Realty Income (NYSE:O) has underperformed the broader market by a wide margin over the last several years. O is widely regarded as one of the highest quality names in the net lease REIT sector, but its higher quality has not allowed it to escape the same headwinds posed by higher interest rates. While its cost of capital has been steadily climbing, its acquisition cap rates have not yet fully caught up. The company recently made a large investment into the Las Vegas Bellagio casino property, which appears to have been welcomely received by many investors. I explain why the derived yield from that investment is actually disappointing and not really higher than its typical investments. After seeing this company engage in several expensive acquisition deals for what appears to be the sake of increasing acquisition volumes, I can no longer justify owning the stock, especially given that there are many competitive “yieldy” alternatives available. I am downgrading my rating from buy to hold.

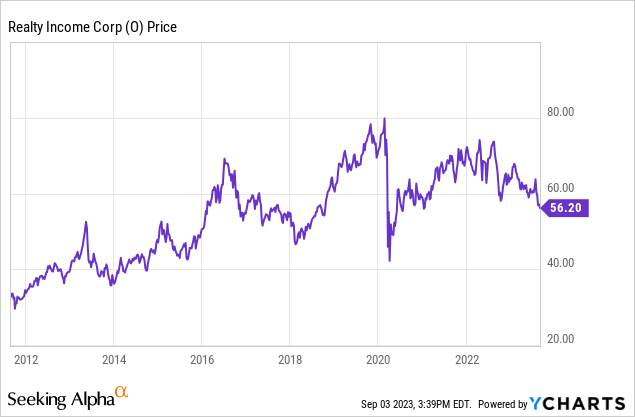

O Stock Price

Like many REITs, O has gone nowhere over the past decade.

I last covered O in April where I rated the stock a buy in spite of calling it “fully valued” amidst the higher interest rate environment. I have been on high alert on O for quite some time now, noting in February that management seems to be “chasing yield.” In hindsight, I should have just moved to the sidelines at the first sign of potential red flags, though I must still exercise discipline and rectify that mistake now, as my concerns about yield chasing appear to be getting worse.

O Stock Key Metrics

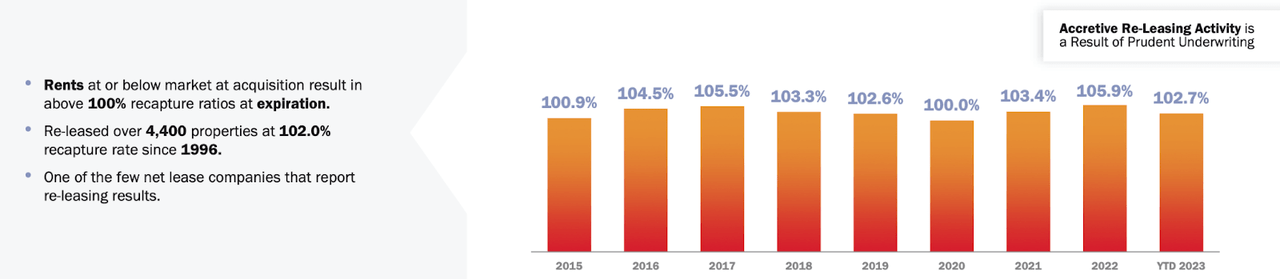

The primary investment thesis to own O over any of its more attractively valued peers is that its portfolio is deemed to be of higher quality. That distinction is discernible by three factors. First, O’s acquisition cap rates tend to be lower than peers, second, it has derived unusually high rent recapture ratios at lease expiration.

