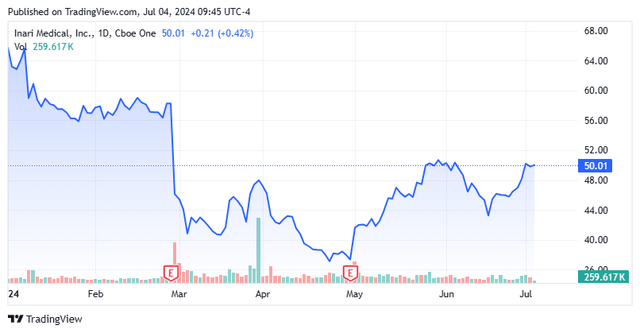

Today, we put Inari Medical, Inc. (NASDAQ:NARI), a medical device maker that is the leader in treatment of venous thromboembolism, or VTE, in the spotlight. Management has stated the U.S. VTE market is roughly $6 billion. The company products also address pulmonary embolisms and other heart conditions. The stock is down just over 20% so far in 2024, largely as a result of a DOJ probe acknowledged in late February and related to meals and consulting service payments provided by Inari to healthcare professionals. However, the shares have performed better recently.

Seeking Alpha

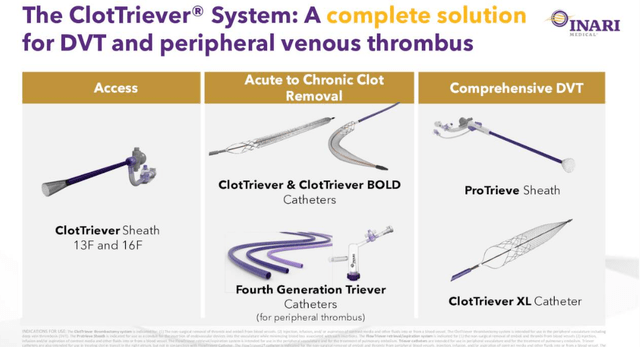

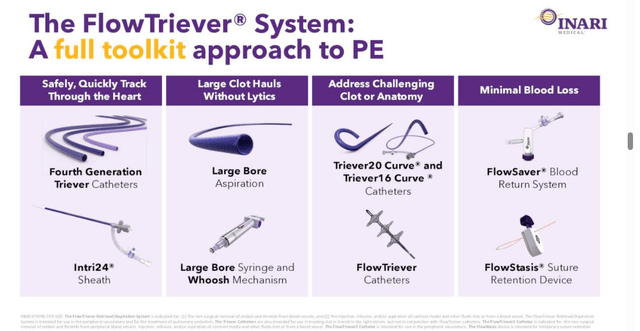

May 2024 Company Presentation

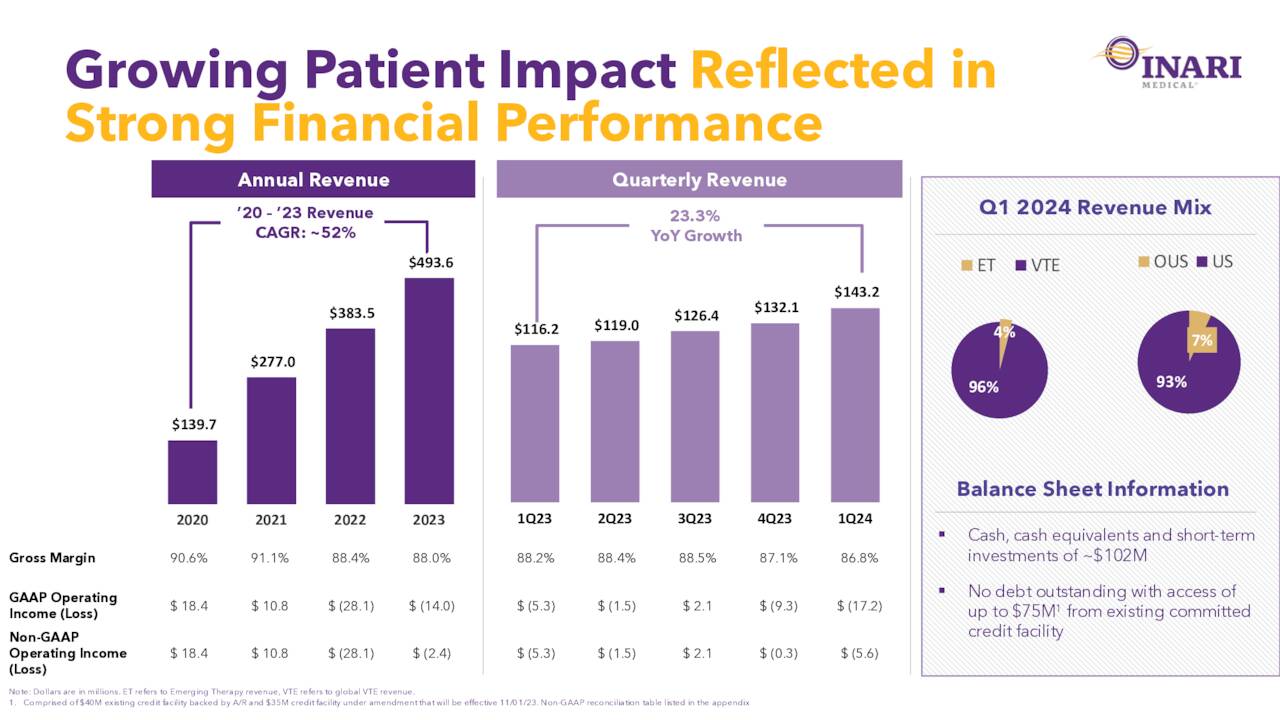

Inari Medical is headquartered just outside of Los Angeles in Irvine, CA. This medical device manufacturer makes minimally invasive, novel, and catheter-based mechanical thrombectomy devices and accessories. The stock currently trades near $50.00 a share and sports an approximate market capitalization of $2.9 billion. Only seven percent of the company’s revenues come from overseas, but management plans to grow that to 20% or better over time, with Japan and China being two key target markets.

May 2024 Company Presentation

Recent Results:

The company posted its Q1 numbers on April 30th. The company posted a GAAP loss of 42 cents a share, just over twice the loss per share expected from analysts. Inari posted a net operating loss of $17.2 million, substantially above the net operating loss of $5.3 million Inari posted in the same period a year. However, most of this was due to non-recurring items. Specifically:

- Change in fair value of contingent consideration liability of $6.3 million

- Acquisition-related costs of $2.8 million

- Acquired intangible asset amortization of $2.5 million.

For the quarter, the company had an overall net loss of $24.2 million, compared to just a $2.2 million net loss for 1Q2023.

Revenues grew by just over 23% on a year-over-year basis to $143.2 million, some $5 million above the consensus.

