Student debt resumed accruing interest on September 1 and payments will be due in October. This is all over financial media with pundit’s views ranging from a crash in consumer spending to it being a complete non-event and consumption progressing as usual. Each side of the argument can even pull up graphs of very convincing data showing they are right.

The state of the U.S. consumer has huge implications on which stocks will perform well so it behooves us to really examine the issue and figure out where the truth really lies. I think the best way to form an educated opinion on such a contested issue is to fully consider both sides of the argument. As such, we will look at data points that suggest this is a big deal as well as those which point to consumption remaining strong. Finally, we will conclude with our take and the implications for specific investments.

Data suggesting it is a huge deal

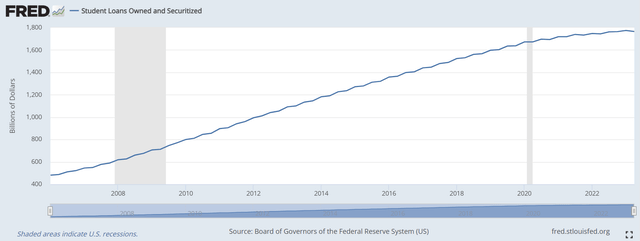

The magnitude of student loans is quite large at $1.76 trillion

FRED

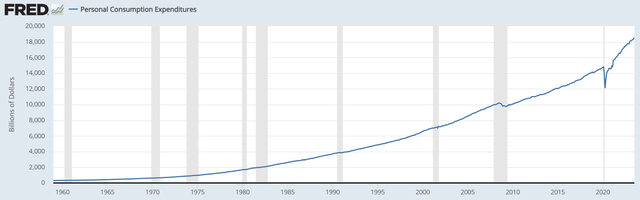

As a frame of reference, recall that personal consumption is just north of $18 trillion

FRED

Student loan balances sit just under 10% of total annual consumption, but of course the entire balance is not due all in one year. If outstanding student loans are paid down over the course of 10 years on average, that would knock out about 1% of consumption spending.

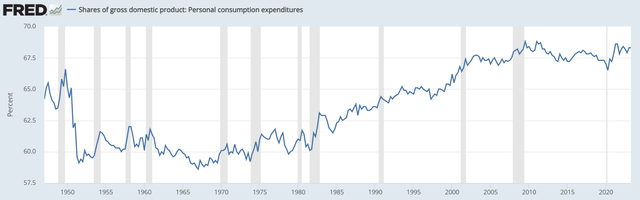

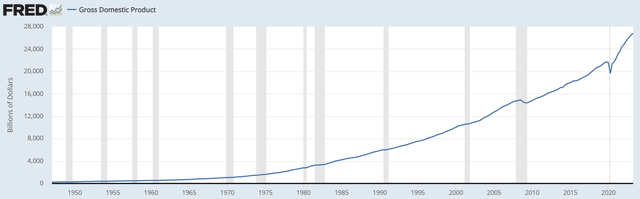

Consumption, or the C in the GDP acronym CIGX is 68.3% of overall GDP.

FRED

This indicates that the transition from almost 0 student loan paydown to an environment where loans are paid off over perhaps 10 years could be a hit to GDP of as much as 0.6%.

There are a ton of moving parts here, and I think there are valid arguments to suggest paydown periods might be longer than 10 years so I suspect the realized hit to GDP will be significantly smaller.

Nonetheless, this is still a major economic event.

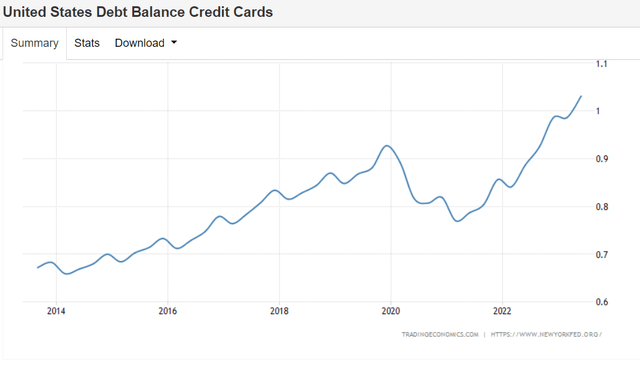

Also worth noting is that student loan interest and payments are the historical norm here. We are not entering unprecedented times, but rather exiting the anomalous period in which interest payments were paused. Consumer bears argue that 2022 and 2023 have represented a period of reckless spending brought about by the lack of student loan payments along with the various stimulus checks. There are significant data points supporting this view.

