Technological innovation can be exciting. But one of the risks is that you never know which companies will be harmed by it and which will be benefited, especially in the early stages of upheaval. One great example of this involves Getty Images Holdings, Inc. (NYSE:GETY), the online image library and provider of related services. Had you asked me, even a few years ago, whether the company would be at risk of technological change, my answer would have been a resounding no. But the rise of generative AI and related technologies has now put the firm at risk.

Last year, the company was already experiencing some fundamental weaknesses. Even though the number of active annual subscribers and paid download volume were up year over year, the number of total purchasing customers had been declining. Although the company has come out with its own generative AI offerings, including one in partnership with tech giant NVIDIA Corporation (NVDA), the picture from a shareholder sentiment perspective has been downright awful. As an example, back in late September of last year, I downgraded the stock from a “buy” to a “hold” because of how things were going. And since then, shares have seen a downside of 20.5% at a time when the S&P 500 (SP500) is up 17%.

If you look solely at how shares are priced today, the stock looks awfully tempting. In the event that the company can find some way to differentiate itself from the other generative AI offerings that are out there, it could very well go on to create some nice upside for shareholders. But to see whether or not this will be the case, we need to be paying careful attention to new data that comes out. And it just so happens that the next time for that is the earnings release for the final quarter of the 2023 fiscal year, scheduled for post-market on Thursday, March 14th.

Leading up to that time, investors should be paying careful attention to some important metrics. But until we see some concrete developments, I cannot yet upgrade the firm to something more bullish.

Expect mixed results and pain to continue

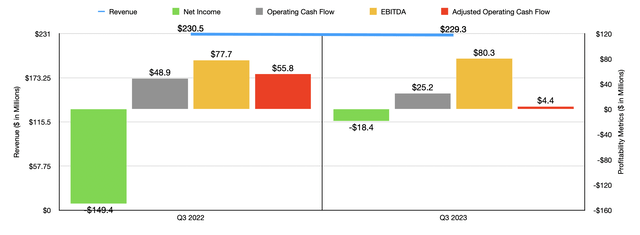

Author – SEC EDGAR Data

Before we get into what to expect for the final quarter of the 2023 fiscal year, it might be helpful to touch on the financial results reported by the company as of late. This would involve data through the third quarter of 2023. For that time, revenue came in at $229.3 million. That’s down only modestly from the $230.5 million generated the same time one year earlier. Working in the company’s favor was the fact that total active annual subscribers stood at 202,000 at the end of that quarter. That was nearly double the 107,000 that the business had one year earlier. Management attributed this growth to expansion in its ecommerce subscriptions, including but not limited to iStock and Unsplash+.

Author – SEC EDGAR Data

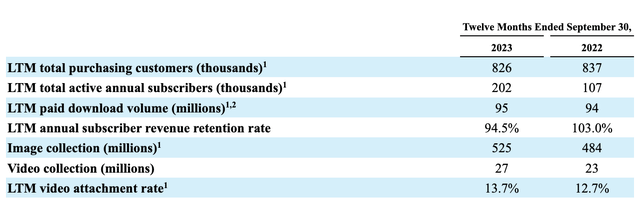

There were other areas of growth for the firm. All of these were driven by a continuously growing image collection and video collection. The image collection stood at 525 million. That’s comfortably above the 484 million reported one year earlier. Its video collection, meanwhile, grew from 23 million to 27 million. This helped to attract more active annual subscribers, and it pushed the paid download volume for the company over the trailing 12-month window up from 94 million to 95 million.

But where things turned bad was when we started talking about the total purchasing customers. This dropped from 837,000 to 826,000 in the course of a single year. This metric represents the total customers who made a purchase from the company within the trailing 12 months. Management attributed this to a shift in customers into annual subscription products. All the decline here showed up in the Editorial portion of the company, with revenue on a reported basis dropping 2.3% and being down 3.3% on a constant currency basis.

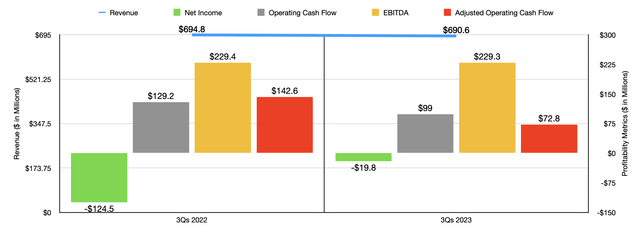

Author – SEC EDGAR Data

Even though revenue fell, the bottom line for the enterprise did improve. It went from negative $149.4 million for net profits to negative $18.4 million. Other profitability metrics were rather mixed. Operating cash flow, for instance, fell from $48.9 million to $25.2 million. Even if we adjust for changes in working capital, we get a decline from $55.8 million to $4.4 million. On the other hand, EBITDA for the company managed to inch up slightly from $77.7 million to $80.3 million. In the chart above, you can see these mixed results, with revenue falling but profits and cash flows coming in all over the map, for the first nine months of 2023 relative to the same time of 2022.

