Investment Thesis

Recent underperformance in Redishred’s (TSXV:KUT:CA)(OTCPK:RDCPF) share price presents investors with an opportunity to purchase an underfollowed microcap with a strong M&A strategy, that is currently trading at a ~14% LTM free cash flow yield.

Description

Redishred is primarily a paper shredding business that was founded in 2006 with the goal of acquiring and growing a scalable platform in the information destruction and security industry. Its headquarters are located in Mississauga, Ontario, Canada, but it operates across the U.S., with operations in 25 states. The company operates through its brand Proshred, which is a franchise and license business in the document destruction space. Interestingly, the company has been acquiring many of its franchisees and currently operates 16 corporate locations, which drives most of consolidated revenues. As such, this is a consolidation story, where management has discussed its plans to acquire the remaining 14 franchised locations, in addition to other independent operators, as owners retire and look to sell their businesses, over the coming years (Most recently discussed by management at Singular Research’s Emerging Growth & Value Alpha Leaders Webinar in February 2024).

Historical Results

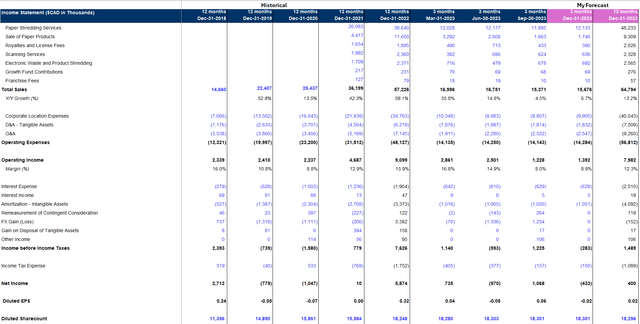

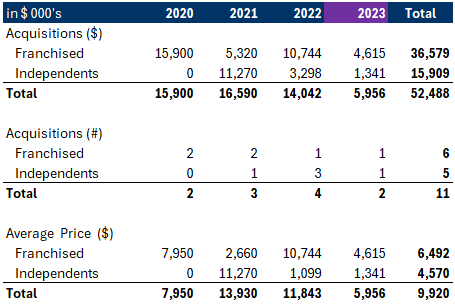

I’ve provided below an income statement and EBITDA to Free Cash Flow Bridge to provide context around the business’ historical financials and revenue mix. As the company’s Year-end results will not be published until April 2024, I have taken the liberty of including my own rough estimates of what I believe Q4 results may look like (forecasts shown under purple headings, all figures in $CAD). I am expecting roughly flat Quarter over Quarter and Year over Year results, benefitting from some organic growth from recent price increases and M&A growth, but hindered by lower Year over Year SOP prices.

Historical Financials Historical Results

Source: Historical Results and My Estimate of Q423 Results

As you will notice, the majority of revenues are derived from paper shredding services. Of these services, ~65% are scheduled paper shredding services which are, in essence, the collection of a monthly fee in exchange for picking up and shredding paper on-site. The unscheduled services are more ad hoc in nature, as they are, inherent in the name, unscheduled shredding services. However, it is important to note that they occur frequently enough throughout the year that they do not cause any significant fluctuations on annual, or in most cases, even quarterly results.

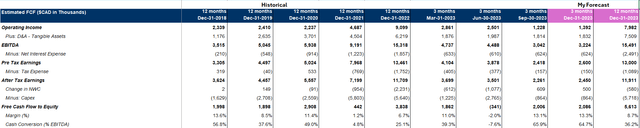

The next large item that has a significant effect on operating income is recycled paper sales. These have caused more variability in operating results in recent years due to the volatility in Sorted Office Paper (SOP) prices. This aspect of the business is commodity-like in nature, thus significantly affects Redishred’s net margins as they fluctuate. On a year-over-year basis, SOP prices have declined ~50%, which has had a negative impact on Redishred’s results. The company segments operating income with and without recycled paper revenues, so investors can have a better sense of operating performance. On the bright side, lower SOP prices allow KUT to acquire franchisees and independents at more favorable valuations. Additionally, SOP prices are correlated with diesel prices, a large input cost for Redishred, which dampens the year-to-year margin fluctuations. Lastly, SOP prices have appeared to have plateaued, which means more recent quarterly results can be used as a more conservative base to forecast future performance.

Q323 MD&A

Source: Redishred’s Q3 MD&A

Investment Case Variables

Now that we know a little bit more about how Redishred operates, it is time to discuss the investment case, which I believe is largely dependent on a few key variables numbered below. Namely:

- The timing and size of acquisitions

- Valuation and structure of acquisitions (funding)

- Consolidated margins as Redishred scales

- Organic Growth

Of course, there are other important variables, like assumptions on SOP prices, the secular risk of abandoning paper usage, etc., however, I believe the variables listed above are the key controllable variables that will determine if this is likely to be a good investment at prevailing market prices.

