Novo Nordisk (NVO) investors have continued to see NVO defy gravity as it surges further into well-overvalued zones as investors piled into the stock. As a result, the momentary selloff in September was quickly defended by buyers looking to buy “every possible” dip that the market offers. In addition, Novo Nordisk posted impressive third-quarter or FQ3 earnings results, suggesting the upward momentum looks set to continue.

As a result, NVO surged to another high this week, breaking above the $105 level. My previous update on NVO wasn’t bearish, although the directional bias highlighted caution. NVO bulls will likely point out that I should have leaned into the bullish camp as big pharma investors likely rotated to the “unstoppable” momentum of NVO and the stock of its leading GLP-1 therapy peer, Eli Lilly (LLY).

Seeking Alpha Quant upgraded NVO’s earnings revisions grade from “C+” to “A-” as Wall Street analysts realized they underestimated the near-term accretion to Novo Nordisk’s operating performance. NVO’s market leadership in diabetes care has reached a key milestone. Management accentuated that the company “met their diabetes aspiration by achieving a global value market share of 1/3 in the diabetes treatment market.”

However, Novo Nordisk expects to continue broadening its opportunities as it “expands its reach” with more patients. The company has already gained significant access to the US market, reaching about 50M people with various levels of obesity under coverage. In addition, the company expects the access expansion to gain momentum as it anticipates “more opt-ins than opt-outs.”

The company has also broadened its geographical coverage to Asia, as it expects to debut Wegovy in Japan in early 2024. Therefore, investors are likely increasingly confident about Novo Nordisk’s ability to be a leading player in the $100B market by the end of the decade.

Despite the strength of its underlying demand, the company has faced supply constraints, which could intensify near-term headwinds. With an “F” valuation grade, NVO isn’t priced for disappointment and needs to continue exploiting the robust demand dynamics to justify investors’ high optimism.

As a result, I’m not surprised that NVO is expected to invest “a substantial $2.29 billion in expanding its production facilities at the Chartres factory in France.” The expansion is set to lead to a significant increase in capacity, “more than doubling the size of the Chartres factory.” Therefore, it does seem like Novo Nordisk believes the underlying demand is sustainable, as the expansion is expected to “be completed between 2026 and 2028.”

As a result, the tight supply dynamics are expected to persist, even though Lilly could capitalize on a more attractive pricing lever to compete against NVO. While the battle could intensify if other pharma leaders join the race subsequently, it remains to be seen which company could shake up the fight between Lilly and Novo Nordisk. For now, it does seem like the market isn’t particularly concerned with competitive pressure bolstered by the positive demand/supply interplay.

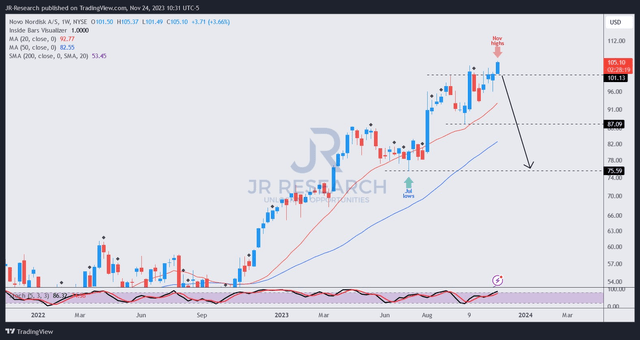

NVO price chart (weekly) (TradingView)

It’s fair to say that I didn’t follow NVO closely enough over the past year, as I missed its most significant bottom before its big move this year. Undoubtedly, I have yet to glean any red flag (sell signal) on NVO’s price action. However, I’m not convinced it could sustain its price momentum over the next year without a healthy steep pullback.

It’s way overvalued, as discussed earlier. With very high expectations baked into the setup, even more challenging YoY comps in 2024/25 could set the stage for holders taking profits, intensifying potential selling pressure.

I might be interested if NVO sellers could force a collapse, leading to a re-test of the $75 level, bringing it back to reality and shaking out recent buyers.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here