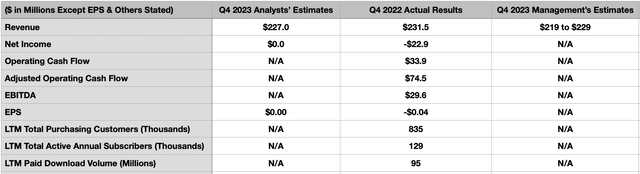

When it comes to the final quarter of the year, there are some things that investors should be paying attention to. The first would be revenue. Analysts are currently forecasting sales of $227 million. That would be down slightly from the $231.5 million generated during the final quarter of 2022. Early last month, management did come out with some guidance for the final quarter. They are forecasting revenue of between $218 million and $229 million with a midpoint of $224 million. In all likelihood, a continued decline in total purchasing customers will continue to be a part of the problem for the business. And with generative AI now becoming more widely adopted, I wouldn’t be surprised to see this number drop more than what it did year over year in the third quarter. This would be, in my view, not only from a transition into annual subscriptions for customers, but also as the firm risks annual subscriber counts falling as well.

Author – SEC EDGAR Data

On the bottom line, analysts expect earnings per share of $0. That would actually be an improvement compared to the $0.04 per share lost in the final quarter of 2022. That translated to a net loss of $22.9 million. No guidance was given when it came to other profitability metrics for the quarter. But in the table above, you can see what the most important ones were for the final quarter of 2022. This includes not only profitability metrics, but also certain operating metrics.

It is always possible that the company could surprise investors in a big way. But honestly, I see this as unlikely. The reason why some surprise is possible is because management is focusing its efforts on generative AI. In early January of this year, for instance, the company launched Generative AI by iStock, which is described as a “safe AI tool to help users and businesses easily turn their creative visions into powerful content.” And the firm has not been doing this on its own. On this project, as well as all of its other generative AI initiatives, Getty Images Holdings is partnering up with NVIDIA. This, combined with the fact that the generative AI technology is using only Getty Images Holdings’ library of content for inspiration, is what management hopes will set it apart from the competition. In fact, management even has committed to offering $10,000 in legal coverage for customers utilizing this particular feature should they be sued for using content that is not theirs. There have been a string of lawsuits as of late when it comes to things like generative AI because it uses other content as inputs, with creators of that original content alleging inappropriate use.

It is possible that management could differentiate itself from the competition, but I believe that trying to be the primary provider of a tool in this space will lead to many failed businesses. Instead, I think that the real value will be implementing the tools over some end use or in owning the network that all of this occurs on. From what I can see, Getty Images Holdings fits neither of these. There has even been concern from the entertainment industry regarding the impact that generative AI might have. Tyler Perry, who owns the largest movie studio in the U.S. that’s outside of California, just put on hold an $800 million expansion project for his studios because he is concerned about the potential impact of OpenAI’s Sora, which is a program that, using simple prompts, can create movie quality scenes.

Author – SEC EDGAR Data

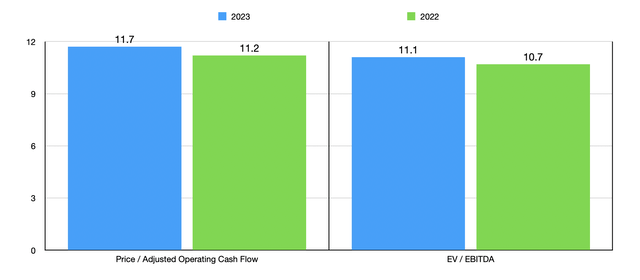

Now in the event that management can show that the future will be bright, the upside for shareholders could be attractive. In addition to the generative AI market offering rapid growth potential, there’s the fact that shares of Getty Images Holdings are currently attractively priced. Using estimates for 2023 and historical results for 2022, I was able to value the company as shown in the chart above.

I wouldn’t exactly call Getty Images Holdings, Inc. stock a deep-value play. But it is at the upper end of what would normally be considered attractively priced in my book. But with all the uncertainty going on, shares would have to trade substantially lower than where they are now to capture my attention.

Takeaway

Based on the data provided, it is looking as though Getty Images Holdings is in a bit of a pickle. While the financial performance of the company will probably be only slightly worse than it was last year, and while its bottom line results might actually be slightly better in some respects, the firm is not doing all that great as a whole. Given this fact and the tremendous amount of uncertainty that faces the business moving forward, I cannot in good conscience upgrade Getty Images Holdings, Inc. at this time.

Read the full article here