Acquisition History

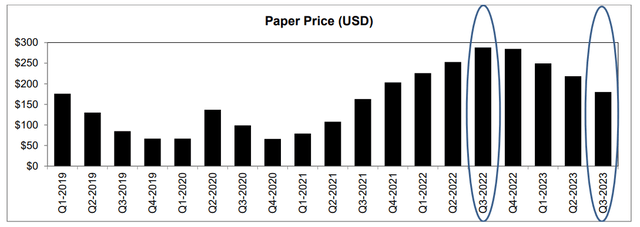

To begin the acquisition discussion, please find below a breakdown of the annual total acquisition spend completed by Redishred from 2020 onwards (in $CAD).

Redishred AIF

Source: Redishred AIF and Recent Press Releases

As you can see, Redishred typically spends about CAD$15M per annum on acquisitions, with 2023 being a slower year. Typically, franchisee acquisitions tend to be larger in size and also command higher multiples. The Company’s preference for franchisee acquisitions is to establish a platform business in a specific geography which can support smaller tuck-in acquisitions of independents. This reason, in addition to franchisees being larger in size (~USD$2M+), means Redishred is willing to pay 5.0-6.5x EBITDA to acquire franchisees versus independents which can be acquired at sub-4.0x EBITDA. For example, Redishred just acquired an independent called MDK Recycling LLC (early January 2024) for USD$0.5-0.8M (depending on achieving performance milestones for the earn-out), a business that generates USD$0.7M in revenues and has 30-35% EBITDA margins. This means they were able to acquire this business at anywhere between 2.0-4.0x EBITDA.

I believe Redishred currently pays too much for the franchisees it acquires, which is my main point of contention with this business, in terms of variables within the control of management. I believe 5.0x EBITDA should be the absolute upper limit of what Redishred should pay for the businesses it acquires. Namely, the company generates over CAD$60M in revenue and trades at an EV/EBITDA of roughly 5.0x. There is no reason as to why Redishred should be acquiring businesses that generate USD$2-4M in revenue for a multiple greater than what they are trading at today. Furthermore, there are high profile acquirers in more favorable industries, such as Constellation Software (CSU:CA) in the VMS space, that can acquire much larger and much less capex heavy businesses at sub 5x EBITDA or less than 2x sales. With that in mind, I see justification for paying more than 5x EBITDA for a USD$3M shredding business, for example.

Acquisition Pipeline

In terms of the acquisition pipeline, management is focused on acquiring the remaining 14 franchisees over the coming years, which is an ~CAD$11M in EBITDA opportunity. In addition, there are 750 identifiable independents that Redishred may look to acquire. Management’s current target is to buy 5% of those over the coming years, which presents another opportunity set of ~CAD$10M-15M in EBITDA. There is therefore a clear path to becoming a CAD$40M EBITDA business within the next 5 years (CAD$15M current +CAD$11M franchisees + CAD$15M independents).

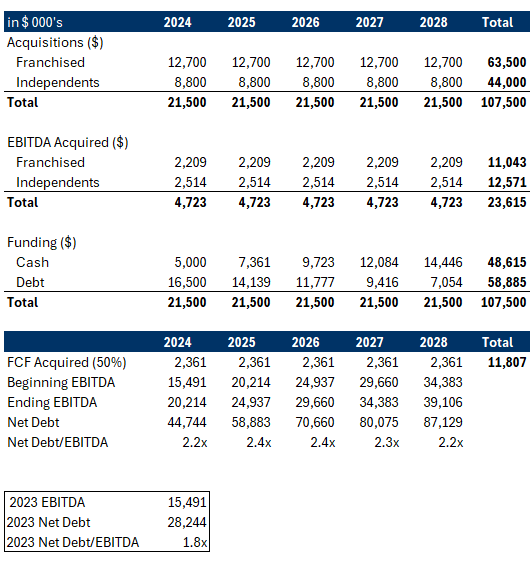

Now that we have approximated the timing and size of acquisitions, we need to estimate the valuation and structure of these acquisitions. Despite my protests, it is likely that the purchase price of future acquisitions of franchisees would fall into the 5.5x-6.0x EBITDA range. As such, it would require ~CAD$63M to acquire the remaining franchisees, or CAD$12.7M per year over the next 5 years. Regarding independents, let’s assume they can be acquired at 3.5x EBITDA, which would require ~CAD$44M or CAD$8.8M per year, over 5 years, to acquire CAD$12.5M in EBITDA. Total funding needs would therefore amount to a little over CAD$20M per annum to reach this CAD$40M EBITDA milestone.

5-Year Acquisition Forecast

I’ve included below a scenario for which Redishred can make these acquisitions using internally generated Free Cash Flow and fund the remainder of the acquisitions with debt. For the time being, equity financing should not be used due to the depressed valuation that KUT currently trades at. Jeffrey Hasham, the company’s CEO has also mentioned he is reluctant to finance acquisitions with equity at these valuations (figures in $CAD below).

my assumptions

Source: My Forecasts

Assuming a 7.0% cost of debt, the company would generate CAD$12M+ in total free cash flow by 2028, while not using any equity financing and keeping Net Debt/EBITDA ratios below 2.5x. The scenario above also does not give much benefit to route density optimization opportunities by acquiring independents in addition to organic growth benefits (slight cost benefits are implied by using a 50% FCF to EBITDA conversion, where it appears to be closer to 40% as of September 2023).

