A Quick Take On HireRight Holdings

HireRight Holdings (NYSE:HRT) provides a variety of employee background verification, screening and related services for organizations.

I previously wrote about HireRight with a Hold rating.

Given a likely revenue decline in 2023 against a backdrop of deteriorating labor demand, my outlook on the stock is to Sell.

HireRight Overview

Nashville-based HireRight was established to devise a range of background verification and HR compliance solutions for organizations across the globe.

The company is led by President and CEO Guy Abramo, who joined in 2018 and formerly served as GIS’s CEO.

HireRight’s main products consist of:

– Screening Manager

– Applicant Center

– Connect (API integrations)

– Self-Service platform

– Additional related services

The company targets mid-sized and large enterprises via its direct sales force and partner network. HireRight also offers its background check services to small businesses through its self-service portal.

Per a 2021 research study conducted by The Insight Partners, the employment screening market, one of the key areas of focus for HireRight, was worth approximately $4.2 billion in 2020 and is predicted to rise to $6.4 billion by 2028. This translates to a projected CAGR (Compound Annual Growth Rate) of 5.5% for the period between 2021 and 2028.

The primary driving factors behind this anticipated growth are the increasing population migration to urban regions, which in turn creates more job openings and a higher demand for employees. Additionally, there has been a surge in the number of applicants per job opening as well as an expansion in contract and temporary workforce opportunities.

Prominent competitors or other industry participants include:

-

First Advantage

-

Sterling Check Corp.