2023 Q2 Supplemental

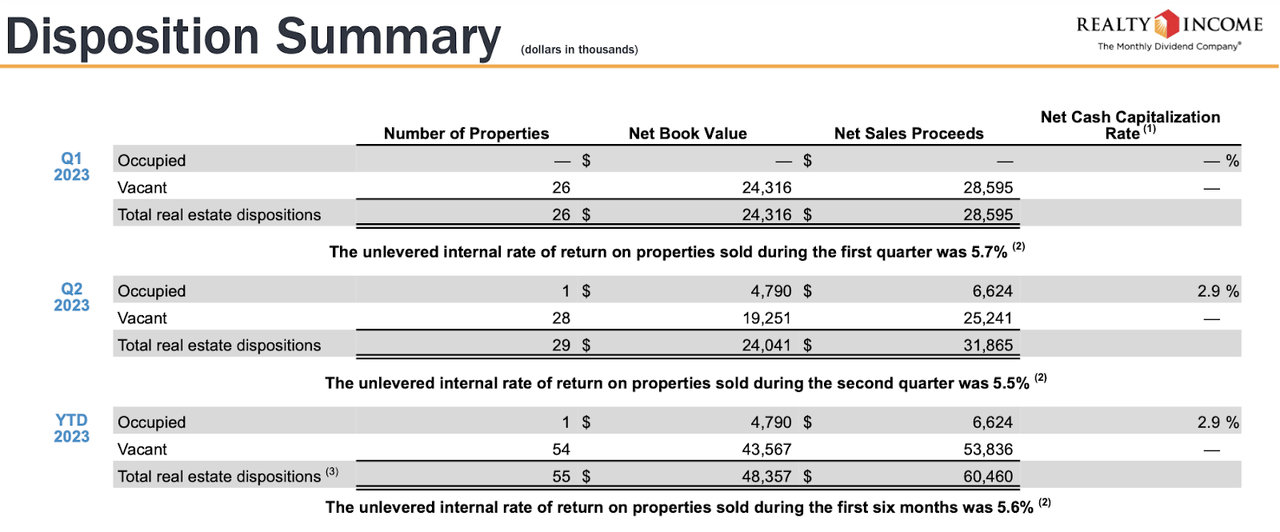

Finally, O has seen a very low amount of disposition activity relative to investment activity, indicating a lesser need for capital recycling.

2023 Q2 Supplemental

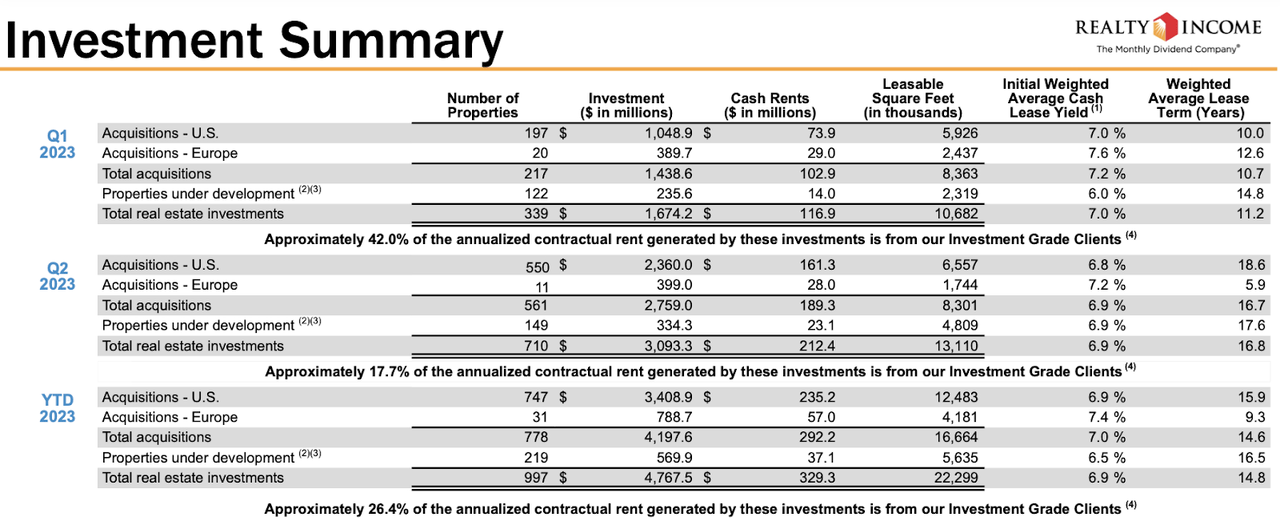

While O has more or less proven that it has a higher quality portfolio, the financial reality is that higher quality does not necessarily mean more profitable operations. If anything, it may mean the opposite due to the lower acquisition cap rates and smaller annual lease escalators. O still has seen its acquisition cap rates rise steadily from around 6.0% last year to around 6.9% as of late.