Credit card debt balances have spiked to an all-time high of $1.03 trillion.

tradingeconomics

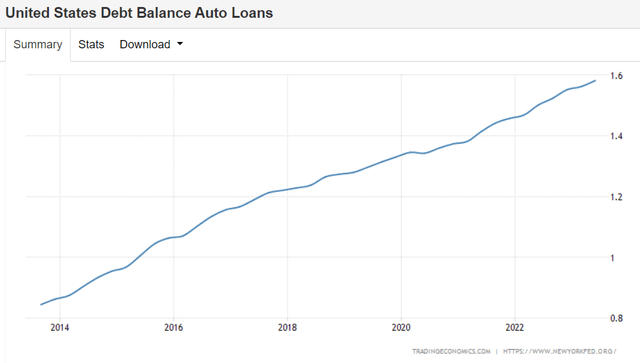

Auto loans have spiked to $1.6 trillion.

tradingeconomics

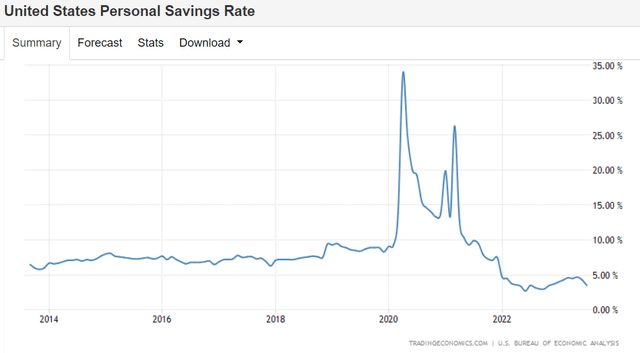

Finally, savings rates have fallen markedly, indicating consumers generally spending more aggressively.

tradingeconomics

The idea of a crash in consumer spending going forward would be that now that interest and payments are due on student debt, consumers are going to have to reel back spending. Consumer spending will retreat from its currently high levels to more normal levels.

As someone who is fiscally prudent by nature, I am emotionally biased in favor of the bearish consumer argument. Observing a friend order a $30 lunch with a $9 delivery fee while I eat a homemade sandwich costing $2.35 in ingredients makes me feel like spending is as reckless as the graphs above suggest. However, this is analysis, and I must put aside my curmudgeonly biases.

In examining the data more thoroughly, I think most of the data points suggesting weak consumer balance sheets are flawed in that they do not account for inflation or income.

The bullish on consumer argument

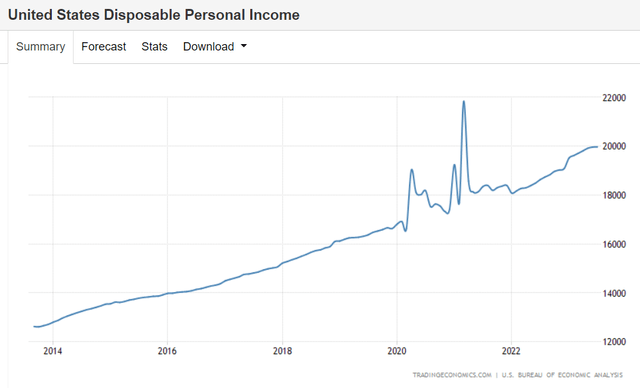

Over the last few years there has been a total of about 20% inflation depending on the time period and the type of goods one is referencing. This inflation naturally pulls up all absolute numbers. So while spending is indeed up significantly, discretionary income is up even more.

tradingeconomics

Aside from the temporary spikes from stimulus checks, disposable income is at an all-time high.

People are spending more money because they have more money. Employment is excellent with higher wages, low unemployment and quite recently a very encouraging spike in labor participation rate.

FRED

I would love to see this number get above pre-pandemic levels, but it is headed nicely in the right direction. With more people working and earning higher wages while they work, GDP is up massively.

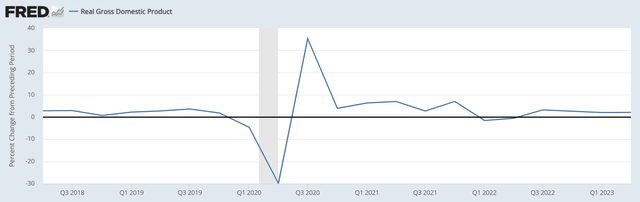

This might not seem true given that headline numbers for GDP have been 2%-3% annual growth for the past couple years, which is not fast by historical standards.

FRED

Note, however, that GDP is usually quoted in real terms (inflation adjusted). Nominal GDP is soaring.

FRED

Real GDP is the correct way to think about growth, but with respect to the spending graphs earlier in this article, they should be adjusted to real terms in the same way that GDP is.

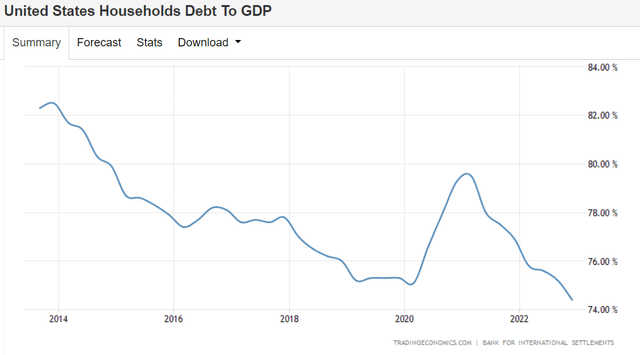

So, while spending is nominally high, I think it has been actually quite reasonable relative to income and relative to GDP. In fact, household debt as a percentage of GDP has been falling, not rising.

