Last weekend’s article was titled “Capitulation” and speculated that the S&P500 (SPY) had made a short-term bottom at the futures low of 4924. It concluded, “5048-5050 is the initial target, but should eventually break for 5108.”

That largely played out as the high of the week came in at 5114. However, this was likely just a short-term swing inside a complex correction. More twists and turns could still come and the S&P500 should eventually drop below 4818 to set up the “trade of the year.”

This weekend’s article will describe this trade in more detail, and look at the probable path next week. Various techniques will be applied to multiple timeframes in a top-down process which also considers the major market drivers. The aim is to provide an actionable guide with directional bias, important levels, and expectations for future price action.

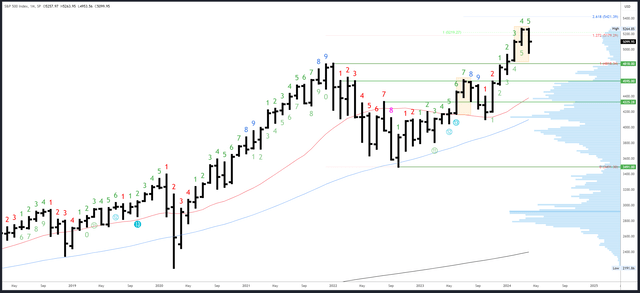

S&P 500 Monthly

There are only two session left until April’s close and it looks like the monthly bar will close in the top half of the range after staging a decent comeback. This will create a neutral bar. The points made in previous articles remain valid – the monthly and quarterly charts still have an overall bullish bias for new highs – but with a neutral bar in April, the very next move is unclear.

A slight edge may be provided by the similarities with the monthly pattern created from June-August last year. The July peak was a weak high just as March is now. “Higher for longer” rate fears and earnings season were the main themes back then as they are now. The pattern suggests a strong close to April and a turn back down in May. This is something I will monitor on the lower timeframes.

SPX Monthly (Tradingview)

The 5264.85 high is the only resistance.

April’s low of 4953 is minor support. 4853 and 4818 are major levels below there.

April is bar 5 (of a possible 9) in an upside Demark exhaustion count.

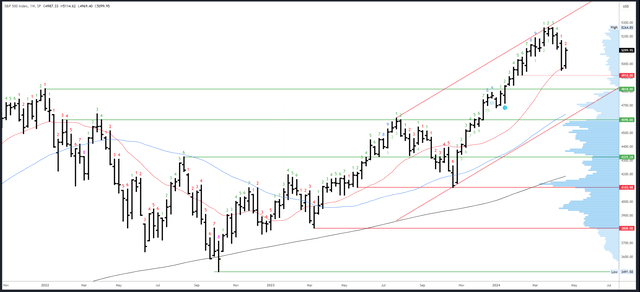

S&P 500 Weekly

An inside bar formed this week, which is neutral / potentially bearish, especially since the week before closed right on the lows. Overall, the odds favor continuation lower at some point, and the 4818 break-out re-test is a magnet. Saying that, this week’s strong close suggests more upside first and the route lower is not going to be straightforward.

SPX Weekly (Tradingview)

Resistance at 5108 has been tested. 5168 is the next level of note, then the 5264 high.

The 20-week MA has held as support. If this breaks, the 4918-20 area is minor support, then 4845 and 4818.

The upside Demark exhaustion signal looks to be having an effect with a similar delay to the July ’23 signal. A new downside count is underway and will be on bar 3 next week.

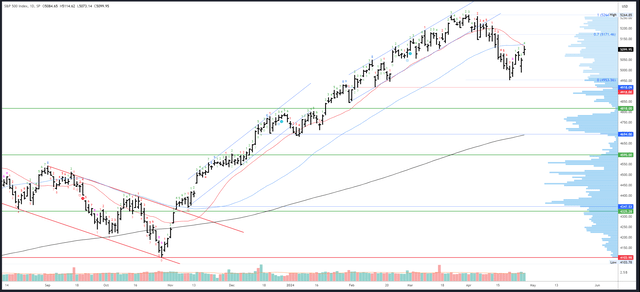

S&P 500 Daily

Thursday’s reversal set up a bullish end to the week. Resistance at the 20dma is clear and marked Friday’s high, but I would speculate it can be pushed through early next week. This corrective phase will likely chop back and forth and may need to squeeze out shorts before the next drop. 5168-74 could be reached and this area marks the area of the gap and the high before the big drop on 15th April.

SPX Daily (Tradingview)

Above 5168-74, there is gap fill at 5199, and then the 5156-64 resistance at the highs.

Immediate support is at Friday’s low of 5073, then 4990 followed by the futures low of 4924 in confluence with the 4918-20 pivots. The gap at 4845-53 is actually a monthly gap so is relevant for a bounce, but all roads seem to lead to 4818.

An upside Demark exhaustion signal will be on bar 5 (of 9) on Monday and will therefore be active Thursday and Friday.

Drivers/Events

The Iran/Israel conflict has thankfully settled down and is no longer making market headlines. This has allowed markets to focus on data and earnings, which have been a real mixed bag. The GDP miss caused a big reaction lower, as could be expected, while the PCE Price Index helped Friday’s rally as it showed inflation in-line with the 0.3% estimate (markets overlooked the revisions higher to January and February).

The busiest week of earnings season was an overall positive one. Decent earnings reactions from Alphabet (GOOG) (GOOGL), Microsoft (MSFT) and Tesla (TSLA) helped fuel a recovery in the “Mag 7,” although all stocks remain at lower highs. Apple (AAPL) reports next week.

Next week’s data is focused on the labor market. The Employment Cost Index will be released on Tuesday and bulls want to see this miss or in-line. Wednesday will bring JOLTS Job Openings and the Jobs Report is on Friday.

Jobs data hasn’t had much effect on Fed policy and Powell only pivoted when inflation forced him to. Strong data should therefore be positive for stocks. On the other hand, weak data could be problematic unless it starts to stimulate talk of early cuts. With the GDP miss, it may only take 2-3 weak NFPs to dampen the “higher for longer” rate view.

The FOMC meeting is on Wednesday. Since the Fed pivoted very recently, no big changes are likely.

Probable Moves Next Week(s)

A short-term bottom has been made and the S&P500 is recovering, helped on by earnings and relative calm in the Middle East. Similarities with the June-August period last year and a strong weekly close suggest the bounce can break above 5108 resistance. This likely targets 5168-74 where another leg lower should set up.

Bigger picture, the weak low at 4953 is unlikely to be the end of the Q2 drop and 4818 should act as a magnet in a complex corrective phase. Trading the swings in this correction will be a challenge, but patience should be rewarded as a drop under 4818 would set up the “trade of the year”. With the higher timeframes providing a bullish bias, buying near 4700 should target new highs above 5264 into Q4.

Read the full article here