In an ideal world, investments that we make would appreciate quickly, allowing us to sell out and look for opportunities for additional gains. The shorter the time is between the time we purchase and the time we can justify selling, the better. Unfortunately, the world is not perfect. And investors make mistakes. In most cases, you should be prepared to hold for a couple of years. But every once in a while, our timing is lucky enough that significant upside can be captured in that short window of time. And one good example that I could point to regarding this is Tennant Company (NYSE:TNC).

For those not familiar with the company, it operates as a producer and seller of both manual and mechanized cleaning equipment that can be used for a variety of purposes, including industrial and commercial use. In addition to selling these products outright, the company also sells aftermarket parts, related consumables, and more. It also provides equipment maintenance and repair services. Back in August of last year, I ended up revisiting the business. Up to that point, things had already been going quite well. Revenue, profits, and cash flows were all rising nicely. Shares were also attractively priced. That led me to reiterate the ‘buy’ rating I assigned the stock previously.

Since the publication of that article, things have gone really well. While the S&P 500 is up 19%, shares of Tennant Company have seen an upside of 52.4%. But that’s not all. I originally wrote a bullish article about the company in September 2022. And from that time through the present day, shares are up a whopping 106.6%. That dwarfs the 35.2% rise seen by the S&P 500 over the same window of time. Fast-forward to today, and I must say that I feel a bit differently. Although the company continues to grow at a nice clip, and it is a high quality operator with very little debt, I believe that shares have reached fair value. Because of this, I have decided to downgrade it from a ‘buy’ to a ‘hold’ to reflect my view that performance moving forward should be more or less in line with what the broader market should achieve.

Cleaning up nicely

Strong fundamental performance can be thanked for the strong upside that shares of Tennant Company have seen over the past several months. Take, for instance, how the company performed during 2023. Revenue for that time totaled $1.24 billion. That’s 13.9% above the $1.09 billion generated in 2022. Organic sales growth contributed to most of this upside. Overall organic revenue jumped by 13.6%, not only because of higher volumes shipped, but also primarily because of higher selling prices. The rest of the sales increase was driven by foreign currency fluctuations that benefited shareholders marginally.

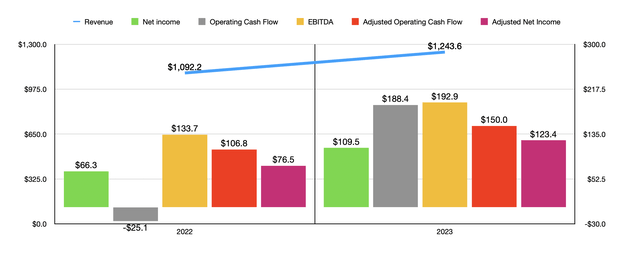

Author – SEC EDGAR Data

With revenue rising, profits have also moved higher. Net income jumped from $66.3 million to $109.5 million. This was mostly the result of the firm’s gross profit margin climbing from 38.5% to 42.4%. Digging deeper into the company’s data, management was able to achieve this improvement because of two things. The first and most significant seemed to be the ability to raise prices that exceeded inflationary pressures. And the second involved cost-cutting initiatives that, on their own, more than offset multiple years worth of inflation. After we make certain adjustments, net income grew from $76.5 million to $123.4 million. Naturally, other profitability metrics followed suit. Operating cash flow went from negative $25.1 million to positive $188.4 million. If we adjust for changes in working capital, we get an increase from $106.8 million to $150 million. Meanwhile, EBITDA for the company expanded from $133.7 million to $192.9 million.

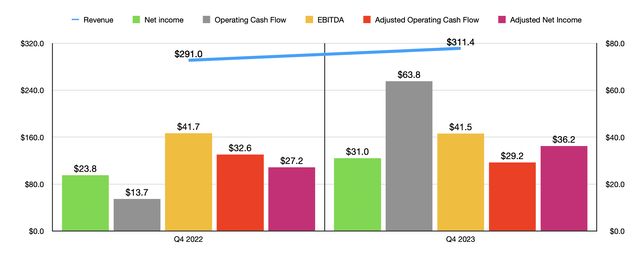

Author – SEC EDGAR Data

For those worried about what the future holds, particularly given the economic uncertainty we are faced with, I would urge cautious optimism. I say this because, even if we look at the most recent quarter, which will cover the final quarter of 2023, we see only marginal signs of weakness. Revenue in that quarter totaled $311.4 million. That’s 7% above the $291 million reported one year earlier. As the chart above illustrates, other profitability metrics increased as well. The only weakness involved adjusted operating cash flow, which fell from $32.6 million to $29.2 million, and EBITDA, which ticked down from $41.7 million to $41.5 million.