2023 Q2 Supplemental

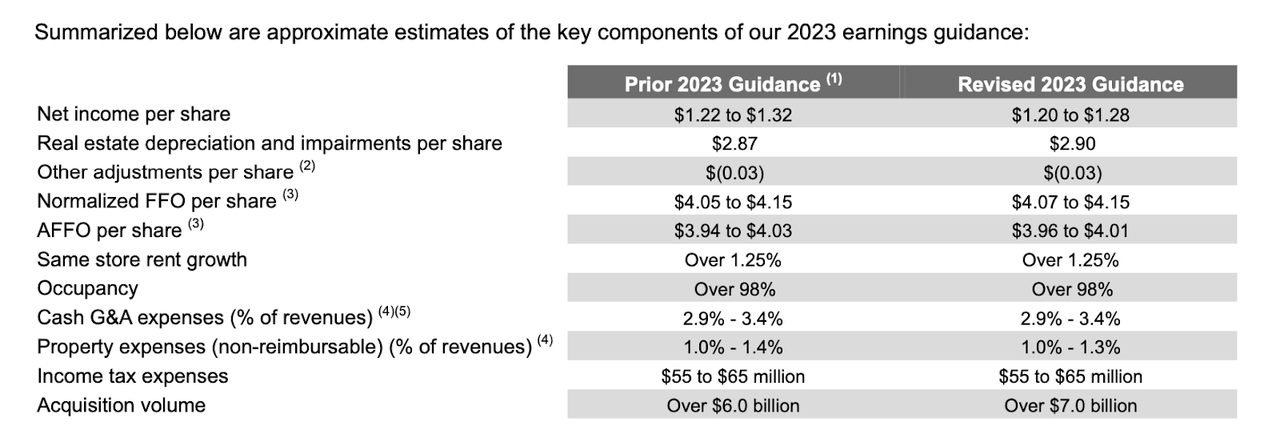

That cap rate expansion has not jump started growth – adjusted funds from operations per share grew by only 3% to $1.00 per share. One reason for the disappointing growth is the headwinds posed by higher interest rates.

