Summary

Readers may find my previous coverage via this link. My previous rating was a hold, as I viewed Thomson Reuters Corporation’s (NYSE:TRI) valuation as too high when compared to peers with similar growth profiles. There was also potential for headwinds to get worse, which could cause the valuation to revert to mean. I am reiterating my hold rating for TRI as the stock has not reached the valuation that I find attractive. That said, I am encouraged by the business development so far.

Financials / Valuation

TRI revenue grew 1.3% to $1.594 billion, failing to meet consensus expectations of 2.7% growth. That said, from an organic revenue perspective, TRI saw 6% growth. Looking at TRI biggest segments, Legal was up, Tax & Accounting was up 12% y/y, and Corporates was up 7%. While topline missed consensus, EBITDA margins and EPS beat. Operating leverage and the benefits of the Change Program drove an EBITDA margin expansion of 560 bps to 39.6%, exceeding consensus expectations of 36.3%. EPS of $0.82 were also higher than the $0.71 expected.

I have spoken in depth about TRI’s valuation issues in my previous posts, and I am not going to repeat it. In this post, I would like to answer the question: At what valuation should I invest in TRI?

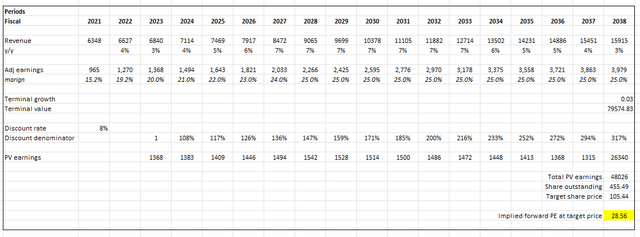

To figure that out, I built a 15-year DCF. DCF works for TRI given the stability of its business model and visibility into earnings. In my model, I was quite optimistic in assuming that TRI growth would accelerate back to its recent high of 7% and earnings would improve by 100bps a year until it reached the median margins that peers are operating at (MSCI, Verisk Analytics, Fair Isaac Corp., Moody’s, FactSet Research, Costar Group, Gartner, and Dun & Bradstreet). TRI will grow at 7% for the 10-year growth period, followed by a gradual deceleration to 3% terminal growth. At an 8% discount rate, which I think is quite reasonable given the visibility and quality of the TRI business (which is very sticky), I have a target price of $105. Working backward, $105 implies that TRI is trading at 28.5x forward PE. This is the threshold and valuation that I am waiting for before I buy the stock. While some might say that TRI will always trade at this level, I don’t think that is the right way to frame it. The TRI valuation did fall to 25x during COVID, so the opportunity will come.

Based on author’s own math

Comments

Putting aside valuation concerns, contrary to my concern about headwinds manifesting, it was positive to see the three largest segments of TRI (legal, corporate, and tax professionals) blended organic growth profile accelerate on a sequential basis, putting brakes on deceleration organic growth concerns (I talked about this in my valuation section previously). 4Q23 organic growth is also expected to remain at this momentum as management reiterated their guide for full-year organic revenue growth of 5.5–6% and 6.5–7% for the 3 largest segments.

Notably, for 3Q23, Corporates did not see a further decrease in organic growth, and Tax professionals turned from deceleration to acceleration. Legal segment also showed signs of stability, and I believe the upcoming quarter’s performance will be much better, driven by multiple positive drivers. Firstly, Westlaw Precision should continue the current momentum that it is seeing. After only one year on the market, Westlaw Precision has already achieved a 15% penetration rate and is now 25% higher on a dollar basis vs. Westlaw Edge. The potential uplift from Westlaw Precision could accelerate if TRI manages to successfully pull forward the timeframe for achieving generative AI capabilities. While I cannot put an exact timeframe on this, given the fact that TRI is spending >$100 million a year on it, this is a visible growth catalyst. The management’s capacity to build AI-related capabilities is also well-founded; in November 2023, they plan to launch Westlaw Precision AI-Assisted Research; in January 2024, they will launch a chat-type interface for Practical Law; and in the second half of 2024, they will release additional generative AI across segments. All of these should increase the Westlaw Precision product gap against Westlaw Edge, pushing more adoption for Precision.

Obviously, it takes time for that book of business to be recognized as revenue in the fourth quarter and as we go into 2024. But as we go into 2024, we see a step-up in the Legal Professionals organic growth quarter-over-quarter. So we’re quite optimistic. Source: 3Q23 earnings

Secondly, in August 2023, TRI closed the acquisition of Casetext, which will be growth-accretive. Beyond the obvious revenue additions, I anticipate that TRI will also reap revenue synergies from the acquisition. This is because they are merging Casetext’s sales and legal segments, and their product teams are collaborating closely with Casetext on a shared product roadmap. Casetext and the Westlaw curated database, in my view, should put TRI ahead of the curve when it comes to developing and deploying its generative AI capabilities.

So the capabilities that Casetext bring in terms of combining unique and proprietary data sets with large language models is something that will apply to Tax & Accounting, and we’re looking at applying it to Risk, Fraud & Compliance, and ultimately, areas like ESG and News. Source: 3Q23 earnings

On the other hand, while the Corporates segment did not see a further decrease in organic growth in 3Q23, it is expected to soften slightly in 4Q. Long sales cycles in the Corporates segment persist as a result of macroeconomic uncertainty and reduced discretionary spending by customers. Fortunately, this elongated cycle issue applies to the Corporates segment only, and I believe it should not impact the other two major segments given that they are relatively new solutions. In addition, as I mentioned previously, TRI will continue to face the headwind from the weak news and print business, in particular in the current weak macro environment where advertising budgets are being slashed.

Risk & conclusion

Well, the possible upside risk is that TRI organic growth accelerates past 7% and the new “normalized” growth is low teens. That would make the relative performance between TRI and peers smaller. That would likely justify its current multiple, and the stock sentiment would be very positive, driving the stock up.

Overall, TRI shows signs of stabilization and promising business development. Recent acquisitions like Casetext and advancements in AI technology offer growth potential, yet challenges persist, like elongated sales cycles in the Corporates segment and headwinds in news and print business. My hold rating persists due to valuation concerns. I’ve calculated a target price of $105 based on a 15-year DCF model, indicating a preferred valuation of 28.5x forward PE.

Read the full article here