Overview

Adding different streams of income sources to my portfolio made it a lot easier for me to ride out any type of market volatility throughout my years of investing. Not only did it make it easier to mentally overcome a dropping portfolio value, but it also helped me feel like I had a greater sense of control to counteract shaky markets. When prices collapse, the inverse effect of this is higher dividend yields. As a result, I discovered that reinvesting my shares and deploying additional capital into income-based investments when they dropped in value actually sped up the compounding in my portfolio.

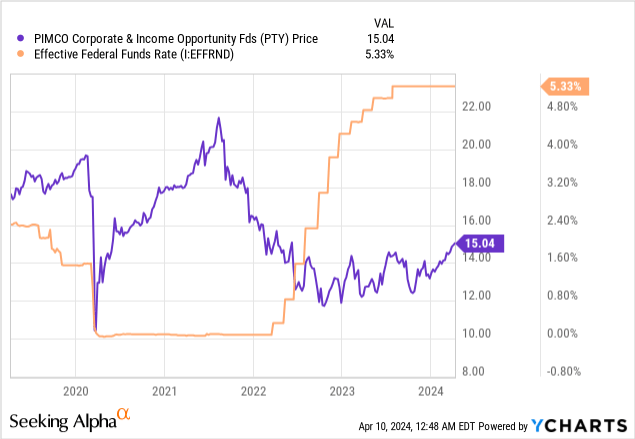

PIMCO Corporate and Income Opportunity Fund (NYSE:PTY) currently has a 9.4% dividend yield. However, you may have been lucky enough to snag shares that resulted in a yield between the range of 10 – 12% when the price was falling from August 2021 all the way to May 2023. PTY is able to consistently provide a high yield due to its structure as a CEF (closed-end fund) operating with a focus on fixed-income generation. This income is generated through Corporate Debt Obligations, mortgage-related or other asset-backed securities, foreign bonds, and fixed or floating rate debt. The fund’s stated objective is to seek maximum total return through a combination of current income and capital appreciation.

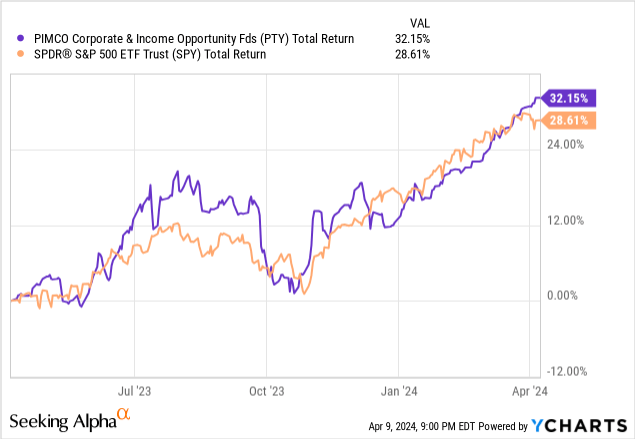

While it’s a bit irrelevant to share the performance against the S&P500, I do want to point out how in the past you were able to get an equity-like return with credit. Most of the returns here from PTY are received through the high distribution. To help fund this high distribution, PTY’s strategy has the inclusion of leverage to assist with higher return potential. I rate PTY a Buy because this is one of the top quality income-based CEFs that can consistently deliver monthly income from a diverse credit portfolio in my opinion.

Management has an established track record, and PTY’s price range has remained mostly the same for over two decades. This makes PTY very predictable when it comes to timing entries or exits. This CEF can be a very powerful tool to fund your retirement or add splashes of dividend income to your portfolio. While the price currently sits at a high premium to NAV, I don’t necessarily think this matters too much in the grand scheme here. After all, funds that have excellent management teams behind them commonly trade at premiums. Since the fund prioritizes income generation, you can simply reinvest your dividends or deploy more capital during price drops to lower your cost basis.

