A stunning year for the S&P 500 (SP500). The only way to describe it. Small-caps? Who cares? Passive market-cap weighted indexing has worked in a historic fashion. And for all we know, that could continue. Maybe we are in one of those historic periods where volatility just doesn’t want to rise, and we keep making records of new all-time highs getting hit.

If that’s the world we’re in, then it may be worth *trading* the ProShares Ultra S&P500 ETF (NYSEARCA:SSO). I say trading purposely because such a world of consecutive positive returns which benefit leveraged ETFs like this one tends not to last, and when the turn comes, it can be vicious.

SSO is a 200% leveraged ETF, which effectively means that, before fees and expenses, its return for the day is approximately double (2x) that of the S&P 500. The technical term for this is “gearing,” which means SSO achieves its 2x daily return through the use of securities and financial derivatives to effectively multiply the return or risk of the underlying asset or portfolio to which they are related.

The fund is designed to deliver returns linked to a daily goal. However, investors who know what they are doing might buy and hold SSO shares for substantial periods, as long as their risk tolerance and investment objectives correspond to the underlying characteristics of the fund. Over the very long term, the compounding effect of daily returns can produce substantial departures from the fund’s 2x target – sometimes positive, sometimes negative, depending entirely on volatility and overall path behavior.

The latter point is important. In low volatility periods, the daily 2x reset means the fund is leveraging on top of levered gains from the day prior. The compounding potential of that for prolonged streaks in market path behavior can be significant. By the same token, though, in high volatility periods where stocks are up big one day and then drop the next, the 2x reset erodes performance. This is because you’re effectively, through SSO, magnifying returns at the exact wrong time just before a turn lower. Please carefully review the SEC Bulletin on leveraged ETFs before placing any trades.

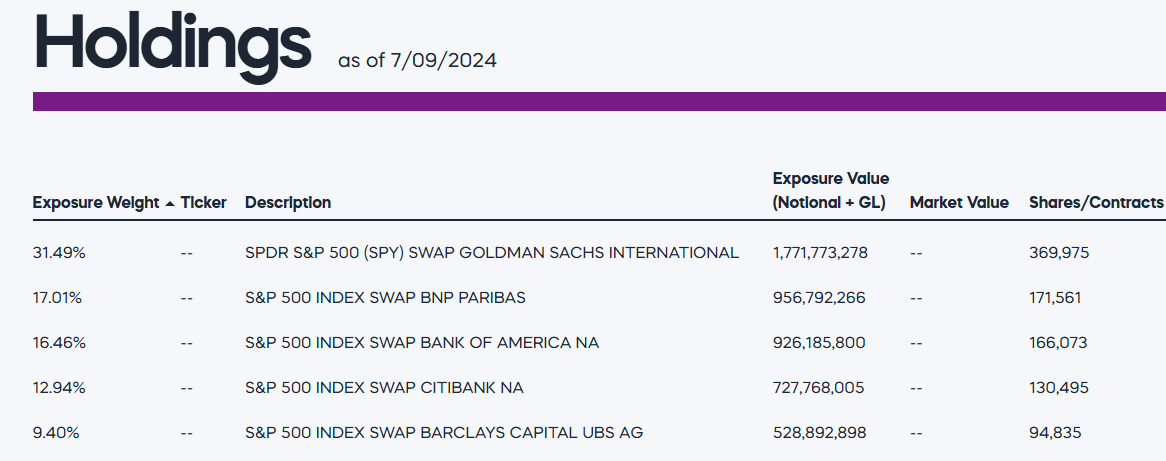

A Look At The Holdings

Fundamentally, SSO’s holdings are built to look like the S&P 500 Index’s – all while being leveraged. Its top positions are driven by the mega-caps of the index of stocks representing America’s biggest and best-known companies in various business and industry sectors.

proshares.com

We can see a third of the fund is entirely made up of swaps to achieve the leverage. What this means is it isn’t actually owning shares in the S&P 500 – just return streams with various big bank counterparties.

Sector Composition and Weightings

The sector composition of the ProShares Ultra S&P 500 is the same in tracking as the S&P 500 itself, just with leverage. The implication of course here is that this has heavy Tech sector exposure, leveraged obviously through the 2x behavior. If there were a reason to be bearish Tech, this isn’t exactly the fund you’d want to be bullish on as a result.

Peer Comparison: Leveraged ETF Alternatives

SSO is clearly not the only ETF in town angling for your business, offering leveraged exposure to large‑cap US equities. One competitor is the Direxion Daily S&P 500® Bull 2X Shares ETF (SPUU). When we compare the two to each other, we see that despite doing the same thing, SPUU has actually outperformed by nearly 300 basis points. My guess as to why? It could be the daily tracking and compounding effects into a leveraged return stream causing the cumulative performance to differ. I am not sure if that’s a reason to favor SPUU over SSO, but worth keeping in the back of your mind.

StockCharts.com

Pros and Cons

There are benefits and risks to investing in the ProShares Ultra S&P500 ETF that wise investors will weigh thoughtfully. Like most leveraged funds, the fund offers investors a chance to increase their exposure to the asset they’re tracking. SSO does this by leveraging its holdings using derivatives and swap agreements. Investors can potentially enhance returns on their investments if their asset class of choice increases in value (in this case, US large-caps).

But because the fund is leveraged, any losses – say, due to a bear market – are magnified in the leveraged long position. You have to be comfortable with that risk. Moreover, the compounding growth of daily returns can lead to significant deviations from 2x exposure on long time horizons. When I post on X saying “path matters more than prediction,” I’m specifically talking about how the sequence of returns impacts the actual destination in terms of the endpoint of total return.

Alongside operational complexity, the fund also has counterparty risk. That’s because some assets of the fund are held in derivatives and swap agreements that need to be revalued at each time the fund is priced. Here, the value that will appear in the fund is dependent on the creditworthiness and stability of its counterparties – the funds that have entered into these derivative and swap agreements, such as Goldman Sachs, BNP Paribas, and so on.

At face value, the fund’s expense ratio of 0.91 percent is low compared to using traditional leverage. However, because of the compounding effects of leverage on those costs over time, those expenses could eat into the returns and potentially hamper the fund’s performance.

Conclusion

For those investors who want to crank up the performance of the market-cap benchmark that tracks the biggest companies in the US, the ProShares Ultra S&P500 ETF seems like a good bet. Having said that, I’d be nervous given this stretch in market performance to use a fund like this here. It clearly can continue to work and perform, but there is a real vulnerability that the future path of markets looks different from the most recent past. And if that’s the case, that path is not one you want to leverage daily.

Read the full article here