The price of copper (HG1:COM) is often seen as an indicator of economic conditions. When copper rises, many analysts see that as a bullish economic signal that manufacturing demand is growing faster than supply. Conversely, a sharp decline in copper’s price is seen as a recession sign.

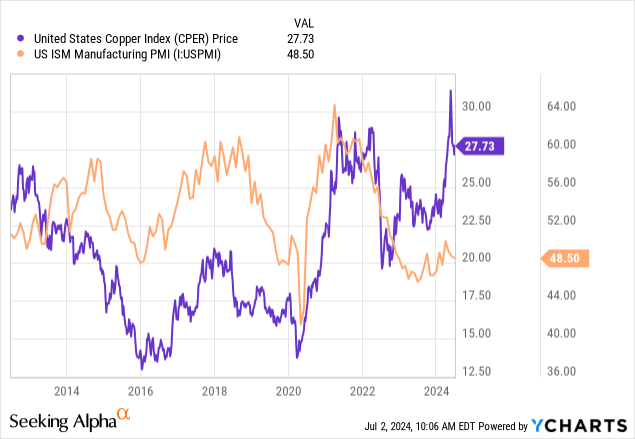

Historically, the price of copper, as seen through the United States Copper Index Fund, LP ETF (CPER), is closely correlated to the US manufacturing PMI, a survey measure of changes in US industrial activity. When the PMI is below 50, that indicates a decline in the US manufacturing sector, which is usually tied to a global industrial slowdown, considering the US is a primary driver. Interestingly, the recent rise in copper juxtaposes the manufacturing PMI, breaking the historical trend. See below:

The copper-PMI correlation was strong until this year, as copper has boomed while the manufacturing PMI has continued to indicate a decline in activity. Thus, we must consider why copper rises without a shared increase in macroeconomic conditions.

Many copper-focused mining companies, such as Southern Copper Corporation (NYSE:SCCO), have had similar gains over the past year. SCCO has risen ~53% YoY and 30% YTD. The stock has only seen minor declines over the past month as the price of copper may have peaked, falling sharply to $4.45/oz after hitting $5.1/oz.

Arguably, SCCO is valued as though it will continue to profit from copper’s significant price premium to production costs. In my view, investors interested in SCCO may benefit from considering the potential that its production costs will continue to rise, potentially faster than anticipated. Additionally, I believe that economic conditions point to a lower copper price over the coming years. That said, notable supply and demand factors may benefit both copper and SCCO over the long run. Still, given how volatile SCCO is, it may be best to wait for a lower price to invest in those long-term opportunities.

Economic Stagnation and Booming Copper?

I believe copper is a crucial area where we can see a disconnect between investing time horizons. The bullish thesis on copper usually focuses on its role in electronics and views that demand for copper will rise dramatically over the coming decade or two as electric vehicles and AI fuel a much higher need for copper.

Significant long-term supply factors also benefit the price of copper. Last year, environmental and economic protestors hampered First Quantum’s (OTCPK:FQVLF) massive Panama Cobre mining project, which was expected to fill the mineral’s supply demand gap.

While this may be bullish for copper prices, it could be problematic for SCCO. Around 41% of its output comes from Peru and 59% from Mexico. The company’s Peruvian mine, Tia Maria, has been on hold for many years after violent protests a decade ago. Other mines in Peru have recently been subject to blockades and similar demonstrations.

In my view, many South and Central American countries are decidedly against international mining companies, believing they harm the environment and fail to improve economic conditions for local communities. True or not, that is the rising sentiment, and I’d argue that SCCO has significant political risk from Peru. Should social, economic, or political conditions in South and Central America worsen, I expect we’ll see more mine shutdowns due to protests.

On the one hand, copper miners in these areas face significant shutdown risks from these threats. Conversely, this issue has led to slow global copper production growth and an expected copper shortage. The IEA recently forecasted that, by 2030, copper mines will only meet 80% of the world’s demand, expected to rise from electric vehicles and other sources.

That said, there is not necessarily an immediate shortage of copper. The Shanghai Futures Exchange copper warehouse is the largest in the world. It has over 300K tons of copper, its most considerable seasonally adjusted level, or around 2-3X above the inventory level typically seen in late spring over recent years. Over recent years, China’s copper import levels have been very high, indicating the country is stockpiling copper for some future needs. However, more recently, its imports have declined slightly, but are still stagnated around that high level.

China accounts for over 60% of global copper imports, leading the US (the second highest) by over 4X. Much of that copper is used for construction and enormous energy projects. In 2022, most global copper went to equipment (32%), construction (26%), and infrastructure (17%). Around 13% went to transportation.

As many have speculated, it is likely true that complete global conversion to Electric Vehicles will require a significant increase in copper production. That said, new technologies from Tesla (TSLA) are projected to limit copper requirements, potentially upsetting that forecast. Further, in the immediate horizon, global copper demand is primarily driven by China’s colossal construction and infrastructure projects.

I point to my recent article on Vale (VALE) regarding the issue with China’s projects. To summarize, it appears that the country is building many empty cities to keep its population busy and employed. Now, it is starting to bear the economic consequences of excessive “make work.” Recently, we’ve seen a sharp slowdown in these projects, likely leading to significantly lower Chinese demand for copper. Certainly, the iron ore market is the most at risk from this issue, but I believe it should also push copper into a glut, which may or may not be temporary depending on whether EV demand truly increases copper needs as some predict.

What is SCCO Worth Today?