May 2024 Company Presentation

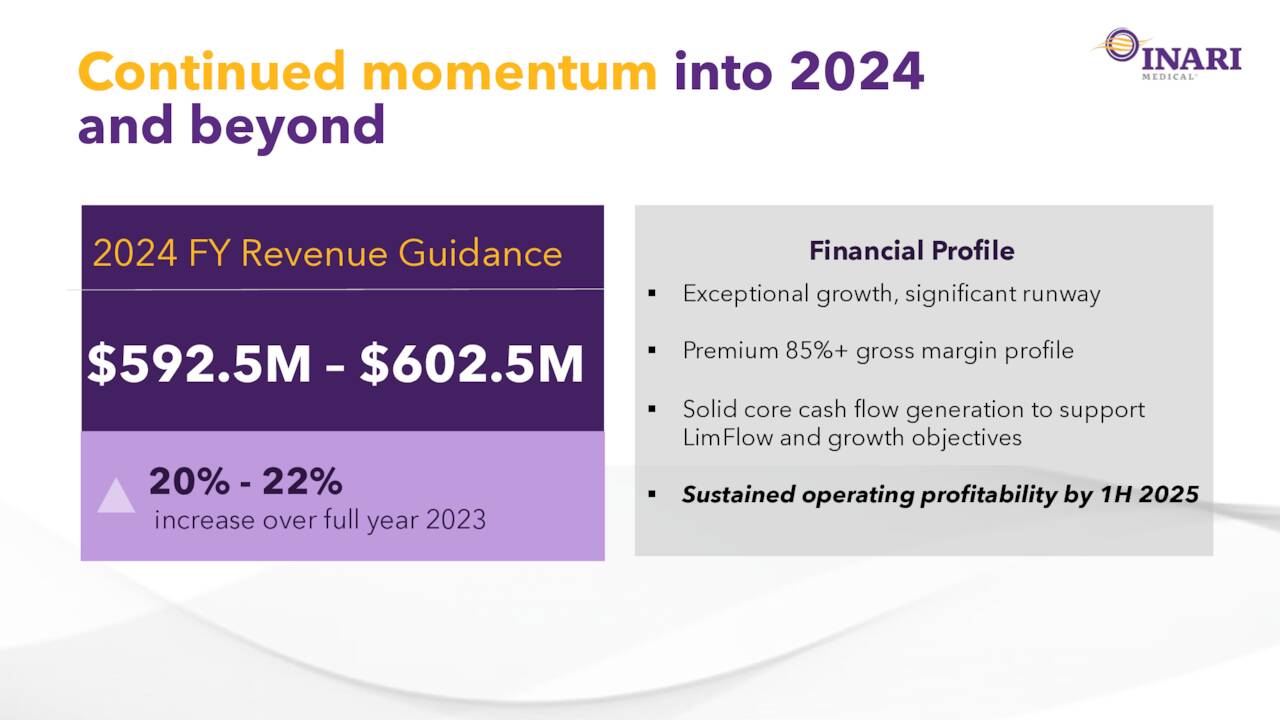

Management also bumped FY2024 sales guidance a bit to $592.5 million to $602.5 million from $580 million to $595 million. This would represent revenue growth of 20% to 22% from FY2023, it should be noted. Leadership also stated Inari Medical will reach “sustained operating profitability” in the first half of 2025. The company has/will launch a slew of new products that have significant potential, and was covered in depth by an article here on Seeking Alpha in late March.

May 2024 Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community has mixed views on Inari at the moment. Since first quarter results hit the wires, five analyst firms, including Wells Fargo, Needham, and Canaccord Genuity have reissued Buy ratings on the stock. Price targets proffered range from $55 to $84. Both Truist Financial ($47 price target) and Piper Sandler ($50 price target, down from $55 previously) maintained Hold/Neutral ratings on NARI. Piper Sandler originally downgraded NARI to Neutral and slashed its price target from $85 to $55 a share right after news of the DOJ probe came out. Sandler’s analyst also cited growing competition from Penumbra (PEN) in the VTE space as a concern.

It also appears that several insiders have sold nearly $12 million worth of shares collectively since news of the DOJ probe triggered the sharp decline in the stock in late February. The company ended the first quarter with just over $100 million worth of cash on its balance sheet and no long-term debt. Inari Medical also has an undrawn on $75 million credit facility in place.

Conclusion:

Inari Medical posted a loss of just three cents a share in FY2023 on just over $493 million in revenue. The current analyst firm consensus has losses expanding to 48 cents a share in FY2024, even sales shoot up to nearly $600 million. They do project that Inari Medical will see a profit of roughly a quarter per share in FY2025 on sales growth in the high teens. It should be noted, there is a fairly wide range of earnings projections (five to 89 cents a share) for the coming fiscal year.

It is difficult to make a compelling investment case on P/E since earnings even in FY2025 will be minimal. The stock is selling for just under six time forward sales. In contrast, Penumbra, which is solidly profitable and should see revenue growth over the next two fiscal years in the mid to high teens, trades at 5.7 times forward sales.

I don’t think the DOJ probe will amount to much but could be a slight overhang on the stock until resolved. On the first quarter earnings call, management stated it was “cooperating” with the government agency but did not provide much color on the investigations and only one analyst asked about it.

In summary, Inari Medical, Inc. feels fully valued here, and I would rate the stock a Neutral at best. If the stock fell back down to its post probe lows in the high $30s and nothing more came of the DOJ investigation, I would probably establish a small holding in the stock at that time.

Read the full article here