Investment Outlook

Riskified Ltd. (NYSE:RSKD) provides enterprises with ecommerce fraud protection software and services.

I previously wrote about Riskified in September 2023 with a Hold outlook on high operating losses.

While management has reduced operating losses, Riskified Ltd. revenue growth continues to fall, and major economies are showing signs of slowdown.

I remain Neutral – Hold on RSKD for the near term.

Riskified’s Market And Approach

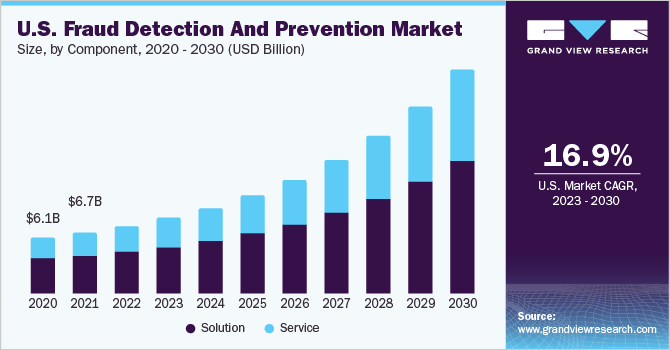

Per a 2023 market research report by Grand View Research, the global market for e-commerce fraud detection and prevention software and services was estimated at $26 billion in 2022 and is forecast to reach $94 billion by 2030.

If achieved, this growth would represent a CAGR (Compound Annual Growth Rate) of 17.6% from 2023 to 2030.

The primary reasons for this forecasted growth are an increasing penetration of the internet along with greater smartphone usage worldwide and a broader set of threat vectors for increasingly motivated fraudsters.

An increasing number of e-commerce merchants are expected to add to demand, as are emerging economies such as India and Indonesia, among others.

The chart below shows the growth history and estimation for the U.S. fraud detection and prevention market through 2030:

Grand View Research

Major competitive vendors to Riskified include the following companies:

-

Signifyd

-

ClearSale

-

Sift

-

Kount

-

Forter

-

NICE Actimize

-

LexisNexis Risk Solutions

-

Fraud Barrier

-

Interceptas

-

Fraud.net

-

BehavioSec

-

Others.

The company targets medium and large-sized e-commerce merchants in the retail, fashion, digital goods, travel and athletic segments and counts among its customers Booking.com, Shein, Wayfair, Prada, Finish Line, Swarovski and GoPro.

It uses a “land and expand” strategy within target companies that have several business lines, so its ability to efficiently grow its business within each client is a significant determinant of its profitability.

