Investment Overview – Arvinas’s Shares Buoyant As Vepdegestrant / Ibrance Combo Study Initiated

I covered the “protein degradation” specialist drug developer Arvinas (NASDAQ:ARVN) in a deep dive note for Seeking Alpha back in late November last year, giving the company’s stock a “Buy” recommendation.

Nearly five months on, the biotech’s shares trade at a value of ~$38 – up >75% since my note, after experiencing a phenomenal bull run between November last year and February this year, which saw the share price climb from $15, to >$50 per share, before dipping slightly in recent weeks.

The gains were primarily related to Arvinas’ lead asset, vepdegestrant, an estrogen receptor (“ER”) protein degrader for the treatment of patients with locally advanced or metastatic ER positive / human epidermal growth factor receptor 2 (“HER2”) negative, or ER+/HER2-, breast cancer.

Vepdegestrant is being developed in partnership with pharma giant Pfizer (PFE). In 2021, Pfizer paid Arvinas $650m upfront for the rights to the drug, also known as ARV-471, as well as making a $350m equity investment in Arvinas, and pledging up to $1.4bn in additional milestone payments, plus a 50/50 profit and cost sharing agreement on global sales, should the drug be approved.

Data to date has been decidedly mixed, as I discussed in my previous note. In 2021, Arvinas and Pfizer shared Phase 1 data showing one confirmed partial response, two additional patients with unconfirmed PRs, and a clinical benefit rate (CBR) of 42% in 12 evaluable patients.

In November 2022, data was shared from a Phase 2 study of patients with locally advanced or metastatic ER+/HER2- breast cancer, showing only two partial responses (“PRs”) out of 71 patients.

Given the prior failure of two other protein degrader therapies targeting breast cancer – French pharma Sanofi’s (SNY) selective estrogen receptor degrader and Swiss based Roche’s (OTCQX:RHHBY) giredestrant – the market concluded that vepdegestrant lacked the necessary efficacy, sending Arvinas’ stock on a long-term bear run.

Arvinas, in response, had noted that this study’s primary endpoint had always been clinical benefit rate – “defined as a confirmed complete response, partial response, or stable disease ≥ 24 weeks” – and that the CBR achieved in all patients was 38%, rising to 51% in patients harboring ESR1 mutations.

What seems to have revived Arvinas’ share price is data shared last December from a combination study of vepdegestrant in combination with palbociclib – Pfizer’s $5.8bn (in 2023) selling breast cancer therapy Ibrance. In this study, an overall response rate (“ORR”) of 42% and median progression-free survival of 11.1 months was observed in heavily pre-treated patients with a median of four lines of therapy.

Arvinas and Pfizer quickly moved to initiate a pivotal combination study of vepdegestrant / ibrance as a first line therapy in ER+/HER2 (breast cancer) VERITAC-3 to accompany the pivotal Phase 3 study of vepdegestrant as a second line monotherapy – VERITAC-2. Results from VERITAC-2 have been promised in 2H24. Both studies have the same primary endpoint, being Progression Free Survival (“PFS”). As such, Arvinas has an exciting catalyst arriving this year, and investors should expect significant volatility as a result.

Arvinas Attracts Another Major Pharma Partner As Novartis Grabs Rights To Prostate Cancer Candidate

Arvinas is making the headlines today as management reports that the company has entered into a strategic license agreement with Swiss Pharma giant Novartis (NYSE:NVS), for:

… the worldwide development and commercialization of ARV-766, Arvinas’ second generation PROTAC® androgen receptor (“AR”) degrader for patients with prostate cancer. The transaction also includes an asset purchase agreement for the sale of Arvinas’ preclinical AR-V7 program to Novartis.

By the terms of the deal:

Novartis will be responsible for worldwide clinical development and commercialization of ARV-766 and will have all research, development, manufacturing, and commercialization rights with respect to the preclinical AR-V7 program. Arvinas will receive an upfront payment in the aggregate amount of $150.0 million. Under the License Agreement, Arvinas is eligible to receive additional development, regulatory, and commercial milestones of up to $1.01 billion, as well as tiered royalties for ARV-766.

So far, Arvinas’ stock price has gained ~6% on the news – the company retains a market cap valuation of $2.65bn at the time of writing – while Novartis’ share price remains static. Nevertheless, this deal is important to both the pharma giant and the smaller biotech for contrasting reasons.