-

Accurate

-

Certiphi

-

Cisive

-

Disa

-

Checkr

-

GoodHire

-

Asurint

Solo’s Recent Financial Trends

-

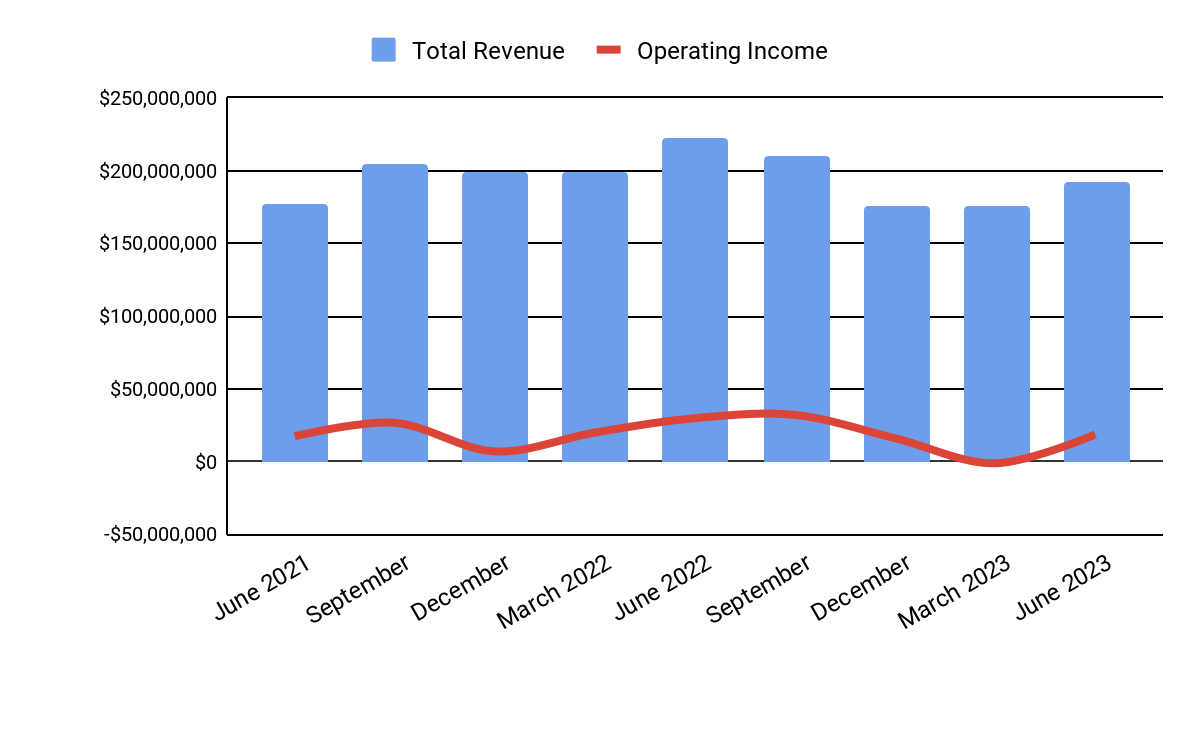

Total revenue by quarter fell year-over-year due to lower hiring volumes. Operating income by quarter rose sequentially due to increased gross profit and lower SG&A expenses.

Total Revenue and Operating Income (Seeking Alpha)

-

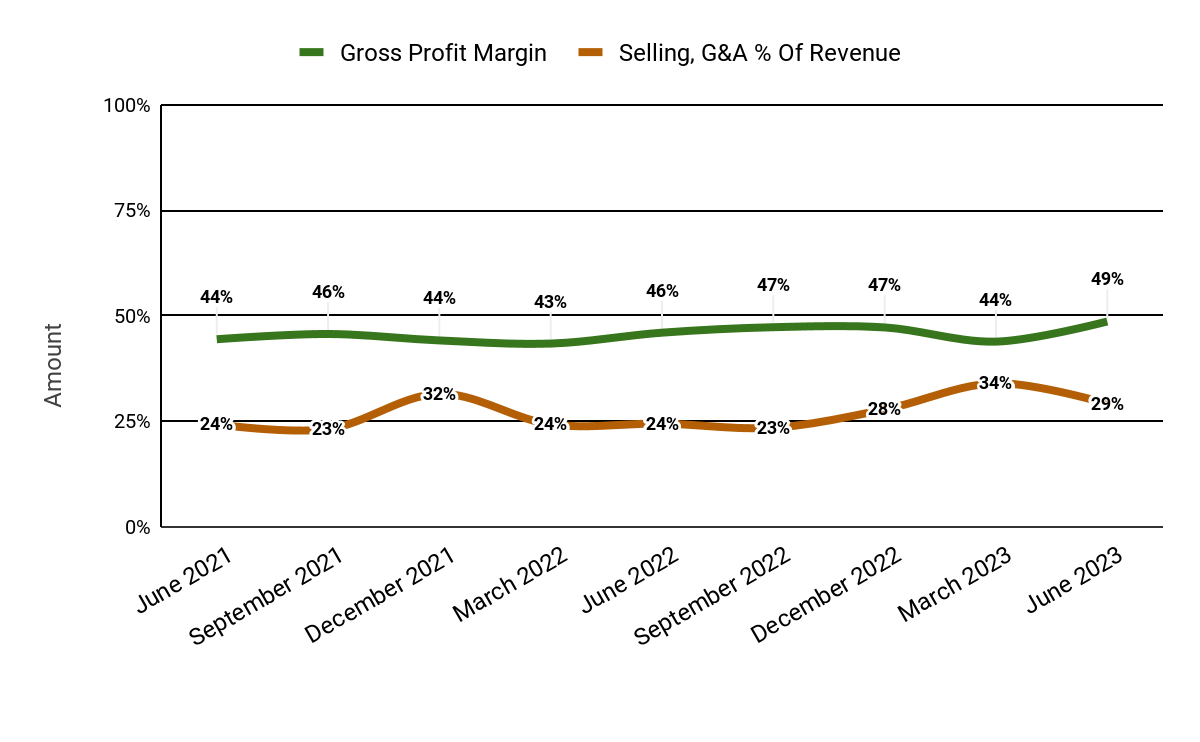

Gross profit margin by quarter has risen. Selling and G&A expenses as a percentage of total revenue by quarter dropped sequentially, possibly due to increased operating efficiencies from its back-office efficiencies, although the result was still higher year-over-year.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

