Introduction

While 2023 saw railroads underperform, this year some of them are beating the market once again. CSX Corporation (NASDAQ:CSX) is among them.

As the first quarter of the year gets closer to its end, we still have news about a transportation demand recovery which should strengthen as the year unfolds. Forward-looking investors seem to agree with the outlook as CSX stock has been trending higher since last November. Let’s take a look at the most recent earnings report and, more importantly, the weekly carloads and intermodal traffic report for the week ending March 2, 2024.

Summary of previous coverage

Before we move on, new readers should know a few things about my way of assessing Class 1 railroads. My understanding of North American railroads is grounded on what I have learned from Warren Buffett’s investment in BNSF.

Mr. Buffett uses a few important criteria when assessing a railroad. First of all, he greatly values a company’s earning power, that is how many times its pre-tax earnings cover interest expense. This is because capital-intensive businesses need to be able to meet their obligations at any given time. In addition to this important metric, when we consider the industry, we have to assess a railroad’s operating efficiency (operating ratio, fuel efficiency), the returns on invested capital, and the way excess capital is returned to the shareholders.

When I first assessed CSX, I found out that, though under the perspective of traditional metrics the company seemed in good shape, when using the so-called Buffett metrics, the picture was mixed.

In the meantime, my research moved on and I once again studied BNSF to estimate the long-term returns Buffett enjoyed thanks to his railroad.

After this estimate, I did the same exercise on CSX. The results were, once again, somewhat mixed. On one side, CSX investors’ total returns have been great. On the other side, this railroad funded most of its buybacks through LT debt. This could not continue and, in fact, as soon as we saw some weakening traffic and higher interest rates, CSX was forced to pause its buyback program. This is a bad move because of two aspects: the company didn’t profit from falling share prices and, as a result, the stock experienced some additional downward pressure.

