Investors reacted extremely poorly to Xometry, Inc.’s (NASDAQ:XMTR) Q4 2023 earnings, with the stock down over 30% and on its way to the lows of 2023. While guidance was unexpectedly soft, it also is likely overly conservative. Manufacturing business conditions appear to be stabilizing, and Xometry should register solid growth in 2024. If Xometry’s growth does not decelerate as much as expected, there could be substantial upside, particularly if the company’s profit margins continue to improve.

Market

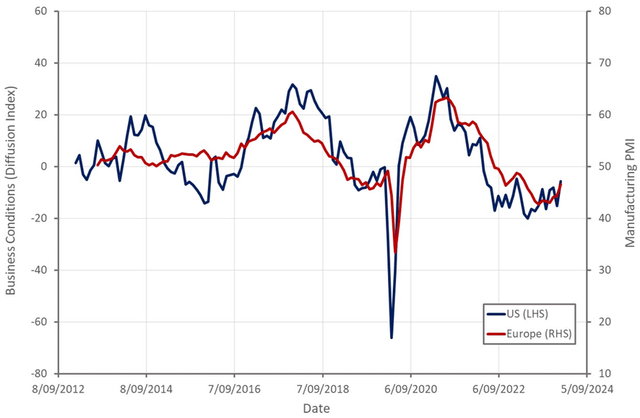

While manufacturing conditions remain soft, there are signs that a bottom may be imminent. Manufacturing PMIs continue to point towards deceleration, but they have been trending up in recent months. Against this backdrop, Xometry’s growth has declined significantly over the past 18 months, although the core marketplace business continues to perform relatively well.

Figure 1: Manufacturing Business Conditions (source: Created by author using data from The Federal Reserve)

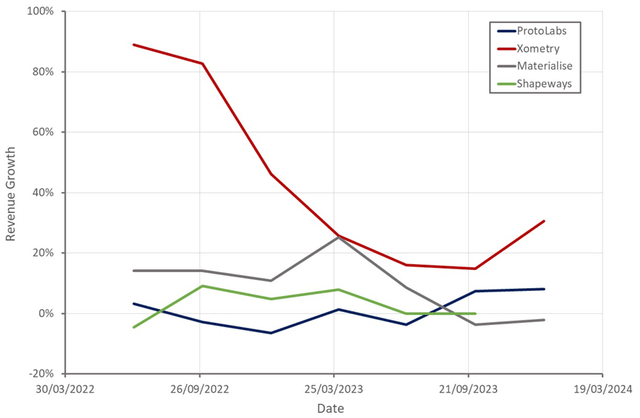

Xometry is certainly not the only company in this area to struggle in recent quarters. For example, Proto Labs’ (PRLB) growth has been soft for two and a half years. Current conditions may be difficult, but Xometry expects a continued shift towards digital manufacturing, which should mean a return to robust growth once the demand environment improves.

Figure 2: Comparable Company Revenue Growth (source: Created by author using data from company reports)

Xometry

Xometry’s growth initiatives in 2024 include:

- Expanding its marketplace menu

- Enhancing supplier services

- Expanding its buyer and supplier networks

- Driving deeper enterprise engagement

- Growing internationally.

Xometry continues to expand the options available in its marketplace, including new processes, materials, finishes and certifications. This increases the company’s addressable market but is only likely to have an incremental impact.

Xometry also continues to improve its Instant Quoting Engine, expanding coverage of manufacturing processes and improving accuracy. Xometry’s process recommender is now able to analyze CAD files, identify the most appropriate manufacturing process and provide a quote. Xometry has also introduced an add-in for SOLIDWORKS in Europe, the UK and Turkey, which provides buyers with instant quotes, lead times, and design-for manufacturability feedback.

In support of its goal of driving deeper engagement with customers and winning more production use cases, Xometry integrated Teamspace into its platform in the fourth quarter of 2023. Teamspace is a cloud-based collaboration tool that enables customers to manage projects and streamline order management. Teamspace aims to expand the marketplace beyond a focus on individual buyers and parts to procurement teams managing assemblies and products. Since the launch, over 1,500 teams have been created.

Xometry’s desire to gain more production use cases, large customers and enterprise-wide deployments means that enterprise sales are currently a focus. The company has increased its sales force to support growth in this area and is reportedly making progress with Fortune 500 customers. Revenue per customer continues to trend upward, which supports this notion.

Xometry believes that its solutions could eventually be adopted by up to 500,000 suppliers. The company only currently has around 5,000 paying suppliers, leaving it with a large growth runway. The acquisition of Thomas Publishing also aims to better monetize suppliers by helping them generate leads using a performance-based ad platform. There is little evidence of progress in this area so far, although this may just be due to market conditions.

