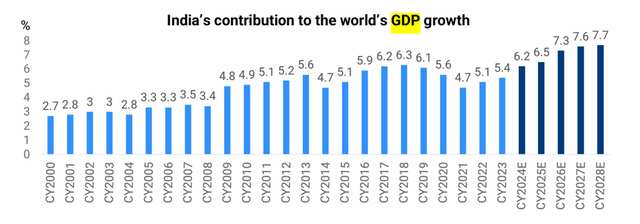

All signs indicate that the world’s “fastest-growing major economy” may finally be poised for a GDP growth slowdown. I wouldn’t be too concerned, though, as recent downgrades are more down to timing (delayed government spending amid election season last quarter), as well as weather headwinds (heat wave), rather than any sustained moderation in India’s economic momentum. Instead, I’d focus on the all-important monsoon rainfall, which is trending a lot better than last year, along with strongly expansionary manufacturing and services PMI prints, as evidence that India’s near-term growth trajectory remains firmly intact.

Edelweiss

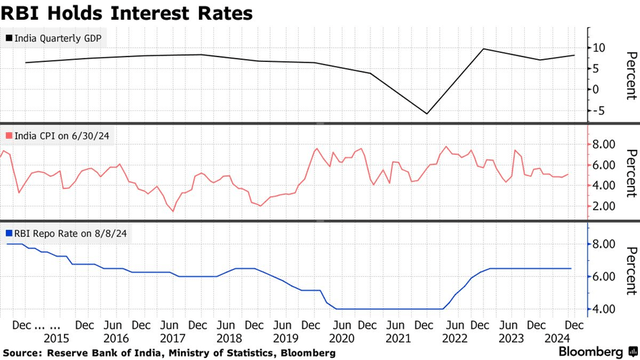

It’s also worth noting the potential for upside surprises to GDP from here. Note that, to a large extent, India’s recent growth has been achieved despite liquidity conditions constraining credit growth across the banking system (see HDFC Bank: Focus On Fundamentals Over The Upcoming $2bn Catalyst). The good news, though, is that liquidity has started turning around in recent months (with some help from the central bank), while inflationary pressures have been receding (with help from the monsoon). And with inflation-adjusted interest rates looking more restrictive than ever post-Fed pivot, the path is clear for India to kickstart its rate cut cycle in the coming months. Thus, all things considered, India’s GDP growth trajectory is probably headed for the upside rather than downside, in my view.

Bloomberg

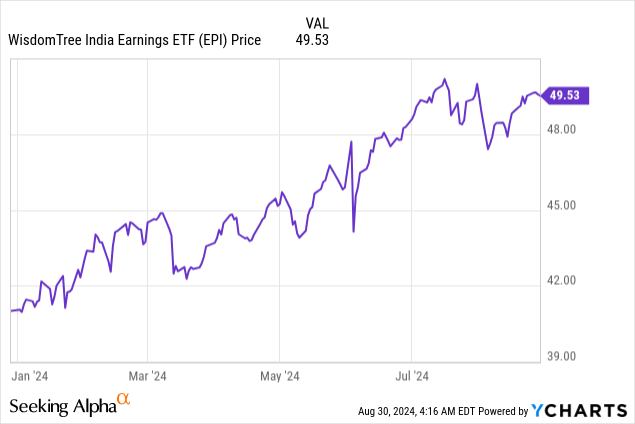

For equity investors, the prospect of high nominal GDP growth rates and easier monetary conditions means the near-term setup is perhaps as compelling as it’s ever been. Capturing the upside may be trickier, with India ETFs set to take a hit from new post-budget tax policies. That said, sticking to breadth and quality, two factors that have worked very well through PM Modi’s last two terms, should continue to pay off. WisdomTree India Earnings Fund ETF (NYSEARCA:EPI) checks these boxes and more; thus, in line with my prior coverage (see EPI: Sticking To The Fundamentals Pays Off In India), I wouldn’t look beyond EPI for ‘all-cap’ Indian exposure.