Novartis Overview – Importance Of Prostate Cancer Drug Pluvicto

In 2023, Novartis earned $45.44bn of revenues, delivering net income of $8.57bn, a margin of ~19%. Free cash flow generated in 2023 came to $13.2bn, another figure that may have resonated positively with shareholders. For 2024, the company has promised top line growth in the mid-single digits, and bottom line growth in the high single digits, which also speaks to a healthy company.

Novartis markets and sells drugs such as the $6bn selling (in 2023) heart failure drug entresto, immunology therapies Cosentyx, Xolair and Ilaris, which earned $5bn, $1.5bn and $1.4bn in 2023, kesimpta, indicated for multiple sclerosis, and zolgensma, indicated for spinal muscular atrophy – which earned $2.2bn, and $1.2bn of revenues last year.

While the above assets earned more than 30% of Novartis total revenues last year, the pharma’s most important / lucrative division is oncology – a segment in which Novartis markets and sells five “blockbuster” (revenues >$1bn per annum) drugs – anemia therapy Promacta / Revolade, breast cancer therapy Kisqali, Tafinlar, targeting BRAF mutated cancers, Tasigna, indicated for leukemia, and Jakafi, indicated for myelofibrosis. These five drugs contributed >$10bn to Novartis’ top line in 2023.

As important – if not more important – than all of these oncology drug products, however, is pluvicto, Novartis’ flagship prostate cancer therapy, approved by the FDA for commercial use in the US in March 2022, and in Europe in December 2022. In its pivotal study:

Participants treated with Pluvicto plus SOC had a 38% reduction in risk of death and a statistically significant reduction in the risk of radiographic disease progression or death (rPFS) compared to SOC alone. Interpretation of the magnitude of the rPFS effect was limited due to a high degree of censoring from early drop out in the control arm.

Novartis has high hopes for Pluvicto and hopes to expand the drug’s label into the pre-taxane patient population, which could happen this year and could nearly double the drug’s addressable patient population to >40k. With a list price of ~$42k per dose, and patients requiring up to six doses in a course of therapy, there’s an argument to be made that pluvicto could one day achieve revenues in the double-digit billions.

Pluvicto + ARV-766 – A Smart Move To Bring Promising New Asset Into Pipeline

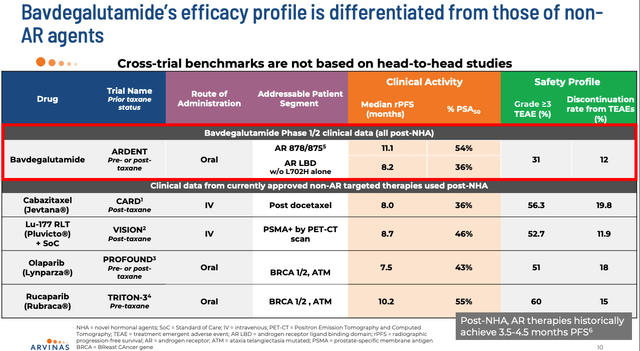

Arvinas has designed ARV-766 as a next generation version of its first prostate directed candidate, bavdegalutamide, which achieved some intriguing results in a Phase 1/2 study, as shown below:

bavdegalutamide efficacy profile compared to SOCs (Arvinas presentation)

The PSA reduction data is not broadly comparable to current standards of care, such as AstraZeneca’s (AZN) Lynparza, and, of course, Novartis’ pluvicto, with an apparently strong safety profile, also, the caveat being that comparing different clinical studies is often a thankless task, since different types of patients are enrolled, and different objectives set.

Nevertheless, Arvinas says that while bavdegalutamide “has proven the concept for a PROTAC AR Degrader in prostate cancer,” ARV-766:

… has been shown in clinical settings to have better tolerability and a broader efficacy profile that could potentially reach 3x more patients in mCRPC.

Arvinas believes ARV-766 could benefit up to 35k patients with prostate cancer, which may potentially set the drug up as a long-term competitor to pluvicto. As such, I see Novartis’ deal for the rights to develop and market and sell ARV-766 as having not one, nor even two, but three major benefits for the company.

Firstly, Novartis may want to try ARV-766 in combination with Pluvicto, to see if it can achieve similarly positive results to those achieved by Pfizer, when Pfizer combined its proven breast cancer drug ibrance with vepdegestrant, with encouraging results.

Secondly, if ARV-766 continues to impress in clinical studies, Novartis will have a ready-made, best-in-class prostate cancer franchise on its hands, and the keys to a double-digit billion market opportunity will be in its hands.