The company remains so healthy that management is continuing to invest in multiple things at once. For instance, during 2023, the company repurchased $22 million worth of shares. This was on top of paying a consistent dividend, marking the 52nd consecutive year in which the annual cash distribution increased. On top of this, the company is investing between $20 million and $25 million each year into its core operations. And that excludes the prospect of growth through mergers and acquisitions. One interesting investment the company recently made was in Brain Corp, which is focused on developing AI-enabled robotic cleaning technologies. You may think that, with all of this spending, the company would be racking up some debt. However, net debt as of the end of the most recent quarter was $83.5 million. That translates to a net leverage ratio of only 0.43. To put this in perspective, management is targeting a net leverage ratio in the long haul of between 1.5 and 2.5. If we use the midpoint, and we assume no further growth, then this would mean that the company could take on a further $302.3 million in net debt and be fine.

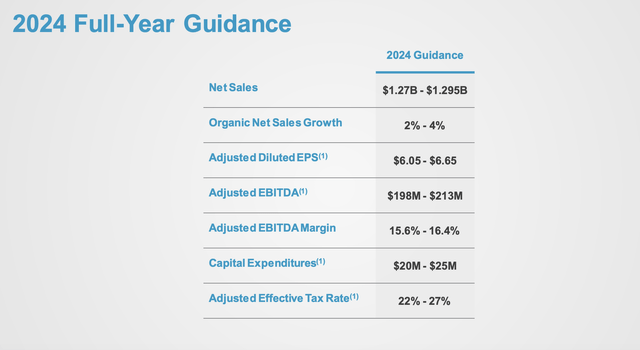

Tennant Company

Speaking of growth, management does expect continued expansion this year. They expect organic sales to expand by between 2% and 4%. That would take revenue up to between $1.27 billion and just under $1.30 billion. Earnings per share are expected to be between $6.05 and $6.65. At the midpoint, we would be looking at net profits of $120.1 million. Meanwhile, EBITDA of between $198 million and $213 million implies, at the midpoint, $205.5 million for the year. Management has not provided any estimates when it comes to adjusted operating cash flow. But based on my own estimates, this should be around $159.8 million in all.

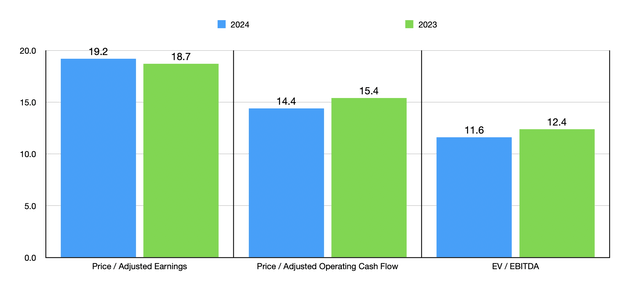

Author – SEC EDGAR Data

Using these results, valuing the company becomes a very simple process. In the chart above, you can see what I mean. On the whole, I would argue that shares look more or less fairly valued, though perhaps when it comes to the EV to EBITDA approach, we might be closer to being undervalued marginally. As part of my analysis, I then compared the company to five similar firms as shown in the table below. On a price to earnings basis, two of the five ended up being cheaper than our candidate. But when it involves the price to operating cash flow approach or the EV to EBITDA approach, I found that three of the five ended up being cheaper than Tennant Company.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tennant Company | 18.7 | 15.4 | 12.4 |

| Mueller Industries, Inc. (MLI) | 10.2 | 9.1 | 5.5 |

| SPX Technologies, Inc. (SPXC) | 63.5 | 27.1 | 21.7 |

| Mayville Engineering Company, Inc. (MEC) | 37.5 | 7.1 | 7.7 |

| The Timken Company (TKR) | 16.2 | 11.7 | 9.8 |

| Parker-Hannifin Corporation (PH) | 28.1 | 22.7 | 17.5 |

Takeaway

As much as I would love to be able to say that I feel a significant additional upside is on the table for investors in Tennant Company, I cannot in good faith do that. It is a solid company with a bright future ahead of it. Management continues to make good investments while also rewarding shareholders directly. Up to this point, shares were also attractively priced. However, that is no longer the case. Given how shares are priced compared to similar enterprises, I would argue that a respectful downgrade to a ‘hold’ makes sense.

Read the full article here