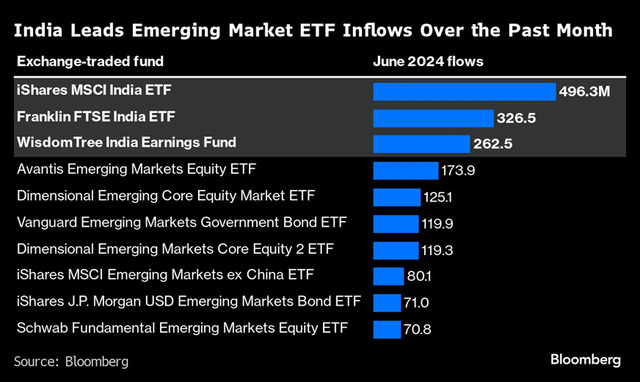

EPI Overview – A Surge of Inflows for India’s ‘Go-to’ Factor ETF

Outside of the two large-cap India funds listed in the US, namely iShares MSCI India ETF (INDA) and Franklin FTSE India ETF (FLIN), EPI has emerged as the ‘go-to’ vehicle to play India’s growth story. Per Bloomberg, the fund saw ~$263m of inflows in June alone; since then, its managed assets have grown to ~$4.1bn (up from ~3.0bn last quarter).

Bloomberg

What makes EPI’s popularity unusual is that, unlike the more conventional INDA and FLIN, EPI is both a factor (profitability-focused) and an ‘all-cap’ fund (77.7% large-cap, 16.4% mid-cap, and 5.9% small-cap). In contrast, comparable factor funds like VanEck India Growth Leaders ETF (GLIN) and Invesco India ETF (PIN) only manage $162m and $264m, respectively.

|

Assets (USD’ m) |

|

|

WisdomTree India Earnings Fund |

4,053 |

|

VanEck India Growth Leaders ETF |

162 |

|

Invesco India ETF |

264 |

Sources: WisdomTree, VanEck, Invesco

EPI’s growing asset base is key to it balancing a highly competitive cost structure with the performance benefits of a factor fund. Consider that EPI investors can now enter/exit with minimal slippage, given its best-in-class ~2bps bid/ask spread (vs ~57bps for GLIN and ~27bps for PIN). So even with a slightly higher 0.87% expense ratio (~2bps higher than before), EPI still comes out well ahead on overall cost.

|

Expense Ratio |

Bid/Ask Spread |

|

|

WisdomTree India Earnings Fund |

0.87% |

0.02% |

|

VanEck India Growth Leaders ETF |

1.09% (0.87% net) |

0.57% |

|

Invesco India ETF |

0.78% |

0.27% |

Sources: WisdomTree, VanEck, Invesco

EPI Portfolio – More of the Same

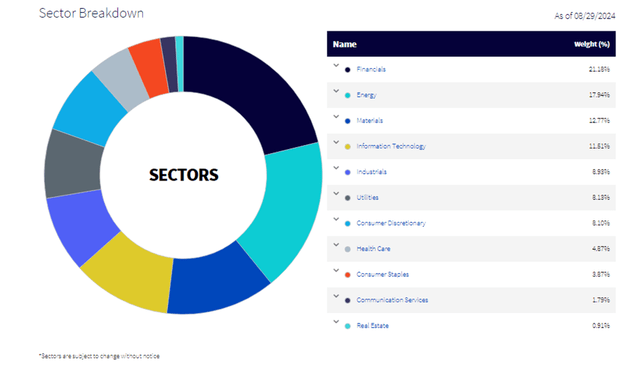

At the sector level, it’s been more of the same for EPI’s portfolio ahead of next month’s reconstitution. Financials, historically the largest exposure, has underperformed and, as a result, contributes a lower 21.2%. More cyclical sectors like Energy (17.9%), Materials (12.8%), and Industrials (8.9%), on the other hand, continue to be relative overweights here. Meanwhile, the big relative underweight is the consumer (~12% to discretionary/staples) – by comparison, conventional large-cap tracker funds like INDA and FLIN run consumer exposures closer to ~20%.