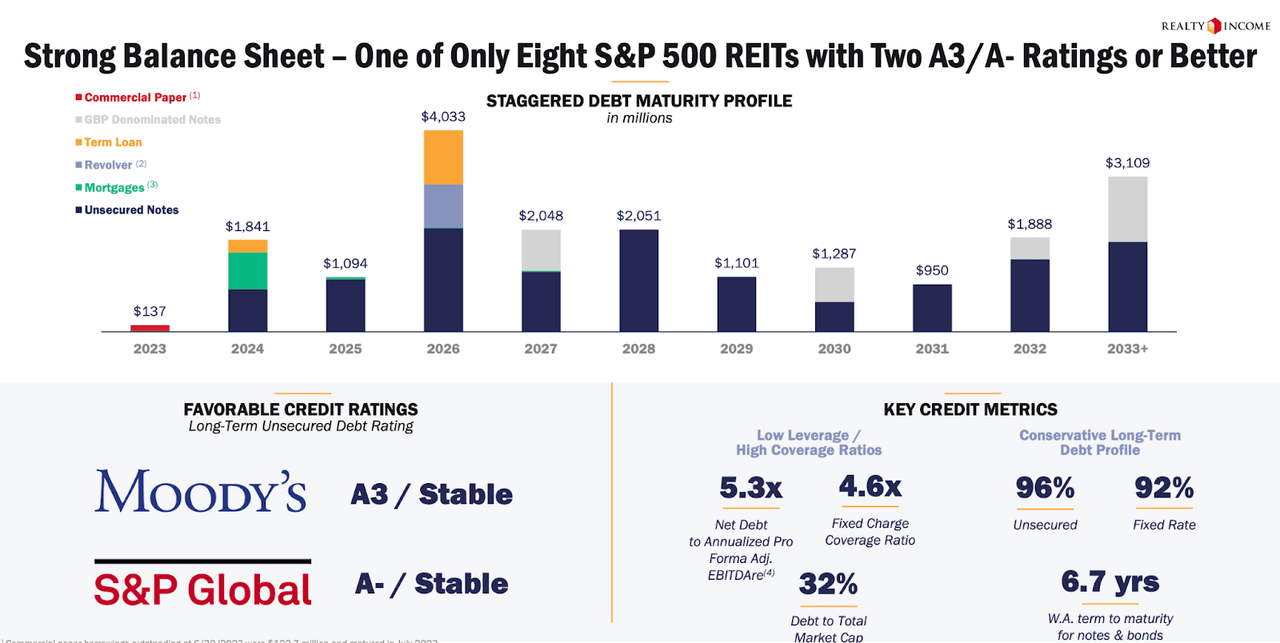

2023 Q2 Presentation

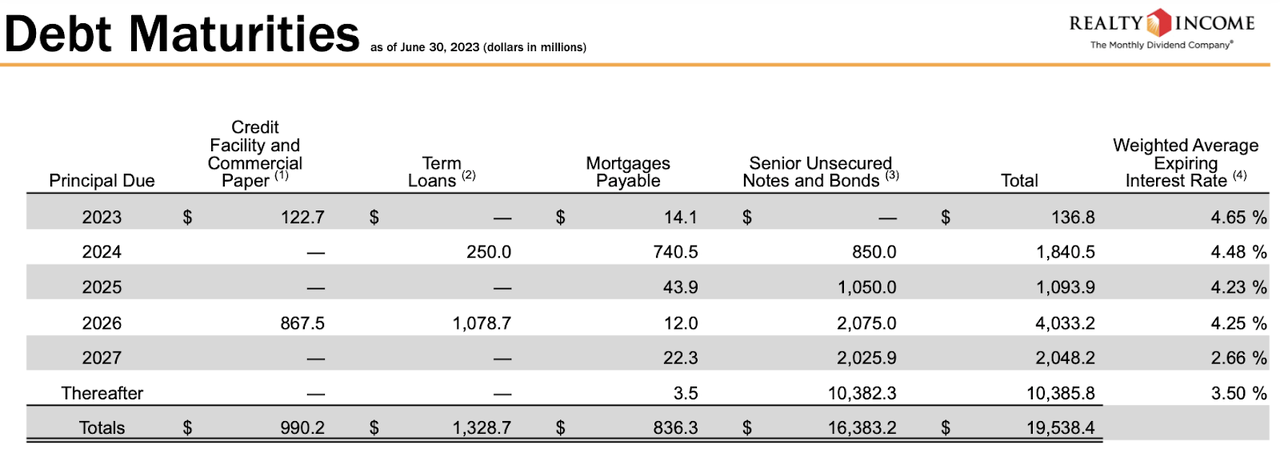

While most of its debt is fixed rate, O does have 8% exposure to floating rate debt. But the more pressing issue is that O has a substantial amount of debt maturing in the near term that will likely need to be refinanced at a higher rate. I expect refinancing maturing debt to be a significant headwind to growth for almost every REIT in the sector, including O with best in class leverage metrics.

2023 Q2 Supplemental

To give an idea of how impactful that headwind can be, a 100 bps increase on $1.8 billion in debt would negatively impact the bottom-line by 0.6%. O continues to guide for around $4 in AFFO per share, implying just 2% YOY growth for the full year.

