BioLife Solutions, Inc. (NASDAQ:BLFS) was overextended on acquisitions, some of which didn’t work out, and it led to margin compression and dilution of shareholder capital.

However, the company has divested from Sterling and will divest from the other freezer business, CBS, focusing on its core competencies.

These are mainly its preservation media where the company is a clear market leader. This market was in a cyclical downturn as funding for the CGT (Gene and Cell Therapy, its main customers) dried up as a result of the interest rate climate, but fortunately, that’s now turning around.

So we now see multiple forces producing better financial results:

- A return to growth in its legacy business, preservation media.

- Gross margin expansion as a result of divestitures and increasing scale.

- Lower OpEx as a result of selling Sterling (and more after CBS will be sold).

- The introduction of new products and renewed management concentration on cross-selling existing solutions now that the freezer problems are in the rearview mirror.

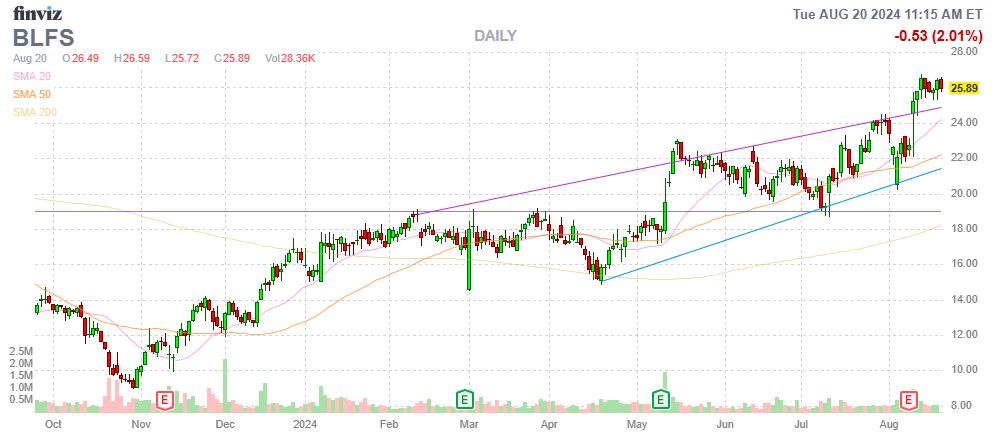

The shares have made a solid recovery on the outlook of improved finances:

FinViz

But how about the financial results themselves:

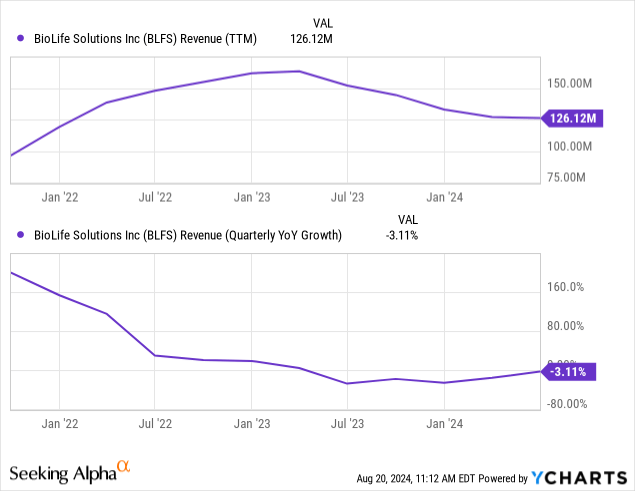

Selling Sterling in April hit revenues. Hence, the graph looks a lot worse than it is.

The positive is that there was sequential growth (+11% to $18M) in its Cell Processing business, driven by strong demand across all product lines, including biopreservation media (“BPM”), HPL growth media, and non-biopreservation products.

The worst there seems behind us as the company also increased FY24 guidance to $99M to $101M (up from prior guidance of $95.5M-$100M) with Cell Processing revenue guidance increased to $70M to $71M (up from $66M-$68.5M).

As explained in previous articles, there are multiple growth drivers:

- Secular growth in the CGT market, which is still in the early innings.

- A cyclical recovery in the CGT market as more funding becomes available.

- Winning new logos and more therapies from existing ones.

