Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

A year ago, I analyzed the shares of Oracle (NYSE:ORCL) and found them to be a BUY. Since then, the shares have been up 50%, and I believe it is time to revisit the company. With the entire software segment and IT in general, Oracle has had a great run as the economy appears stronger than first anticipated. Oracle may be an opportunity for investors to gain exposure to a dividend growth company in the software segment, where most companies avoid paying dividends.

I will analyze Oracle using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

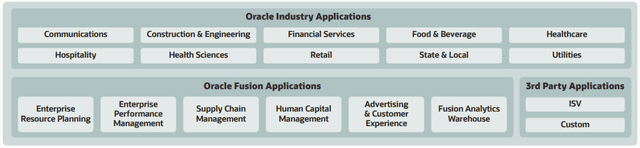

Oracle offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering includes various cloud software applications, including Oracle Fusion cloud ERP (enterprise resource planning), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing. The company also offers cloud-based industry solutions for various industries.

Fundamentals

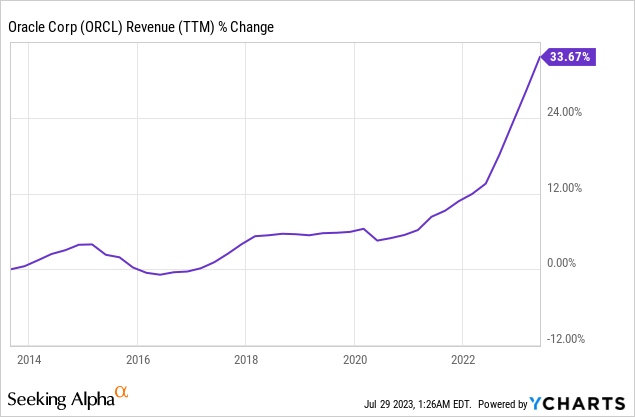

The revenues of Oracle have increased by 34% over the last decade, with the vast majority of the growth coming in the previous several years. The company shifted its offering to the cloud to become more attractive to clients, and so far, it has been a wise decision. Oracle is also pursuing M&A activity, which allows it to increase sales by widening its value proposition. In the future, as seen on Seeking Alpha, the analyst consensus expects Oracle to keep growing sales at an annual rate of ~8.5% in the medium term.

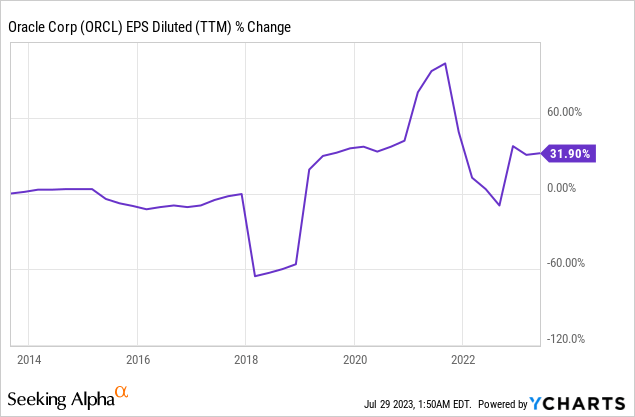

The EPS (earnings per share) of Oracle during that decade increased by 32% (yet 78% when using non-GAAP EPS). Oracle showed slower EPS growth compared to sales growth despite significant buybacks. The reason for that is that the margins have decreased during that decade. As the company shifted its business model and laid off employees, it aimed to improve its operating margins. In the future, as seen on Seeking Alpha, the analyst consensus expects Oracle to keep growing EPS at an annual rate of ~12% in the medium term.

