Summary

Following my coverage on Zimmer Biomet Holdings (NYSE:ZBH), which I recommended a buy rating due to my expectation that with positive developments across the board, I would not be surprised to see an increase in revenue and EPS forecasts in the coming quarters. I reaffirm my positive stance for the following reasons. In the second quarter, ZBH reported strong financial performance, attributed to improved operational efficiency, procedure recovery, enhanced staffing, and reduced cancellations. Both domestic and international sales increased, driven by growing demand for medical procedures. ZBH has also outlined strategies to gain market share in the knee sector and foster innovation in hip products. Notably, ZBH has raised its 2023 growth forecast, reflecting confidence in its strategic initiatives.

Investment thesis

In the second quarter of 2023, ZBH reported strong financial performance, with total sales reaching $1.87 billion. This represented a 6% growth on a year-over-year basis. EPS remained stable at $1.82 compared to the previous year, in line with market expectations. This positive performance was attributed to several key factors, including efficient operational execution, procedures recovery, improved staffing levels, and a reduction in cancellations. These factors collectively contributed to improved top line revenue growth.

In the US, sales increased by 5%, driven by robust demand for elective medical procedures and effective commercial strategies in the Hips and Knees product lines. Internationally, ZBH reported an impressive 7.2% sales growth on a constant currency basis [xfx]. This growth was attributed to the recovery in elective procedures, backlog recovery, and strong adoption of new products.

ZBH outlined four key strategies within its knee business aimed at gaining market share, enhancing product mix, and maintaining price stability. These strategies included leveraging the Rosa and Persona Cementless combination to boost the adoption of robotics and cementless solutions, with a long-term target of increasing penetration. Introducing Persona revision, transitioning legacy ZB systems to the Persona portfolio, and launching Persona IQ were also highlighted. In the hip business, ZBH also laid out four pillars to drive innovation, improve price stability, optimize product mix, and facilitate competitive conversions. These included utilizing ROSA with Hindsight, combining Avenir Complete with G7, introducing the Triple-taper stem, and implementing Haptic Arthroscopy and Mechanized Manipulation Robot [HAMMR].

Looking ahead, I remain optimistic about its future revenue growth, driven by its strategic initiatives and the strong performance in key segments. The company’s commitment to innovation and market expansion positions it favorably for continued growth in the coming quarters.

Guidance

ZBH has updated its guidance, with the new midpoint indicating an expected 7.25% growth on a xfx, up from the previous estimate. This compares to the strong 9.5% growth observed in the first half of the year and implies a projected 5% xfx growth in the second half. Previously, ZBH’s guidance, given during the first-quarter call, suggested growth in the second to fourth quarters would be around 4-5%. This aligns with ZBH’s belief that it can achieve a growth rate of at least 4%, or possibly in the mid-single digits, in a ‘normalized’ business environment. It’s worth noting that the first and fourth quarters will benefit from the extra selling days, offset by headwinds in the second and third quarters. The revenue expectations for the third and fourth quarters remain unchanged, with the anticipation that third-quarter revenue will decline compared to the previous quarter, following normal seasonality trends.

From a margin perspective, I expect the third quarter to represent the low point for the year, both in terms of gross margin [GM] and operating margin [OM] due to typical seasonality. However, the fourth quarter is expected to see a significant sequential improvement, delivering the highest margin for 2023. ZBH’s current goal is to stabilize GM, with the hope of maintaining or even expanding it over time, aiming for GM levels seen in 2022 as a comfortable baseline.

In my opinion, the upward revision in growth guidance reflects management optimism for continued growth, building on the strong performance in the first half of the year. The company’s belief in achieving consistent growth rates of at least 4%, and potentially reaching MSD growth, in a normalized business environment demonstrates its commitment to sustained progress. While certain challenges may impact short-term growth, ZBH remains focused on maintaining and enhancing its margins, positioning itself for long-term success in the evolving healthcare industry.

New CEO

ZBH made a significant announcement regarding its leadership. Ivan Tornos has been appointed as the new CEO, taking over the role previously held by Bryan Hanson. Naturally, transitions in CEO positions tend to create short-term uncertainty among investors, both in terms of the company’s commercial prospects and operational stability. Looking ahead, I do not foresee significant departures from the current strategic direction under Mr. Tornos’ leadership. Mr. Tornos has been serving as ZBH’S Chief Operating Officer since March ’21, and he joined the company in 2018. Given his tenure and involvement in shaping the company’s strategy, I anticipate a relatively smooth transition on the commercial front.

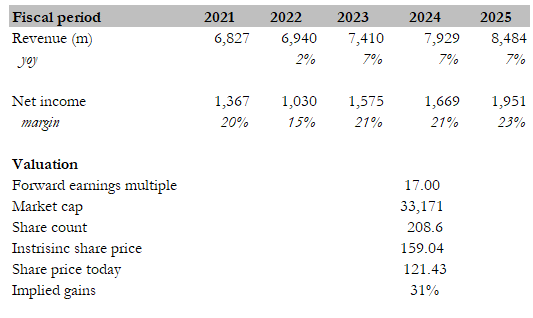

Valuation

I believe the fair value for ZBH based on my model is $140. I have revised my model assumptions to reflect management optimism and expect a similar rate moving forward for the next 2 years. However, I hold the same expectations for net margin. Recall previously I mentioned the debate was whether ZBH can continue trading at 18x forward earnings, and turns out, it got rerated to 15x forward earnings. I believe this de-rating is likely to be the trough as it is now at the low end of its 5 year trading range (between 15x to 19x). As ZBH shows that they can continue growing at high-single-digits, just like its guided FY23 growth, I expect valuation to rerate back to 17x (its 5Y average). If we compare to ZBH peer – Stryker Corp, the reason why ZBH is trading at a discount, I think, is because of the lower growth rate and lower margin today. Hence, if ZBH can grow faster (due to factors stated above) and improve margins, the relative multiple difference should close.

Own calculation

Risk

Potential challenges encompass the possibility of orthopedic market expansion falling short of projections, underwhelming sales performance of recently introduced products like Rosa and Persona IQ, unfavorable orthopedic implant pricing dynamics, the emergence of new tenders in China or other regions, and the potential impact of acquisitions or divestitures on earnings, including the potential hurdles encountered during the integration process.

Conclusion

My positive outlook on ZBH remains steadfast. The company’s strong second-quarter performance, driven by operational efficiency, procedure recovery, and international sales growth, showcases its resilience and strategic prowess. ZBH’s focus on knee and hip product innovation, along with its revised growth guidance, underlines its commitment to sustained progress. The transition to a new CEO, Ivan Tornos, should be relatively smooth given his prior involvement in shaping the company’s strategy. From a valuation perspective, I believe ZBH’s fair value is $140, with the potential for rerating as it demonstrates high-single-digit growth and improved margins.

Read the full article here