Introduction

iShares MSCI Poland ETF (NYSEARCA:EPOL) is an exchange-traded fund that is focused on investing in the Polish equity market. Given Poland’s proximity to the Russo-Ukrainian War that escalated in early 2022 (through to present), and inflationary pressures driven initially largely by higher energy prices, Polish stocks fell out of favor. However, since a nadir in October 2022, EPOL has risen by over 60%.

I previously covered EPOL in early November 2022, suggesting Polish stocks were too volatile to own. Clearly, this was ill-timed and I was wrong. Investor sentiment picked up significantly and much of the risk premium built into Polish stocks unwound to the upside. In other words, the volatility worked favorably. Since the publication of the article, EPOL has risen by 38.93% on a price-only basis using Seeking Alpha data, as compared to the S&P 500’s rise of 5.78%. I think it is worth reviewing the current position to include a full IRR gauge, with consideration for volatility, to see if EPOL is still worth holding after such a dramatic climb.

Return Potential

EPOL is invested in 34 stocks in accord with its chosen benchmark, the MSCI Poland IMI 25/50 Index. The fund had assets under management of $203 million as of May 10, 2023, according to iShares themselves. The expense ratio is reported as being 0.58%, which I will factor into my return estimate. Further, Morningstar estimate forward three- to five-year earnings growth potential of 5.23%, which is quite meagre. However, this is a good sign that analysts are not over-estimating the potential of the fund.

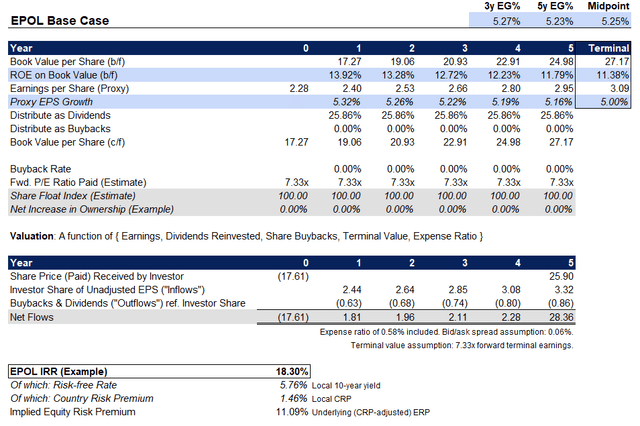

The benchmark index previously cited is a capped version of the regular version. I will refer to the latter given the substantially similar composition of the two indices, and on the basis that the regular version presents more detailed information to include trailing and forward price/earnings ratios of 7.72x and 7.33x, respectively (as of April 28, 2023). The price/book ratio for the index is reported as 1.02x, with an indicative dividend yield of 3.35%. The data essentially implies a forward return on equity of 13.21% and a dividend distribution rate from earnings of some 25.86%. Holding most factors constant, I estimate an IRR potential of 18.3%.

Author’s Calculations

That is a very high IRR, although bear in mind that local risk-free rates are currently almost 6%, and EPOL’s equity volatility is high. I calculate the three-year beta of EPOL vs. the S&P 500 as being 1.99x, which is exceptionally high; it means an annualised standard deviation of 35.90% vs. the S&P 500’s 18.00%. Meanwhile, the correlation between the two is 0.74x, which is high. In other words, while we have had a good start to 2023, if markets were to turn down, EPOL would likely suffer disproportionately.

Having said that, long-term shareholders should benefit from holding U.S. stocks. I have covered many global equity ETFs and U.S. equity ETFs recently, and while some do not offer considerably good value, many are demonstrating sound long-term return potentials. Therefore, I don’t think stocks are likely overvalued on a long-term time frame. As a result, I believe pro-cyclical funds like EPOL are not inherently poorly positioned. Further, EPOL is not objectively overvalued; on the contrary, the high implied equity risk premium suggests plenty of risk still priced in.

Conclusion

In summary, I think EPOL is an attractive albeit riskier hold for long-term investors. On valuation alone, you could see a further 40% uplift. The forward earnings multiple of 7.33x is very low, too. Even assuming zero real earnings growth over the long run (i.e., if long-term earnings growth among EPOL’s portfolio companies matches the local 10-year yield), an equity risk premium of 7% (higher than average given Poland’s elevated country risk premium; see estimates from Professor Damodaran of 1.46% in his most recent estimate) would still result in a multiple of 14.3x. That’s almost double the current valuation.

I have to be bullish on EPOL, even though it sounds a little odd after previously recommending a neutral stance prior to a rampant rise. I think I have learned a lesson that it is important to aggregate all the numbers and force oneself to value a fund as objectively as possible given the data available at the time. While EPOL still remains volatile, on a volatility-adjusted basis offers good value over the long run, and even better, you could easily see earnings multiple expansion combined with reduced volatility. This could result in a very competitive risk-adjusted return.

Having said all this, one should be prepared to hold EPOL over a multi-year period, and I would still caution not to hold too much of one’s portfolio in EPOL given the local political risk.

Read the full article here