Introduction

It has been almost a year since the last time I covered Honeywell International (NASDAQ:HON), and with the recent announcement of an acquisition, I think it is a good time to revisit. Since my first article on HON, where I suggested that the company’s unimpressive growth makes it a little expensive. Fast forward 10 months, and the hold rating proved to be the right one as it has underperformed the broader market quite a bit. I will cover the company’s latest acquisition, give my thoughts on it, and go through an updated valuation. To change my rating to a buy, the company needs to show me the top-line growth and/or margins to see an improvement as I do see quite a bit of potential.

Latest Acquisition- LNG Expansion

Honeywell is making the headlines today (July 10) because it has agreed to acquire Air Product’s (APD) LNG unit for an all-cash deal of $1.8B, which will continue to build on the company’s energy transition portfolio globally. It is said that the deal will be immediately accretive to HON’s sales growth and margins. It seems to me that HON sees a lot of potential in LNG over the next few years. The company will gain a strong foothold in the ever-growing LNG market, particularly in equipment like heat exchangers, which are essential components for efficiently liquefying natural gas.

There is a lot of buzz surrounding the LNG potential, especially within the power and data center sectors. And even though APD’s LNG business unit isn’t directly involved with data centers, the unit is still going to be in high demand the more data centers pop up over time. More data centers, more heat exchangers. With the rise of AI and AI-enabled data centers, power-efficient solutions are on everybody’s mind. Heat exchangers are used in the liquefaction process, where natural gas is supercooled into a liquid state for storage and ease of transport. This process has drawn a lot of attention as a more efficient way of cooling data centers, an alternative way. This way data centers that are built close to LNG terminals will benefit the most due to access to the cold energy source, which should be much more cost-efficient. This method is not yet widespread, but it is slowly gaining traction, with early adopters like Singapore LNG Corporation’s collaboration with Keppel Data Centers to develop a system for the use of cold energy from the terminal for data center cooling.

So, maybe Honeywell sees a huge opportunity ahead with regard to data center cooling and the continual high demand for AI-intensive data centers that require a lot of power. According to the announcement, the LNG market has quadrupled in the last 20 years and is going to double in the next 20 years, and that may be the reason why APD decided to focus on its other business instead.

According to a report from World Energy Outlook, there will be a surge in new LNG projects that are still to come online in 2025, which is around “45% of today’s total global LNG supply”.

There is a lot of worry about the potential of LNG due to the Biden administration’s LNG export ban, that will stunt the potential of the sector, however, recently, a federal judge blocked Biden’s LNG export band, saying it “violated federal law by halting licenses in January to assess impact of shipments on climate change.”

In my opinion, I like the new addition to HON’s portfolio, and I still believe there will be a lot of growth coming due to the mentioned power needs of data centers that are revolving around the AI hype, which still is in its infancy in my opinion.

I would like to see what Honeywell will have to say about the acquisition in the upcoming quarterly report, scheduled for July 25, before the markets open. Let’s see how the company performed over the last year.

Briefly on Financial Performance

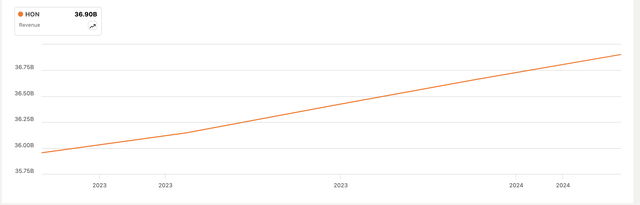

In terms of revenues, we can see a steady upward momentum throughout 2023, which if we look at the percentage numbers isn’t very impressive but is better than a decreasing top line. Over the last year, the company has averaged around 3% CAGR, which isn’t very exciting.

Seeking Alpha

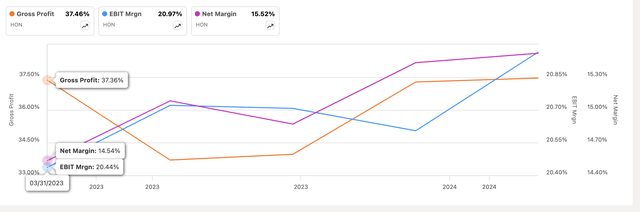

In terms of margins, we can see slight improvement from the beginning of the year to the latest quarter, however, it is still not very impressive in my opinion. The company expects to see around 23% in operating margins for FY24, which is a good sign that the company is improving its efficiency and profitability.