WisdomTree

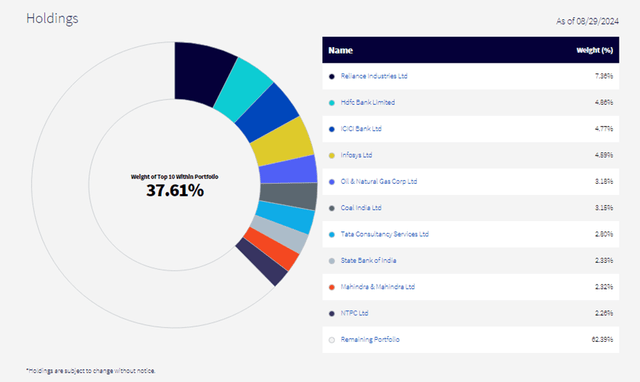

EPI’s top holdings, conglomerate Reliance Industries (RLNIY), HDFC Bank Limited (HDB), ICICI Bank Limited (IBN), and tech services company Infosys Limited (INFY), are very much in line with conventional India trackers. Where this factor ETF sets itself apart from INDA/FLIN, though, is in the profile of its smaller holdings, starting with a much larger exposure to cash-generative (but cyclical) large-caps like Oil & Natural Gas Corp Ltd (3.2%) and Coal India (3.2%), as well as to a long tail of high-growth (but profitable) small/mid-caps, many of which have rallied strongly in recent months.

WisdomTree

As for the Indian factor ETF universe, EPI’s portfolio breadth stands out. With nearly 500 holdings, EPI is far broader and more diversified than ‘all-cap’ alternative, GLIN, which, instead, opts for a more concentrated, higher portfolio turnover approach. PIN is less comparable due to its large-cap focus, though it’s worth noting that it also runs a narrower 189-stock portfolio. Given India is a market where growth is broad-based and where smaller caps tend to lead larger caps (in terms of both profit and stock price growth), EPI’s breadth may well prove to be advantageous, in my view.

|

No. of Holdings |

|

|

WisdomTree India Earnings Fund |

476 |

|

VanEck India Growth Leaders ETF |

83 |

|

Invesco India ETF |

189 |

Sources: WisdomTree, VanEck, Invesco

EPI Performance – A Winning Formula

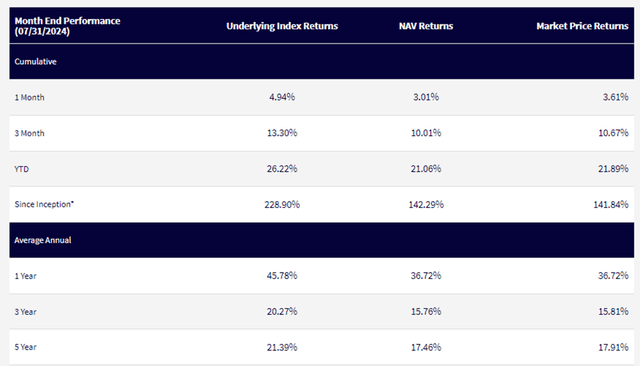

Performance-wise, it doesn’t get much better than EPI. Total returns have been consistently strong over the last decade, and this year (+21.1% to date) has been no different. In turn, the three and five -year annualized track record is now up to +15.8% and +17.5%, respectively.

WisdomTree

No large-cap ETF, including factor comparable PIN, has come close in recent years, though this comparison is perhaps unfair given ‘all-cap’ EPI has benefited from small/mid-cap outperformance. As for less-established GLIN, the other ‘all-cap’ India ETF comparable, EPI has notably trailed over the last year. Yet over longer three and five-year timelines, EPI still comes out on top – a testament to the effectiveness of its fundamentals-focused approach through the cycles.

To some extent, EPI’s outperformance makes up for its tracking error (about five percentage points year-to-date vs. its WisdomTree India Earnings Index benchmark). The problem, though, is that this gap will only get wider now that India has hiked both its capital gains and securities transaction taxes. Coupled with the many other unavoidable ‘hidden’ costs associated with investing in India (transaction costs, currency fluctuations, etc.), it’s worth being extra mindful of this performance drag from here.

|

Pre-Budget |

Post-Budget |

|

|

Capital gains tax (Short-Term) |

15% |

20% |

|

Capital gains tax (Long-Term) |

10% |

12.5% |

|

Securities Transaction Tax (Futures) |

0.0125% |

0.02% |

|

Securities Transaction Tax (Options) |

0.0625% |

0.1% |

Source: Union Budget

Summing Up

India’s GDP growth may well have slowed last quarter, but the weakness appears to be more transitory than structural, with much of the upside simply pushed out into the following quarters instead. Thus, the structural Indian investment story remains unchanged, as does the longer-term outlook for corporate profitability. Investors looking to maximize their upside should look no further than ‘all-cap’ EPI, which remains the go-to Indian factor ETF for a good reason.

Read the full article here