Investment Thesis

I recommend selling Ultrapar Participações S.A. (NYSE:UGP) shares. The company operates in an extremely regulated sector and should see increased competition with the possible return of state-owned Petróleo Brasileiro S.A. – Petrobras (PBR) in the fuel distribution segment.

Additionally, the company will face challenges with the new provisional measure that the Government announced, which will affect Ultrapar’s tax credits (9.27% of market value). Finally, the company’s valuation does not offer a good margin of safety.

Introduction

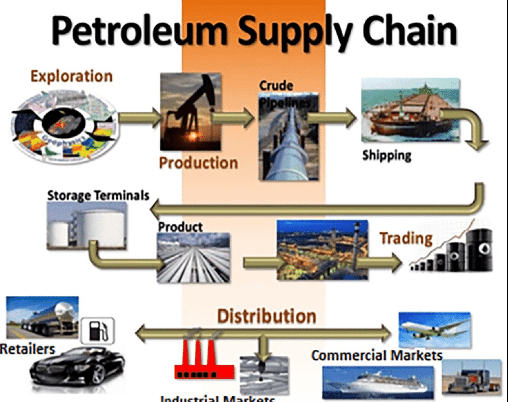

In the oil and its derivatives chain, there are basically four major links: oil production (extraction), refining/processing, distribution, and resale. In the first link of the chain, there is oil production, in the second link there is the oil refining stage, which is a set of processes aimed at transforming oil into derivatives of commercial value such as diesel fuels, gasoline, LPG, and kerosene.

Research Gate (Petroleum Supply Chain)

Following the chain on the fuel side, the next link is made up of distributors that store and distribute petroleum derivatives (gasoline, diesel oil, aviation kerosene, liquefied petroleum gas, and natural gas for vehicles). And, in the last link, there is the resale segment, normally known as the retail sector gas stations.

In Brazil, the fuel distribution sector operates with low margins and has oligopoly characteristics, with the dominance of Vibra Energia S.A. (OTCPK:PETRY), Ultrapar Participações S.A. (UGP) and Raízen, a subsidiary of Cosan S.A. (CSAN) and holder of Shell-branded stations.

It is worth noting that Vibra Energia is the former BR Distribuidora, the fuel distribution segment of Petrobras, and was privatized during the Government of Jair Bolsonaro. And before explaining more about Ultrapar, the central point of this report, I need to explain a little more about my concerns with the sector scenario.

Sector Scenario

It is very difficult to talk about the fuel distribution sector in Brazil without talking about Petrobras. In 2019, the BR Distribuidora, a subsidiary of Petrobras in the fuel distribution segment, was privatized and later had its name changed to Vibra Energia.

The reasons were clear at the time. Petrobras was in a glorious process of deleveraging and focusing on its core business (oil exploration). As a result, the privatization of the company generated cash for Petrobras. Another reason was the improvement in the competitiveness of the sector.

However, the Workers’ Party Government returned to the Brazilian Federal Government, and the thoughts were completely different. When asked about resuming the distribution sector, the former president of Petrobras said he wanted to be closer to the end customer.

What is the reason for this? Clearly, the Government must do everything to try to maintain its popularity by subsidizing fuel. Petrobras, for example, no longer follows the International Price Parity Policy, and the fuel price gap already reached 19%. If the company regains its leading role in the distribution sector, it will have another weapon to artificially control fuel prices.

It is interesting to note that the Government also intends to invest again in refineries. This occurs because, in the thinking of the Government, if Brazil is self-sufficient in oil derivatives, it will be able to completely abandon any correlation with the international price.

And what practical impact do I see in the case of Ultrapar? The fuel distribution sector is already extremely regulated by the Government, with several accounting nuances in results such as tax credits.

If the state-owned Petrobras regains its leading role in the sector and seeks to subsidize fuels, this would be terrible for Ultrapar’s revenue, which would have to adapt to the prices charged. This entire background corroborates my thesis of selling the shares, and now let’s talk a little more about Ultrapar’s history and business model.

