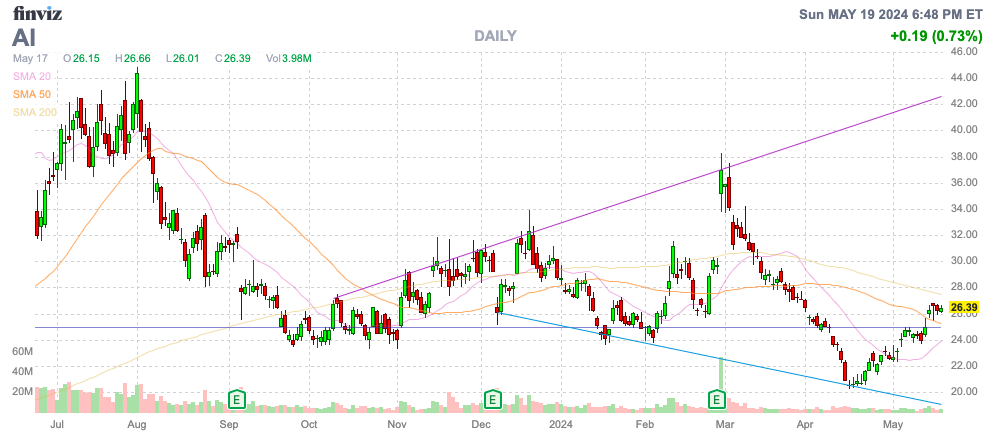

The AI software space is waiting to launch, and C3.ai, Inc. (NYSE:AI) remains a prime example of the frustration. The company reports FQ4 results next week (post-market on May 29th) and should provide a great indication of whether FY25 provides any accelerated growth, especially considering the shift to consumption billings was supposed to kick in with additional growth by now. My investment thesis remains Neutral on the stock heading into earnings.

Source: Finviz

AI Pilot Ramp

C3.ai now has the massive ramp of new AI customers on pilot programs on top of existing customers who switched to consumption pricing models. The whole scenario suggests a ramp up in revenues as both set of customers expand usage over time.

The AI software company announced 445 engagements during FQ3, up 80% from the prior February quarter. C3.ai started the consumption pricing model in FQ1 ’23 and has now entered quarter 9 in the transition to the pricing model based on vCPU/hour usage versus a large upfront subscription model.

The company has outlined the following pilot deals during the period, with a large ramp up in the last year:

- FQ3 ’24: 29 total, 17 gen AI

- FQ2 ’24: 36 total, 20 gen AI

- FQ1 ’24: 24 total, 8 gen AI

- FQ4 ’23: 19 total

- FQ3 ’23: 17 total

- FQ2 ’23: 13 total

- FQ1 ’23: 13 total.

The point to switching to the consumption model is increasing the amount of customers engaging with the C3.ai software platform via these pilot deals. The model should start paying off in FY25, and the company should start turning these pilot programs into production deals with ~70% of deals turning into production programs, with the 12-week generative AI pilots only requiring a $250K payment for a 12-week trial.

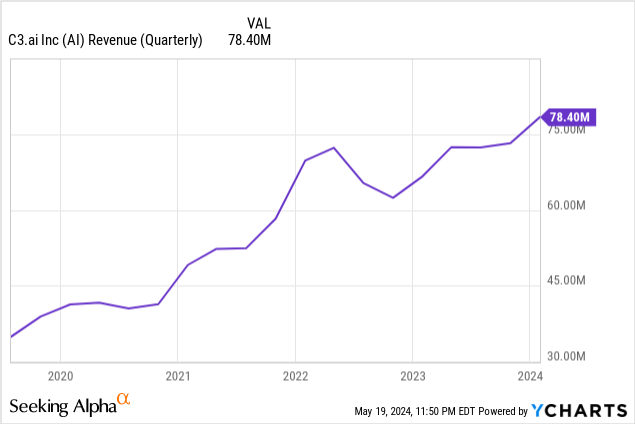

The key to the upcoming quarter is C3.ai turning the corner on the consumption model following the transition. The software company already ramped revenues up to record levels of $78 million in FQ3’24 after several quarters of just $72 million.