- New therapies moving through the trial stages, increasing demand as trials get larger.

- More therapies gaining FDA approval and becoming commercial.

- Cross-selling other solutions

On the market recovery (Q2CC):

On a macro level, the industry-wide headwinds that began to ease late last year continued in Q2 of this year. For BioLife, this spent less inventory destocking pressure from our larger direct customers and continued strength in our distributor revenue, which we view as a proxy for the earlier-stage research-focused market segment.

There was also solid demand from distributors (good for 35% of demand). There was also strong demand for other products, illustrating that companies are investing in a wider range of tools, but the recovery is still somewhat tentative, for instance, evo carriers have reduced their fleet sizes, and growth in storage was modest.

Its preservation media has a 70% market share (Q2CC):

We believe that we have a market share in excess of 70% of the relevant commercially sponsored clinical trials in the U.S. with approximately 45 Phase 2 and Phase 3 trials utilizing CryoStor.

And it’s used in 15 FDA-approved commercial therapies with management seeing 9 additional opportunities for customer therapies reaching the commercial stage in the next 12 months.

The company introduced a new product, CellSeal CryoCase, a cryo-compatible rigid container designed to replace standard cryo bags for the final CGT dose, from the linked PR:

Early user testing has shown comparable cell viability and recovery for multiple cell types compared to storage in existing bags and drop testing in a frozen state demonstrates high resistance to leaks or fractures. Initial testing indicates that the CryoCase may materially reduce or eliminate particulates inherent in cryopreservation bags.

According to management, the CryoCase is available for testing and customers have expressed a strong interest.

Finances

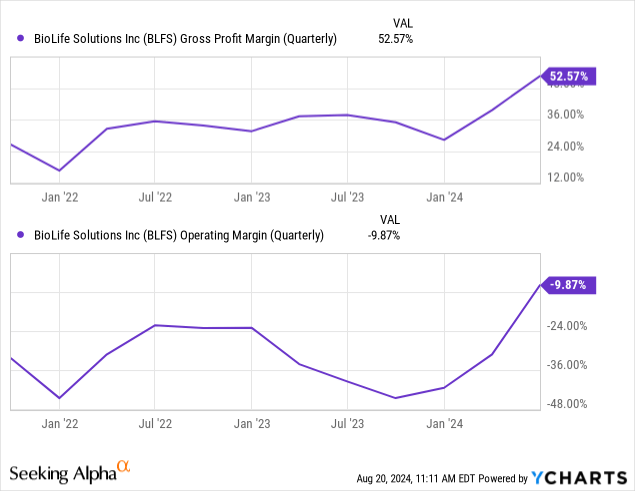

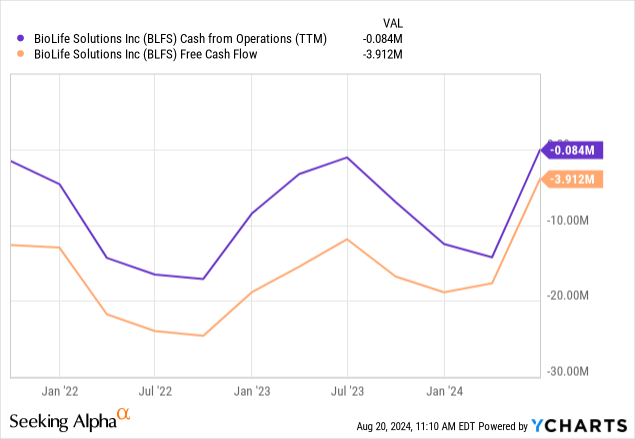

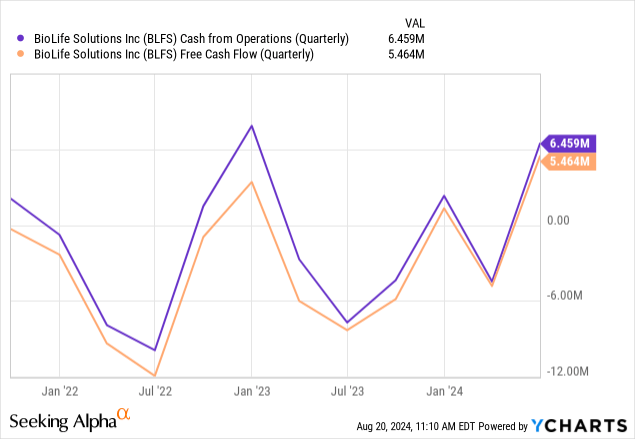

Margins improved strongly on the back of a return to growth and especially on the divestiture of Sterling. Margins will improve further with the sale of the second acquired freezer business, CBS, which is expected to close before yearend. Adjusted EBITDA was $4.8M or 17% of revenue. Cash flow also improved notably:

The improvement is clearer on a quarterly basis:

Showing that cash flow is already solid in the black. Cash stood at $36.9M at the end of Q2.

Valuation

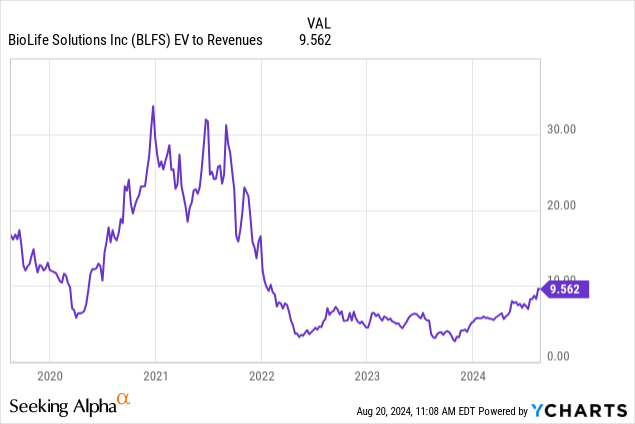

This is the ugly part:

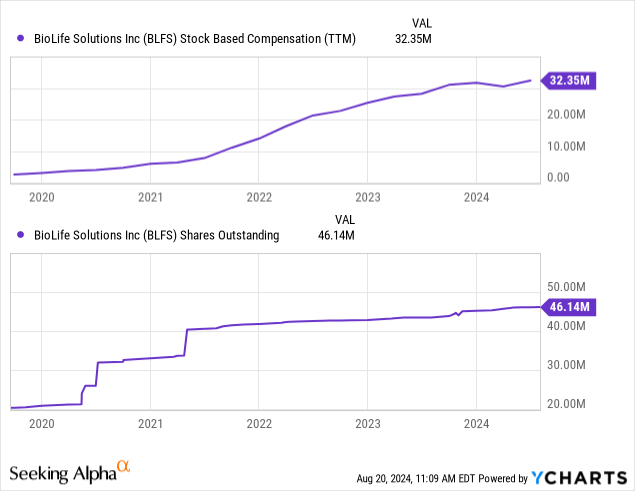

We find the $32.4M in stock-based compensation on $100M in revenue (mid-point of guidance while the average analyst expectation is for $109.7M) quite exorbitant and the share count more than doubled in five years, the result of the acquisition spree. This is a funny graph:

It shows the extremes of the pandemic and free money valuation excesses, but the 9.4x sales multiple of the present is hardly cheap either, especially as the company isn’t profitable yet (and analysts still expect losses next year with an EPS of -$0.23).

We are a little surprised at that dim analyst view for FY25, Q2 GAAP operating loss was just $2.8M which seems easily correctable on a non-GAAP basis as SBC was $5.5M in Q2. There were one-off items like a $4M change in the fair value of equity investments pushing it further into the red.

Conclusion

The company is cleaning up its act, getting rid of its low-margin freezer businesses that caused many problems (and shareholder dilution), and returning to focusing on its core business just as a turnaround seems to have arrived.

There is likely further good news ahead as that recovery takes hold, the company closes the sale of CBS, and experiences another jump in margins as a result.

We’ll probably see some further gains for the shares on the back of that good news, although we think the shares will return to their trend channel before that.

The good news isn’t a done deal though, the recovery could falter, etc., and SBC and valuation metrics are fairly steep, so BioLife isn’t the first name that comes to our mind for shareholder returns as much of the good news seems to have been priced in already despite being a long-term growth stock and a market leading company.

Read the full article here