History And Business Model

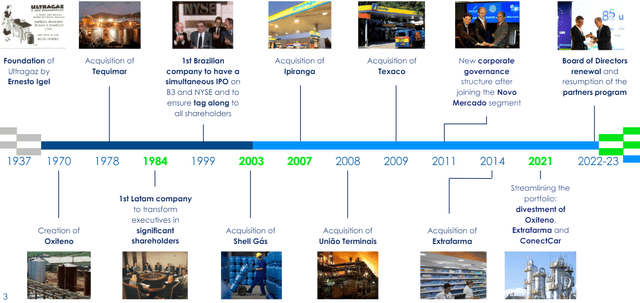

Ultrapar is headquartered in the city of São Paulo and operates in the fuel distribution market (Ipiranga brand), LPG (Ultragaz brand), and liquid bulk storage (Ultracargo brand). Below, I will talk in more detail about each segment, but first, let’s analyze the company’s timeline.

Timeline (IR Company)

Ipiranga has a very strong brand, the network has more than 6200 gas stations. The stable cash generation segment is important given the essential nature of the product. Scale, brand, and customer loyalty are undeniably positive points in the company’s portfolio.

Ultragaz is one of the leaders in the LPG segment, with around 20 competitors. Ultragaz serves around 11 million homes, with a network of 6 thousand resellers. Finally, Ultracargo positions itself as the leader in its market, characterized by a regulated and capital-intensive environment. Below, the company provides some more information about each segment.

Business Portfolio (IR Company)

As we can see, the fuel distribution segment (Ipiranga) contributes around 61% of EBITDA, the LPG segment (Ultragaz) contributes 28% of EBITDA, and Ultracargo contributes 11% of EBITDA.

Now that we understand the company’s business a little better and how it positions itself in the market, there is nothing better than doing a financial analysis of Ultrapar against its Brazilian competitors Vibra Energia and Raízen.

Ultrapar Fundamentals

Below I will use Seeking Alpha and Koyfin to analyze the numbers of Ultrapar and its competitors in the energy distribution segment such as Vibra Energia and Raízen.

| Ticker | (UGP) | (PETRY) | Raízen |

| Market Cap | $4.6B | $4.1B | $5.2B |

| Revenue | $25.1B | $32.6 | $43.9 |

| Revenue Growth 3 Year [CAGR] | 19% | 26% | 35% |

| EBITDA Margin | 4.2% | 5.1% | 6.6% |

| Net Income Margin | 2% | 3.3% | 0.2% |

| ROE | 20% | 37% | 2.7% |

| Dividend Yield | 3.1% | 2.1% | 3.6% |

| Net Debt / EBITDA | 1.8x | 1.2x | 1.9x |

When carrying out the financial analysis, we see that Ultrapar has the lowest revenue growth in the last 3 years. However, it is important to highlight that the company has a divestment strategy and focuses on its core business.

However, it is important to highlight that the company has the lowest EBITDA margin among its peers. When we analyze the net margin, ROE, and net debt/EBITDA, the company loses to its competitor Vibra Energia, and this corroborates my thesis of selling the shares, but are these numbers reflected in the valuation?

Valuation Is Not Attractive

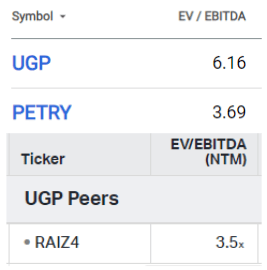

As the companies have extremely volatile businesses dependent on exchange rate variations and are leveraged, I will use a comparative analysis with the EV/EBITDA multiple:

EV/EBITDA (Seeking Alpha and Koyfin)

I obtained the results for Ultrapar and Vibra through Seeking Alpha, while Raízen was obtained through Koyfin, as it is only traded on the Brazilian stock exchange.

It is interesting to note that Ultrapar trades at a relevant premium, its multiple is above 6x while its competitors trade below 4x. In my opinion, this premium is due to the quality of the company’s management, so we will use Ultrapar’s own history.

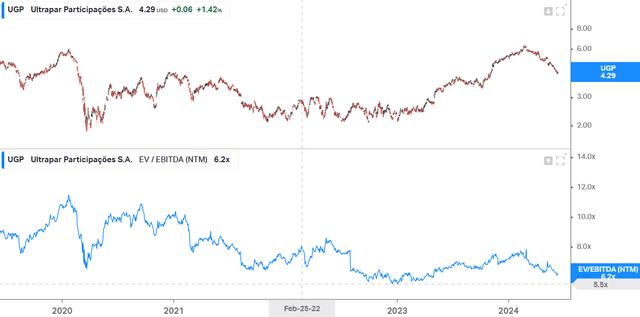

EV/EBITDA (Koyfin)

By using its own history, we have a better comparative basis. As we can see, Ultrapar trades at a projected EV/EBITDA of 6.2x. In my opinion, given the structural and cyclical characteristics of the sector, it is appropriate to use the lowest EV/EBITDA multiple that the company has traded in the last 5 years as a target, and we can see that it has already traded at 5.5x EV/EBITDA.