2023 Q2 Supplemental

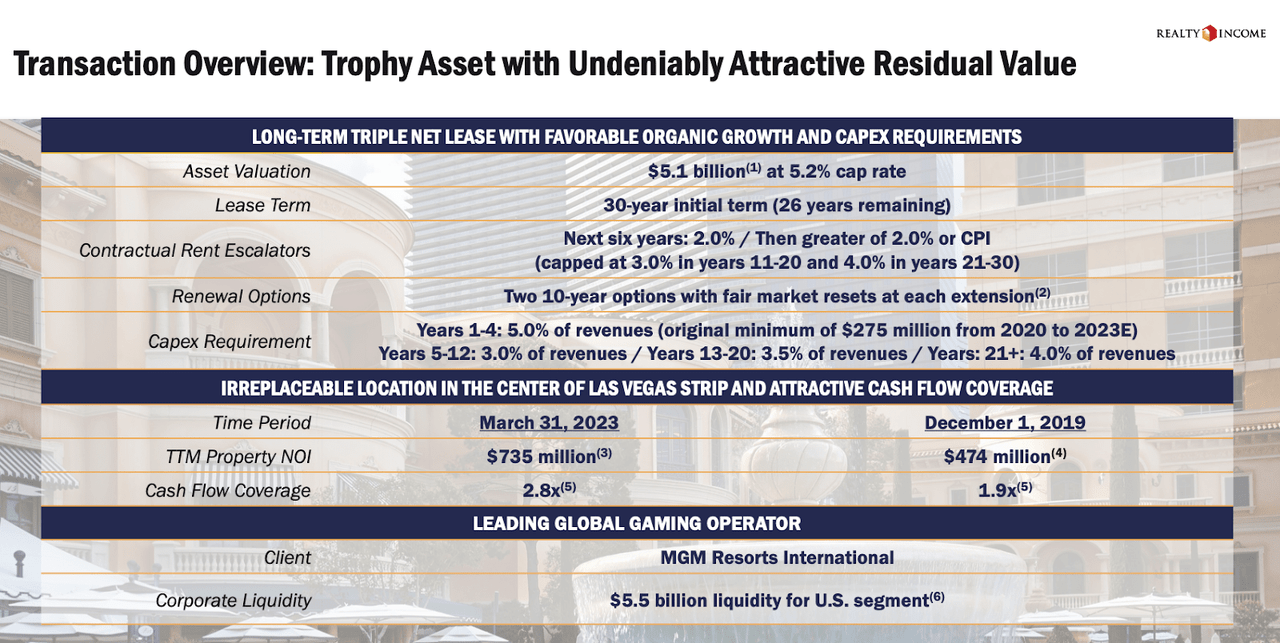

I had previously stood by O in spite of these interest rate headwinds due to it being the highest quality operator and thus offering a higher likelihood of a re-rating upwards. I no longer believe that is the case, as I am growing concerned that management is now employing a “growth at any cost” strategy. O recently announced that it was acquiring a stake in the Las Vegas Bellagio property. It would be a $950 million investment, split between a 7% yielding common equity investment and 8.1% yielding preferred equity investment, making for an average 7.7% yield. I have seen some analysis suggest that this deal is a positive given that the 7.7% yield is higher than their typical acquisition cap rate.

Bellagio Presentation

That is a woefully inaccurate take, however. It bears noting that Blackstone Real Estate Income Trust initially acquired the Bellagio property for $4.25 billion in 2019. This acquisition with O occurred at a $5.1 billion valuation based on a 5.2% cap rate.

Bellagio Presentation

Let me explain the math behind that 7% “common equity” yield. The 5.2% cap rate implies $265.2 million in annual rent income. There is $3 billion of 3.67% yielding debt maturing in 6.2 years. After subtracting $110.1 million of debt interest cost, as well as $52.56 million of preferred dividends, there remains $102.45 million in cash flow available for the common equity. O’s common equity investment implies a $1.37 billion valuation – leading to a 7.5% yield. The difference between our calculated 7.5% yield and the 7% reported yield may be some other operating expenses not disclosed.

This 7% yield on the common equity investment is very different than the 6.9% acquisition cap rate disclosed in the latest quarter and should not be compared directly. When O acquires its typical property at a 6.9% cap rate, its own equity yield ends up being higher than that due to much of it being refinanced in debt. With O stock trading at 7.3% FFO yield, ideally their equity yield on new acquisitions surpasses that.

