I last updated British American Tobacco p.l.c. (NYSE:BTI) investors in December 2023, arguing why I believed it reached “washed-out levels.” As a result, I assessed that BTI could have formed its long-term bottom after the company announced a substantial asset impairment related to its US combustible brands. Commonly known as BAT, the company reported its preliminary results for the full year FY23 in early February 2024. While the market reacted positively initially, BTI’s buying momentum has struggled to gain traction. As a result, I assessed that BTI remains materially undervalued as investors continue to evaluate its ability to transform its business model toward reduced-risk products over time.

BAT posted solid results, underscoring its best-in-class “A+” profitability grade. Accordingly, the company posted a reported revenue decline of 1.3% (3.1% growth on constant currency). Notwithstanding the anticipated secular volume decline attributed to its smokeable products, the more pronounced shift toward new categories (reduced-risk products) has helped mitigate the challenges. Management highlighted that BAT posted a 21% revenue growth (constant currency) in its new categories, bolstering the market’s confidence in its transition strategies. Supported by “resilient pricing” in its legacy segments, I gleaned that the market could have been too pessimistic over BTI. Seeking Alpha’s Quant “A+” valuation grade underscores my valuation thesis, suggesting the market hasn’t accorded much confidence over its transformation plans.

BAT management also highlighted that it would partially liquidate its stake in ITC to unlock more liquidity and improve capital allocation. Moreover, BAT has also committed to continuing its robust dividend growth policies, highlighting the importance of assuring income-focused investors. With a forward dividend yield of 9.8%, I believe management’s optimistic outlook should help underpin more robust buying sentiments from income investors moving ahead.

Notwithstanding my optimism, BAT’s transition to a smokeless future is mired with significant uncertainties. Health regulators worldwide are still grappling with the addictive effects and associated harm with these supposedly more “palatable” products, even as they potentially offer smokers a less harmful future. As a result, we could see a harsher regulatory climate than the potential menthol flavor ban, helping to protect the youth from being exposed to the still addictive nature of these reduced-risk products at a young age.

The UK government is reportedly working on legislation to “ban disposable vaping devices to safeguard children’s health.” The caution is justified, as the government assessed “a notable increase in their usage among young individuals.” I’ve also seen similar vaping trends in Singapore (where I currently live) affecting the younger population. The health regulators are even more stringent here, outlawing vapes directly. Moreover, Singapore “isn’t the only country that has banned vaping.” Accordingly, “around 37 countries have banned sales or distribution of e-cigarettes and other emerging tobacco products.” Therefore, I believe the evolving regulatory environment is still subject to significant uncertainties. As a result, investors must be cautious about anticipating a significant valuation re-rating in BTI, notwithstanding the relatively solid growth in its new categories recently.

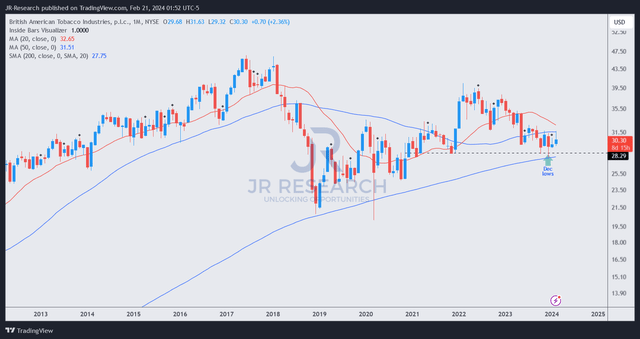

BTI price chart (monthly, long-term) (TradingView)

Based on my assessment of BTI’s long-term price action (seen above), I have confidence that it has likely struck its long-term lows at the $28.30 level in December 2023. I’ve adjusted the chart to account for dividends, suggesting BTI has continued to attract income investors looking for a relatively attractive investment opportunity.

With a forward yield of nearly 10%, I don’t assess imminent risks on a near-term cut, underpinning investor sentiment. As a result, I believe BAT investors looking to add more exposure and anticipating its long-term bottom should capitalize on the recent pullback and buy more.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here