Introduction

I’m not the biggest fan of growth stocks. The stakes are usually very high, and potential profits depend on the direction of interest rates and inflation expectations. After all, the lower future inflation is expected to be, the more attractive it becomes to discount future cash flows.

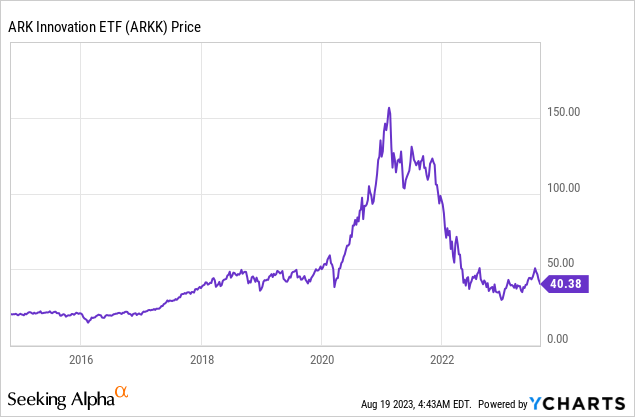

Using Cathy Woods’ ARK Innovation ETF (ARKK) as a benchmark, we see a massive surge in 2020 and 2021 caused by (global) zero interest rate policies, very low inflation, and QE to further support liquidity.

In the second half of 2021, inflation started to accelerate, causing a shift in interest rate expectations. It became more attractive to invest in companies with higher profits (value stocks), which triggered a massive rotation.

This year, ARKK is up 30%, thanks to slowing inflation and expectations that the Fed might be close to its terminal rate.

However, it goes to show how fragile pure-play growth stocks are, which is why I usually go for a mix of growth and value. Or, as some call it: growth at a reasonable price.

Intuitive Surgical (NASDAQ:ISRG) is one of these stocks. The company is one of the fastest-growing companies on my list. In early July, I initiated coverage of this company due to my increasing focus on the healthcare sector.

Since then, we’ve seen an interesting development.

- The company has beaten earnings estimates, hiked its guidance, and shown terrific developments in the application of its surgery robots and related services.

- Wall Street has hiked its price forecasts.

- ISRG’s stock price is down 18% over the past four weeks.

This stock price decline is interesting, as it gives ISRG a more attractive valuation and because it seems that because of the success of weight loss pills, the market is expecting companies that (indirectly) benefit from the side effects of obesity to lose long-term growth opportunities.

Wall Street Journal

In this article, we’ll focus on the new risk/reward for ISRG and what to make of what I believe is one of the best growth stocks on the market – with a reasonable valuation.

So, let’s get to it!

The Risk Of Weight Loss Drugs

ISRG is one of the most fascinating companies in healthcare, as it has perfected the art of efficiency in surgeries. In this case, the company is riding two massive tailwinds:

- It is at the core of healthcare innovation.

- It improves efficiencies, which reduces long-term costs for healthcare providers. Especially in light of the increasing labor shortages and rising costs, this is key.

Intuitive Surgical

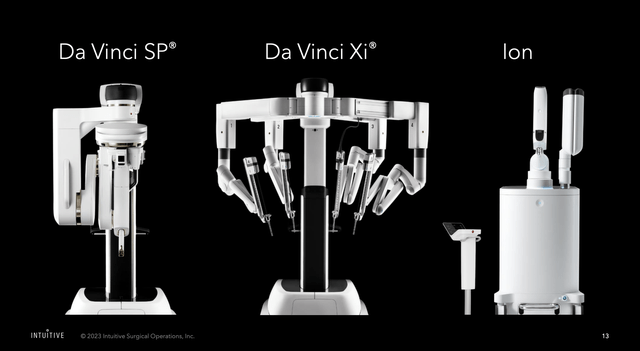

The company produces and sells three key robotic systems, Da Vinci SP, Da Vinci Xi, and Ion, which have an installed base of more than 8,000 units in the United States and abroad.