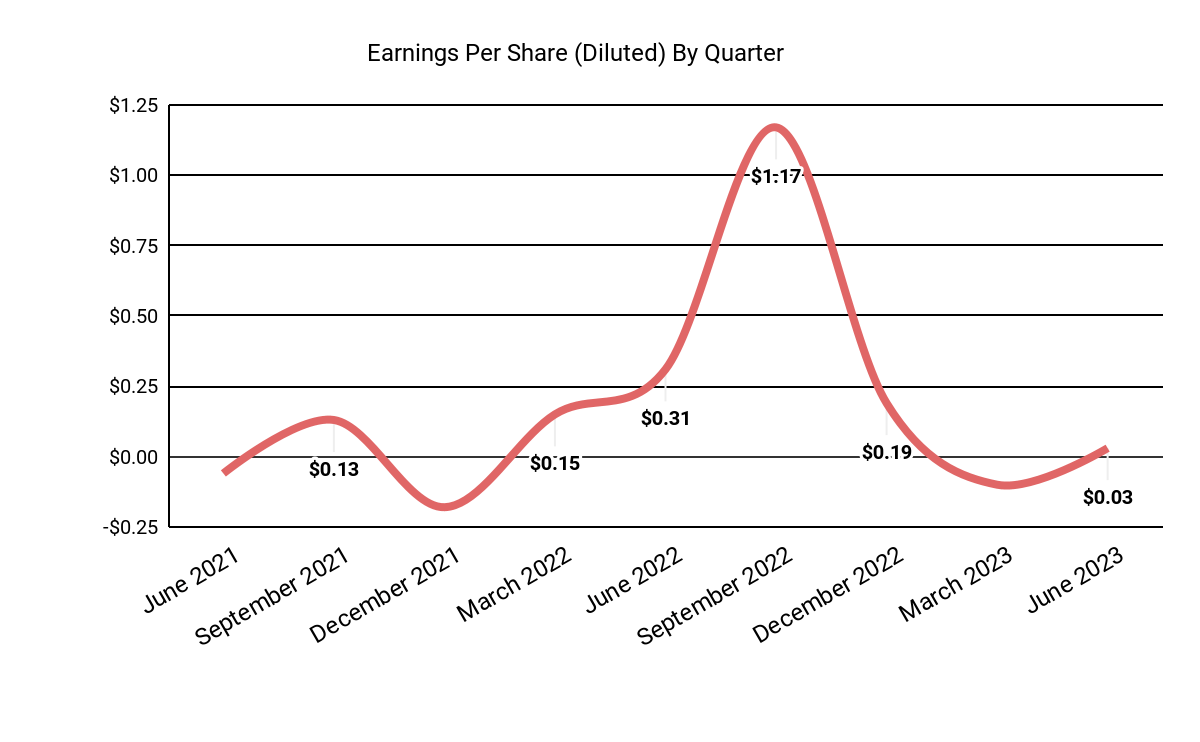

Earnings per share (Diluted) have fluctuated materially due to reduced hiring volumes, although the company has remained earnings-positive throughout the period shown in the chart below.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