Top Tier Management & Consistency

Typically, CEFs are best utilized by investors that depend on the income produced from their portfolio. The majority of the people in this category are those who are in retirement and use the income produced to fund their daily lifestyle. Therefore, you’d likely choose to invest your funds with an asset manager that has a great track record and a wealth of knowledge in the credit space. Approximately 84% of PIMCO assets are outperforming their respective benchmarks over a 5-year period. PIMCO also has $1.86T in AUM (assets under management) including assets for central banks, sovereign funds, and pension funds. These folks are the top-tier specialists in generating income and benchmark-beating returns.

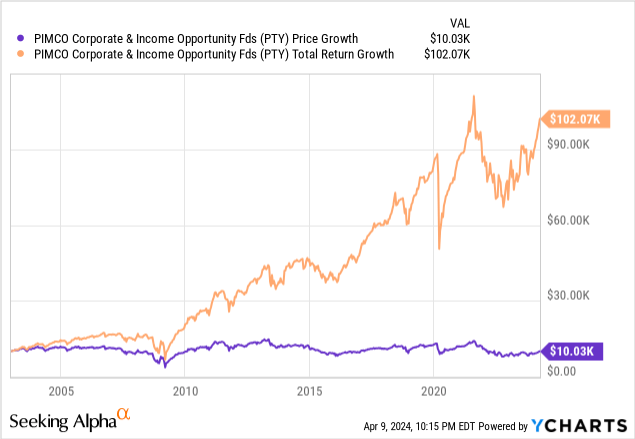

PTY was established in 2002 and has been consistently providing a high level of distribution income for over 2 decades at this point, while the price has remained within the same range. Back in 2002, the price was $15 per share and now in 2024, the price sits at nearly the same exact spot. It’s pretty cool to think about an original investment of $10,000 would still be worth $10,000, yet it would have generated a total return of over $100k in distributions. PIMCO’s ability to generate these consistent returns comes with an appropriate management fee of 0.74%.

Diverse Portfolio

PTY’s portfolio is diverse in nature, consisting of many different sources of debt to generate income from. We can see that high-yield credit makes up the largest portion of the market value, at nearly 30%. The diversification across the portfolio allows you to maximize income while the fund actively shifts portfolio weightings whenever management finds an opportunity for attractive yields to be generated.

| Sector Allocation % | Market Value % |

|---|---|

| High Yield Credit | 29.93% |

| Mortgage | 13.51% |

| Non-Agency Mortgage | 12.76% |

| Net Other Short Duration Instruments | 12.27% |

| Non-USD Developed | 11.50% |

| Emerging Markets | 8.44% |

| Invest. Grade Credit | 8.18% |

| Other | 6.84% |

| US Government Related | 4.46 |

| CMBS | 3.22% |

| Municipal | 1.65% |

| Agency MBS | 0.75% |

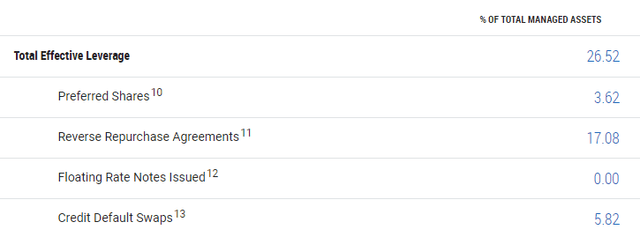

I really like that this strategy has been time tested to withstand a multitude of different market environments. In addition, PTY has global exposure, which further expands the fund’s reach and opportunity for income generation. The fund also typically invests at least 80% of net assets at any given time. I previously mentioned that PTY takes advantage of leverage to amplify potential returns. As of 2/29/24, leverage is being used across 26.5% of the total managed assets.

PIMCO

We can see that the largest amount of leverage comes from reverse repurchase agreements. Reverse repurchase agreements can be briefly explained as when one person, entity, or fund sells securities to another side with an agreement to buy them back at a later date. By deploying this strategy, PTY can pull in additional income from interest on these reverse repurchase agreements.