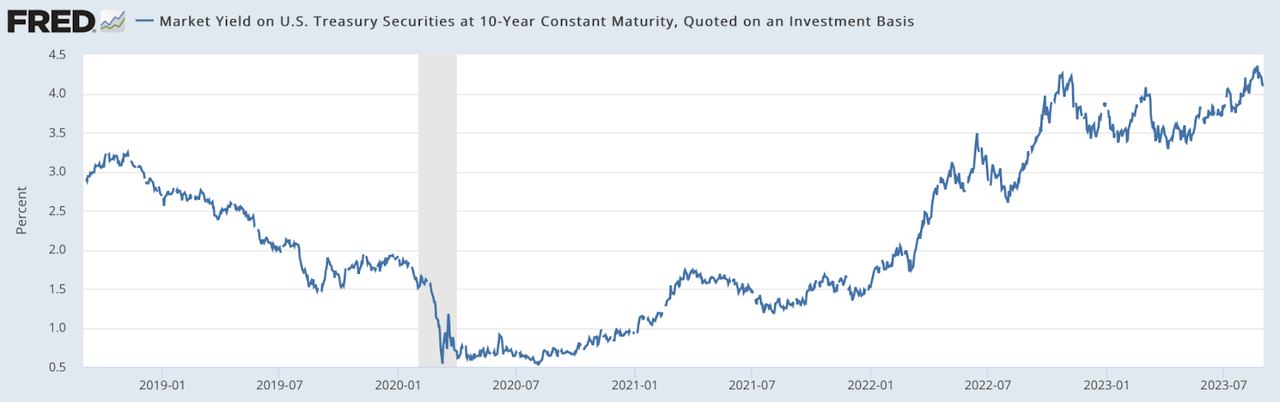

Investors should instead be focusing on the 5.2% implied cap rate for the property (and comparing that to the 6.9% average cap rate of the latest quarter, and the even higher cap rates at peers). Here’s why – consider that the $3 billion in debt must eventually be refinanced. The 10-year US Treasury yield has expanded around 200 bps since it was initially issued.

St. Louis FRED

That would imply that the debt would need to be refinanced at a 5.7% yield or higher. Even assuming just a 5% yield the yield on the common equity investment would drop to 4.6%. The preferred equity investment may also see some pressure as well – because it comes after the debt, its yield is reduced at any refinanced yield over 7.09%.

Readers may counter that my observations are all based on assumptions regarding the refinanced interest rate. I’d counter that this is not the right question to ask. Instead, investors should be asking: why is O acquiring this property at a nosebleed 5.2% cap rate in the current higher interest rate environment? I do not share the opinion that the Bellagio is of such high quality that it should trade at such a low cap rate and more importantly, even if it is, that does not mean that O should be acquiring into it. Investors may already question why O’s acquisition cap rates have been and continue to be lower than peers on average – but this 5.2% implied cap rate is even more extreme. Do the 2% annual lease escalators make up for the lower cap rate? I wouldn’t say so, as it takes 30 years before this 5.2% cap rate catches up to a 6.9% cap rate with a 1% annual lease escalator. Investors should be concerned that O is growing for the sake of growth, with acquisitions that may even prove dilutive if interest rates keep rising.

Is O Stock A Buy, Sell, or Hold?

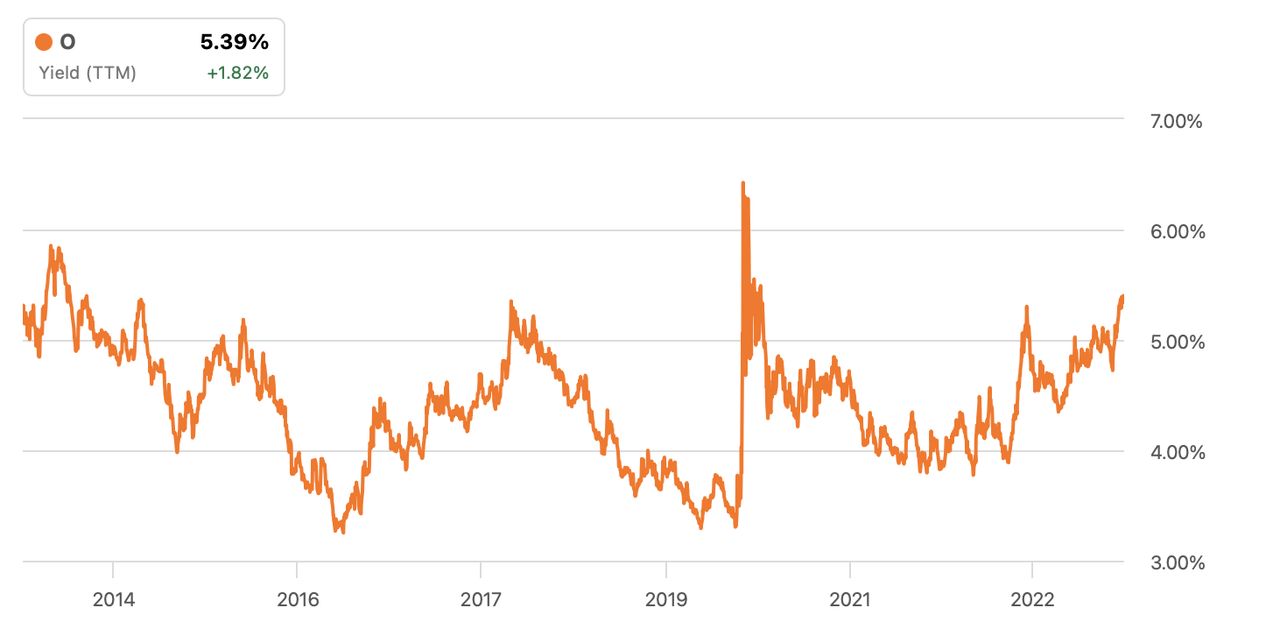

Investors may still be attracted to O due to the fact that its dividend yield is at the highest in a decade (excluding the pandemic crash).