Intuitive Surgical

According to the company (emphasis added):

The da Vinci surgical systems are designed to enable surgeons to perform a wide range of surgical procedures within our targeted general surgery, urologic, gynecologic, cardiothoracic, and head and neck specialties. To date, surgeons have used the da Vinci Surgical System to perform dozens of different types of surgical procedures. Da Vinci systems offer surgeons three-dimensional, high definition (“3DHD”) vision, a magnified view, and robotic and computer assistance. They use specialized instrumentation, including a miniaturized surgical camera (endoscope) and wristed instruments (e.g., scissors, scalpels, and forceps) that are designed to help with precise dissection and reconstruction deep inside the body.

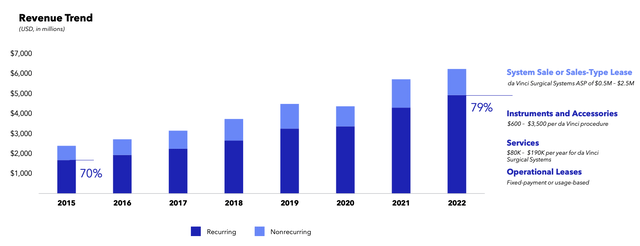

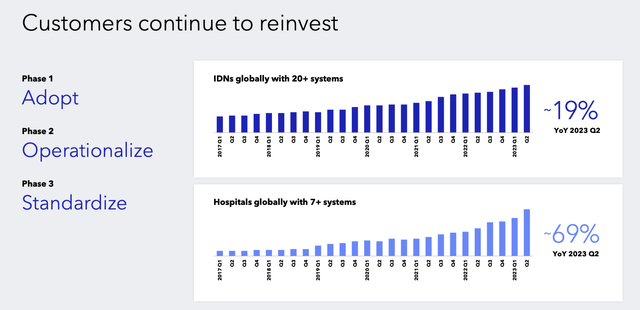

It also needs to be said that an increasing share of its revenue is now recurring, which is a sign that the company makes money for many years after it has installed a new system. It’s also an attribute of a wealth compounder.

Intuitive Surgical

In other words, as long as ISRG is the leader in its field, it benefits from secular growth like a rising global population, increasing healthcare needs, and (this is even more important, the huge need for more efficiency in healthcare.

Having said that, obesity is one of the biggest drivers of healthcare demand.

I think we all know that obesity has become a pandemic in the West, leading to a wide range of health issues (according to the CDC):

- High blood pressure (hypertension)

- High LDL cholesterol, low HDL cholesterol, or high levels of triglycerides (dyslipidemia)

- Type 2 diabetes

- Coronary heart disease

- Stroke

- Others

As one can imagine, the expectation that a wonder pill can cure obesity is damaging the stock prices of a lot of companies.

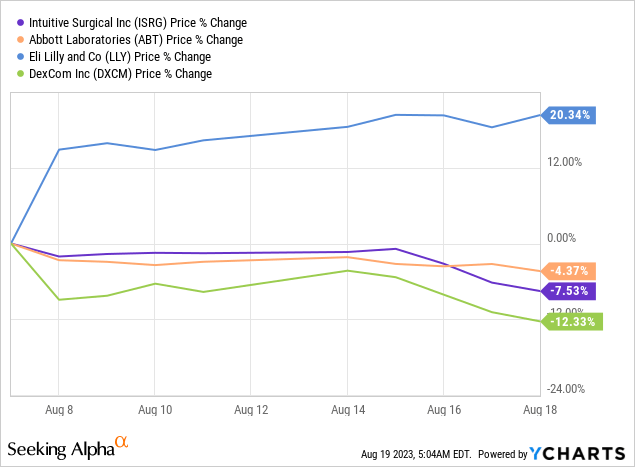

Since August 7, ISRG shares have lost 8%. Ely Lilly (LLY), one of the companies behind the pill, is up 20%. Other companies related to heart diseases and diabetes are also down.

