In November 2020, I wrote an in-depth short-opportunity article regarding Expedia Group (NASDAQ:EXPE). At that time, I believed that it would struggle to recover from the COVID lockdown shock fully and would struggle with the associated debt and profit margin pressures. On top of that, the company’s competitive risks appeared to be notable, with Airbnb (ABNB) going public around that time.

Now, EXPE has not lost significant value since then. It is currently down about 7% from the time I covered it. To me, given the market has risen by ~50% in a stronger-than-expected recovery, EXPE’s lack of performance is telling of its fundamental issues. The landscape the company is facing is very different than it was in 2020, calling for an updated outlook.

Expedia Group’s Failure to Recover

When I covered the firm years ago, I believed it was unlikely to fully recover from the lockdown impacts as it exacerbated pre-existing pressures on the company. The company acts as a conglomerate for online travel booking platforms. Its assets, such as Expedia, Hotels.com, VRBO, Travelocity, and others, were innovative in the 2000s as those platforms replaced traditional travel agencies. However, with the rise of Airbnb and Booking Holdings (BKNG) brands, it has lost considerable market share due to other online travel agencies than Expedia or Booking.

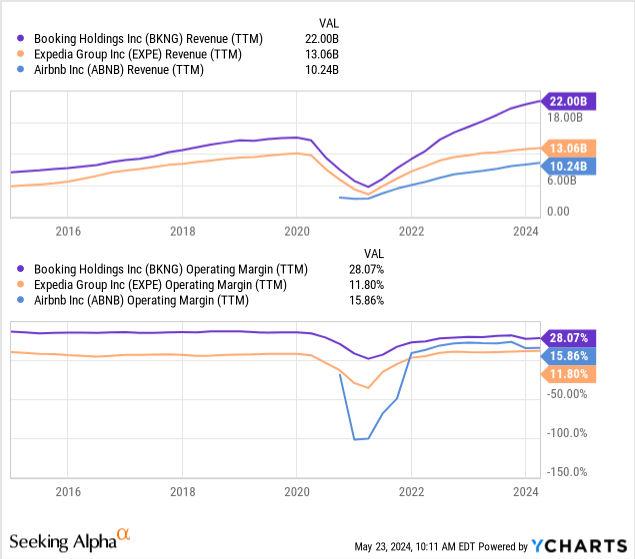

The OTA industry is challenging today as the barriers to entry are low, and the moats are minimal. Hotels and other travel venues will look to advertise everywhere they can, and customers will usually flock to where they’ll get the best value. I believe this keeps profit margins relatively low, mainly when the overall market is not growing. See below:

Since 2020, Expedia has seen its margins and sales return to its pre-COVID level. Its competitors have seen a marked improvement, with Booking’s sales rising far above its 2019 high while sustaining better margins. Of course, these three firms have different business models, giving them naturally different margins. On a TTM basis, 54% of Expedia’s revenue went to marketing compared to ~44% for Booking, making a significant difference in profitability. Airbnb has particularly low marketing costs as it benefits from more organic traffic.

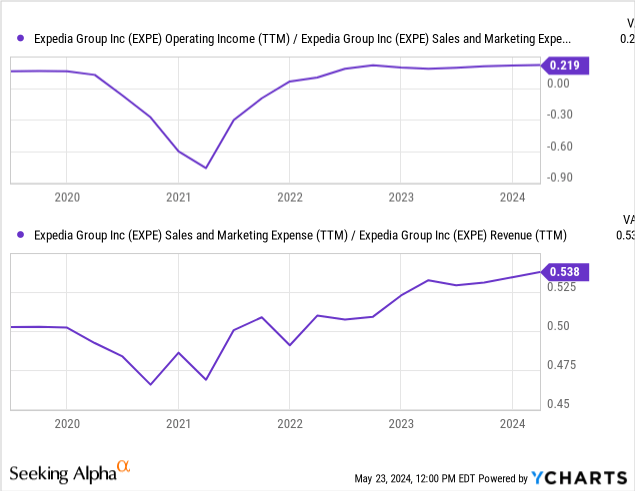

Expedia’s marketing issue may be solvable. The company offers a broader range of platforms extending beyond hotels, potentially giving it less focus on its marketing approach. As noted in its last investor call, the company has looked to pare back some of its marketing spending and improve its platform, particularly on VRBO, with the plan of ramping it back up with a higher return. Its operating income to marketing ratio has improved, rising above its pre-COVID level. However, its total marketing expense to sales continues to increase. See below:

Fundamentally, online marketing is getting more expensive. Google ads cost-per-clicks have steadily risen as more companies have looked to use the platforms. This has been great for Google (GOOGL) and others, but it has transferred significant potential profits away from companies like Expedia.

As noted years ago by its CEO, Google is Expedia’s biggest competitor. Most people research travel options on Google, and Expedia often competes with Booking and others for the top ad spots on sponsored search. Thus, Expedia has grown very dependent on Google, therefore losing profits for those advertising spots. Booking has gained an edge by its larger size, likely giving it better advertising efficiency and organic traffic. I feel less Google-dependent companies, like Airbnb, have a significant edge because they’re not losing potential profits through so much advertising competition.

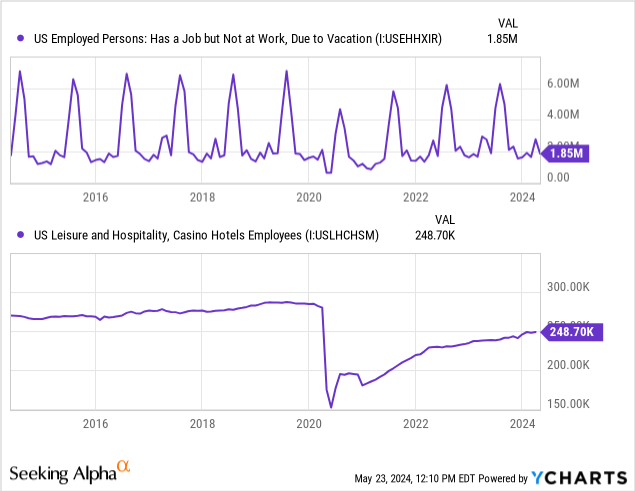

It does not help that the vacation travel industry failed to recover after 2020. As one notable indicator of vacation travel, the number of employees in casinos is still down by around 10-15% from its normal pre-COVID level. Further, during peak seasons, we’re seeing a similar decrease in the number of employed people on vacation. See below:

Unfortunately, the data indicates that the “new normal” after 2020 is less vacation. Vacation time has declined in all seasons, with summer substantially declining. Based on those trends, many workers are taking shorter periods off, likely taking “staycations.” Undoubtedly, this is partially the result of the significant decline in household savings rates, driven by higher living costs.

Fundamentally, it is unclear if we will ever see a recovery in the types of vacations on which Expedia’s business is built. According to TSA data, air travel volumes are very high. Hence, Expedia has shifted its focus toward business-to-business. Last quarter, its B2B YoY sales growth was ~25%, while its B2C was ~3%. Its adjusted EBITDA margin on B2B was ~20% compared to ~11% on B2C, though its overall adjusted EBITDA was 20% lower on B2B, stemming from that segment’s revenue being ~60% lower. Thus, this segment offers high growth and profit potential and may replace losses on B2C in the future.

What is Expedia Worth Today?

Expedia’s business is in a different spot today than at the end of 2020. Back then, when there were chronic lockdowns, it was unclear if the travel industry would recover as quickly as its balance sheet demanded. In reality, it did not recover, with people spending materially less than before. However, Expedia has adapted by shifting toward B2B, which may have an edge in not needing as much advertising spend, giving it more significant profit margins.

I am not as bearish on EXPE as before, if at all. The company is showing signs that it may be building out a new moat without the immense competitive risks of its traditional business. Unless we see an economic or geopolitical issue resulting in further vacation declines or losses in business travel, I think Expedia’s core business should be fine, giving it time to adapt to the differing environment.