Recent Financial Trends And Valuation

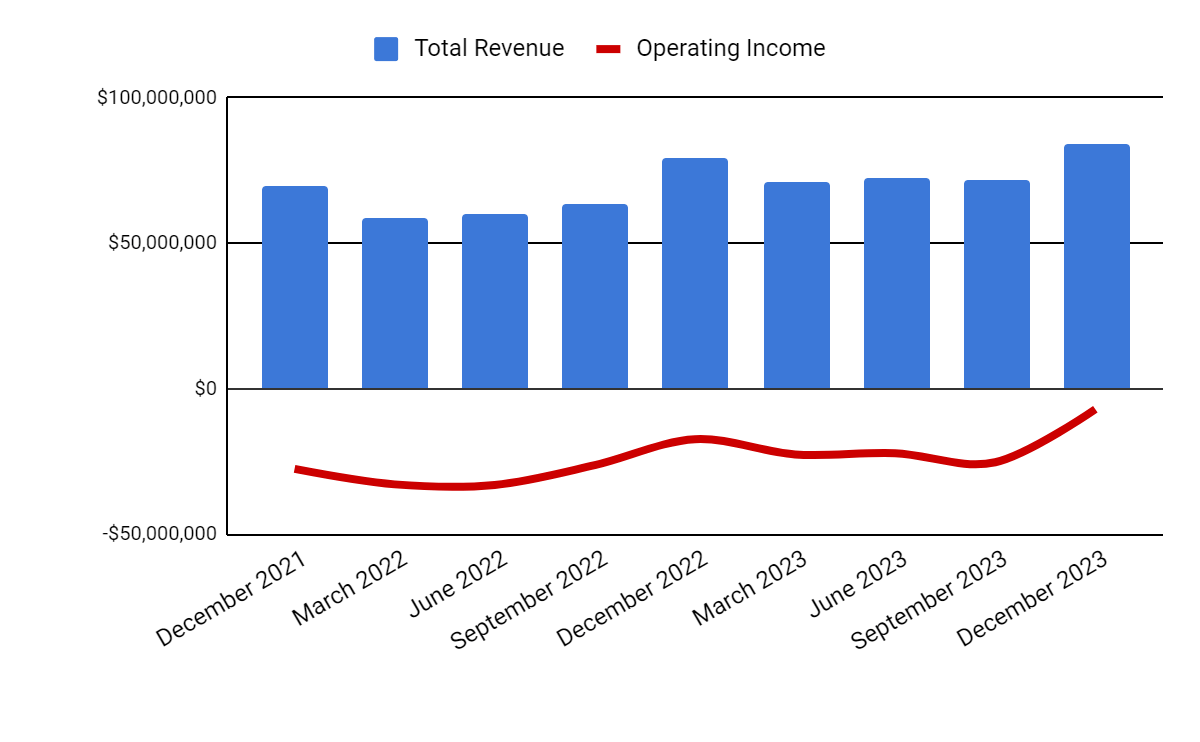

Total revenue by quarter (columns) has grown at a slower rate due to cost reductions; Operating income by quarter (line) has made meaningful progress toward breakeven because of management’s increased focus on profitability versus growth at any cost.