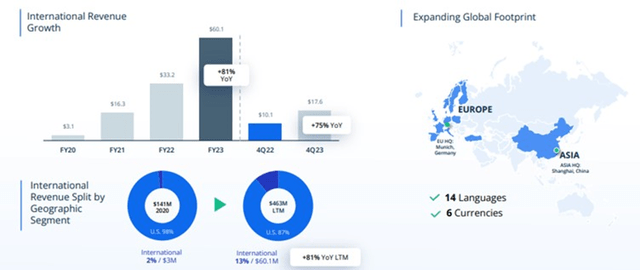

Xometry is still underpenetrated internationally, although this is currently an area of strong growth. Solid growth internationally should continue to be a tailwind for Xometry going forward, particularly as this part of the business becomes a more material contributor.

Figure 2: Xometry International Growth (source: Xometry)

Financial Analysis

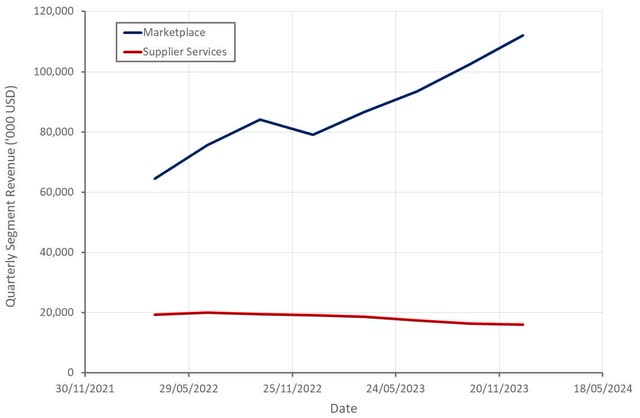

Xometry’s Q4 revenue increased 34% YoY, adjusted for the exit from the tools and materials business. Marketplace revenue was up 42% YoY in the fourth quarter, driven primarily by growth in the number of active buyers. Growth in production work was particularly strong, including Xometry’s quick-turn injection molding offering. Supplier services revenue decreased 15% YoY, primarily due to the discontinuation of the sale of tools and materials.

While Xometry’s fourth quarter results were strong, forward guidance was soft, and this likely drove the large selloff post-earnings. January was weaker than the company had expected, with the number of large orders declining significantly. While data improved in February, Xometry’s guidance assumes softer conditions persist throughout the year.

Xometry is expecting $118-120 million USD revenue in the first quarter, up 12-14% YoY. For the full year, Xometry is guiding to around 15% revenue growth. Marketplace revenue growth is expected to be at least 20%, while supplier services revenue is expected to be down around 10% due to the discontinuation of the sale of tools and materials. Service revenue comps will get easier in the second half of the year though.

While this guidance makes sense given macro uncertainty and the recent drop in demand, I believe it is overly cautious. Data suggests that manufacturing business conditions are stabilizing and could soon begin to improve. Proto Labs also observed softer demand in December and January but gave guidance based on stronger conditions observed in February.

Figure 3: Xometry Revenue (source: Created by author using data from Xometry)

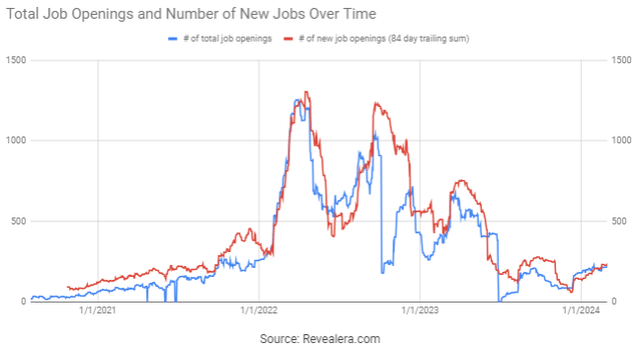

The number of job openings at Xometry also seems to point towards stabilization and potentially a reacceleration of growth rather than further declines.

Figure 4: Xometry Job Openings (source: Revealera.com)

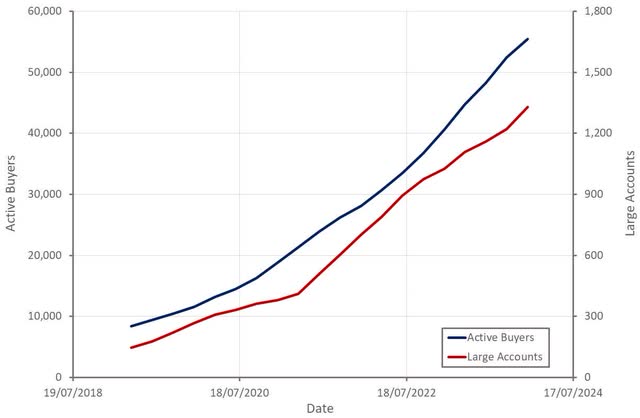

The number of active buyers on Xometry’s platform increased 36% YoY in the fourth quarter to 55,458. This growth came despite the fact that Xometry cut back on marketing spend in the U.S. and Europe in late Q4. There were 7,271 paying suppliers in Q4 2023 on a trailing 12-month basis, a decrease of 6% YoY.