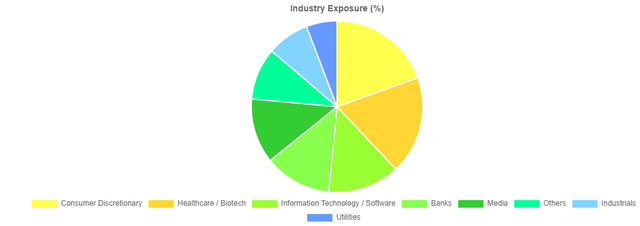

Lastly, PTY’s investments are mostly based within US operations, making up about 77% of the total exposure. However, the fund does have some global exposure to other regions like France, the United Kingdom, Italy, and Spain. The industry sector allocation is also quite diverse with the majority focus being in Consumer Discretionary, Healthcare, and Tech/Software.

CEF Data

High Income & Risk Profile

PTY’s latest declared monthly dividend of $0.1188 per share brings the current yield up to 9.4%. If you are retired, it would be ideal to receive a steady distribution; one that is predictable, reliable, and consistent in nature. PTY has almost provided this over the last decade. The dividend was reduced by 8.6% back in September 2021 to the current level of $0.1188 per share on a monthly basis. Before this cut, the monthly distribution rate was $0.13 per share. While I cannot locate any sort of communication from PIMCO on the matter, my best guess would be a reaction to the tight credit spreads and weird volatility of the market at that time. Perhaps the reduction was simply a defensive-based move in order to maintain a safer cushion of NII.

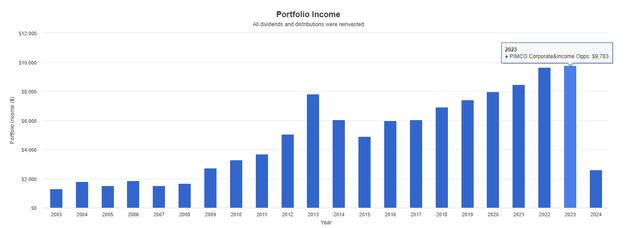

Using Portfolio Visualizer, we can see how the income from PTY has grown over time. This output assumes an original investment of $10,000 with no additional capital ever being deployed except for the dividends being reinvested. As a result, our initial $10,000 investment in 2003 would have originally yielded us an income of $1,304. In the present day, that original $10,000 with dividends reinvested would now be yielding us an income of $9,783 and a total position value of over $110k, despite the price never really seeing substantial increases.

Portfolio Visualizer

While this is a great level of income growth, it’s worth mentioning that this income is not tax-efficient. The distributions received from PTY are typically classified as ordinary income and therefore would be best utilized within a tax-advantaged account.

To some people’s surprise, these high distributions have historically been generated from a portfolio of credit investments that mostly fall into the “below investment grade” category. This class of credit quality has also been known as “junk”. These are companies that are rated BB and below and may have a higher risk of default. While this risk is certainly true in theory, I think PIMCO’s ability to effectively manage this risk over the last two decades is a testament to their ability to assess the risk and quality of their investments.

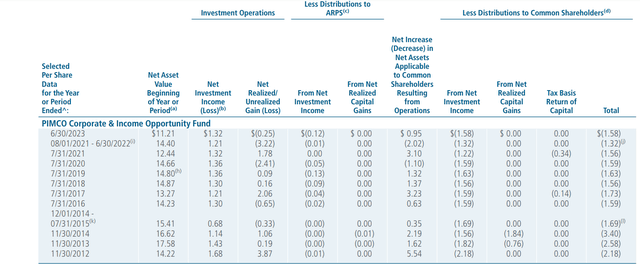

PTY Annual Report

Taking a look at the most recent annual report shows us that the PTY hasn’t been out-earning their annual distribution total from NII (net investment income). This does make me raise an eyebrow to question the sustainability of the dividend since the annual distribution is $1.4256 per share. For the fiscal year of 2023, their total net investment income was $1.32 per share. However, looking back at the previous years, this has always been the case. I searched endlessly for some sort of communication or additional documentation that could add more clarity to the matter, but was unable to locate anything.

I did notice that there was a $0.25 increase that resulted from additional common share offerings. As a result, the NAV has slowly decreased in value. However, the annual report states that there is no ROC (return of capital) so I am still a bit in the dark about where the rest of the distribution comes from.