If the company returns to trading at this level, bringing a greater margin of safety for an increase in recommendation, the downside is 11%. Therefore, the fair price of Ultrapar shares is $3.88 per share, which is why my recommendation is to sell the shares, as the risk-return ratio is not attractive in my opinion. Now, let’s see what the Quant Rating and Factor Grades tools tell us.

Ultrapar According To Quant Rating And Factor Grades

As we can see, the Quant Rating tool assigns a recommendation to hold the shares:

Quant Rating And Factor Grades (Seeking Alpha)

However, I don’t believe it is the best way to analyze the company. In my opinion, we should analyze the company’s valuation and the results against its competitors in Brazil, since the companies are under the same tax and fiscal rules. And speaking of tax rules, I will list one last, more recent risk that emerged for Ultrapar.

Changes To Taxation Rules

Last week, the government announced a proposal for a provisional measure (MP 1227) that changes the rules for PIS/Cofins tax credits (federal sales tax credit assets). The suggested modifications are expected to raise $5.8 billion.

The measure may be divided into two parts: one related to the presumed tax regime of PIS/Cofins ($2.4 billion), and the other related to PIS/general credits worth $3.4 billion.

The measure limits the use of PIS/Cofins credits to other PIS/Cofins debts, whereas until now the credit could be used to offset cash payments on other federal tax debts (income tax and social security contributions).

In my view, fuel distributors will be the most affected. The main impact will occur as it will take longer to monetize these credits against the PIS/Cofins liabilities generated by normal operations.

At the end of 1Q24, Ultrapar had around $480 million in credits (around 9% of the market cap). This information is present in the financial statement, page 18, Recoverable taxes, PIS/COFINS. The company gave the number in BRL, and I converted it to dollars using a ratio of 5 to 1, and we arrived at $480 million.

Recoverable Taxes (IR Company)

The complexity and unpredictability of the sector corroborate my recommendation to sell the shares, and speaking of the 1Q24 results, I will comment on them before listing the risks to the thesis.

Latest Earning Results

In 1Q24, Ultrapar released mixed results. Its revenue was $6 billion. (-12% q/q and +0.5% y/y), however, what caught my attention was the compression of the EBITDA margin, which was 3.95% in 1Q24 against 4.6% in 4Q23. This was due to the fuel distribution segment (Ipiranga) due to lower sales volume.

EBITDA (Seeking Alpha)

The company’s leverage remained stable and relatively healthy during the period. Ultimately, net profit was $86 million. (-62% q/q and +66% y/y). In my opinion, the published results bring significant challenges for the company, mainly in terms of operational efficiency, and this corroborates my sell thesis for the shares.

Potential Threats To The Bearish Thesis

I want to highlight three major risks to my bearish thesis for Ultrapar shares. The first concerns changes to tax rules. It is important to highlight that, although the provisional measure is effective immediately after publication, it needs to be voted on and approved by the Chamber of Deputies and the Senate within 60 days to be definitively valid.

The second risk to the thesis is Petrobras’ return to the fuel distribution segment. The company’s former CEO has already stated that it would be difficult to purchase Vibra Energia, however, he also states that the company is considering taking “a step back” in some segments. In my view, this step back could be dangerous not only for Ultrapar, but mainly for Petrobras shareholders as I described in my report.

The third risk to my thesis concerns the company’s strategy against the competition. This is because the company has been investing to diversify its sources of revenue and not depend solely on the fuel distribution segment. As a reference, the segment is currently responsible for 61% of EBITDA, but it was already responsible for 84% in 2021, and this could be very positive for the company’s thesis.

The Bottom Line

Ultrapar faces major difficulties in its sector, such as competition and the possible return of Petrobras (a state-owned giant) to the fuel distribution segment. This can be quite dangerous since Petrobras can be used as an instrument to subsidize fuels, which would harm all private competition.

Another point is that the company has a significantly higher EV/EBITDA multiple than its peers, and when we look at the company’s historical multiple, I also don’t see a good margin of safety.

Based on this analysis, I recommend selling Ultrapar shares. Investors should pay attention to competition, regulatory changes, and unattractive valuation. In my opinion, the risk-return relationship is not positive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here