Seeking Alpha

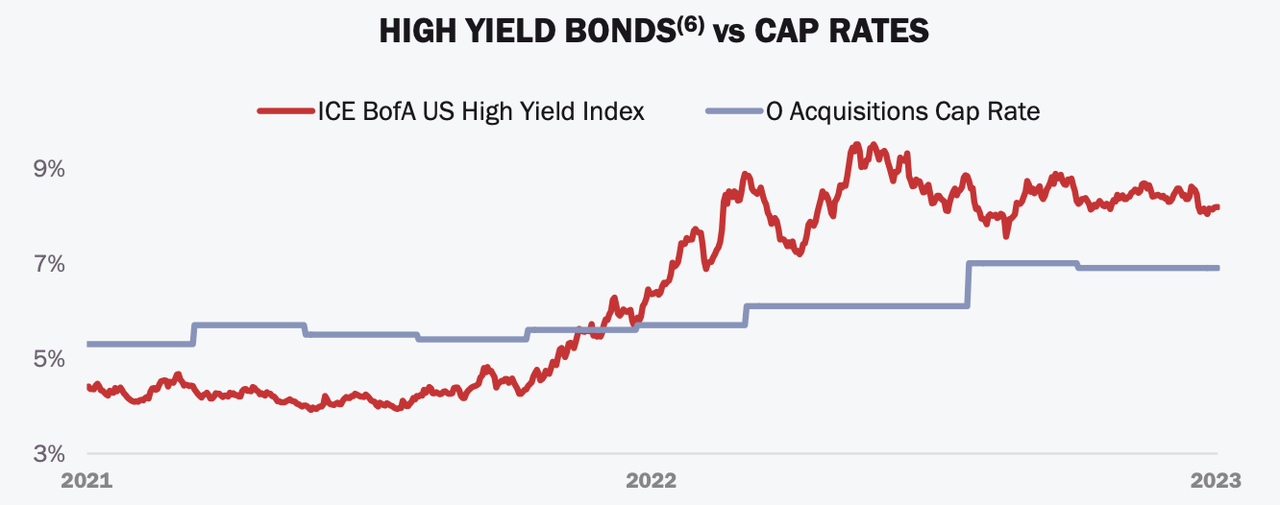

But it is important to note that this is a different environment. With interest rates so high, forward growth rates may be pressured due to the company needing to refinance its maturing debt at higher rates. Moreover, acquisition cap rates have not experienced a similar bump as typical high yield bonds.

2023 Q2 Presentation

That latter point may be underappreciated – it appears that, perhaps, due to elevated competition in the net lease space, acquisition cap rates aren’t adjusting upwards. That means that O may not be able to offset rising cost of capital with an equal gain in acquisition cap rates. I had previously stood by O due to the stock offering attractive rewards in the event of falling interest rates, but after this latest Bellagio investment, I am now of the view that management may end up destroying shareholder value over the long term. O’s larger size makes it harder to sustain growth comparable to peers, as it needs to underwrite greater acquisition volume to move the needle. But that is clearly leading management to pursue acquisitions with far lower cap rates than peers, and the problem of growth only becomes worse and worse the larger the company gets.

What kind of forward returns can shareholders expect? The 7.3% FFO yield and 1% annual lease escalators imply around 8.3% forward returns (that would be inclusive of all growth), but actual returns may be lower than that if management continues acquiring properties at nosebleed cap rates. That return potential does not appear attractive given that growth may be further held back by higher interest rates on refinancing debt. I see a lower likelihood of a re-rating higher due to management’s increasingly aggressive capital allocation strategy. I am downgrading the stock from buy to hold, and have no position.

Read the full article here