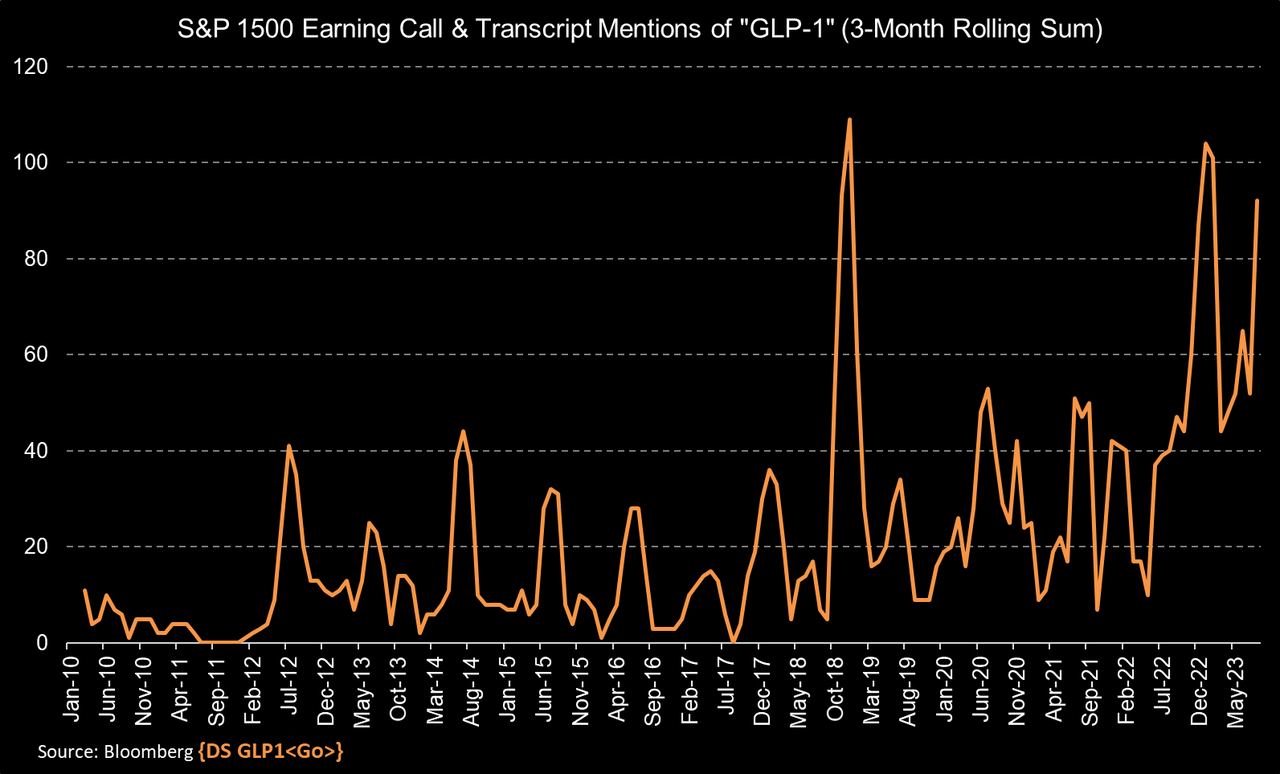

On a side note, earnings calls are increasingly mentioning GLP-1 (the name of these drugs):

Bloomberg

However, as much as I would like for a pill to be effective (I’m not rooting against the health of people to make a buck on healthcare stocks), the evidence isn’t there yet.

For example, these drugs are expensive, and health providers are cutting access.

On top of the high costs, it is not yet clear what the side effects are and what happens the moment people stop taking these drugs. After all, I think the goal should be to solve obesity without getting people hooked on pills for the rest of their lives.

Dr. Susan Yanovski, a co-director of the office of obesity research at the National Institute of Diabetes and Digestive and Kidney Diseases, warned that patients would have to be monitored for rare but serious side effects, especially as scientists still don’t know why the drugs work. – NY Times

While the uncertainty surrounding these pills is obviously putting some pressure on ISRG and its peers, the company is not very impressed by these drugs. Also, it’s too early to make the case that these pills can have a major influence.