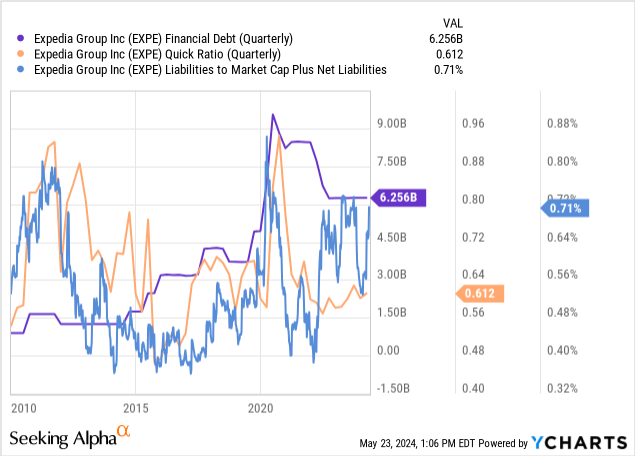

Still, I expect its B2B segment to grow at a rate that may not offset expected pressure on its B2C segment, giving it minimal expected EPS growth. Though it has made some efforts to reduce leverage, the company’s net liabilities are 71% of its Enterprise Value, and its quick ratio is 61%, pointing to subpar liquidity. That said, the company has usually operated with liquidity around that level. See below:

The company’s May 2025 bond maturity is $2B. Across all its bonds, yields are around 1-3% higher than the coupon, stemming from higher interest rates. If this is refinanced, the company should experience an increase in interest costs. However, they will not be too large, with ~$1.5B in annual operating income.

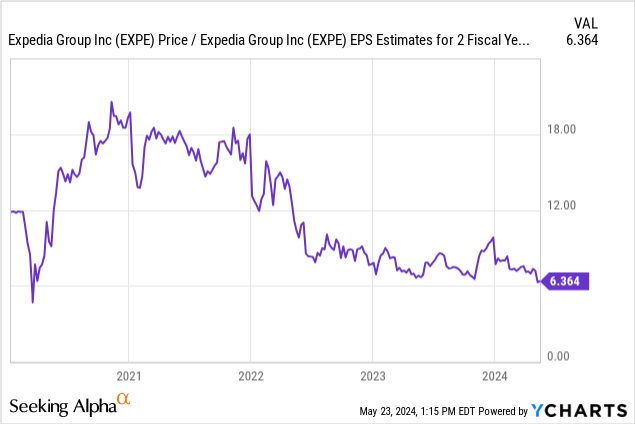

Personally, I think it is unlikely that EXPE will experience the EPS growth that the analyst consensus anticipates. According to the analyst consensus, Expedia should see its EPS rise by ~20% annually for the next decade, reaching the mid $20 range by 2029. To me, this seems unlikely (though possible) based on its difficulties post-COVID, the travel environment, advertising competition, and the potential for a travel-restraining recession. However, based on its two-year EPS estimates, EXPE’s forward “P/E” is 6.3X, which is very low. See below:

In my view, this valuation fairly discounts its risk profile. While I have doubts the performance of its B2B segment is strong enough that it could manage the 20%+ EPS growth that most analysts expect. Its valuation would be low even if it significantly underperforms expectations, offering ample protection against its risks.

The Bottom Line

Overall, my outlook for EXPE is neutral. There is a reasonable argument that it is undervalued if we assume the vacation travel industry will normalize and its marketing efficiency will improve. Its B2B segment will continue to grow. To me, I expect growth from its B2B segment, but I expect continued strain on B2C. I expect EPS stagnation. Even then, my view is based on my macroeconomic projection, which, admittedly, tends to be bearish. Further, EXPE’s valuation reasonably accounts for its risks, even under my bearish assumptions.

Given its balance sheet, and return to severe economic strain could put Expedia in a challenging position. That was my view in 2020, and although it did not crash, it also did not recover from that point. In the future, I expect Expedia will either rise or decline significantly, depending greatly on the travel economy as a whole. Thus, if I were to make a bet on EXPE, it would be that its directional volatility would increase and push it out of the range it has held since 2020.

Read the full article here