Dear readers/followers,

Alexandria Real Estate Equities (NYSE:ARE) is a unique REIT which focuses exclusively on Life Sciences and is one of my higher conviction positions. In fact, my conviction is so high that the stock currently accounts for 5% of my overall portfolio and I expect no less than 50-75% return over the next three years.

Last time I wrote about the stock was in May, after the stock declined sharply following the collapse of Silicon Valley Bank, which has intensified the selloff in commercial real estate (and office especially). The conclusion I came to was that ARE was punished unfairly, because although they’re technically classified as an office REIT, their tenant mix and balance sheet makes largely immune to most threats that offices face today.

In May, I issued a STRONG BUY rating for the stock at $117 per share. Since then the stock has traded sideways as the bulls and bears seem to be battling it out. Today I want to have a closer look at ARE’s Q2 2023 results and address some key bear arguments.

De-bunking the bear arguments

From what I could gather, the bears have the following arguments:

- Tenant’s space utilization is low as confirmed by cell phone data studies

- A large part of tenant’s space is not lab space at all, but traditional office space which can easily be downsized as people work from home

- Other office buildings can easily be converted to facilitate Life Science tenants

If true, all of these could negatively impact ARE’s occupancy in the future.

Let’s address these one by one.

First, the cell phone data which implies that ARE’s space utilization has dropped by 50% since pre-Covid and which has been the key driver behind Jonathan Litt’s short thesis.

ARE has issued a statement explaining that cell phone data mainly appears to be down from 2019 levels, because of stricter privacy policies of both Apple and Google, which have resulted in 70% lower data collection from apps.

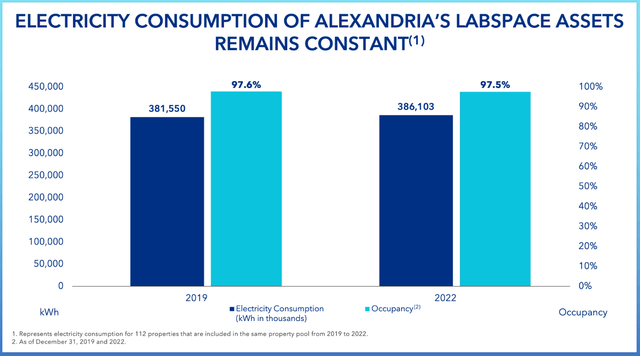

The company has stated that space utilization remains high and presented an alternative measure – electricity consumption, which confirms managements statement as overall consumption increased slightly between 2019 and 2022 (note that the same is not true for traditional office space, which has seen a meaningful decline in consumption).

ARE Presentation

The second bear argument correctly assumes that not all space in ARE’s buildings comprises of labs, but a large part of it is office space with desks, conference rooms etc. Normally, there is a lab where employees conduct tests and experiments and then there is a separate space with desks where they do the rest of their work.

What’s important is the way in which employees interact with the space, because that’s essentially what dictates whether the job can be done remotely or not. My understanding (confirmed by ARE’s statement) is that employees move between the lab and their desk multiple times a day. What logically follows, is that they cannot really do their job remotely.

The final argument of bears is related to conversions. But once again, this fear is way overblown. Conversions may be possible in some rare cases, but for the most part, they are ineffective and very costly, because of three primary reasons.

Nr. 1 – Location: Life Sciences thrive in clusters, usually near “idea generators” such as universities or other research institutions, as tenants need to source ideas and employees somewhere. Unless an existing office building is located in or near an existing cluster, it’s highly unlikely that it will be able to attract high quality Life Science tenants.

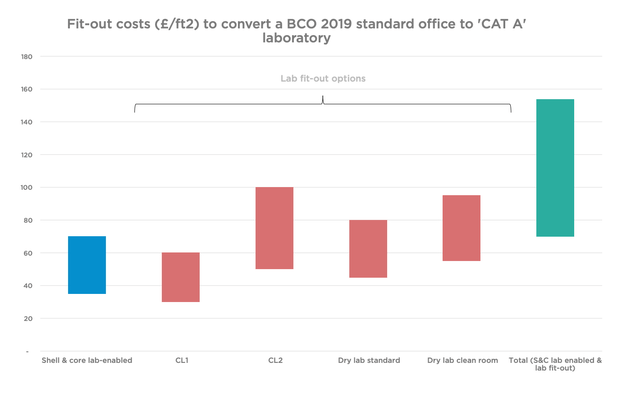

Nr. 2 – Fit-out cost. The conversion is always costly. According to a study from Rider Levett Bucknall a conversion from a standard office to a lab will cost the developer $90-190/sft in fit-out costs alone. And that’s on top of structural changes described below.

Rider Levett Bucknall

Nr. 3 – Specific requirements. This is another big hurdle as Life Science buildings actually differ a lot from traditional offices. There are different requirements and these are very costly to fulfill. To name a few, a conversion will likely need:

- reinforced floors due to heavy lab equipment

- different floor plates

- larger loading docks because more material gets brought in and out

- space for hazardous waste

- vibration resiliency (typically requiring building structure two to three times stiffer than a normal office)

- zoning laws and other regulations due to storage of chemicals and hazardous materials

As you can see, I think the bear thesis falls apart on many fronts, but the strongest bull argument in my opinion is continued strong leasing at unprecedented leasing spreads, which clearly shows that tenants use and value their space and have to intention of downsizing.