Seeking Alpha

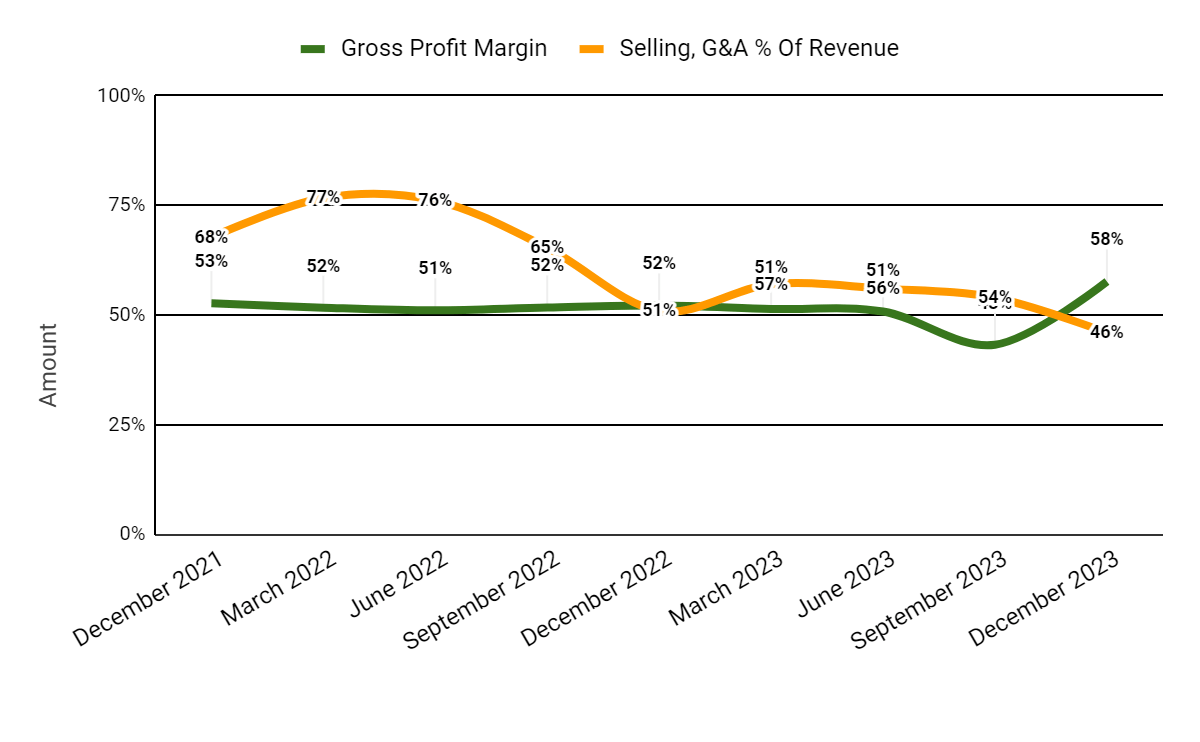

Gross profit margin by quarter (green line) has turned up as a result of increased economies of scale; Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have trended lower due to cost management efforts.

Seeking Alpha

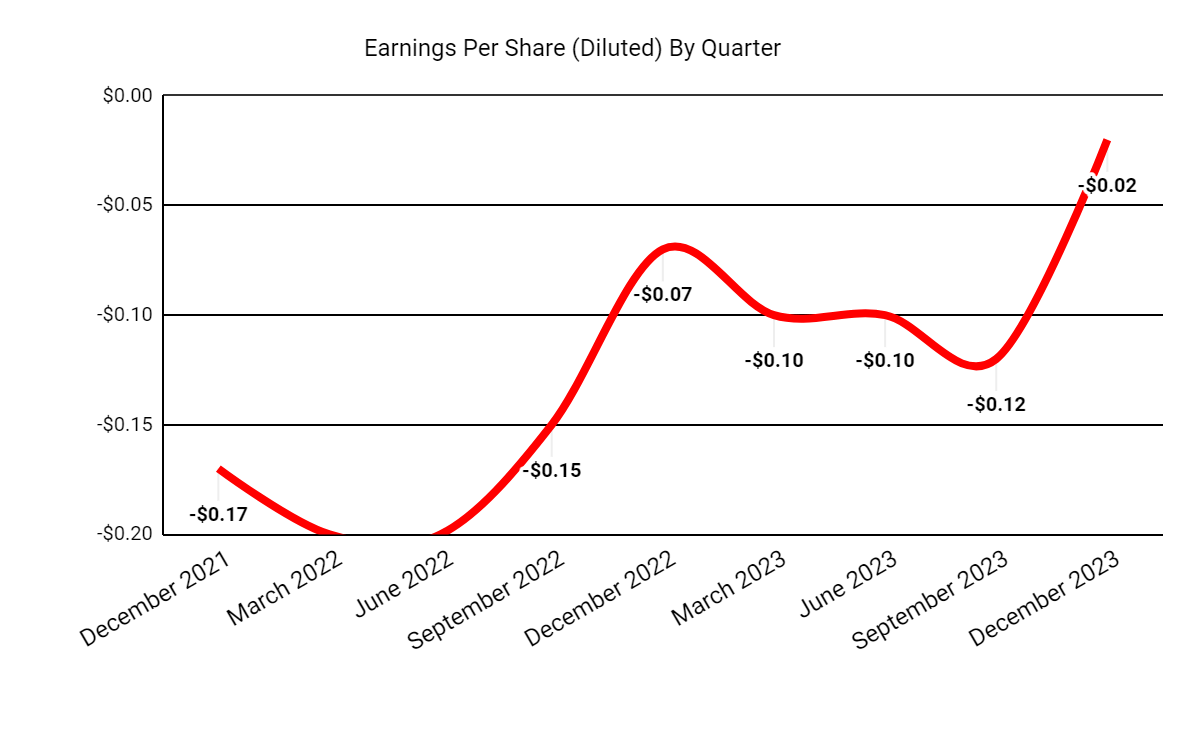

Earnings per share (Diluted) have approached breakeven in the most recently reported quarterly results as the company has increased its focus on achieving profitability in a higher cost of capital environment.

Seeking Alpha

(All data in the above charts is GAAP.)