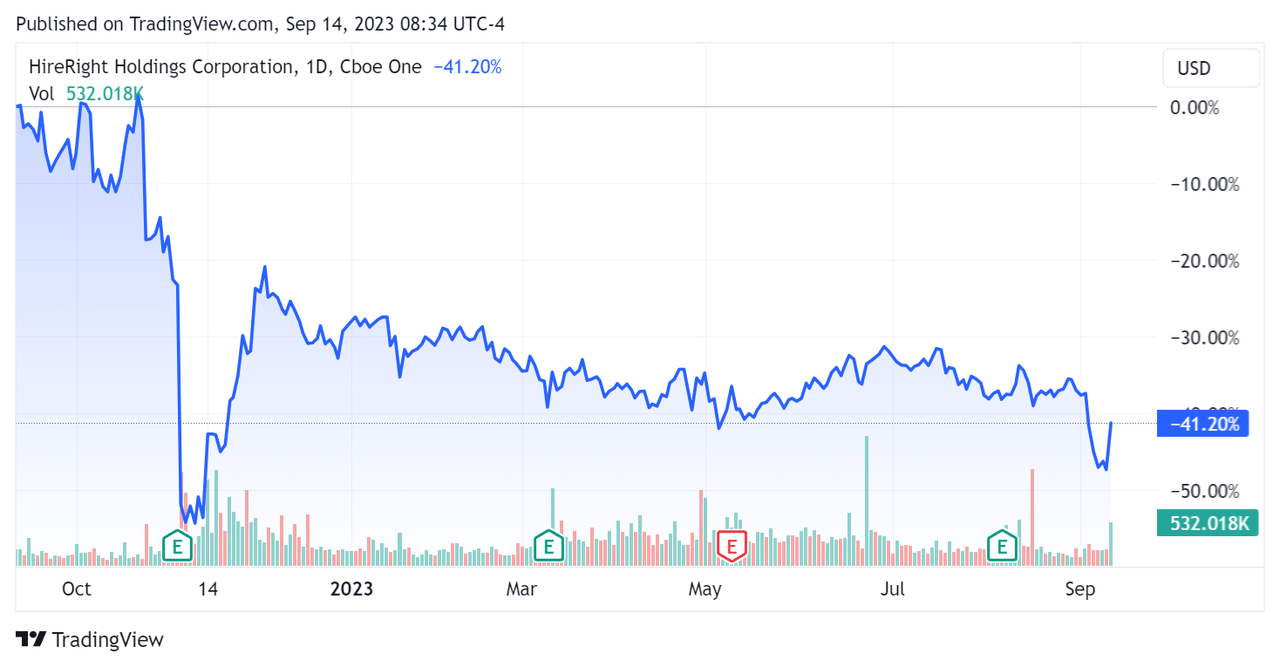

In the past 12 months, HRT’s stock price has fallen 41.2%, as the chart shows here:

52-Week Stock Price Percentage Change (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $77.5 million in cash and equivalents and $688.9 million in total debt, of which $8.4 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $80.6 million, during which capital expenditures were $3.8 million. The company paid $13.2 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For HireRight

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.7 |

|

Enterprise Value / EBITDA |

9.0 |

|

Price / Sales |

0.9 |

|

Revenue Growth Rate |

-8.7% |

|

Net Income Margin |

13.7% |

|

EBITDA % |

18.5% |

|

Market Capitalization |

$622,380,000 |

|

Enterprise Value |

$1,250,000,000 |

|

Operating Cash Flow |

$84,430,000 |

|

Earnings Per Share (Fully Diluted) |

$1.29 |

(Source – Seeking Alpha)