Seeking Alpha

In terms of the company’s financial position, it has around $12B in cash and equivalents, against around $22B in long-term debt, and has made around $5B in free cash flow for FY23 and looks to make around $6B in FY24. I think the debt outstanding could be lower as that would attract even more investors, but is it really an issue? I don’t think so. The company’s FY23 interest coverage ratio stood at around 10x, meaning the annual interest expense on debt was easily covered by the company’s EBIT.

Overall, the company has been chugging along just fine, in my opinion. Nothing too exciting here, but the company has made four acquisitions this year, which may provide a boost to top-line growth and improvements in margins going forward, however, it is still too early to tell and I would like to hear what management has to say about these acquisitions over the next year or so. Let’s have a look at a potential valuation profile.

Valuation

As usual, I will keep it on the more conservative end to give myself a decent margin of safety.

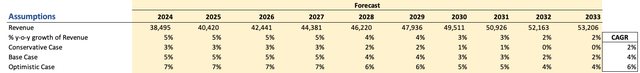

For revenues, the CAGR of the last three years has been around 3%, 0% the last five years, and -1% the last decade, so it seems it is improving in recent years. Let’s say the acquisitions it made over the last year will boost its top line further and will be accretive to sales, as the company said above, therefore, I went with around 4% CAGR over the next decade. I don’t think I can assign a higher growth number until we get more information from management in the later earnings releases. I am also modeling two other scenarios as per below.

Author

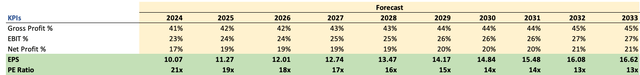

For margins, the same applies, I am assuming the acquisitions are going to improve the company’s efficiency and profitability, so in the long term, we will see a decent improvement. Nothing out of the realm of possibility.

Author

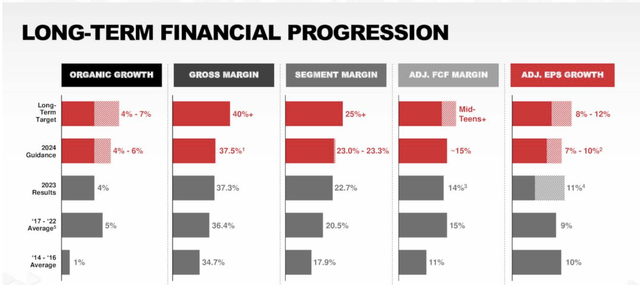

These assumptions are right in line with what the company expects to achieve in FY24 and the long run, as per the below slide from last quarter’s presentation.

Investor Slides

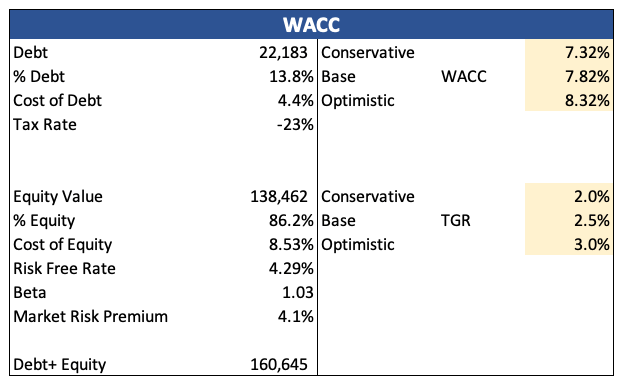

For the DCF model, I am going to use the company’s WACC of around 7.8% as my discount rate, and a 2.5% terminal growth rate because as usual, I would like the company to at least match the US long-term inflation goal.

Author

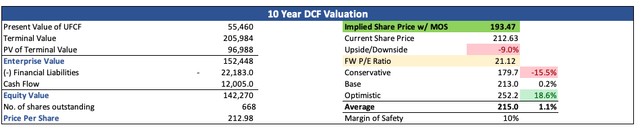

Furthermore, I am going to discount the final intrinsic value by 10% to keep it even safer and give myself more room for errors in assumptions. With that said HON’s intrinsic value is around $193.50 a share, meaning the company is trading slightly above its fair value.

Author

Closing Comments

There is a lot of potential here, however, I am going to stick with my hold rating from earlier because I would like to get more information on the acquisitions and how accretive they truly will be for the company’s operations going forward. I will be tuning in to hear management’s thoughts on the acquisitions and their reasoning behind this activity recently.

The company valuation could change dramatically if these acquisitions are going to provide much better margins and/or top-line growth, but for now, there is zero indication, therefore, I am going with the wait-and-see approach, and I am reiterating a hold rating.

Read the full article here