With Enphase (NASDAQ:ENPH) down nearly -40% from my initial write-up in March, I wanted to take a closer look at the name. I originally like the company’s growth prospects and transformation into an integrated home energy firm, but thought that its valuation was too pricey, and as such placed a “Hold” rating on the stock. However, much has changed since my initial take.

Company Profile

As a refresher, ENPH’s primary business is supplying microinverters to the solar industry. While there are different types of invertors for solar panel systems, ENPH products convert DC to AC power at each individual panel, which is advantageous for monitoring and power regulation at the panel level. This is particularly useful for homes and buildings that get shade from trees or other structures. It’s also generally easier to expand a system with microinverters. However, they can be more expensive than other options such as string inverters.

In addition to providing microinverters, ENPH is also starting to become a fully integrated home energy firm that also offers AC batteries, communications gateways, and cloud management systems. Battery solutions are about 3x the cost of microinverters.

Company Presentation

High Loan Rates, NEM3, Channel Inventory and Weak Q3 Guidance

When I initially looked at ENPH, I noted that the company was very dependent of the California market, and that at the time a proposed change to Net Energy Metering policies could impact solar systems sales. The new tariff, called NEM 3.0, went into effect in mid-April and significantly cut average surplus energy payments. However, it was supposed to encourage homeowners in the state to add battery storage systems instead of returning excess power back to the grid.

While ENPH has had issues, it does not appear to be from NEM 3.0, as California has outperformed for the company and it said I saw solid early indications from the change.

Discussing battery uptake and NEM 3.0 on its Q2 earnings call, CEO Badrinarayanan Kothandaraman said:

“As we introduced our third generation IQ Battery 5P to the U.S. market in Q2, we reduced pricing for our second-generation battery. We also expanded the warranty for both batteries to 15 years. We see the new price points and warranty for both batteries, as well as strong early customer adoption of the new battery driving increased sell-in and sell-through during Q3. We believe there will be a bigger inflection for Q4 and beyond as California battery attach rates increase with NEM 3.0. … I’d like to speak a little bit about NEM 3.0. Early anecdotes on NEM 3.0 activity from our installers are encouraging. Since the crossover date in April, we have seen an increasing rate of NEM 3.0 California proposal activity with healthy storage attach rates. We offer a comprehensive NEM 3.0 solution, which includes a smart battery, power control system to avoid main panel upgrades and energy management system that maximizes ROI for homeowners. The smart battery can do both backup as well as utility rate arbitrage. Grid-tied batteries require less labor and fewer balance of system components, making them significantly easier and faster to install. Our Solargraf design and proposal tool can model the complex interactions between solar, batteries, consumption and tariffs and provide a simple proposal. Our financial analysis show that for a cash system, homeowners can expect a bill offset between 70% and 90% and payback between 5 and 7 years. We think installers can effectively sell these economics to consumers.”

For California, the company said it saw microinverter sell-through rates that were 34% higher year over year and 20% more than Q1. It credits its backlog of NEM 2.0 installations, which it indicated would last through the summer before NEM 3.0 installations would take over.

However, other states were not performing as well, hurt by higher interest rates on solar loans and lower utility rates. That combination makes it less attractive to install solar for homeowners. Overall, non-California sell-through fell -11% year over year and -6% sequentially. Texas, Florida, and Arizona were particularly difficult markets. The company said its market share was stable.

In Europe, the company saw its revenue triple year over year and rise 25% quarter over quarter with sell-though up 13% sequentially. The company said it is gaining traction in Germany, and that Q3 trends in Europe are robust.

However, with the bulk of its revenue coming from the U.S., ENPH issued some pretty dismal Q3 guidance compared to expectations. The company forecast Q3 revenue of between $550-600 million, which was a far cry from the $749 million in revenue that analysts were expecting at the time.