Lastly, since the portfolio of PTY consists of companies and debt classified as below investment grade, they may be more sensitive to interest rate changes. More specifically, it may cause lower profit margins and revenues, which can translate to these debts being more difficult to pay down. With the Fed still weighing interest rate cuts, I believe we will remain in a higher interest rate environment. Therefore, interest payments on these loan obligations may cause additional strain and contribute to higher defaults.

Price Entry May Not Be That Important

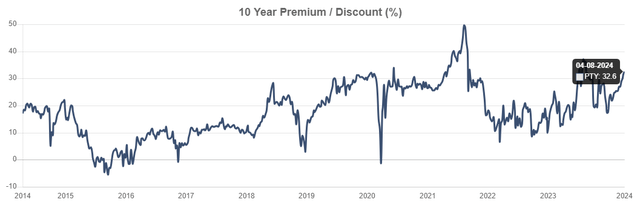

One of the main factors that caused investors to stay hesitant and on the sidelines is the current premium to NAV (net asset value). The price currently trades at a premium to NAV of 32.6%. For reference, the average premium over the last three-year period has been 23.15%. Over the last decade, the price has only dipped into discount territory a handful of times. Even during the market drop of 2020, the price only slightly reached a very brief discount of -1.32%.

CEF Data

From a price perspective, we still haven’t reached the same highs above $20 per share that were achieved in 2021. While these were highly volatile times and I don’t believe the premium to ever reach that high again, I think entry around $15 per share is still ideal. In fact, throughout the fund’s history, the price has traded above $15 per share more frequently than it traded below. While timing entry can feel good, let’s not forget that the income is why we are all here.

While entry can help you get a better upfront dividend yield, reinvesting those dividends and adding on price declines is where the most impactful growth happens. I think a lot of investors can get caught up trying to enter a closed-end fund as close as possible to discount territory. While this is totally understandable, it may be a distraction when the ultimate goal here is consistent income that can support your lifestyle. PTY has done exactly that and will likely continue to do so as long as NII can support it.

PIMCO

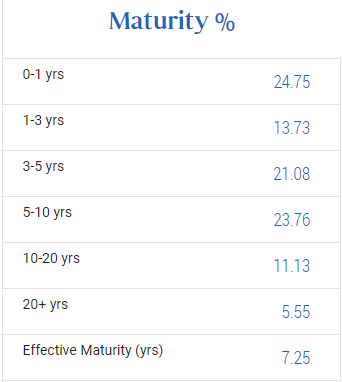

Lastly, I wanted to tie this to the debt maturity durations. The large majority of PTY’s debt maturity is at 7.25 years. The vast majority of the maturities are in the short term with a period of less than one year. The second-largest portion of the majority falls within the 5-10 year time frame. Debt issued with longer maturity timelines is usually more sensitive to changes in interest rates. This is because bonds have an inverse relationship with interest rates. So, when interest rates rise, the market value of bonds usually decreases.

The decrease can be linked to fixed interest payments becoming less attractive at those levels. This works in reverse as well, because when interest rates fall, the market value of these bonds/debts tends to increase. So even if rates decrease slightly, it would be beneficial. As interest rates come down, it may open some breathing room for companies to pay the debt and interest they owe. So in a way, lower rates also mean lower risk for PTY. We can see the inverse relationship below how when rates were near zero, the price of PTY rose rapidly.

Takeaway

PIMCO Corporate and Income Opportunity Fund is a closed-end fund that has provided a high level of distribution income while the price remains in a predictable and steady trading range. As a result of this consistency, PIMCO’s ability to generate income month after month makes this a great option for investors at retirement. I believe the high-yielding income that is produced can snowball into an amount large enough to potentially fund your lifestyle. The distributions are seen as ordinary income and best utilized within a tax-advantaged account, however. While the price currently trades at a premium to NAV, I don’t believe this to be the end of the world. The price frequently finds a way to equalize around the $15 per share mark.

Read the full article here