This is what the company said during its 2Q23 earnings call:

Some customers have indicated that they are seeing increased patient interest in weight loss drugs. It is too early to conclude if the slowing growth is a temporary pause as patients evaluate these new drug therapies or if it is a trend that continues. We believe that during the quarter, da Vinci continued to gain market share in the bariatric surgical market.

In other words, despite the threat of competition, da Vinci gained market share in weight-focused surgeries.

Furthermore:

What we saw in Q2 was that growth rate slowed. We have some input from customers that the level of patient interest is such that patients are now considering drugs versus surgery. It’s unclear yet based on that set of inputs from customers, the duration of that evaluation by parents — patients and obviously it’s layered. So what we did for our guidance was we just said at the high end, for the remainder of the year, the bariatric growth rate in the US is consistent with what we saw in Q2. And at the low end, we said the growth rate continues to slow a little bit over the course of the year as patients become increasingly educated about the weight loss drugs. And obviously, there’s a number of factors that patients have to consider with respect to those drugs, cost, side effects, what happens if they come off the drugs and regain weight, et cetera. But I think from our perspective, we’re early in understanding what the longer-term impact will be. Customers have said that they have confidence that there is a role for surgery in weight loss and that that will endure over kind of the longer term. What happens in for the rest of the year, I think we’ll see.

Even if these drugs turn out to be a game changer (and I hope they do), I do not think that the bull case for ISRG is going to be derailed.

ISRG Continues To Fire On All Cylinders

Since my last article, the company has reported its second-quarter earnings. The second quarter saw 22% growth in procedures, with notable strength in general surgery and gynecology for benign conditions, particularly in the United States.

General surgery procedures like cholecystectomy and hernia repair were outperforming, and there was healthy growth in colon and rectal procedures as well.

Global procedure growth remained strong due to recovery in China and consistent strength in Japan, Germany, and the UK. Ion procedures also showed strength, with a 145% increase.

The boost in procedures can be attributed to a backlog of patients whose treatments were delayed during the pandemic.

Furthermore, the company noted that new surgeons joining the da Vinci platform contributed positively to procedure growth, indicating the effectiveness of training programs and the rising number of graduates from residency and fellowship programs trained on da Vinci.

On top of that, the company’s placements showed stronger momentum, with 331 systems placed in 2Q, compared to 279 systems in the prior-year quarter.

The clinical installed base now covers 7,900 multi-port da Vinci systems, 435 Ion systems, and 142 single-port da Vinci systems.

Intuitive Surgical

However, it needs to be said that the company is seeing some headwinds in China.

During its 2Q23 earnings call, ISRG noted that local competitors’ increasing participation in tender processes under the national quota and pricing pressure resulting from government policy changes and competition have increased uncertainty in the outlook for China’s procedure, system placement, and revenue performance.

Speaking of China, during its call, ISRG highlighted recent clinical studies.

- A conducted in China compared outcomes of robotic right colectomy and laparoscopic right colectomy. The study covered over 15,000 patients from 42 studies. The robotic approach demonstrated advantages such as shorter hospital stays, significantly lower risk of conversion to laparotomy, and reduced complication rates, especially when considering intra-corporeal anastomosis procedures.

- Another study from Connecticut assessed the outcomes of robotic-assisted and video-assisted thoracoscopic surgery. The robotic arm exhibited lower rates of conversion to open procedures compared to the VATS arm, suggesting comparable perioperative outcomes with reduced conversion risk.

Valuation

Despite the threat of weight loss pills and increased competition in China, the company revised its full-year procedure growth forecast to a range of 20% to 22%, up from the previous range of 18% to 21%.

This upward adjustment is based on expectations of sustained elevated procedure volumes, barring significant macroeconomic challenges.

The forecast also acknowledges potential uncertainties tied to bariatric growth in the US, patient healthcare utilization, and economic conditions.

- The gross profit margin for 2023 is projected to fall between 68% and 69%, subject to variations driven by product, regional, and trading dynamics, as well as new product introductions.

- Pro forma operating expense growth for the year is expected to be between 12% and 15%, with non-cash stock compensation expense forecasted to range between $600 to $620 million.