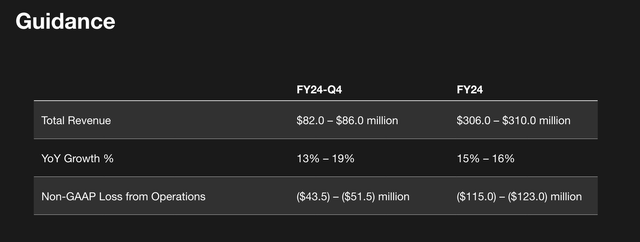

The company guided to FQ4 revenues topping $82 million. The consensus estimates are $84 million for nearly 17% growth and C3.ai confused the market with discussion of customers agreeing to 3-year subscription deals with a consumption aspect with revenue neutral over a 10 to 12 quarter period versus the full consumption pricing model, but possibly a different revenue trend than a month-to-month consumption model.

While the company appears to turn the corner, C3.ai is running into the same issues as Palantir Technologies (PLTR). The AI data software company has a long list of customer engagements and pilot tests, but the revenue picture isn’t targeting any appreciably strong growth beyond 20% despite the 80% surge in customer engagements and pilot deals, more than doubling YoY to around 30 a quarter.

At the recent Needham conference, CEO Tom Siebel highlighted some major benefits to customers with their generation AI software tools as follows:

…a leading law firm in the United States, we trained their enterprise learning model on the – you’ll be able to relate to this, on the corpus of sec.gov. So we loaded every S1, every 10-K, every 10-Q to train the enterprise learning model. So when this law firm wants to write the next S1 for whoever comes public next, I don’t know, Databricks or Anthropic or whoever it is, okay, they put in the name, address, the financials, the risk factors, hit the carriage [ph] return, and it generates the first draft of the S1 in an hour. Well, hey, that used to take seven associates two weeks.

The major disconnect remains the revenues from these deals, where a customer saves the work of up to 7 employees over the course of multiple weeks, yet C3.ai isn’t seeing a massive ramp in revenues.

Tepid FY25 Growth

What investors will want to see is FQ4 revenues topping the $84 million consensus targets. Such a quarterly revenue total will be $6 million above the prior high of $78 million in FQ3.

Source: C3.ai FQ3’24 presentation

The consensus analyst targets for FY25 are for tepid sequential quarterly revenue growth, while the consumption model combined with a ramp up in pilot tests is aligned for more significant growth. C3.ai is targeted for $86 million in FQ1 revenues with a slow ramp to $93 million in FQ3, while the company will surpass the 10th quarter on the consumption model when AI demand is booming.

Another important number is the quarterly cash burn or net losses. C3.ai ended the quarter with a cash balance of $723 million, so the cash burn level isn’t as relevant if revenue growth is fast enough. Regardless, the company guided to being free cash flow positive in FQ4 and FY25 after $106 million in negative free cash flows through the first 3 quarters of FY24.

The guidance for FQ4 was a loss from operations of $47.5 million at the midpoint. The big loss more than doubles the prior quarter loss and the market will want to see C3.ai close the gap back towards breakeven versus a loss rate surpassing 50% of revenues.

The primary big issue with C3.ai and the whole AI software sector is this statement from outgoing CFO Juho Parkkinen on the FQ3 ’24 earnings call:

But I mean, we’re still planning for FY’25. I mean, we think the opportunity is massive. We’re very excited about the generative AI opportunity, but it’s too early for us to give you any sort of guidance as to what the FY’25 revenues look like. We are confident on free cash flow positivity for ’25, however.

On one hand, C3.ai predicts a massive generative AI opportunity, yet analysts don’t even predict the company can produce FQ4 quarterly revenues topping $100 million after hitting an estimated $84 million in the April quarter being reported on May 29. As with Palantir Tech, the struggle is that the massive opportunities still aren’t materializing to a great extent.

Using a current FY25 revenue target of just $368 million and a conservative assumption of a cash balance falling to $500 million with the ongoing operating losses, the stock should trade in the following ranges, with investors looking to buy C3.ai at the lower end of the range:

- 5x EV/FY25 revenues of $368M = $20.

- 8x EV/FY25 revenue of $368M = $29.

Takeaway

The key takeaway is that C3.ai trades right in the range of where a software company would normally trade based on EV/S targets with strong profits. C3.ai, Inc. isn’t close to being profitable yet, and the AI software story isn’t producing the growth to warrant a premium valuation.

Investors would definitely watch for any signs of an inflection point in the sector.

Read the full article here