Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on May 11th, 2023.

Neuberger Berman Next Generation Connectivity Fund (NYSE:NBXG) launched in mid-2021. They seemingly looked to participate in the boom that technology was going through, pushing growth stocks to new heights. Unfortunately for the fund, they launched only shortly before the bubble was set to pop. The Fed needing to raise interest rates rapidly to get inflation under control was the culprit, and inflation has remained sticky while we are still dealing with it today.

This wasn’t the only fund to experience a similar fate; BlackRock Innovation and Growth Trust (BIGZ), which we recently covered, showed a similar trajectory shortly after launch. Then there was BlackRock Science and Technology Trust (BSTZ) and Virtus Artificial Intelligence & Technology Opportunities Fund (AIO), also in the tech space. Those funds launched before the tech bubble of 2020/2021. So in those cases, they rode the trend higher but ultimately were doomed to the same fate.

With tech looking wrecked these days, 2023 showed that there was some rebounding and potentially stabilizing even. At least we don’t see the seemingly endless declines through 2023 that we experienced in 2022. This is helped by the expectation that the Fed is likely to pause with further rate hikes. While inflation remains elevated, they want to provide the interest rate hikes already implemented to work through the system. Not to mention that the whole bank crisis is also likely to play a role in slowing down the economy and could dent inflation further. There are even some expected interest rate cuts later in the year or 2024. That should bode well for growth-related investments.

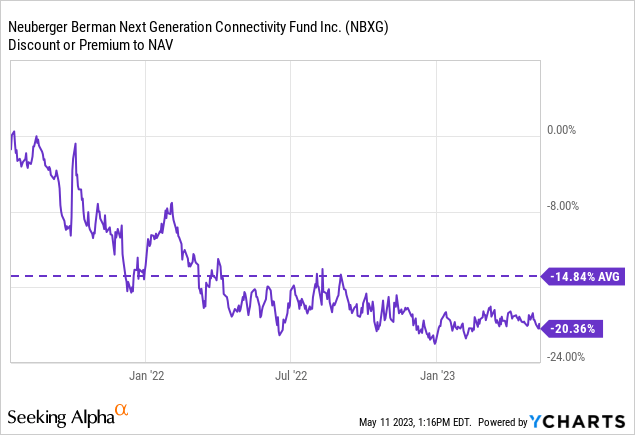

If one can handle the higher risks of these volatile funds, they are all providing relatively attractive discounts. In the case of NBXG, we are seeing the fund still trading at an over 20% discount today. That can make it a fairly compelling option. It also provides a bit of a differentiated exposure than most of the other tech funds. They still include some private investments, such as BIGZ and BSTZ, but they focus more on “connectivity.” This leads to a differentiated portfolio relative to the other tech closed-end funds.

At the same time, the fund offers some distribution yield while waiting for some potential rebounding. The current yield is certainly tempting, but the other side is that with a lack of capital gains to fund such a distribution, it should be assumed that it could be cut at any time. As a CEF, though, they will likely always pay at least something to shareholders. There have been occurrences when these funds suspend distributions, but they are quite rare.

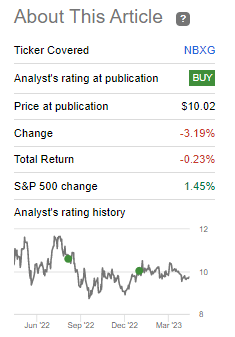

Since our last update, the fund has provided some losses but has really started to mostly seem to stabilize. It was towards the end of January 2023, so while the fund is positive YTD, it missed some of the January positive results when that prior update went out.

NBXG Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: -1.10

- Discount: -20.36%

- Distribution Yield: 12.32%

- Expense Ratio: 1.30%

- Leverage: N/A

- Managed Assets: $963.25 million

- Structure: Term (anticipated liquidation date of May 26th, 2033)

NBXG is a “non-diversified, limited-term closed-end management investment company focused on next-generation mobile network connectivity and technology.” They have no focus on U.S. or non-U.S. companies – instead, they are investing where they see fit. This also includes any market cap and private holdings.

The fund utilizes no leverage. However, with the type of underlying portfolio that this fund carries, it has seemed volatile enough. It’s probably wise to avoid adding even further volatility that can come with leverage. It also meant that while the crash of 2022 was going on, it could have actually been worse if the fund had been leveraged.

