Needless to say, it was surprising to see Walmart’s (NYSE:WMT) stock price reaction to last week’s fiscal Q3 ’24 earnings release, which saw the stock leave investors with a one-day drop of 8% or almost $14 per share following the earnings release on Thursday, November 16th, ’23.

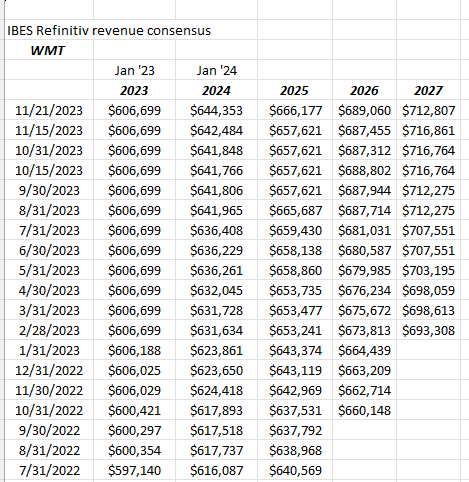

Walmart’s forward revenue estimates continue to be revised higher following last week’s earnings, while EPS estimates were revised lower.

What I should have looked at with Walmart’s earnings preview, was the comparison against last year’s quarters, particularly as overbought as the stock was coming into the earnings release:

- This October ’23 quarter saw a 1% EPS and revenue beat, while last October saw a 14% EPS beat on a 3% revenue beat, as last year revenue grew 8.75% YoY, while EPS grew just 2% YoY.

- The January ’24 quarter will be lapping January 23’s quarter where EPS beat by 13% and revenue beat by 3%, on revenue growth of 7% and EPS growth of 12%. The January ’24 quarter consensus is expecting 3.75% revenue growth on a drop in EPS of -5%.

- In April ’23, revenue grew 7.5% while EPS grew 13% and April ’23 was another 13% EPS beat on a 3% revenue beat.

Walmart facing tough comps through April ’24 or the next 2 quarters.

The “unexpected legal expenses” were a surprise on the conference call, as nothing Walmart management ever does seems “unexpected”.

One bright spot on the call, which I wasn’t aware of but is key to the brand’s future are the “store remodels” happening. Obviously, that boosts SG&A expense, but I think it’s necessary.

Since I try and engage friends and family about Walmart and get their basic impressions as to whether they shop at the stores and try and get their impressions, the one thing I consistently hear is that the stores are dirty, or rather not neat, and it leaves shoppers with a less-than-favorable impression.

I remember walking into my first Walmart in Kansas City, Kansas, in the early 1990s after hearing about this great growth stock, and I was singularly unimpressed with the crates and pallets strewn around the store, particularly in the front of the store, and the aisles weren’t necessarily easily negotiable.

Operating and SG&A expenses have been a remarkably steady 20-21% of revenue for Walmart the last 10 years, but this last quarter jumped to 22%. (Some of that may be the aforementioned “unintended legal expenses”.)

Other than Jim Bianco, on X (Twitter), who commented on Walmart’s “deflation” comments in the conference call, I couldn’t find one analyst or strategist who made reference to the deflation comments, although with Walmart generating an expected $645 billion in revenue in fiscal ’24 (ends Jan ’24), and 50% to 70% of that being grocery, the “deflation” comments by Walmart management imply a continued decline in CPI, particularly the “Food-at-Home” segment, and that is Fed-friendly to say the least.

Jim Bianco commented that Walmart was simply taking recent history and extrapolating it, but Jim may not realize how much Walmart does in “grocery” in terms of their market share, and more importantly, how important Walmart is to the average American consumer’s household food budget. Walmart may have seen this deflationary pattern before and therefore was comfortable in articulating its likely trend.

I didn’t take the deflation comments as a warning or a negative. If food and grocery are deflating, Walmart can benefit from that in gross margin i.e. cost of goods sold. Walmart matters to food & grocery given their size, and that commentary was interest-rate-friendly to say the least. (That’s my opinion – take it for what it’s worth.)

Finally, as mentioned above, Walmart’s revenue revisions continue to be revised higher following last Thursday’s earnings release, and that’s very much a plus for the retail giant.

Can’t say I’m unhappy with this progression. Note the fiscal ’24 and ’25 revisions.

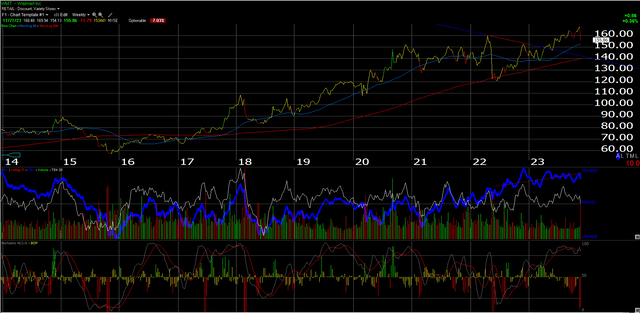

Here’s Walmart’s weekly chart as of today’s (11/21/23) close, with the stock bouncing off its 200-day moving average (not shown) and ending the day higher on heavier volume.

The stock may take some time to get back to the previous all-time high in the mid-$160s since it’s overbought and the margins were mixed and the quarter was “busy”.

Walmart management did say it may take a few years to get the margins where management wants them, (which is at least 100 bps higher on a consistent basis) but management also said new initiatives like advertising and e-commerce are both higher-margin businesses that will help boost margins, as will AI and their supply-chain reconfiguration.

Tough comps the next two quarters may keep the retail giant under wraps in terms of performance relative to the market. The 3% and 10% EPS growth expected this year and next year seems small relative to the low 20s P/E on Walmart but remember, while the P/E is in the low 20s, Walmart’s price to cash flow is just 13x.

Clients saw smaller positions added last Thursday and Friday, and this week as well.

None of this is advice or a recommendation. Take it all as one opinion. Past performance is no guarantee of future results. All EPS and revenue data is sourced from IBIS data by Refinitiv.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here