- Other income, primarily interest income, is anticipated to total between $160 and $180 million, reflecting the impact of rising interest rates.

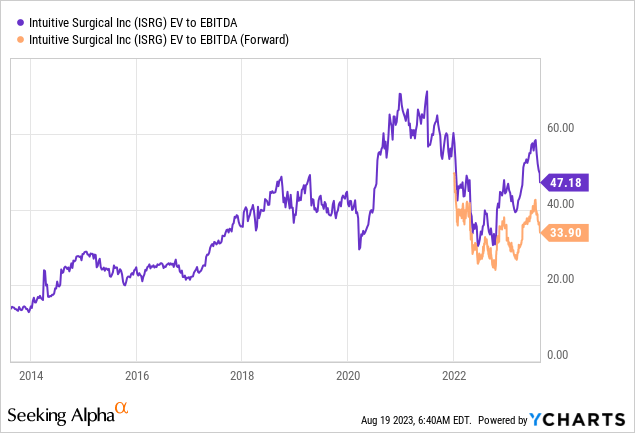

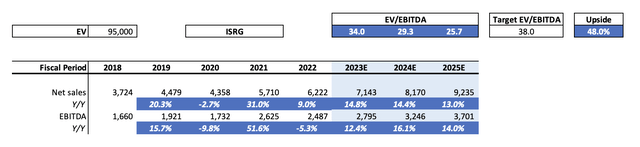

Having said that, the company is now trading at roughly 34x NTM EBITDA.

While it may seem like an elevated valuation, I believe the company’s valuation is attractive. For example, long-term EBITDA growth is expected to remain close to 14%. There are only a handful of multi-billion market cap companies that can compete with that.

If we apply a 38x EV/EBITDA multiple, I get between 48% and 60% upside.

This is based on a $100 billion market cap and $5 billion in expected net cash next year. The company has more cash than gross debt.

Leo Nelissen (Based on analyst estimates)

This would put the longer-term price target at $440.

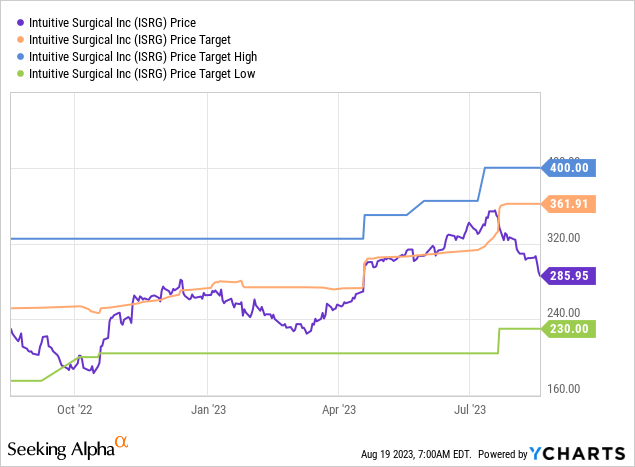

Looking at shorter-term targets, we see that the company has been upgraded in recent weeks, despite seeing a stock price decline.

The current consensus price target is $362, which is 26% above the current price. I agree with that target.

In other words, while short-term market uncertainties will likely keep a lid on growth stocks, I believe that ISRG is one of the best growth plays in healthcare, and if this sell-off continues, I may buy it – despite my focus on dividend (growth) stocks.

Takeaway

Operating in the ever-evolving healthcare sector, ISRG thrives on two pivotal drivers – pioneering healthcare innovation and enhancing efficiency to alleviate long-term costs for providers. Its three robotic systems, including Da Vinci Xi and Ion, have already contributed to more than 1.8 million procedures.

While weight loss pills create ripples in the industry, ISRG remains resilient.

As patients explore these drugs, the company’s stronghold in the bariatric market persists.

Amidst global uncertainties, ISRG remains strong as it posts solid growth in procedures, global placements, and innovation. The numbers tell a compelling story, and the stock’s recent dip offers a tempting entry point.

If the current downtrend continues, I’m keeping a close eye on ISRG for potential inclusion in my portfolio.

Read the full article here