Figure 5: Xometry Active Buyers (source: Created by author using data from Xometry)

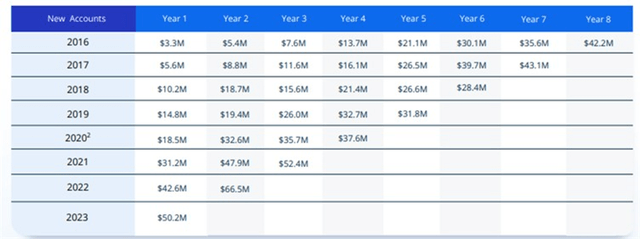

Xometry’s buyers continue to land larger and expand at a healthy pace, which should be supportive of future growth.

Figure 6: Xometry New Account Cohorts (source: Xometry)

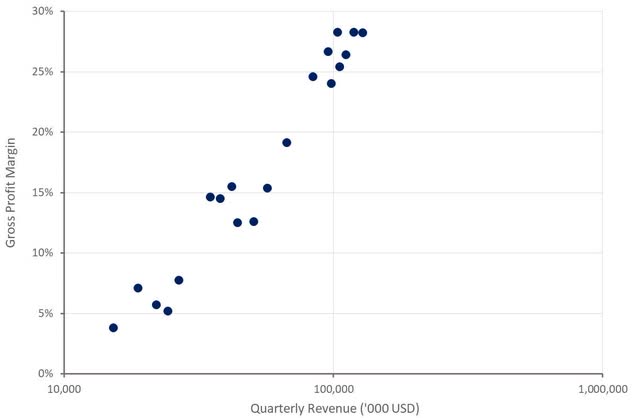

While Xometry has been able to expand its gross profit margins significantly over the past four years, this has stalled somewhat in the last 12-18 months. This is likely at least partly attributable to the demand environment. Xometry is ultimately targeting another 2-7% gross profit margin expansion.

Figure 7: Xometry Gross Profit Margins (source: Xometry)

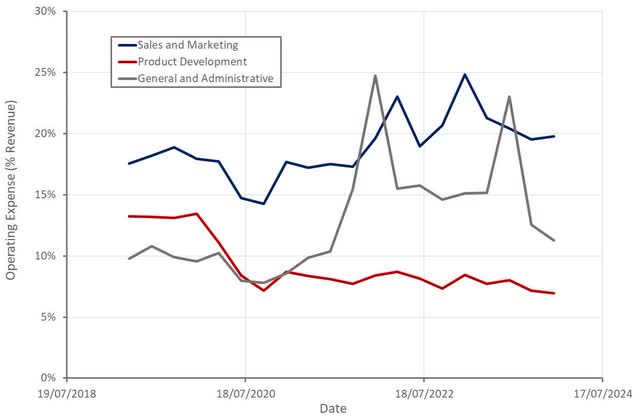

Xometry’s operating profit margin continues to improve on the back of a rising gross profit margin, operating leverage and cost control efforts. For example, Xometry cut advertising spend in Q4 by 19%. The company expects to resume more normal marketing investments in the first quarter though.

Figure 8: Xometry Operating Expenses (source: Created by author using data from Xometry)

Xometry is currently targeting adjusted EBITDA breakeven in the third quarter of 2024 and a long-term adjusted EBITDA margin of 20-30%. This would probably put the company’s operating profit margin in the mid to high teens range.

Figure 9: Xometry Long-Term Margin Outlook (source: Xometry)

Conclusion

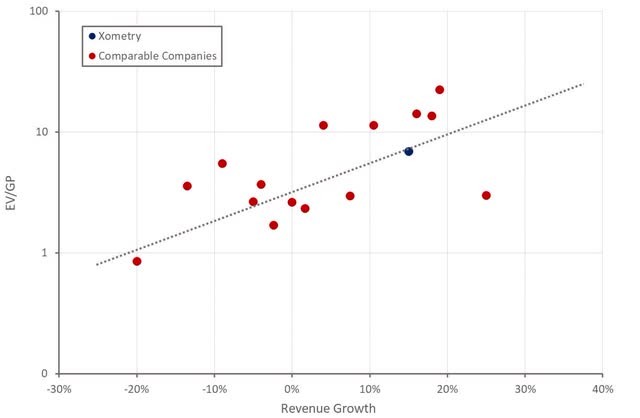

After the recent price decline, Xometry is priced in line with comparable companies based on revenue guidance and Xometry’s current margin profile. If growth comes in stronger than expected and Xometry can continue moving towards breakeven, there could be substantial room for multiple expansion. While there are near-term risks, I believe that Xometry is now an attractive opportunity over a 5+ year time frame as there appears to be too much pessimism baked into the company’s valuation.

Figure 10: Xometry Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here