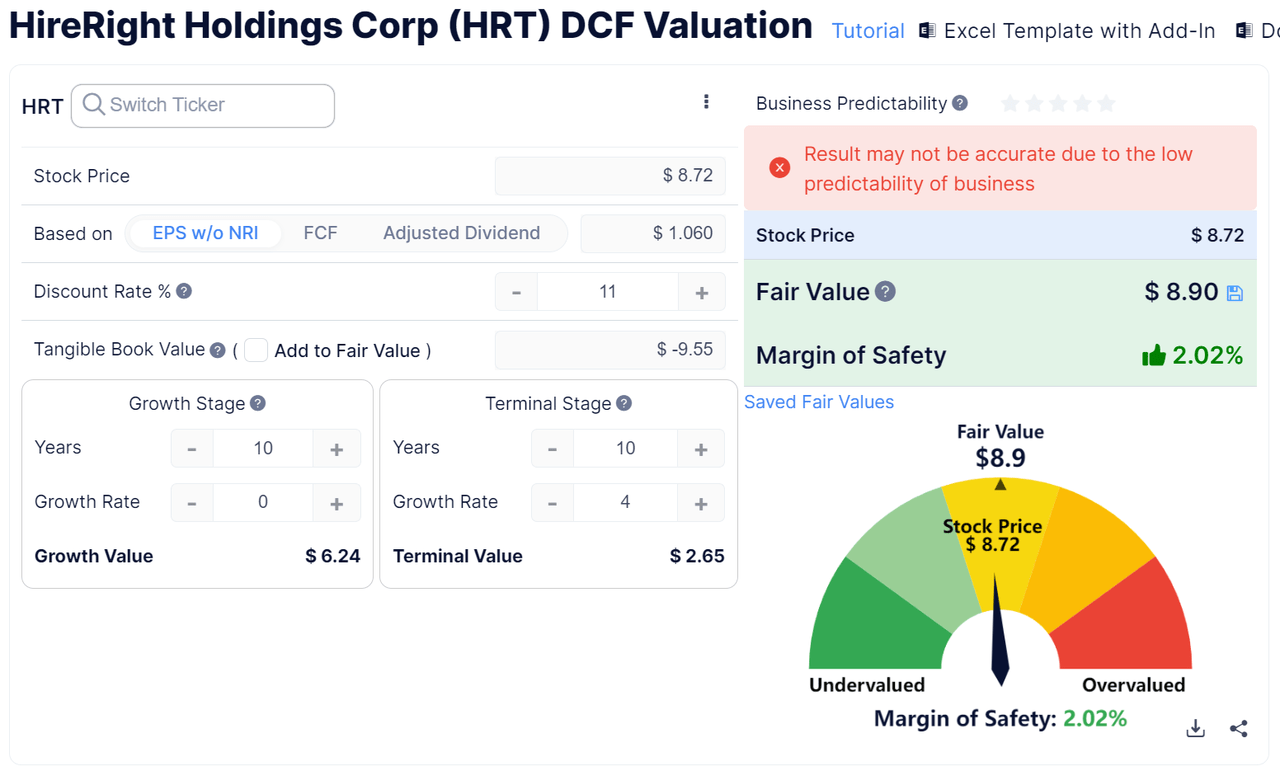

Below is an estimated DCF (Discounted Cash Flow) analysis of HireRight’s projected growth and earnings:

Discounted Cash Flow Calculation – HRT (GuruFocus)

Based on the DCF, the firm’s shares would be valued at approximately $8.90 vs. the current price of $8.72, indicating they are potentially currently fully valued.

As a reference, a relevant partial public comparable would be Sterling Check (STER). Shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Sterling Check |

HireRight |

|

Enterprise Value / Sales |

2.3 |

1.7 |

|

Enterprise Value / EBITDA |

15.5 |

9.0 |

|

Revenue Growth Rate |

-0.25% |

-8.7% |

|

Net Income Margin |

0.34% |

13.7% |

|

Operating Cash Flow |

$103,880,000 |

$84,430,000 |

(Source – Seeking Alpha)