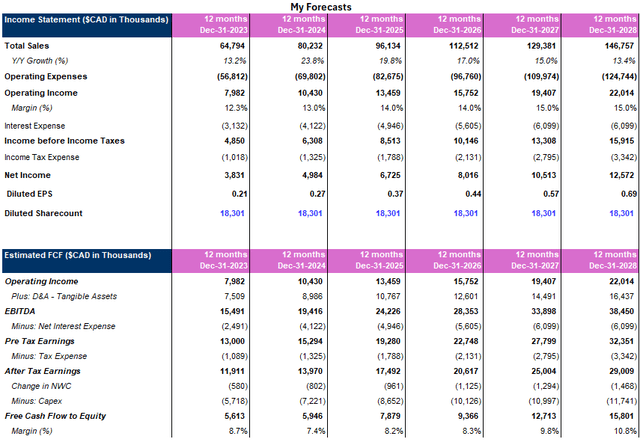

5-Year Financial Forecast

Putting it into a model with a 3.0% organic growth assumption would yield the following results (figures in $CAD below).

My Forecasts

Source: My Forecasts

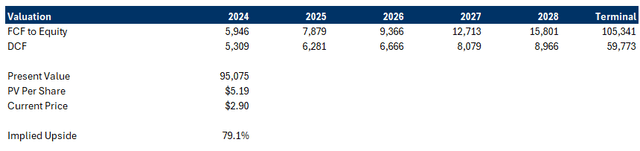

Valuation

In terms of what I think the business is worth, please find below a DCF with an assumed cost of equity of 12.0% and a 15.0% terminal discount rate (figures in $CAD below).

My Valuation

Source: My Forecasts

In other words, my base case is that Redishred is worth almost 2x the current market price and can likely triple in value within 5 years if results are similar enough to what I am forecasting above. As the LTM FCF yield is currently ~14%, I am not including any multiple expansion. In the event that they can reach that CAD$40M EBITDA figure by 2028, with minimal to no equity financing, I believe we would likely get some multiple expansion as well, which would increase those returns.

Of course, this is all contingent on the successful execution of their M&A strategy, utilizing debt and internally generated cash flows to finance these acquisitions, getting favorable rates and terms on the debt used for acquisitions, etc.

Insider Ownership

I also like to look at insider ownership when determining if a business is worthy of investment, for insider alignment purposes. By my math, about 1/4th of shares outstanding are currently owned by insiders. There hasn’t been much insider buying recently despite the depressed share price, which isn’t super encouraging. In addition, the CEO, Jeffrey Hasham, only owns ~220k shares. I hope to see insiders increase their personal positions in the business, especially since they authorized a buyback plan (barely used), which normally would signal that they believe the stock is cheap.

Key Risks

I believe the key investment risks to be the following:

- Poor execution on M&A strategy

- Continued illiquidity and lackluster results can increase the difficulty of liquidating your position at a favorable price (~5k shares traded per day)

- High diesel prices without a commensurate response in increasing SOP prices

- Structurally low SOP prices

- Acceleration in workplace paperless effort or an increase in work-from-home habits can lead to higher churn

- A significant increase in interest rates

As M&A plays a big part/role in my bull thesis, an inability to fund acquisitions, acquire targets at favorable prices or integrate new acquisitions will have a large impact on valuation. I believe current market prices reflect a conservative outlook on this front already, however, an inability to execute on management’s M&A strategy from this point onward would make Redishred dead money at best for investors.

The other risks I’ve stated are not controllable variables by management and have historically been cyclical, so may lead to temporary underperformance/outperformance due to their non-negligible impact on financial results. However, since they are not in the control of management, I do not believe them to be an accurate measure of management’s operational success, rather I believe tracking recycled paper volumes, revenue line items that are not affected by SOP prices, and operating margins (ex-recycled paper revenues), to be better barometers in understanding how well management is executing operationally.

The business has about ~CAD$28M in net debt, however, has a very serviceable Net Debt/EBITDA ratio of ~1.8x. I therefore do not believe there to be any significant liquidity risk in the business or need/desire to raise capital to modify the capital structure, especially at the currently low market valuation. Equity raises have been used in the past, but as a funding mechanism for new acquisitions when the Redishred’s multiples were significantly higher than the acquirees.

Lastly, the illiquidity in the stock would pose an additional risk in the case of business underperformance, as there would likely be few buyers to absorb any selling pressure. If management continues to execute, I believe liquidity will increase as more investors gain interest in the business.

Conclusion

To conclude, Redishred is a cheap, quality name that is increasingly rare to find in the current market environment. The business has largely recurring revenues with a clear path and visibility to essentially more than doubling revenues in the next 3-5 years through an achievable M&A strategy and some organic growth. In addition, this is one of the few roll-up strategies where there are concrete and evident cost synergies achieved through M&A (there is a lot of fluff out there), such as route density benefits. Crucially, the business is cheap at a ~14% FCF yield, while growing consistently organically and through M&A, providing a good setup for substantial upside with a lower-than-usual risk of permanent capital loss for a company of this size.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here