Wallenius Wilhelmsen (OTCPK:WAWIF)(OTCPK:WILWY) is a RoRo shipping company primarily that has been benefiting from the return to normal in car exports and trade in vehicles that was depressed during COVID-19. There are more tailwinds, namely the fact that Chinese exports were decimated by COVID-zero policies last year. China is an issue in terms of global demand, but not in global supply, and the trade volumes are what matters. Also, with the data on car volumes, we can say with some confidence that there is a margin of safety that should keep car demand pretty flat even if there are some larger credit and demand hits in the economy.

Q2 Data

Let’s start with high level data.

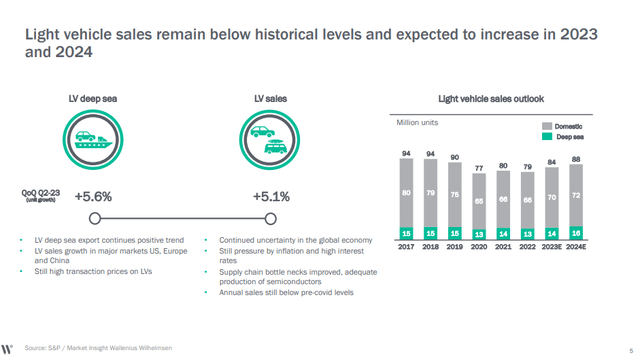

Light Vehicle Volumes (Q2 2023 Pres)

Light vehicle sales are pretty low, around 11% below pre-COVID levels, giving us a pretty good indication of what is happening in terms of excess demand since pre-COVID. 11% is a large margin of safety to assure pretty constant trade volumes even if the automotive markets are hit by a credit crunch and falling demand at some point in the next 12 months.

While volumes are important, there are other factors at play as far as RoRo economics go. Light vehicle sales growth means that the ships are more heavily laden, so there is growth in terms of charter revenue, but the revenue per storage unit is less now due to the generally weaker demand for goods and more availability of shipping.

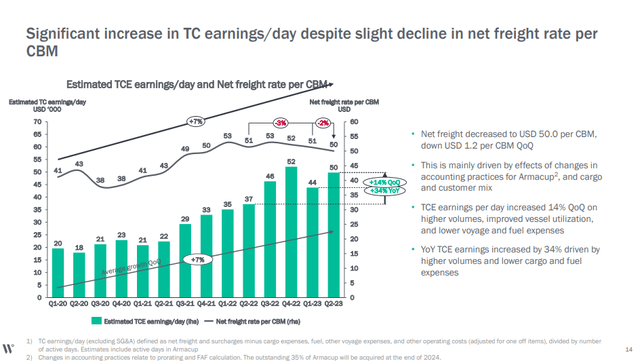

Dailies (Q2 2023 Pres)

There is some sequential pressure on daily earnings compared to Q4 2022, showing that there is cooling going on in RoRo shipping demand, but the YoY figures look good. Ultimately, the sharp uptrend in exports from Asia, and shift in demand to more distant manufacturers in Japan, Korea and elsewhere where currencies have depreciated more, is a general positive force in terms of keeping up charter rates and volumes – volumes of both cars and heavy machinery since both get transported by RoRo. In particular, on the volume side, the end of COVID-zero in China is important, since a lot of automotive parts were creating bottlenecks there when shutdowns were happening in 2022.

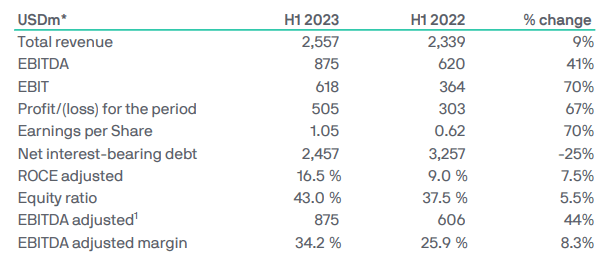

Shipping services is almost 90% of the EBITDA, and ultimately the commodity deflation easing fuel costs, and the general scope to control costs while revenues rise and charters become more valuable, has allowed for RoRo EBITDA growth.

IS (Q2 2023 Pres)

Bottom Line

The release of capacity from COVID-zero comes at a good time in terms of the development of BEV, where BEV exports from China are rising and filling up RoRo vehicles. Longer routes, namely from places like Japan to the US and Europe, make RoRo ships less available as they’re occupied for longer, meaning higher charter rates. This is being driven by Far East Asian depreciation, which is going to be an enduring phenomenon. In terms of volumes, while promotional activity on the buyside in the case of demand contraction will leak into lower prices in charters for Wilhelmsen, the volumes themselves should remain rather flattish thanks to the margin of safety in the car sales volumes being substantially below pre-COVID levels still and the presence of pent-up demand as a potential way to get through a recession relatively unscathed despite being a consumer durable.

This is a strange economic cycle. RoRo, and a lot of business related to cars in general, will be safer than it usually is in a downcycle despite pressure from the credit side. The PE multiple is around 4x for this stock. That’s very low. About 7% of EBITDA is being bolstered by logistics activity around the Ukraine war, being paid for by NATO activity. While the earnings direction is going to be more ambiguous for these cyclical although high quality businesses, the 4x PE is definitely compelling enough value to consider the stock. Although we still place higher value on predictability and recession resistance, especially because you can find it for almost as cheap if you know where to look.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here