I’ve created a major financial metrics table as a handy reference:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

1.3 |

|

EV/EBITDA (“FWD”) |

32.4 |

|

Price/Sales (“TTM”) |

3.0 |

|

Revenue Growth (“YoY”) |

13.9% |

|

Net Income Margin |

-19.8% |

|

EBITDA Margin |

-24.6% |

|

Market Capitalization |

$885,180,000 |

|

Enterprise Value |

$441,680,000 |

|

Operating Cash Flow |

$7,280,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.34 |

|

2024 FWD EPS Estimate |

$0.15 |

|

Rev. Growth Estimate (“FWD”) |

12.3% |

|

Free Cash Flow/Share (“TTM”) |

$0.03 |

|

Seeking Alpha Quant Score |

Hold – 3.38 |

(Source: Seeking Alpha.)

RSKD’s Rule of 40 performance has improved markedly in recent quarters, but still has a ways to go before achieving a strong result.

|

Rule of 40 Performance (Unadjusted) |

Q2 2023 |

Q4 2023 |

|

Revenue Growth % |

17.8% |

13.9% |

|

Operating Margin |

-29.6% |

-8.3% |

|

Total |

-11.8% |

5.6% |

(Source: Seeking Alpha.)

Why I’m Neutral On Riskified

Riskified is producing slower revenue growth than in previous years, despite not yet crossing the $100 million quarterly revenue milestone.

It is further seeing slower growth as management is running the company to reach breakeven, reducing SG&A expenses in the process.

As a result, the former premium the stock may have held for being a high-growth stock has now been sacrificed.

When the company went public in 2021, its trailing twelve-month revenue growth rate was nearly 54% compared to its forward growth forecast of only 12.3%.

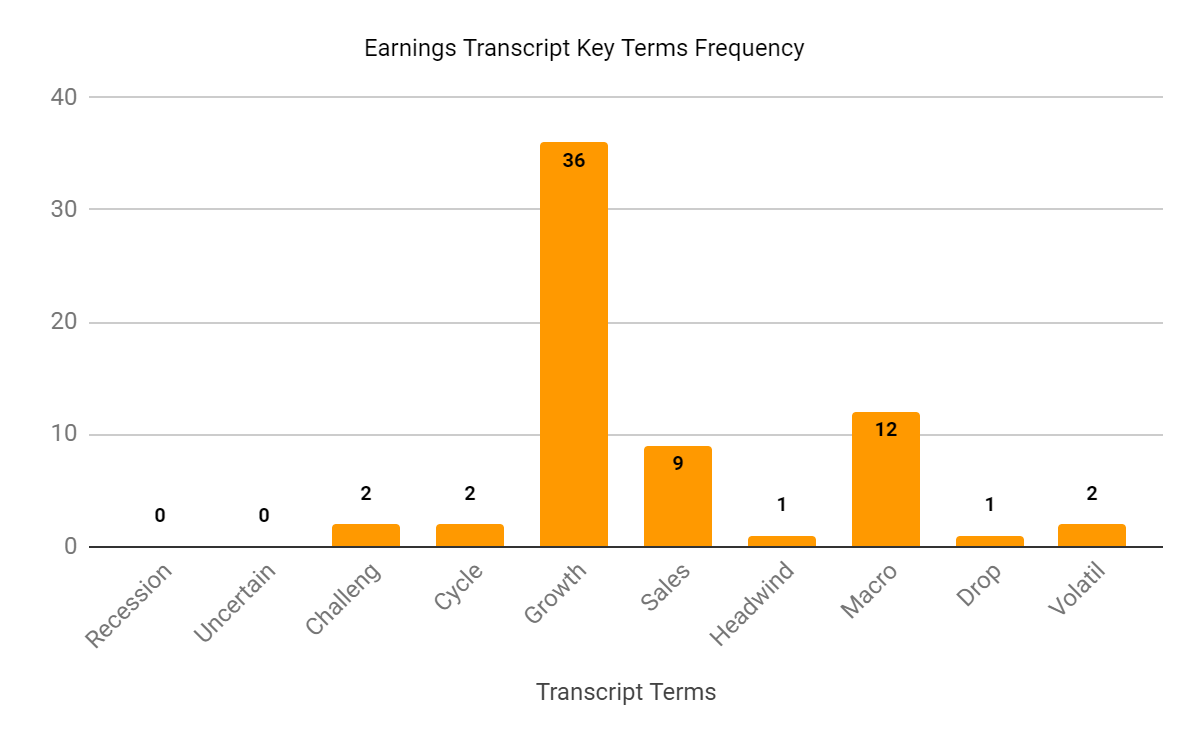

I’ve prepared a chart showing the frequency of various keywords and terms in management’s most recent earnings call:

Seeking Alpha

I’m interested in the frequency of negative terms, and the company is continuing to face “Macro” “Headwinds” and challenging economic conditions.