Strong recent results

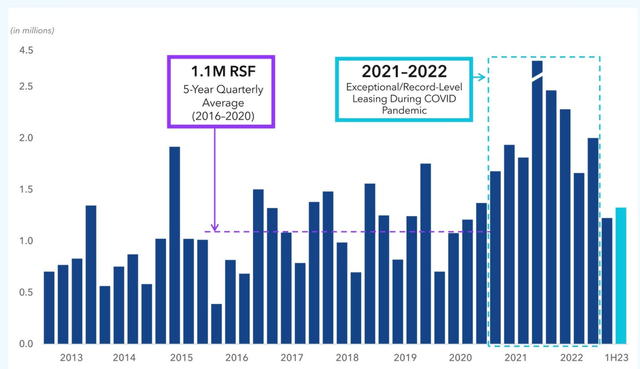

Over the first half of the year, the REIT has leased almost 2.5 million sft of space, which is slightly ahead of their long-term quarterly average of 1.1 million sft (excluding record level leasing during the pandemic).

ARE Presentation

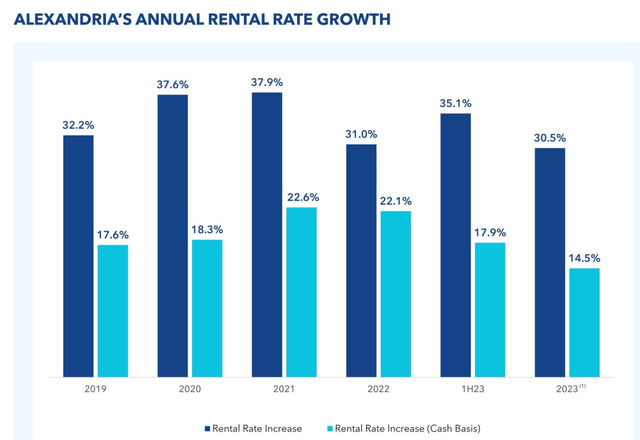

What’s even more reassuring is that the REIT continually achieves very high spreads on new leases, which confirms that tenants value the space, but also means that there is a lot of growth potential build-in, which will be gradually released as leases expire.

Over the past two quarters, the spread stood at 30.5% and almost 15% on a cash basis, which is amongst the highest of any REIT (if not the highest).

ARE Presentation

Going forward, Alexandria’s FFO is poised to grow by high single-digits, as a result of:

- Stable occupancy and high build-in 3% rent escalators

- Low rents on current leases that will gradually get increased by double-digits as they expire

- Sizeable pipeline of 6.7 Million sft of space expected to begin operation within 3 years, which will add an additional $610 Million in NOI. And notably, the pipeline is already 73% pre-leased.

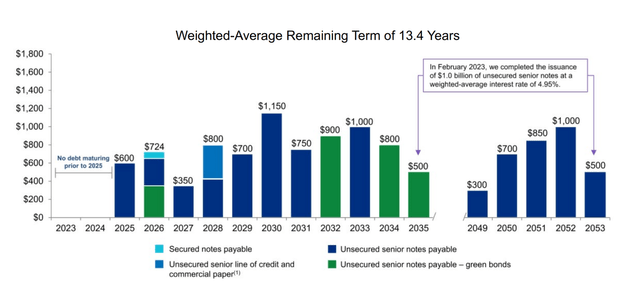

In the meantime, the company maintains one of the best balance sheets of all REITs with a BBB+ rating, no maturities until April 2025 and a very long weighted average debt term of 13.4 years.

ARE Presentation

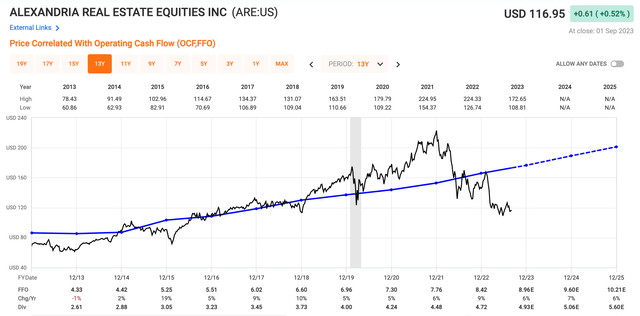

Despite very good operation performance, the stock’s valuation remains low at 13x FFO with a 4.2% dividend yield. Following Q2 earnings, I see no reason to move my $195 per share price target outlined in my last article. I reiterate my STRONG BUY rating here at $117 per share.

FAST Graphs

My expectation for ARE for the next three years is as follows:

- dividend yield of 4.2% likely to grow by 5%+

- FFO growth of 6-8% per year

- annual upside from multiple expansion to 19x FFO of 13%

- Total expected annual return of 20-25%.

Of course, the stock will not re-rate to a higher multiple overnight. Major catalysts will be needed for that. But as I’ve highlighted in my recent article called My Bullish Thesis And Catalysts That Could Take Us To New ATHs, these catalysts could play out relatively soon.

Read the full article here