My basis for valuing SCCO is that copper will not sustain its current price point over the next two to three years due to lackluster or poor industrial macroeconomic conditions in both the West and China. I believe the recent rally is primarily fueled by irrational exuberance surrounding EVs and AI, with inadequate regard for the immediate buildup of copper inventories.

Regulatory and protest issues in Latin America are positive and negative for SCCO, potentially exacerbating a future shortage and increasing shutdown risks while limiting growth. On that note, the Latin American political climate continues to shift toward populism, which is most likely a constraint to SCCO. This includes Mexico’s new president, Claudia Sheinbaum, a climate scientist who is expected to continue anti-mining policies.

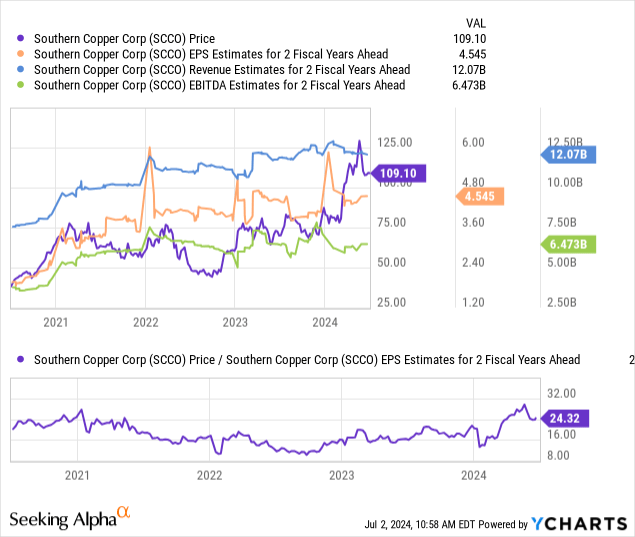

Despite the rise in copper, there is no significant improvement to Southern Copper’s income and sales expectations, based on two-year ahead analyst forecasts. See below:

Based on this horizon, the company’s forward P/E is 24X, which is very high for a mining company. I prefer miners at forward valuations below 10X, which accounts for their high historical volatility and cyclical economic risk factors. Those risk factors are elevated today, potentially leaving SCCO significantly overvalued.

From its last investor presentation, we can see its operating cash cost per pound of copper has risen from ~$1.5 <2020 to over $2 recently. Its production costs are still low compared to its peers, particularly those operating in the US. That said, low production costs often come with higher regional risks, such as labor strikes. Further, we’re seeing a sharp rise in costs that could upend profit gains that may be seen from sustained higher prices.

When copper was at its current level around 2021, SCCO earned $4.35. Arguably, the company’s EPS may be up to $5 annually if we assume copper sustains $4.5/lbs. Realistically, its operating costs will likely continue to rise, pointing to lower profitability at current prices. Further, even at a $5 EPS, its current stock price appears overvalued at a “P/E” over 20X.

In my view, the only way for SCCO to be fairly valued today would be for copper to trade closer to $7 and for the company not to have rising cost risk factors, as that would cut its valuation in half. In my view, it is doubtful that we see copper sustain that price point without also having a significant supply issue among copper miners in Latin America.

The Bottom Line

Southern Copper Corporation has immense copper reserves, experienced management, and a good track record. It also has a manageable and low debt level and an overall strong liquidity and solvency position. However, a good company at an extremely high price is not necessarily a good investment, just as a poor company at an extremely low price may be a good investment.

Due to electronic demand, copper demand should also rise over the coming decade. However, it is unclear if expectations surrounding that rise will prove fruitful in light of technological changes that may lower copper requirements. Further, I expect lower copper demand from China’s construction and infrastructure sector will largely offset theoretically higher demand in the West. Moreover, copper demand in developed countries may slip as EV sales slip.

I believe SCCO is currently valued on irrational expectations. Consider that if copper does enter a huge EV-driven shortage, as some expect, then copper prices will rise high enough that electric vehicles will become too expensive. Arguably, we’re seeing some of that today, as indicated by the slowdown in EV sales. I feel SCCO has been caught up in the EV and AI “trades” built on speculation instead of fundamentals. That is not to say those technologies will not improve copper demand, only that the overall supply and demand balance may not be greatly impacted, at least to the extent priced into Southern’s valuation.

Although I like the company and believe copper may be attractive long-term, I am bearish on SCCO today because it appears significantly overvalued. Given the seemingly negative macroeconomic conditions, I’d prefer SCCO at a forward “P/E” of 10X, requiring a 50%+ decline in its stock price. Until bullish copper sentiment fades, my target for SCCO is not as bearish, with a decrease from $70 to $80 seeming more reasonable than its price just months ago before the seemingly irrational boom and bust in copper.

SCCO could be a decent short opportunity. Short interest is at 7.6% currently, indicating there is some negative speculation surrounding it. That said, I do not plan to bet against it today because there is decent potential that bullish speculation surrounding copper rebounds. The fact is that there is usually far more money to be lost betting against irrational speculation than potential gains because staunch bulls will buy some stocks (or assets) at nearly any price once it is disconnected from fundamentals. Please fully understand the risks of shorting before placing any such trades.

I see fundamentals like gravity. They only matter when a stock is sufficiently close. Because Southern Copper Corporation’s price has little connection to its fundamentals, speculative activity could push it to greater heights. For me, that risk is too significant to make SCCO worth short-selling. That said, I would be surprised to see SCCO trading at its current price or higher a year from now, but I am no stranger to such surprises.

Read the full article here