Coursera (NYSE:COUR) is an online educational platform providing online courses like data science, computer science, language learning, social sciences, project management, and certification education. COUR recently posted its Q2 FY23 results. In this report, I will analyze its quarterly results. I believe it is overvalued, and the stock is at a crucial technical level. Hence I assign a hold rating on COUR.

Financial Analysis

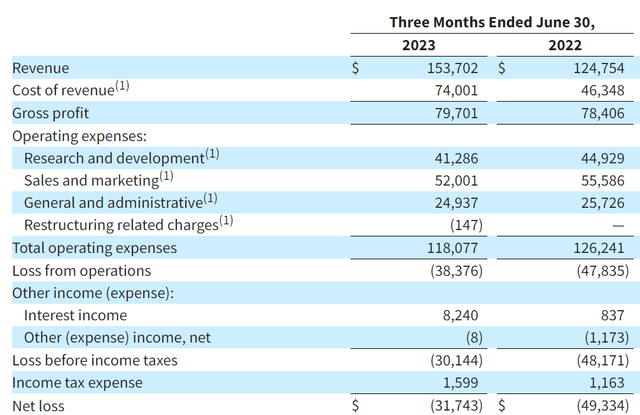

COUR recently announced its Q2 FY23 results. The revenue for Q2 FY23 was $153.7 million, a rise of 23.2% compared to Q2 FY22. I believe solid growth in its consumer, enterprise, and degrees segments was the main reason behind the revenue increase. The revenue from the consumer segment grew by 25% in Q2 FY23 compared to Q2 FY22. I believe the high demand for entry-level Expert Certificates developed by industry partners was the major reason behind the solid growth in the consumer segment. The revenues from the enterprise segment grew by 24% in Q2 FY23 compared to Q2 FY22. I believe strong growth in its business and campus verticals was the main reason behind the revenue increase in the enterprise segment. Now talking about the degrees segment, the revenues grew by 10% in Q2 FY23 compared to Q2 FY22. I believe a 9% increase in student enrollments led to higher revenues in the degrees segment.

COUR’s Investor Relations

Their adjusted EBITDA for Q2 FY23 also improved compared to Q2 FY22. I believe operating expense discipline and a one-time benefit of $2.3 million caused by a contract revision with an educator partner were the main reason behind improved EBITDA performance. Due to the increased revenues and EBITDA, their net loss decreased to $31.7 million, which was $49.3 million in Q2 FY22. I believe its financial performance in Q2 FY23 was solid, and the management has provided revenue guidance for Q3 FY23; they expect Q3 FY23 revenue to be around $158 million, which is higher than Q3 FY22 revenue which is impressive. The management introduced 11 new professional certificates and new job roles in Q2 FY23, and they also expanded their agreement with BNP Paribas Cardif, and this agreement will help them extend their business in Latin America. Looking at the management’s efforts, I believe they might achieve the revenue targets. But despite the solid growth in Q2 FY23 and positive revenue growth expectations for the coming quarters, I am not so confident about investing in the company. I am saying this because the industry in which they compete is highly competitive, and to survive in this industry; every company has to spend loads of money on advertising and innovations. Due to this, despite high revenue growth, the company is not profitable, and their operating loss and net loss are huge. So I believe they might find it difficult to be profitable with increasing competition. Hence despite solid revenue growth, I would advise not to invest in this loss-making company.

Technical Analysis

Trading View

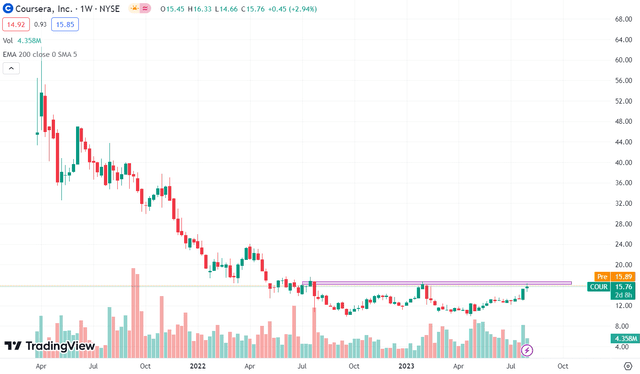

COUR is trading at the $15.8 level. The stock price is down by 65% from its IPO level, which shows that it has been a wealth destroyer for its investors. They posted solid quarterly results beating the market expectations, and as a result, the stock rose by more than 17% in the past three trading sessions. Currently, the stock is near the resistance zone of $17; it tried to break the $17 level two times in the past but failed to break it both times. It fell more than 35% after touching the $17 level; hence I believe the stock is currently at a crucial level. In my opinion, one should only think of buying it when the stock gives a strong closing above the $17 level in a weekly time frame. Because despite the strong surge in the stock in recent days, there is a possibility that the price might touch the $17 level again and continue its downward trajectory.

Should One Invest In COUR?

Talking about COUR’s valuation. COUR has an EV / Sales [FWD] ratio of 2.69x which is way above the sector ratio of 1.21x, and COUR has a Price / Sales [FWD] ratio of 3.82x compared to the sector ratio of 0.91x. The valuation ratios clearly show that COUR is currently overvalued, and despite high revenue growth, COUR is still a loss-making company. Hence, despite solid quarterly results, I am assigning a hold rating on COUR due to its high valuation and other reasons; as I mentioned before, the stock is currently at a crucial level, and there is a high chance that it might fall from its current levels.

Risk

The COUR platform offers various educational content and credentials thanks to its collaboration with educator partners. They pay educator partners as content costs for their Consumer and Enterprise products. Additionally, a portion of the overall tuition paid by Degrees students is used as the basis for their Degrees revenue. As a result, if the university partner increases or decreases tuition, if a partner raises content costs, or if the business renegotiates or modifies the terms of agreements with their educator partners, it could have a significant and adverse impact on their revenue, gross profit, and operating results. For instance, it could have a material effect on their business and financial condition if a sizable number of university partners, or university partners whose courses or credentialing programs account for a sizable volume of learner enrollment on their platform, sought to renegotiate the content fees payable by them or the percentage of tuition payable to the company. They have encountered resistance to their content charge arrangements and may face comparable difficulties in the future. Additionally, for competitive, governmental, or other reasons, they may alter the parameters of these agreements, including the pricing conditions or contract length. Any substantial change in their costs for content, price, or other aspects of their contracts with these educator partners could negatively impact their business.

Bottom Line

Despite strong results, COUR is still a loss-making company with a high valuation. In addition, it is at a crucial technical level where the stock might face major resistance. Hence considering all the factors, I am assigning a hold rating on COUR.

Read the full article here