Instead, similar to the BlackRock tech funds, they implement an options writing strategy to generate option premiums. That has the upside of somewhat limiting the downside moves and providing capital gains for the fund’s distribution. Conversely, though, it can always mean potential losses if they have to close a position when they don’t want a position called away or risk limiting the upside in a swift rebound environment if a position is called away and the upside is capped.

There are always pluses and minuses to consider for every strategy. As an actively managed fund, they have quite a bit of flexibility though. Instead of using a sort of automated system of writing calls like some ETFs do, they can more opportunistically write calls.

Performance – Deep Discount

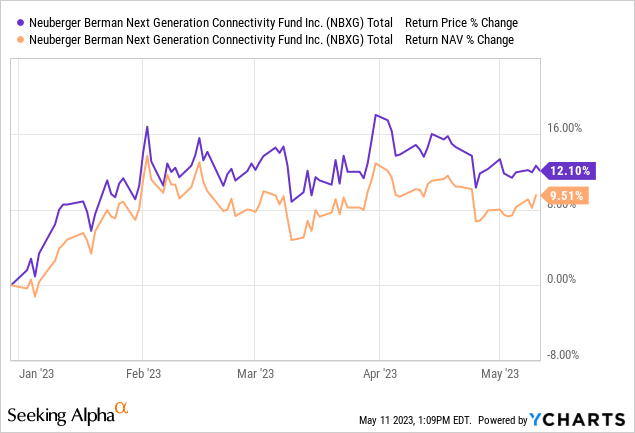

Thanks to some tech recovery, NBXG has put up positive total return performances on NAV and a share price basis.

Ycharts

However, the actual recovery for 2023 has been fairly limited. It has mostly been some of the larger tech companies that have been dragging up the Nasdaq and the S&P 500 indices. In particular, NVIDIA (NVDA) is a holding for NBXG, and as we’ll see later, it has done a lot to put the fund in positive territory YTD. There have been a few other solid winners, but nothing like NVDA getting the massive push of AI (perhaps the next bubble in the making.)

Historically speaking, a new closed-end fund frequently drops to a discount shortly after its IPO. From there, it can spend some time jostling around before finding a sort of range. When this fund launched, it really was a truly unique situation of rising rates at a pace we haven’t seen since the 1980s. Now most are expecting a recession at some point in the next year or so. So trying to find any range can be a problem for a new fund, but even harder during this fund’s short and unusual existence.

All that being said, when the fund launched, it launched at a $20 NAV and share price. Today, the share price has dropped significantly further than the NAV, which has created the deep double-digit discount we see today. At least for now, this appears to be the fund’s sort of range of around a 20% discount. We’ve seen it drop further, but that was relatively brief before rebounding a bit.

Ycharts

Distribution – Lack Of Coverage Means Caution

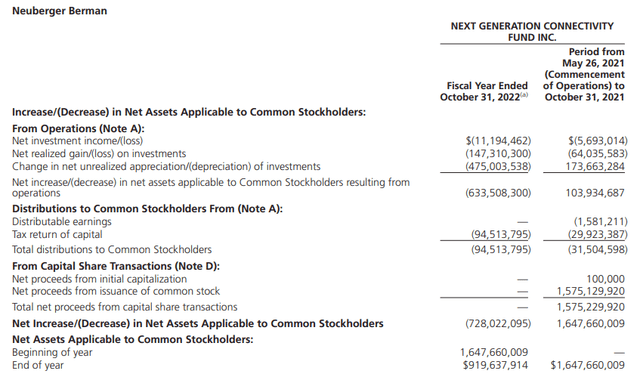

As is the case with most equity funds, they rely on capital gains to fund their entire distribution yield. With NBXG’s NAV distribution rate of 9.81%, you’d be pretty hard-pressed to name some tech stocks that are paying yields that high plus enough to cover the fund’s expense ratio.

In fact, most of what they invest in doesn’t offer a meaningful yield or any yield at all. Therefore, the fund actually doesn’t produce any positive net investment income, meaning that the entire distribution will require capital gains.

NBXG Annual Report (Neuberger Berman)

This isn’t unique to NBXG either; we see this across the board with tech-focused CEFs. That leaves it more at the discretion of what the fund feels like paying out rather than being able to really track any sort of coverage for the distribution.

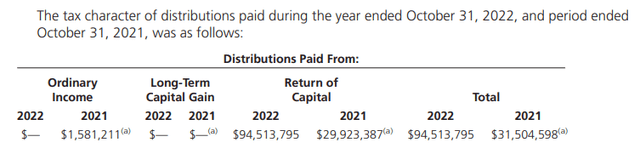

Naturally, with the type of performance we’ve seen, the distribution’s tax character will show plenty of return of capital. Which is precisely what we see they are reporting.

