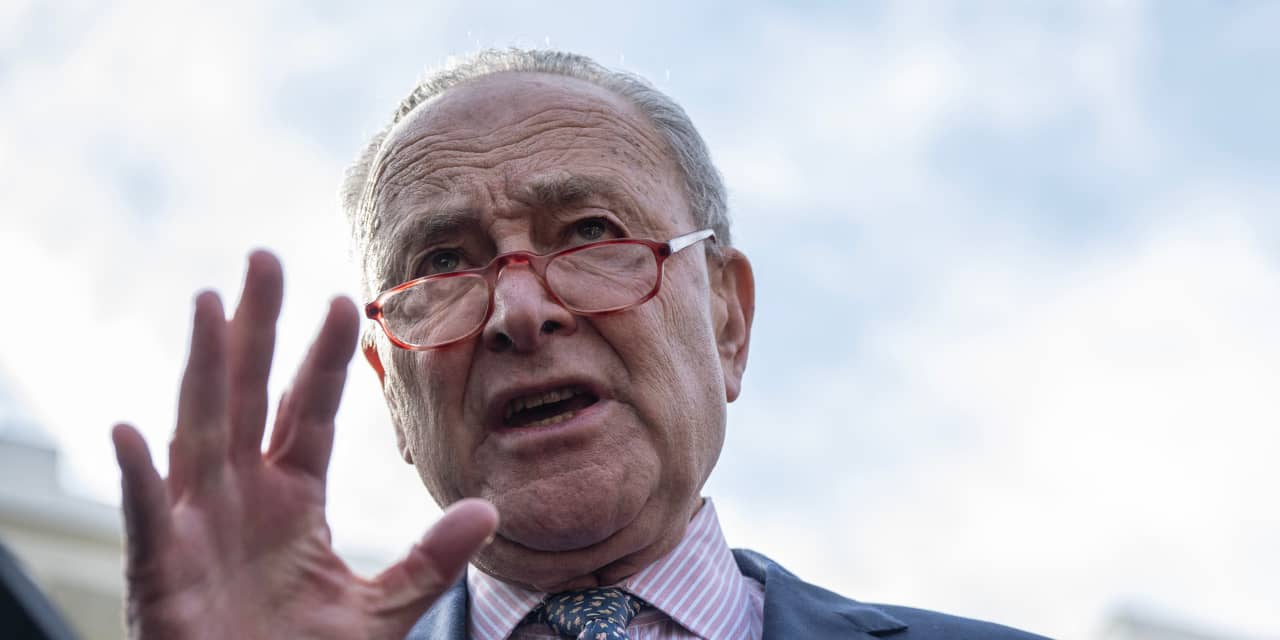

A group of mostly Democratic senators led by Majority Leader Chuck Schumer are urging Federal Trade Commission Chair Lina Khan to closely scrutinize two proposed multibillion-dollar deals in the oil sector for their potential consequences for U.S. consumers.

Exxon Mobil Corp. (ticker: XOM) plans to buy Pioneer Natural Resources (PXD) for $60 billion, while Chevron Corp. (CVX) has a $53 billion deal for Hess Corp. (HES).

The lawmakers said allowing the deals to move forward would hurt competition, reduce domestic oil supplies, and could raise gasoline prices for consumers.

Because Exxon Mobil and

Chevron

are already the two largest corporate giants in the industry, “any further consolidation could harm American consumers,” the lawmakers wrote in a letter to Khan.

The 23 senators who signed the letter said the FTC should examine the anticompetitive harms presented by the mergers and urged Khan to oppose them if the agency finds they violate antitrust law.

“This industry is already too concentrated, and Americans are already paying the price,” the senators said.

Exxon

Mobil said in an email to Barron’s that the two companies combined represent about 5% of U.S. oil production.

“For those who seek even greater U.S. energy independence and far lower emissions, this merger represents nothing but upside for our economy and our environment, given that ExxonMobil has the resources to get more out of the ground and do it at vastly improved emissions levels,” the company said.

A Chevron representative wasn’t immediately available, and the FTC in an email to Barron’s declined to comment.

The FTC is in the middle of a big antitrust case against

Amazon.com

(AMZN), but ultimately lost a bid to prevent

Microsoft

‘s (MSFT) acquisition of Activision Blizzard. The Biden administration has shown a willingness to fight what it sees as anticompetitive corporate actions.

The Justice Department is currently at trial in two separate antitrust cases, one against Alphabet‘s (GOOGL) Google in Washington, D.C., and one against

JetBlue Airways

(JBLU) in Boston. In the Google case, the government contends the search engine company abused its monopoly power to dominate the industry. In the JetBlue case, the government is trying to block the carrier’s merger with rival

Spirit Airlines

(SAVE).

The senators noted that after more than 2,600 mergers in the U.S. petroleum industry in the 1990s, including Exxon’s merger with Mobil in 1999 and Chevon’s merger with Texaco in 2001, higher gasoline prices resulted.

The Government Accountability Office found that five of those mergers resulted in higher wholesale gasoline prices, they said.

After gasoline pump prices rose to historic highs of more than $5 a gallon last June, ExxonMobil reported $56 billion in 2022 profit, and Chevron posted profit of $36.5 billion. Big Oil companies collectively earned nearly $200 billion in 2022, prompting President Joe Biden to ask the FTC to investigate possible price-gouging.

ExxonMobil is the nation’s largest oil-and-gas corporation, and Pioneer owns more drilling acreage than any other producer in Texas’ Permian Basin, the world’s most prolific oil-and-gas field. After their merger, the combined company could produce “a staggering 1.2 million barrels per day,” more than twice that of its next competitor, the letter said.

Hess is one of the largest producers in North Dakota’s Bakken Shale, the deepwater Gulf of Mexico, and offshore Guyana, South America.

Exxon’s plans to expand its refinery operations on the Texas Gulf Coast and increase its exporting operations suggest that the combined company plans to export more oil and gas than either company did separately, the senators wrote. That could mean lower supplies available in the U.S. and higher gas prices, they said.

Besides Schumer, the letter was also signed by Sens. Amy Klobuchar (D., Minn.), chair of the Senate Judiciary Committee’s antitrust panel, and longtime antitrust proponent Elizabeth Warren (D., Mass.), among others.

Write to Janet H. Cho at [email protected]

Read the full article here