We previously covered W. P. Carey (NYSE:WPC) in August 2023, discussing its safe dividend thesis then, attributed to its reiterated FY2023 AFFO guidance.

Then again, given the REIT’s heavily leveraged business model, the growing expenses, and rising inflationary pressure, it was unsurprising that the stock had been sold off as well, as investors fled to safe havens.

While we have rated WPC as a Buy then, the stock has further plunged drastically over the past few months, attributed to the unexpected announcement of its office asset sale and mixed FQ3’23 earnings call.

Despite so, we maintain our Buy rating, since we believe that the management has opted for a more prudent path at this time of elevated interest rate environment, naturally de-risking its near-term prospects.

We shall discuss further.

The WPC Investment Thesis May Appeal To The Prudent REIT Investors

For now, WPC has delivered unexpected news twice over the past few months, starting with the divestiture of its office assets in September 2023 and the mixed FQ3’23 earnings call in November 2023.

Based on the management’s commentary, we expect approximately $735M in net proceeds from the divestiture, comprising $350M from the new REIT, Net Lease Office Properties (NLOP), and $385M from its capital raises.

Despite the sustained rate swaps, it is evident that the elevated interest rate environment has contributed to WPC’s growing annualized interest expenses of $307.88M (+1.9% QoQ/ +30.4% YoY). This is attributed to the expanding weighted-average interest rate of 3.3% (+0.1 points QoQ/ +0.7 YoY).

With the headwinds unlikely to abate anytime soon, we believe that the REIT may opt to deploy most of the net proceeds to deleverage its balance sheet upon the closing of the divestiture, with its long-term debts already notably moderating on a QoQ basis to $8.17B (-5.1% QoQ/ +5% YoY) by the latest quarter.

Assuming so, we may see WPC temporarily deflect the impact of the uncertain macroeconomic outlook, while “de-risking our equity requirements for next year,” with $1.02B of its debts maturing in 2024 and another $450M in 2025.

Combined with the reset/ cut dividends by approximately -20% and a normalized AFFO payout ratio guidance of “low to mid 70% range,” compared to the current 79.21% and sector median of 74.55%, we believe that the REIT may be better positioned for improved cash flows and enhanced balance sheet health moving forward.

Most importantly, investors may want to note that this divesture has been long coming, with WPC confidentially submitting its relevant regulatory filing for the separation back in November 14, 2022.

This is likely attributed to the management’s realization that the pandemic remote/ hybrid work trend may persist as a new normal moving forward, while renewing its focus on industrial assets.

As a result of these developments, we believe that WPC has executed brilliantly thus far, aside from the unfortunate timing of the divesture and somewhat poorly done communication to the market/ shareholders, which have directly contributed to the drastic decline in its stock prices thus far.

For the second bit of unexpected news, WPC has delivered mixed FQ3’23 earnings results, with revenues of $448.6M (inline QoQ/ +17.4% YoY) and FFO of $1.32 (inline QoQ/ -2.9% YoY).

The REIT also lowers its FY2023 AFFO guidance to between $5.17 – $5.23 and investment volume to $1.3B – $1.5B, compared to the previous guidance of $5.30 – $5.40 and $1.75B – $2.25B, respectively, though partly attributed to its office assets divestiture.

Interestingly, the WPC management’s de-risking path through asset divestiture, reduced investment target, and deleveraging is one that is drastically different from Realty Income (O), which we recently covered as well.

In contrast, O has opted to pursue a path of aggressive growth, with increasing reliance on share dilution and debt (by assuming Spirit Realty’s debt) while similarly raising its monthly dividend payout in September 2023.

While O’s dividends appear to be safe, we believe that WPC’s strategy may be more prudent during this uncertain macroeconomic condition, especially since it is uncertain when the Fed may eventually pivot and we may see a normalized economy.

Only time may tell which choice is better.

So, Is WPC Stock A Buy, Sell, or Hold?

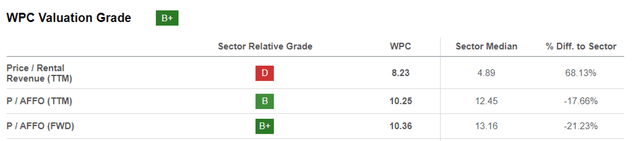

WPC Valuations

Seeking Alpha

For now, WPC’s FWD Price/ AFFO valuations have been dramatically moderated to 10.36x, compared to its 1Y mean of 13.38x, 3Y pre-pandemic mean of 13.64x, and the sector median of 13.16x.

This is probably partly attributed to the ongoing sell off observed in the REIT sector over the past few months, as Mr. Market increasingly worry about the elevated interest rate environment and the impact of rising interest expenses on their profitability and dividend payouts.

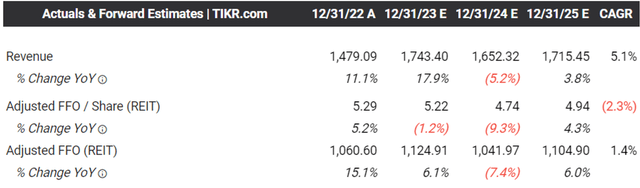

The Consensus Forward Estimates

Tikr Terminal

However, as discussed above, we believe that the WPC management has competently tempered these risks through the divestiture, especially since the REIT is still expected to generate a decent top and bottom line CAGR of +5.1% and +1.4% between FY2022 and FY2025, pro forma.

This is compared to its historical CAGR of +7.8% and +11.6% between FY2016 and FY2022, respectively.

Based on the consensus FY2025 AFFO per share estimates of $4.94 and WPC’s 1Y Price/ AFFO per share valuation of 13.38x, we believe that there is still a great upside potential of +19.9% to our long-term price target of $66.09, once market sentiments normalize in the far future.

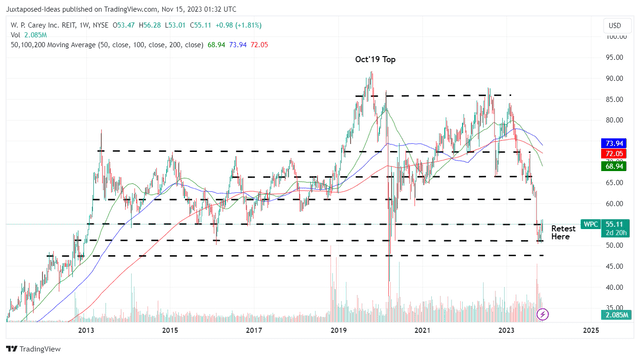

WPC 10Y Stock Price

Trading View

With WPC already returning to its 2013 levels, the stock now offers a much more tempting forward dividend yield of 6.21% as well, after taking into account the reduced dividend payout of $0.8568 from the next quarter onwards and the currently depressed share price of $55.11.

While the forward yield seems to pale in comparison to its TTM yields of 7.73%, we believe that there is still a notable improvement compared to its 4Y average of 5.65% and sector median of 5.38%.

Most importantly, WPC offers a relatively compelling growth and income investment thesis, compared to the US Treasury Yields of between 4.42% and 5.40%, depending on the investing timelines.

As a result of its attractive risk/ reward ratio at current levels, we maintain our Buy rating for WPC for income oriented investors.

Naturally, with it already losing -13.8% of its value since the divestiture announcement, the stock is only suitable for investors with higher risk tolerance and long-term investing trajectory, since its reversal may take longer than a few quarters.

Read the full article here