NBXG Distribution Tax Classifications (Neuberger Berman)

Now, if we are reaching for some positive silver lining from the massive losses the fund sustained, it could come from the loss carryforwards that the fund has. Even if you invest today and the fund experiences a rebound, you could see ROC distributions even as NAV rises. This is because just as an individual can write off losses against capital gains, a fund can do the same.

In this case, they had listed at the end of October 2022 that they were carrying around $189.5 million in loss carryforwards. ROC can become a benefit in a taxable account because it doesn’t become taxable when received. Instead, it works to defer tax obligations until potentially selling the investment as it reduces the cost basis.

NBXG’s Portfolio

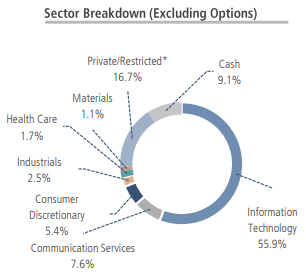

Overall, they listed 66 public companies held and eight private/restricted positions in their portfolio. As is often the case with growth-focused funds, they lean heavily toward the tech sector. This isn’t too different for NBXG, which lists almost 56% of its portfolio in this sector at the end of February 2023. This was a small increase from the 52.5% they had listed previously. Additionally, the private/restricted securities are listed as a separate sector breakdown, but within this category, several of the underlying positions would easily be identified as tech.

NBXG Sector Weightings (Neuberger Berman)

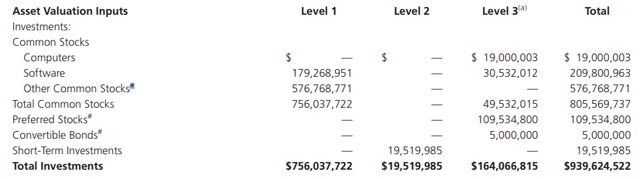

Private investments are always worth mentioning because they can often be level 3 securities. This is another area where the valuation of the fund can be impacted. Often funds with sizeable allocations to level 3 securities will be discounted because there is some skepticism here.

The valuations are based on some assumptions and aren’t provided by active market valuations, such as a security that regularly trades. There can also be periods of time where things aren’t revalued until a new round of fundraising. At the end of their fiscal year, they had just shy of 17.5% of their portfolio as level 3 securities.

NBXG Level Classification Breakdown (Neuberger Berman)

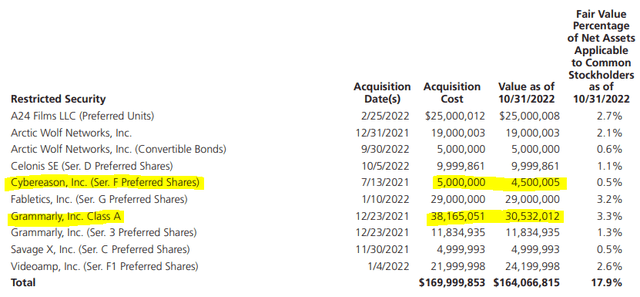

As an example, we don’t have to look any further than NBXG itself and its listed restricted securities. They listed restricted securities that had hardly seen any change in valuation relative to when they acquired these positions in 2021 and 2022. There were only two positions that saw a material drop in their fair value from the acquisition cost. That was reserved only for the Cybereason and Grammarly positions. I also pointed this out in our last update, but it is material and worth reiterating.

NBXG Restricted Securities (Neuberger Berman (highlights from author))

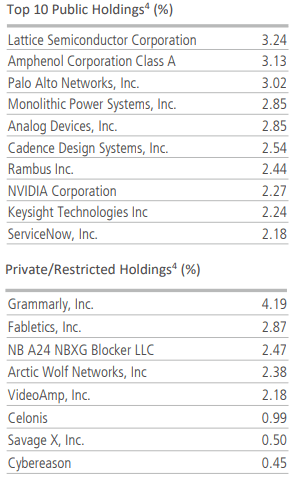

When looking at the fund’s largest holdings, they conveniently break down the top holdings as public and private. That can be helpful when assessing the company. Since they only hold eight private companies at this time, we get to see all eight on the list. These holdings are as of the end of March 31st, 2023.