Tradingeconomics

As usual, the truth is somewhere in the middle between the bull and bear cases.

Our view on the consumer

The magnitude of student debt is large and as payments restart it will deduct from discretionary spending. As such, I do anticipate at least a slowdown in consumption, but it is not a dire situation as the interest and principal burden is hitting consumers at a time when their balance sheets look excellent.

I’m sure there are individuals for whom the restart in student debt payments is a life-style altering event, but on average, I don’t see it as a massive shift. Instead, I think it will be a gentle tightening of purse strings – minor changes to save up money to pay down the debt.

Investment implications

I think it is fairly obvious that sectors like travel/leisure and retail will be impacted. I see it as more of a shift rather than a straight negative. While hundreds of stocks are going to be influenced, there are two particular investments that I want to discuss:

- Grocery stores – helped

- Airbnb – hurt

It is the middle segment of goods and services that I think will be hurt. High-end luxury simply does not care about student debt. The ultra-wealthy have already paid off their student loans or never had them in the first place. People will be looking to save money and will do so in ways that least impact their lifestyle. One of the least disruptive ways to save is to trade down in price point.

- Premium brands vs. generics

- Dining out three times a week vs. dining out two times per week

Grocery stores benefit from each of these concepts.

Prima facie, buying lower priced groceries would seem to hurt sales as overall fewer dollars are spent, but in grocery stores, the lower cost items are the store brands where they retain a higher margin as they capture more of the supply chain. Supermarket Perimeter estimates that:

“Private label products yield 35% profit margins compared to 26%”

These are gross margins with overall grocery store margins being quite small. Given the percentage difference in margin, a shift to more store brands could improve overall margins quite nicely.

Grocery stores are already performing well fundamentally with this just representing incremental improvement.

Within the category, I think Albertsons (ACI) is highly opportunistic along with the quality/value grocery anchored REITs, Brixmor (BRX), Kite Realty (KRG), and Kimco (KIM).

Hotels

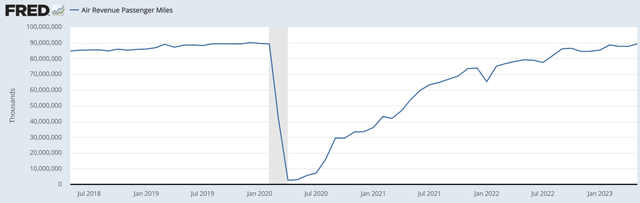

While the media often refers to “revenge travel” as a moniker for the increase in travel post-pandemic, it is not really an increase so much as a recovery to pre-pandemic levels.

FRED

Thus, travel is at approximately the level it was at prior to the pandemic when student loan payments were active. As such, I don’t think travel volumes will drop all that much. Instead, consumers may opt for slightly cheaper vacations.

Four Seasons level of luxury hotels will be business as usual since that demographic is unaffected. It is the midrange that could experience losses as consumers shift to cheaper venues. In hotel terms this means the upper-upscale and upscale segments might get traded out for midscale or economy.

The group most impacted by student loan debt interest is likely going to be young people making between $50,000 and $125,000 per year. This is precisely Airbnb’s (ABNB) demographic as their clientele skews young and skews affluent.

Airbnb earns a percentage of sales, so when consumers shift to cheaper venues it hits ABNB proportionally even if travel volumes stay healthy.

On top of that ABNB has lost New York City due to a ruling effectively banning short term rental of housing units.

“The number of active rentals in New York is currently more than 26,800, of which 84% are listed on Airbnb.”

That is quite a bit of business lost overnight.

What is lost for ABNB could be opportunity for others.

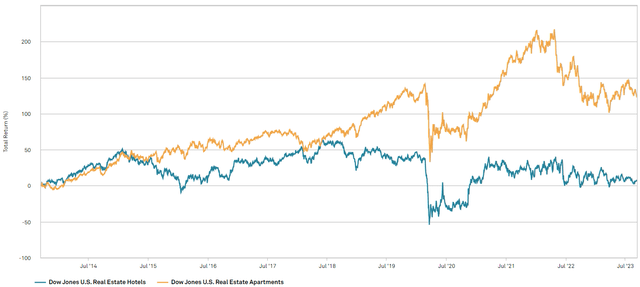

For real estate, what ABNB has effectively done is converted apartments into hotels. It has been a big source of shadow supply in the hotel space and negative supply for the apartment space. This conversion of space led to oversupply and undersupply in hotels and apartments, respectively and likely contributed to this:

S&P Global Market Intelligence

In NYC, that is about to reverse.

26,800 units currently being used as hotels are about to be restored to the apartment market. Apartment fundamentals in NYC are strong enough to absorb the roughly 1% increase in inventory.

Hotels in the area suddenly have less competition. Occupancy should rise and perhaps even allow higher ADR. I am not bullish on hotels at this time, but for those who are this might be an interesting play.

Wrapping it up

Despite the doom and gloom of the media, the U.S. consumer looks healthy. I anticipate a slight pullback in consumer spending, but the impacts on investments will be more related to a shift in spending patterns rather than dollars spent.

Read the full article here