This has come from increasing volatility in consumer spending in recent periods, reducing the firm’s net dollar retention rates and, therefore, its sales and marketing efficiency and a lower revenue growth rate than historically.

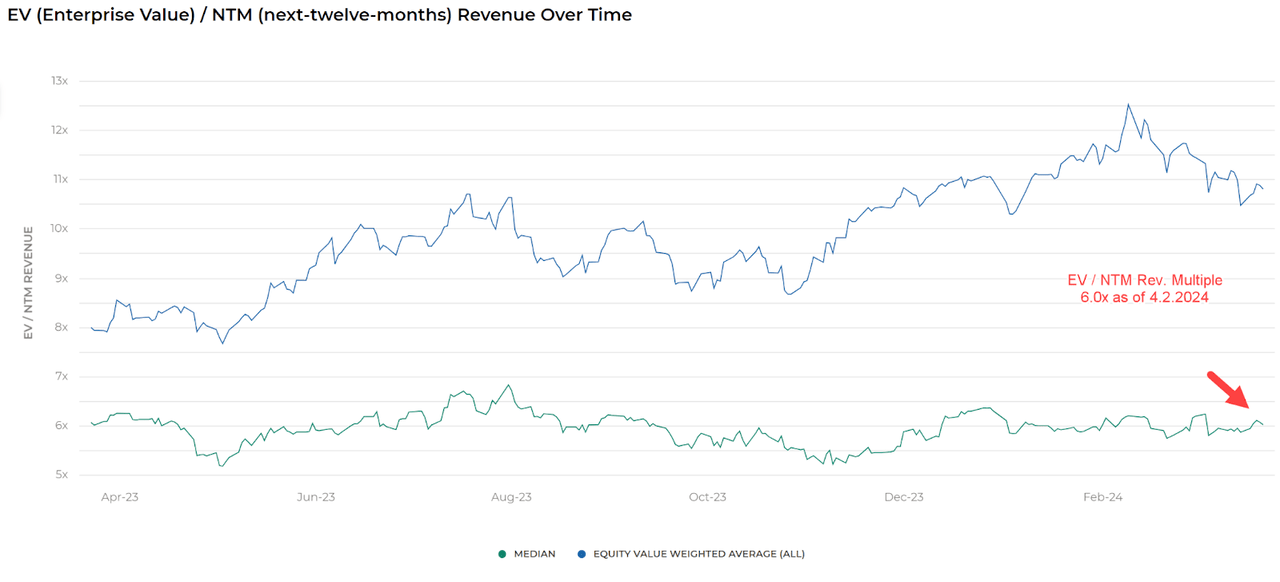

Regarding valuation, the market is valuing RSKD at an EV/Sales multiple of around 1.3x on NTM estimated revenue growth rate of 12.3% against a median Meritech SaaS Index implied ARR growth rate of around 18% (Source).

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple median of around 6.0x on April 2, 2024, as the chart shows here:

Meritech Capital

So, by comparison, RSKD is currently valued by the market at a large discount to the broader Meritech Capital SaaS Index, at least as of April 2, 2024.

Risks to the company’s outlook include an economic slowdown that may be underway in various economies, including the recently reduced U.S. GDP growth rate for Q1 2024 of 1.6%.

Still, RSKD may be rewarded if/when it reaches operating breakeven, which may happen in the next few quarters.

However, considering its significantly slower growth outlook and a higher potential for macroeconomic slowdown ahead, I remain Neutral – Hold on RSKD for the near term.

Read the full article here