Sentiment Analysis

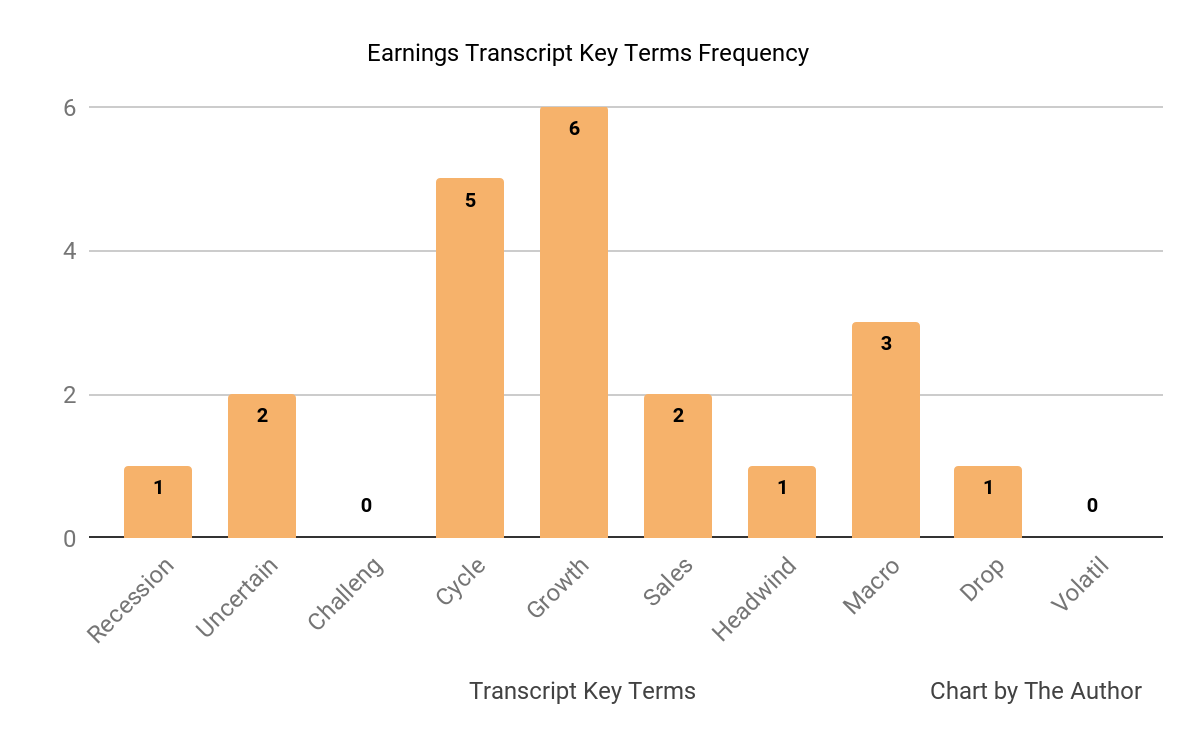

Below is a chart indicating the frequency of various terms mentioned in the most recent earnings call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

Analysts questioned management about revenue results and outlook.

Management responded that technology and services were responsible for revenue decline YoY but that it was seeing “sequential seasonal improvement versus Q1 of this year.”

Also, the company is seeing more demand for global RFPs and believes its platform is well-positioned for wins with larger enterprises.

Management also responded to a question about its debt service costs, stating that interest expense has risen due to rising interest rates.

Also, stock buybacks may slow due to less cash due to the increasing interest expense.

Commentary On HireRight

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management highlighted customer hiring patterns being similar to previous seasonal fluctuations, although admitting volume was lower than in previous years.

However, the firm’s investments in various AI technologies have led to improved automation of various back-office functions and is being rolled out across its global footprint.

The result of these improvements has been to enable management to “streamline our domestic workforce and transition to more cost-effective offshore markets.”

Additionally, it has reduced onboarding and training costs for new hires.

The enterprise client retention rate was 97.4%, and the company produced a 7% upsell increase sequentially from the previous quarter.

Total revenue for Q2 2023 fell 13.6% year-over-year, but gross margin improved by 2.7%.

Selling and G&A expenses as a percentage of revenue increased 4.7% YoY and operating income dropped 37.5%.

The company’s financial position is moderate but the firm has significant debt that is increasing its debt service costs.

Looking ahead, management is guiding for full-year 2023 revenue to decline by approximately 10% YoY.

If achieved, this would represent a material reversal in revenue growth rate vs. 2022’s growth rate of 10.5% over 2021.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has fallen a net of 23%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include improvement in technology sector hiring due to the ongoing and increasing interest in AI-related hiring at various tech companies.

However, management’s guidance for 2023 revenue implies a continued decline in revenue, and while the tech sector may improve, other sectors may produce negative results as higher-for-longer interest rates continue to squeeze the economy.

The firm’s available cash for stock buybacks is also being negatively impacted by higher interest rates, producing less upward pressure on the stock over time.

Given these risks and a likely revenue decline in 2023 against a backdrop of deteriorating labor demand, my outlook on the stock is to Sell.

Read the full article here