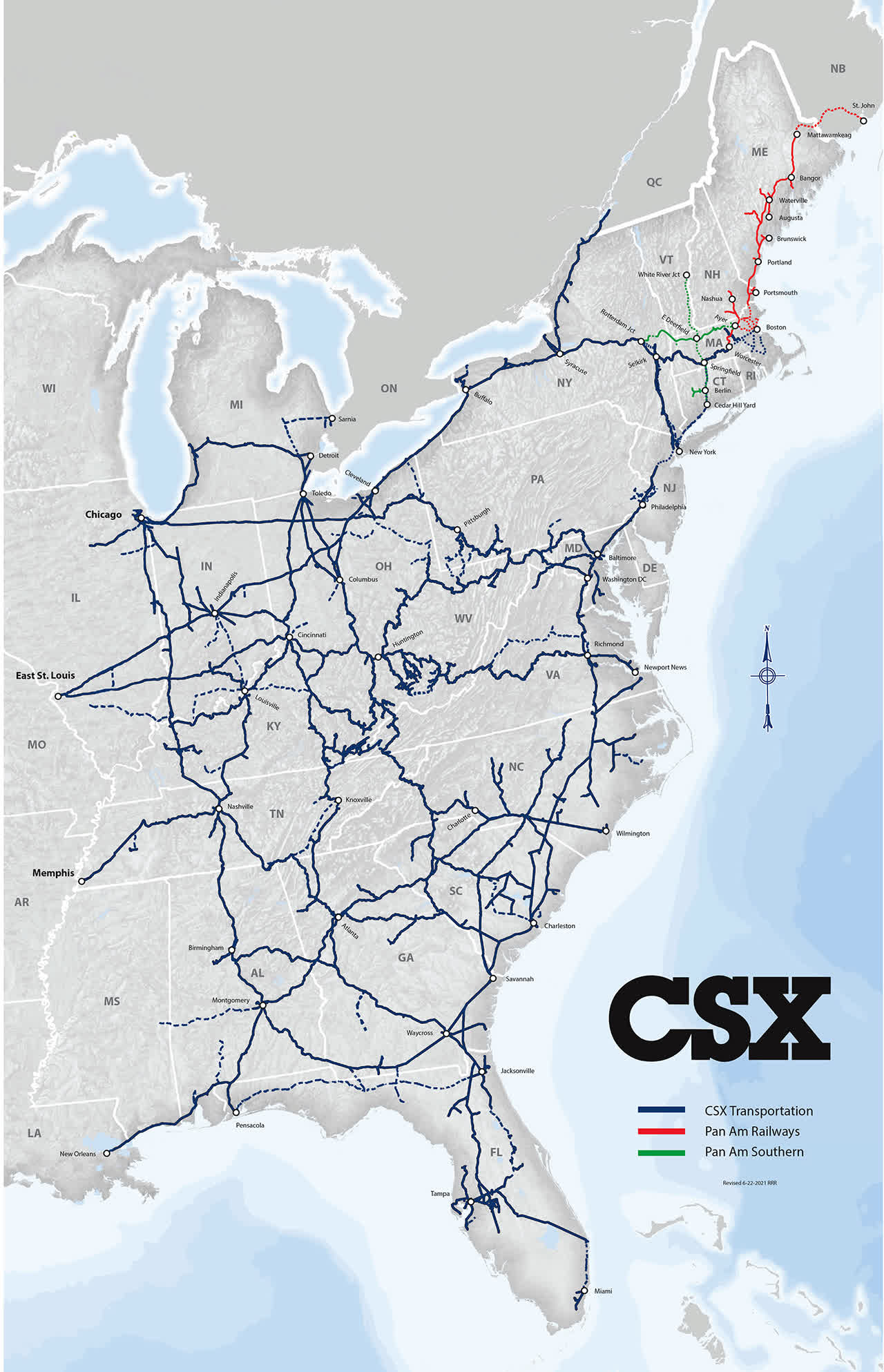

CSX puzzles me a bit. On one side, it owns and runs an incredible network serving some of the economic heartlands of the U.S., connecting many important East Coast ports, unfolding its tracks through the Appalachian mountains and its coal mines, reaching industrial States such as Ohio and Indiana, and touching key gateways such as Chicago and St Louis.

CSX Corporation

Given its geography, CSX Corporation shares a duopoly with Norfolk Southern (NSC). As a result, competition is low, and the moat is wide.

As I explained in my last article, several macro trends should benefit the company:

If we factor in the ever-increasing tailwinds, such as the manufacturing reshoring, billions of government spending, and even a new need for coal (at least for the short term), together with growing demand for commodities and environment-friendly ways of transportation, we have a picture that bodes well for such a company. Yet, I am at odds with its leveraged balance sheet which doesn’t seem to be able to support anymore a policy of debt-funded buybacks.

CSX Q4 and FY 2023 Results

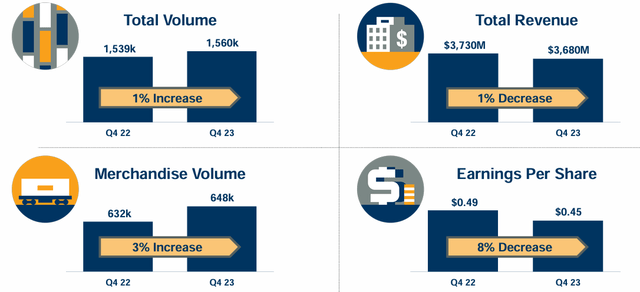

CSX Q4 earnings show how traffic is picking up speed once again, with an overall volume increase of 1% and a merchandise volume increase of 3%. Revenue and EPS were down as a result of lower fuel surcharges. For those who don’t know what these are, it is enough to know that railroads can ask customers to pay more in case fuel prices go up. When fuel prices go down, the surcharge decreases too, impacting the top line. So, when we look at how a railroad is growing its top line, we should always consider the fuel price environment it is operating in.

CSX Q4 Earnings Presentation

CSX’s management, in any case, explained during the last earnings call that the company “delivered positive volume growth in merchandise that beat U.S. industrial production”.

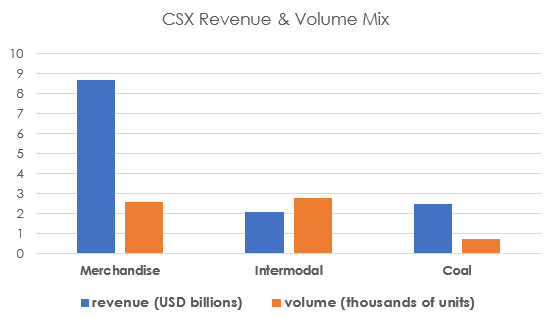

Merchandise includes the main commodities CSX moves on its network: chemicals, agricultural and food products, minerals, forest products, metals and equipment, fertilizers, and cars. It is the most important business segment, because, as we can see below, with its 2.6 million carloads it makes up 43% of total volume that generated $8.7 billion in revenue, which is equal to 59% of total revenues. On their side, intermodal ships 45% of total volume, but generates only 14% of CSX’s revenues; coal makes up 12% of volume and 17% of revenue (the remaining 10% of revenue comes from trucking – 6% – and other revenues – 4%).

Autor, with data from CSX 2023 Annual Report

Given the revenue mix, it is easy to understand that merchandise has a higher revenue per unit shipped. The RPU of merchandise is $3,301, while intermodal RPU only reaches $745 and trucking RPU is $3,290.

