The consumer discretionary sector, despite the narrative of a strong consumer, has been a laggard against the broader stock market. Part of this has to do with Tech dominance, which skews that performance overall, but the other part of it has to do with concerns around refinancing risk by highly levered companies in the discretionary space. With the Fed now looking like it will begin a cutting cycle, however, those concerns might dissipate, and result in the sector getting a relative boost of momentum. If you’re in that camp, you may want to consider the iShares US Consumer Discretionary ETF (NYSEARCA:IYC).

IYC is a passively managed exchange-traded fund, which aims to replicate the performance of the Russell 1000 Consumer Discretionary 40 Act 15/22.5 Daily Capped Index. The fund includes a wide range of industries, from department stores to restaurants, publishing, automobiles, and gambling. If you’re betting on the consumer, this is the pure play to do it, so long as we don’t hit a recession (in which case this is a part of the market you’d clearly want to underweight).

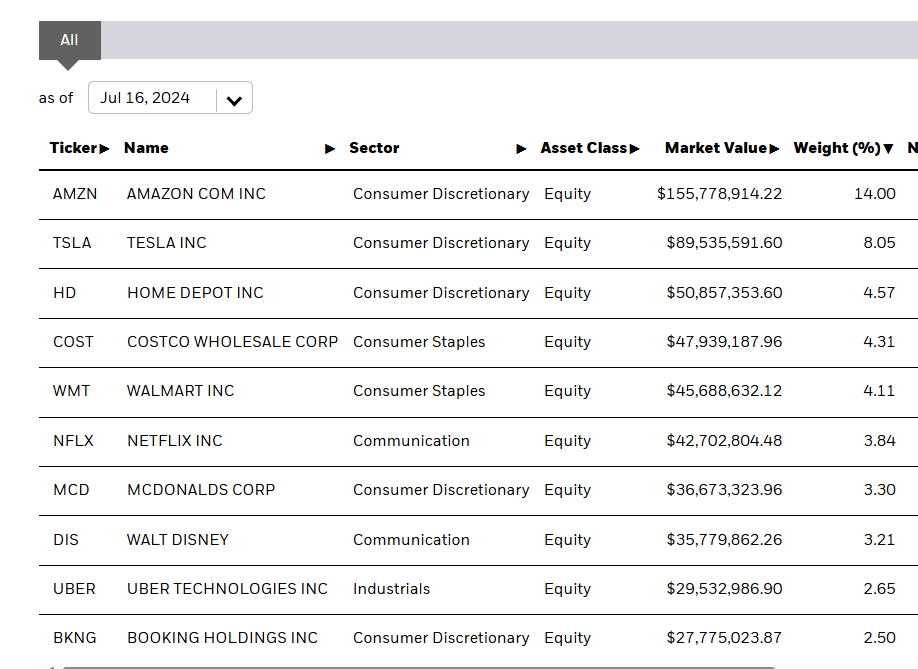

A Look At The Holdings

Because the fund has a market-cap weighted tilt to it within bands, it should come as no surprise that Amazon holds the largest position among the top 10 here.

iShares.com

These are all familiar companies at the top and representative of where consumers shop when they feel cash-rich (or at least have the temporary illusion of it). Amazon needs no introduction, given that it’s the leading e-commerce platform. Tesla, Inc. is the pioneer of electric vehicles. Home Depot captures the homeowner’s undertaking of DIY projects and renovations by providing homeowners with all the needed tools, from the fabrics that decorate walls to the mounting brackets for an extensive wall TV. Costco Wholesale Corporation is the second-largest membership-based warehouse club operator in the world. And of course, Walmart Inc. is the world’s largest retailer (Amazon the second).

