grades

SMCI Factor Grades (SA Premium)

SMCI Stock Valuation & Momentum

Trading at an extreme discount, SMCI has a forward P/E ratio of 12.98x compared to the sector 22.18x, a -41% difference to the sector, and an A+ forward PEG ratio difference of -74%. Strong growth tailwinds, given the demand for HPC solutions that accommodate artificial intelligence applications and the overall push toward ChatGPT, offer SMCI a competitive advantage, especially having key partners like NVIDIA, Intel, and AMD.

“Increased customer demands of our rack scale PnP solutions and continued expansion and transition from a server/storage hardware manufacturer to a Total IT Solutions provider. With applications like ChatGPT that heavily count on large language models or LLM and generative AI, the state of AI infrastructure business has grown rapidly. This AI momentum has benefited Supermicro greatly as we are deploying many of the world’s leading and large-scale GPU clusters,” said Charles Liang, Super Micro Founder & CEO.

With its expanding product line and solutions useful for the AI computing infrastructure, SMCI continues to grow and is capitalizing on ChatGPT and other tech trends.

SMCI Stock Growth & Profitability

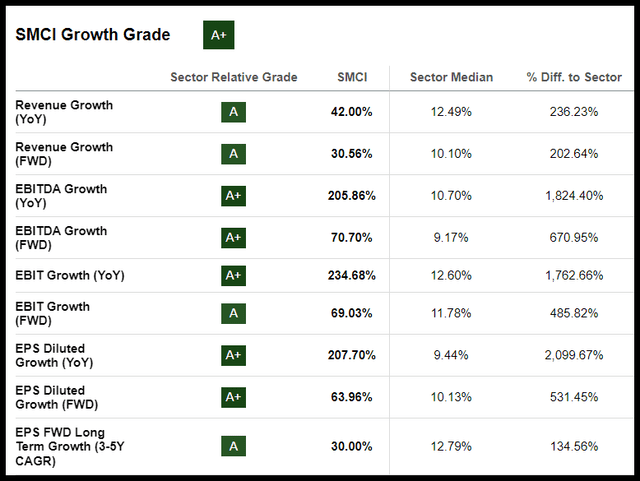

SMCI has consecutively beaten earnings estimates but fell short with an EPS of $1.63, missing by $0.08 for the third quarter. Despite the EPS miss, revenue was up more than 5% year over year, despite the challenging environment. But given the bullish momentum, leading-edge products involving AI boosted by critical partnerships, SMCI’s stellar growth and profitability grades shine.

SMCI Stock Growth Grade (SA Premium)

With continued growth, expanding margins, and solid cash from operations, SMCI’s record pace of GPU designs, and growing back orders as customers transition to bigger server/storage solutions, SMCI is ready to capture market share while deploying its Total IT Solutions. As SMCI continues to emerge as one of the largest global suppliers of Total IT Solutions, the strength of its products, technology, and continued innovation is helping to drive its revenue growth, and the same can be said for Perion Network. Consider both companies if you want a stab at some of the best and most innovative companies capitalizing on ChatGPT at the forefront of the trend.

Conclusion

Perion Network and SMCI have jumped on the ChatGPT wagon. As artificial intelligence grows in popularity, each of the company’s core revenue drivers and growth are expected to perform based on the success of the wave of generative AI. With consecutive top-and-bottom-line earnings beats, proprietary and diversified offerings, the use of innovative technologies in the optimization of each of their businesses to capture trends for growth, highlights why both companies are top stocks in their respective industries and sectors.

As ChatGPT grows in popularity, companies willing to invest to evolve hope to benefit from an automated experience that includes natural language processing algorithms to streamline repetitive processes and engage customers. With continued strong demand, both PERI and SMCI have maintained excellent profitability, continued momentum, upward analyst revisions, and strong growth, all while trading at a discount. Consider both stocks for a portfolio, as they embody some of the best of AI stocks to buy today.

Read the full article here