Thirdly, by acquiring the rights to ARV-766 today for $150m upfront, rising to ~$1bn if successfully commercialized, Novartis ensures it will not have to take on ARV-766 in a commercial setting, or lose out on pluvicto revenues if ARV-766 proves its superior in particular patient subsets.

We might even add a fourth benefit to the deal – if ARV-766 fails to make headway in clinical studies, Novartis can simply walk away from the deal – the company may have written off $150m in that scenario, but that’s a small price to pay to hedge against the alternative scenario, i.e. ARV-766 becoming a direct rival to pluvicto.

Concluding Thoughts – A Good Deal For Both Parties Can Be Share Price Accretive For Both Parties

Before I conclude this post, it’s worth familiarizing ourselves with how protein degraders, and specifically Arvinas’ protein degraders, work – as per Arvinas 2023 annual report / 10K submission:

We have engineered our PROTAC targeted protein degraders to utilize the cell’s naturally occurring protein disposal system, directing the proteasome to recognize and degrade specific proteins associated with disease.

Our PROTAC targeted protein degraders are chimeric small molecules with two operative ends—one, a ligand that binds to the protein targeted for degradation, and the other, a ligand that binds to an E3 ligase.

These two ligands are connected by a chemical chain linker. Our PROTAC targeted protein degraders bring the targeted protein and the E3 ligase together into a three-component grouping known as a trimer complex to facilitate the transfer of ubiquitin to the target protein.

Once four ubiquitins are attached in a chain to the target protein, the proteasome recognizes and degrades the protein.

Personally, protein degradation has always struck me as a smart idea – if you don’t want a specific protein misbehaving in the cell, marking it out for destruction by the body’s own immune system eliminates the problem.

Of course, protein degradation is far more nuanced and complex than it is possible to explain in a short post, nor has it been especially successful to date.

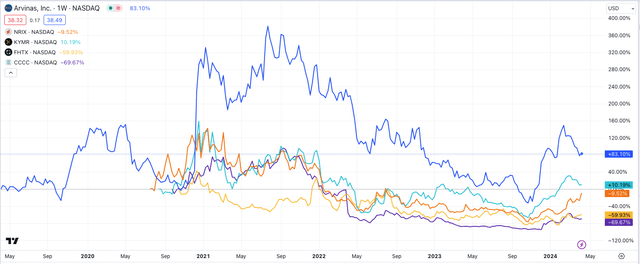

Kymera Therapeutics has struggled somewhat to make its degraders work in auto-immune conditions, and frankly, there are not too many other companies active in the space – Arvinas lists C4 Therapeutics (CCCC), Foghorn Therapeutics (FHTX), Nurix Therapeutics (NRIX), and Proteovant Therapeutics as other protein deg specialists.

Of these four listed companies, Arvinas has been easily the most successful in terms of share price performance, as we can see below:

share price performance – selected protein deg co.s (TradingView)

Arvinas reported cash of $312m, and near-term cash of $949m as of the end of 2023, against a net loss of $(373m) for the year, so there’s plenty of cash available to fund development to complete studies of vepdegestrant, and plenty of achievable milestones in play.

Given its cash reserves, it’s tempting to wonder why management was not more determined to hold on to the rights for ARV-766, but equally, to bring a partner like Novartis on board may be the smarter long-term move – looking ahead, it seems possible that either Pfizer or Novartis could make an M&A bid for the company if either company likes the later stage data it is seeing. Arvinas has two more Phase 1 stage assets, ARV-393, targeting hematology, and ARV-102, targeting neuroscience.

There are clearly risks to the long-term Arvinas bull thesis, but in my view, today’s deal with Novartis is another positive development for a company that looked as though its approach was fundamentally flawed when the market was selling its stock in 2022 and 2023, only to come back with better data in larger patient populations.

Novartis may be busier today initiating its tender offer for Morphosys, the Munich, Germany,-based biotech it agreed to acquire in February, but I also feel that this deal is win-win for the Swiss pharma giant also, as it looks to establish long-term supremacy in the prostate cancer market, and maintain its global importance as an oncology focused pharma.

I’d be content to invest in either company’s stock at current prices, although in Arvinas’ case, due to the inherent risks of drug development and the company’s singular focus on protein deg, I would only invest money I could afford to lose.

While the stock promises triple-digit percentage share price upside potential, perhaps this year the if the VERITAC-2 data are positive (personally, I suspect the Ibrance combo data to be a better bet), a study setback on safety of efficacy could also half the company’s share price overnight. Such is the way of the “hit and miss” biotech industry.

Read the full article here