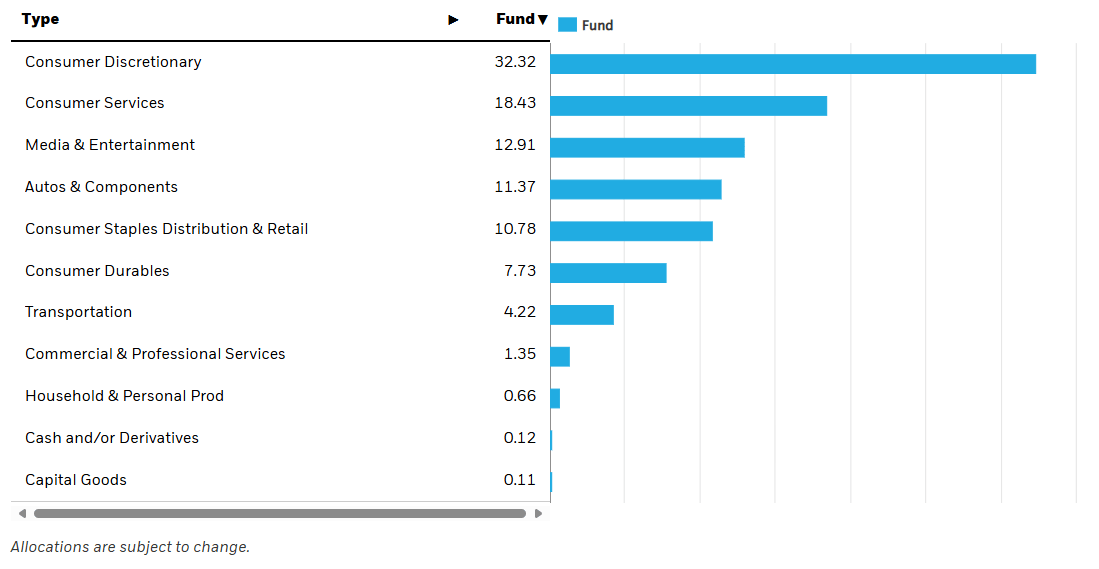

Sector Composition and Weightings

While the below may appear confusing, it’s really not. This is a Consumer Discretionary fund where Consumer Discretionary is a catch-all for some companies, and the other industries listed are just more specific. Not that there are some Consumer Staples names here as well, but overall the exposure is clearly on companies that benefit from heightened spending.

iShares.com

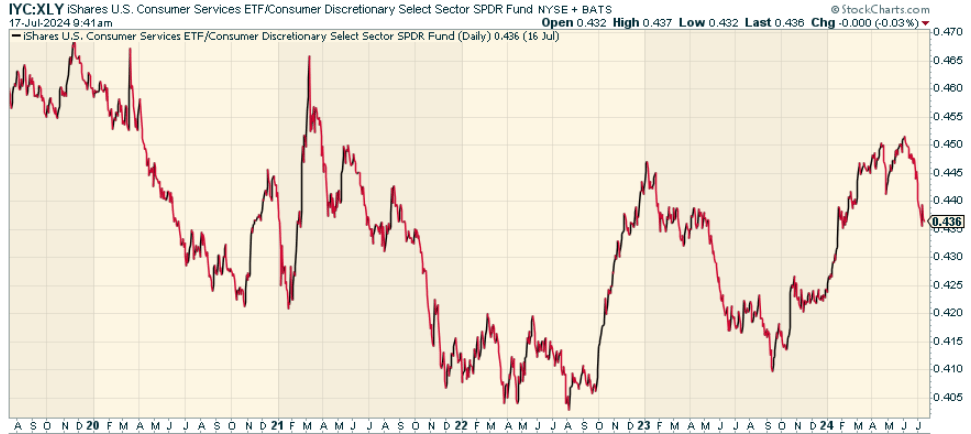

Peer Comparison

The big competitor to IYC is The Consumer Discretionary Select Sector SPDR® Fund ETF (XLY), which tracks the Consumer Discretionary Select Sector Index from the S&P 500. These funds serve the same general investing purpose, but differ in their underlying indices, underlying companies, and sector breakdowns. When we look at the price ratio of IYC to XLY, we find that the two have been in a narrow range, with neither meaningfully outperforming nor underperforming the other over time. No real performance edge in choosing one over the other, from what I can tell.

StockCharts.com

Pros and Cons

Investing in IYC has advantages and disadvantages. For starters, IYC serves as a proxy for the consumer discretionary sector, which can offer good insights into general consumer sentiment and spending practices. On the whole, consumer confidence tends to rise when economic conditions improve, leading to increased spending on discretionary items (which don’t serve purely functional purposes but are still deemed important in the consumer’s eyes). All good if the cycle is favorable.

But that cycle point is the critical one. The sector is very cyclical, susceptible to ebbs and flows in economic growth. In uncertain economic conditions or recessions, consumers often rein in discretionary spending, and the companies in the sector can suffer. Meanwhile, reliance on individual consumer preferences and trends can pack volatility into the sector as tastes shift and demand cycles change. And remember that Amazon makes up such a large portion of the fund here, meaning there is some real company-specific risk to be aware of.

Conclusion

Consumers change their spending habits and money allocations occasionally, and dedicated funds that track different sectors can allow some investors to ride buying waves, grow their portfolios, and catch up on the opportunities of the moment. The iShares U.S. Consumer Discretionary ETF seeks to leverage the demand for discretionary consumer products and services through a basket that includes companies in various sectors, such as apparel, automobiles, restaurants, travel, and leisure, among others.

By offering exposure to these subsectors, IYC allows investors to benefit from the industry’s growth prospects while lowering some risks posed by individual companies. I like the fund overall, I just don’t know if now is the time to position into it given what appears to be an economic slowdown ahead.

Read the full article here