Similar to SolarEdge (SEDG), ENPH was also dealing with too much inventory in the channel. For ENPH, this is mostly in the U.S. but it is also somewhat high in Europe, as well. The company said it was aggressively reducing inventory in the channel, but also that it was not planning to reduce costs of microinverters.

Valuation

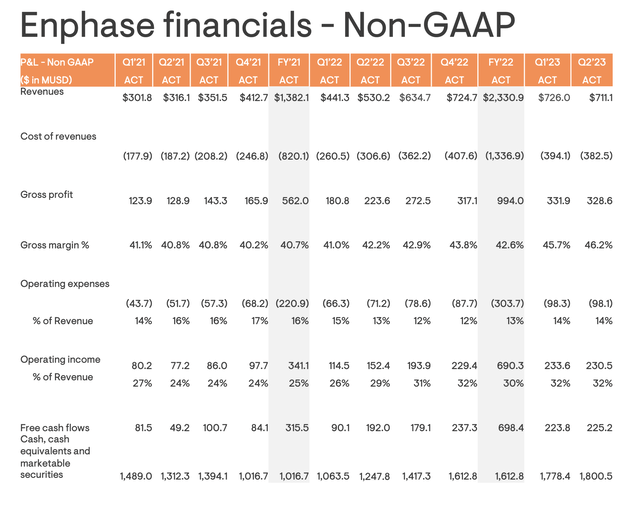

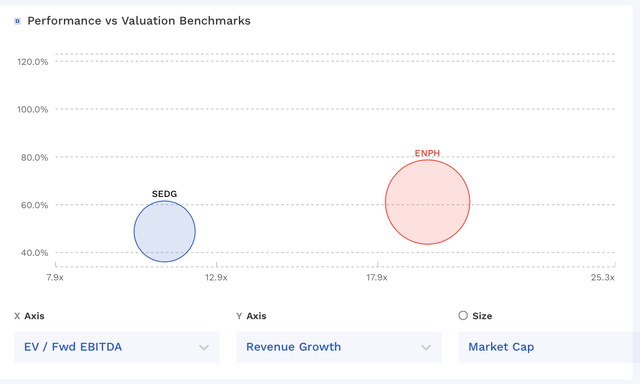

ENPH currently trades at nearly 19.5x 2023 EBITDA estimates of $872.5 million. Based on the 2024 consensus projecting EBITDA of $1.11 billion, its trades at a 15.3x multiple.

On a PE basis, the stock trades at a 38x forward PE ratio. The current consensus is that the company will generate EPS of $5.04 in 2023. For 2024, it is projected to produce EPS of $6.63, which would be good for a PE of 28x based on 2024 estimates.

The company is projected to grow its revenue by 14% in 2023, compared to 69% growth in 2022. For 2024, sales growth is forecast to be 21.5%.

While ENPH’s valuation isn’t all that aggressive for a growth company, it isn’t in the bargain bin and the company now has to prove that it is still a growth company and that its lowered numbers don’t continue to head lower. It also continues to trade at a significant premium to rival SEDG, which recently ran into its own issues.

ENPH Valuation Vs SEDG (FinBox)

Conclusion

While ENPH continues to have interesting long-term growth prospects, inventory channel issues tend to linger for a while and be a drag on results. The company said it is aggressively looking to reduce channel inventory, but not lower prices, which seems a bit at odds with itself. We’ll have to see how this plays out, as its gross margin guidance (42-45% adjusted gross margins) could prove to be a bit aggressive, as that’s showing only minimal deterioration from Q1’s 46.2%.

At the same time, how NEM 3.0 impacts solar sales in California is still a bit of an unknown. While early anecdotal evidence is solid, adding solar with battery isn’t cheap. Meanwhile, interest and loan rates have only continued to rise, so there has been no relief there. Europe is an opportunity, but even that market has shown signs of overall slowing.

Overall, I’m currently neutral on ENPH given its valuation and inventory issues and would like to see how well the company does fixing its inventory issues before getting more interested.

Read the full article here