Elevator Pitch

My investment rating for Mapletree Logistics Trust (OTCPK:MAPGF) [M44U:SP] is a Hold. In its media releases, Mapletree Logistics Trust describes itself as the “first Asia-focused logistics REIT in Singapore” which owns “187 properties” across the Asia-Pacific region as of end-2023.

Earlier, I wrote about MAPGF’s “inorganic growth prospects” in my June 28, 2021 article. This latest write-up touches on Mapletree Logistics Trust’s recent portfolio optimization moves and the real estate investment trust’s exposure to the Mainland Chinese market.

I have a Neutral view of Mapletree Logistics Trust, and that translates into a Hold rating for the REIT. On the positive side of things, the REIT continues to work hard at optimizing its portfolio to drive superior results in the mid to long term. On the negative side of things, the performance of Mapletree Logistics Trust’s properties in Mainland China is likely to be hurt by the unfavorable demand-supply dynamics for the market in the short term.

The REIT’s shares can be bought and sold on the Over-The-Counter market and the Singapore Stock Exchange. The trading liquidity for Mapletree Logistic Trust’s OTC shares is poor, but the three-month mean daily trading value for Mapletree Logistics Trust’s Singapore-listed shares was as high as $15 million (source: S&P Capital IQ). Readers can trade in the REIT’s liquid Singapore-listed shares with U.S. brokerages such as Interactive Brokers.

Positive On Progress Relating To Portfolio Optimization

Mapletree Logistics Trust has the intention to optimize its real estate portfolio to deliver better returns in the future, and the REIT’s recent disclosures suggest that it is making good progress in making its portfolio mix more favorable.

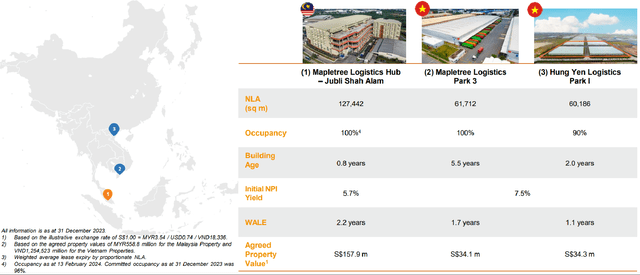

At the end of last month, MAPGF issued an announcement revealing that it planned to buy certain properties in Southeast Asia. In this February 29, 2024 announcement, Mapletree Logistics Trust noted that the proposed “addition of three Grade A logistics facilities” is part of the REIT’s “strategy of active portfolio rejuvenation” focused on acquiring “modern, well-located properties in key logistics hubs.”

Details Of The Planned Purchase Of Three Assets In Southeast Asia

Mapletree Logistics Trust’s February 29, 2024 Investor Presentation

Note that the REIT’s financial year end is in March, and it reports full results and hosts analyst briefings twice every year.

The REIT shared its thoughts on its portfolio optimization strategy at its prior interim results briefing in late October last year. Specifically, Mapletree Logistics Trust indicated at its 1H FY 2024 earnings call that “we continue to see very strong growth in places like India, Vietnam, and Malaysia,” which means that “acquisitions coming up from these three markets will be of great interest to us.” MAPGF also highlighted at its recent quarterly earnings briefing that it has “tenants who want to move out from China” and “go to Vietnam” and “Malaysia” as part of their geographical diversification strategy.

Mapletree Logistics Trust’s comments referred to above help to explain why the REIT has recently announced the proposed purchase of new logistics properties in Malaysia and Vietnam.

In its February 29, 2024 investor presentation slides, the REIT cited data from third-party sources to support the case for increasing exposure to the logistics markets in Vietnam and Malaysia. Foreign Direct Investment or FDI for Malaysia grew at a healthy +15% CAGR for the 2018-2022 time frame as per data from World Bank referenced by the REIT in its investor presentation. Also, MAPGF also mentioned in its investor presentation that Colliers (CIGI) has projected that Vietnam’s e-commerce sales could potentially expand by a strong +22.1% CAGR for the 2022-2026 time period.

Based on the REIT’s estimates, Mapletree Logistics Trust’s gross revenue contributed by the Malaysian market as a proportion of total gross revenue will increase from 4.9% to 6.2% with the completion of this deal. When this transaction is completed, Vietnam’s gross revenue contribution as a percentage of aggregate gross revenue for MAPGF will also rise from 4.0% to 4.7%.

To sum things up, MAPGF has continued with its portfolio optimization moves to expand its presence in fast-growing logistics markets, and this is a key positive for the REIT.

But China Exposure Is A Key Negative

Mapletree Logistics Trust’s near term financial and operating performance might be potentially hurt by its meaningful exposure to Mainland China.

The REIT is expected to have Mainland China account for 18.4% of its gross revenue, even after completing the acquisition of the logistics assets in Vietnam and Malaysia highlighted in the preceding section. In other words, Mainland China continues to be Mapletree Logistics Trust’s second largest market after its home market, Singapore (slightly over a quarter of gross revenue percentage contribution).

A January 2024 Bloomberg report noted that the “vacancy rate for high-end logistics storage” in a key Chinese city “Shanghai” rose by more than +5 percentage points QoQ to approximately 15% for Q4 2023, which is a sign of weakening logistics demand. Looking ahead, Savills mentioned in its 2024 market outlook report that logistics property owners in China are likely to encounter “the prospect of sacrificing rent growth to sustain occupancy rates” this year due to “a broader array of (logistics property) leasing options” driven by an increase in supply. Mapletree Logistics Trust also warned in its late-January 2024 corporate presentation that “China’s leasing environment remains challenging with negative rental reversions expected to persist in the next few quarters.”

According to consensus financial estimates sourced from S&P Capital IQ, Mapletree Logistics Trust’s distribution per unit is forecasted to decline by -1.0% for FY 2025 (YE March 31, 2025) and increase modestly by +0.7% in FY 2026. The lackluster dividend growth outlook for the REIT is realistic, as Mapletree Logistics Trust has significant exposure to the Chinese logistics market, and it is still in the process of optimizing its asset portfolio for the long run.

Concluding Thoughts

Mapletree Logistics Trust boasts a consensus next twelve months’ dividend yield of 6.2% as per S&P Capital IQ data, which is slightly higher than its 10-year average dividend yield of 5.9%. My view is that Mapletree Logistics Trust’s current valuations based on the dividend yield metric are reasonably fair. More importantly, the REIT’s FY 2025-2026 dividend outlook is poor as indicated in the previous section, which limits the potential for a positive valuation re-rating (i.e. dividend yield compression).

A Hold rating for Mapletree Logistics Trust is appropriate, taking into account the positives associated with its progress in portfolio optimization and the negatives pertaining to its Mainland China market exposure.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here