If we compare these results for 2023 to Norfolk Southern’s, CSX’s closest peer, we can have a further understanding of CSX’s performance. In bold, I highlight which one of the two companies beats the other.

| Volume | Revenue | RPU | |

| NSC Merchandise | 2,245 | 7,353 | 3,275 |

|

CSX Merchandise |

2,621 | 8,653 | 3,301 |

|

NSC intermodal |

3,822 | 3,090 | 808 |

| CSX intermodal | 2,766 | 2,060 | 745 |

| NSC coal | 677 | 1,713 | 2,530 |

| CSX coal | 755 | 2,484 | 3,290 |

CSX performs better in merchandise and coal, while NSC seems ahead in intermodal.

In a challenging year for freight transportation, CSX managed to end the year with a slight 1% decrease in volume and a 1% decrease in revenue despite a $259 million decrease in fuel surcharge revenue. This means CSX flexed its pricing power to offset this unfavorable decrease.

Now, starting in September 2023, rail traffic started to pick up speed once again. So, 2024 is expected to be a rather good year, given that it also enjoys easy comps for the next two quarters. This is why CSX’s 2024 outlook targets low to mid-single-digit volume and revenue growth.

CSX’s Key Operating and Financial Metrics

As we have gotten used to, let’s screen CSX’s report through what I call the “Buffett metrics”.

First of all, let’s look at the earnings power, calculated as pre-tax earnings over interest expense. At the end of 2023, it came in as a 6.0, while it was 7.3 in 2022 and 6.9 in 2021. There are class 1 railroads with a ratio above 10. However, a 6.0 after a tough year is considered decent. In fact, it means that at the end of 2023, the company’s pre-tax earnings were 6x greater than its interest expense. Given that interest expense has increased due to higher rates and that pre-tax earnings decreased due to slower traffic, I see no particular danger that CSX won’t be able to meet its interest obligations.

What deteriorated and crossed a significant threshold was the operating ratio. Since precision scheduled railroading (PSR) was adopted, the real target railroads strive to achieve is a ratio below 60% and as close as possible to 55%. At the end of 2022, CSX reported a ratio of 59.5%, but then it closed FY 2023 at 62.1%. With traffic increasing a bit and inflation seeming to be under control, I expect CSX to once again target a ratio below 60% for this fiscal year.

In terms of fuel efficiency, CSX reported 1.0 US gallon per 1,000 GTMs for the quarter and 1.02 for the whole year. Again, this was worse than the 0.99 reported in 2022. To this extent, CSX has to invest to renew its fleet and decrease the average age of its locomotives to replace older and less efficient ones with new locomotives with more efficient engines.

Let’s come to the use of capital.

CSX has used its balance sheet in the past to borrow money that could then be distributed to its shareholders through dividends and buybacks. While this move surely pleased many shareholders, it led CSX’s balance sheet to the point it had an LT debt/operating income ratio above 3.0. Moreover, FCF increased in the past five years both due to increasing cash from operations and decreasing capex, which was well below $2 billion. However, the company has already disclosed it expects its 2024 capex to be $2.5 billion. A railroad can’t just cut capex at will because it needs to maintain and enhance its properties. Considering CSX reported in 2023 $5.5 billion in cash from operations, we can expect this year the railroad to achieve around $5.7 billion in cash from operations. This would lead to $3.2 billion in FCF. But I expect the company to return less than this because it will probably need to pay down some debt to deleverage its balance sheet. In fact, during 2023, CSX was forced to pull back on buyback spending. As a result, CSX’s LT debt increased by less than $100 million YoY, while from 2021 to 2022 it went up over $1.8 billion.

Valuation

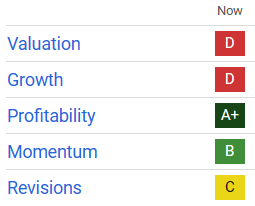

An issue with CSX is the lack of top-line growth, which earns the stock a D as its Quant Growth Grade.

Overall, Seeking Alpha’s Quant Rating system awards the stock a hold which is a balance of the five grades shown below.

Seeking Alpha

On one side, CSX has a very profitable business, as all railroads seem to be. At the same time, valuation and growth have low grades. In fact, CSX has been recently bidden up in price and currently trades at a fwd PE of 19.4, a fwd EV/EBITDA of 12.5, and a fwd P/FCF of 12.7. This goes along with a dividend yield of 1.18% and a nice FCF yield of 4.1%. However, I expect some of the company’s FCF to be used to manage the balance sheet and prevent it from being overleveraged.

Considering CSX has some issues with its top-line growth, I expect the company to report revenue growth more or less in line with inflation, these multiples already bake in a premium for the company. Overall, these multiples are not extremely expensive for a railroad. However, they don’t even offer an incredible entry point right now. As a result, I consider CSX a hold currently.

Read the full article here