NBXG Top Holdings (Neuberger Berman)

The private list includes the “NB A24 NBXG Blocker LLC” position. This is because certain investments would void NBXG’s compliance with being a regulated investment company or RIC. As a way to get around that, these limited liability companies can be set up within a fund. The blocker then becomes a wholly-owned subsidiary that the fund can control.

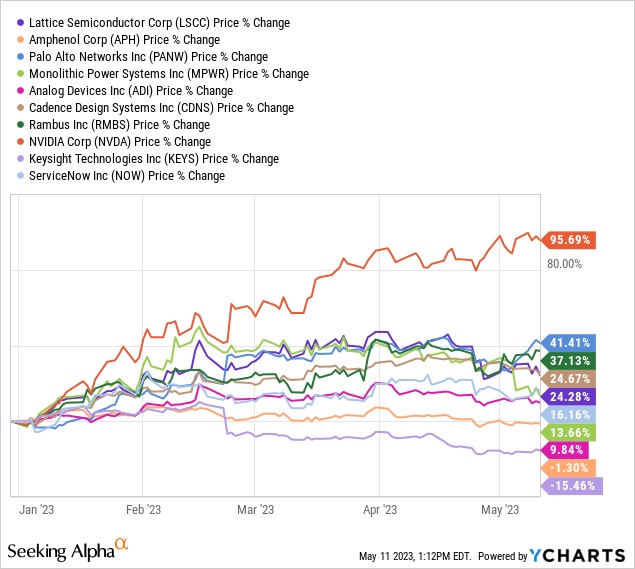

When looking at the performance of the publicly traded stocks on a YTD basis, we get to see where NVDA has just dwarfed all the rest. Palo Alto (PANW), Rambus (RMBS), Cadence Design Systems (CDNS) and Lattice Semiconductor Corp (LSCC) all put up an admirable YTD performance, but nothing really could touch the stratospheric returns that NVDA was able to deliver this year.

YCharts

As I said previously, NBXG’s focus on connectivity sees the fund’s involvement with relatively differentiated portfolio positions compared to peers. NVDA and LSCC overlap with BSTZ’s top ten, for example, but that is it. LSCC overlaps with BIGZ’s top ten, but none of the other names do. For AIO, they overlap with CDNS, but once again, none of the other top ten names overlap.

The management team seems optimistic about the overall connectivity theme and that it will overcome the current challenges. This was included in the last annual report at their fiscal year-end, October 31, 2022. At that time, the market was in an overall trough.

Looking ahead, we remain focused on generating long-term returns by seeking to identify and opportunistically invest in structural enablers and beneficiaries of the next generation connectivity theme. In our view, inflation ultimately will moderate, signaling that the end of the hiking cycle appears to be in sight. As such, with segments of the equity market trading near historical trough valuations, we maintain a balanced view of the market outlook. We believe the next generation connectivity theme remains intact and will endure beyond the current macroeconomic and geopolitical challenges.

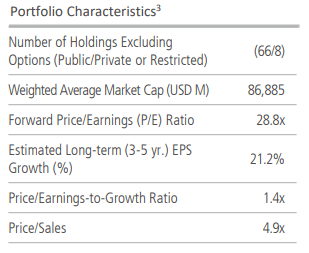

Our prior update showed that the forward P/E ratio came in at 28.2x; the latest shows 28.8x. The P/S came in at 4.8x, while that also climbed to 4.9x. At the same time, the actual estimated long-term EPS growth came down from 25.1% to 21.2%. It seems to indicate that growth is slowing, and valuation is increasing anyway. The below data is as of March 31, 2023.

NBXG Portfolio Characteristics (Neuberger Berman)

Conclusion

Growth and tech investments were wrecked in 2022 but are starting to show somewhat of a pulse in 2023. The rebound has been fairly limited if we look at the results of the broader indices. However, there is some underlying under-the-radar type tech-related growth names that have been able to provide support for tech-related funds. NBXG saw most of its top holdings provide positive results on a YTD basis, thus, providing NBXG with positive results.

At the same time, there still seems to be some caution with the fund trading at a deep discount. Some of this does seem to be warranted, such as having an allocation to level 3 securities; the outlook is also pretty uncertain on the overall economy at this time. Should sentiment become more positive, we could potentially see some upside potential through the discount narrowing.

So I’d say that NBXG and these other tech closed-end funds definitely aren’t for everyone. Those that can take more speculative positions could potentially do so while also collecting a monthly distribution. The caveat here is that even the distribution at the current level is speculative, with a lack of capital gains since launching.

Read the full article here