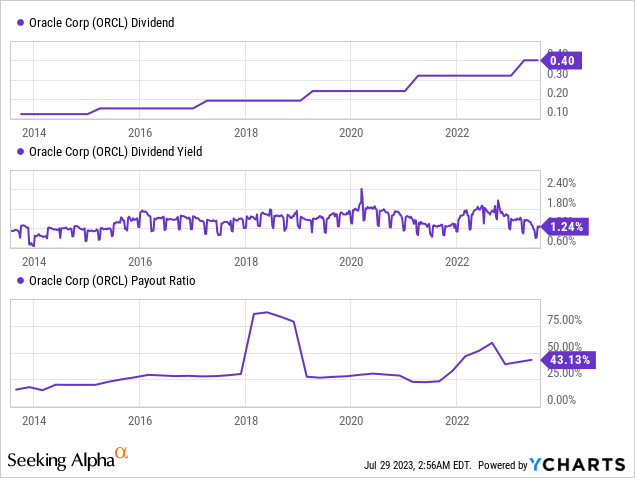

Oracle is one of the few software companies paying dividends to its shareholders. The company pays 43% of its GAAP EPS (and 28% of its non-GAAP EPS) to shareholders as dividends. Therefore, the current dividend payment looks relatively safe. However, the dividend yield is not extremely attractive at 1.24%. Oracle has a track record of more than a decade of increasing its annual dividend, and investors should expect low double digits growth in the medium term, which is in line with the company’s EPS growth trajectory.

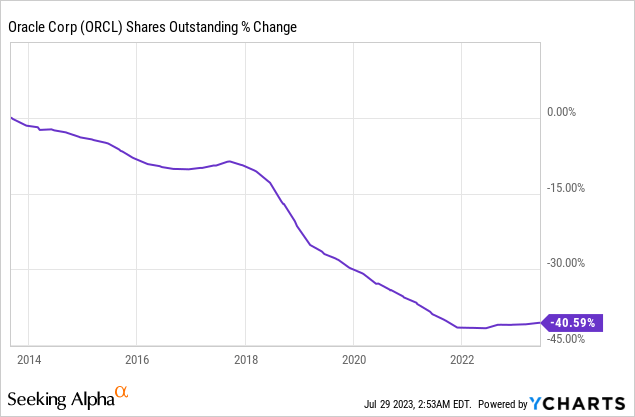

In addition to the dividends, Oracle returns capital through aggressive shares repurchase plans. The company has reduced the number of shares outstanding by more than 40% in the last decade. The share count reduction supports EPS growth and allows the company to keep increasing EPS despite the falling margins as it shifted its business model. Buybacks are especially effective when the share price is attractive.

Valuation

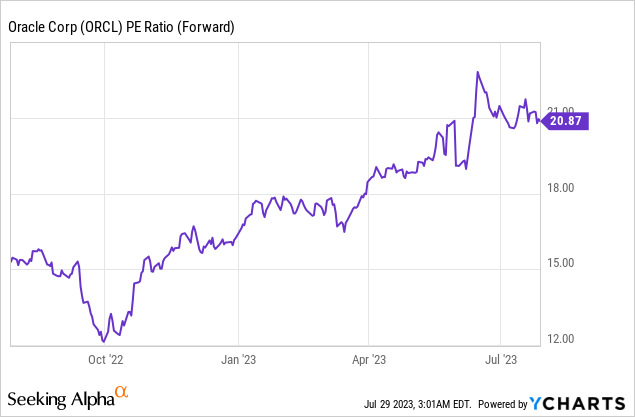

The P/E (price to earnings) ratio of Oracle stands at almost 21 when using the non-GAAP estimated for the current year ending in May 2024. The current valuation seems a bit high, as the company is growing but not extremely fast. Moreover, the business environment differs as the Federal Reserve has raised the rates to 5.5%, making equities less attractive. Therefore, the shares that rate trading at the highest valuation over the last twelve months are slightly overvalued.

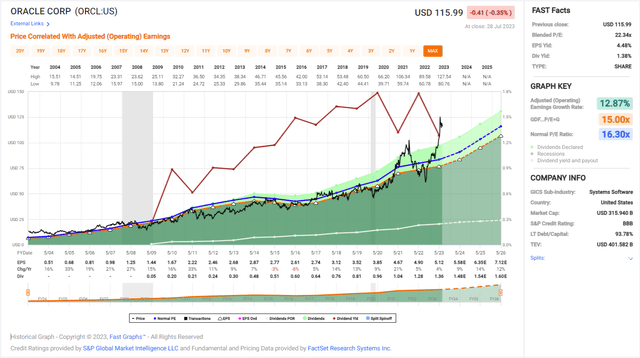

The graph below from Fast Graphs shows that Oracle has become overvalued over the last several years. In the previous two decades, the average P/E ratio of the company was 16, and it enjoyed an annual growth rate of almost 13%. Today the expectations are for a growth rate of 12%, while the P/E ratio stands at 21. When I add that the interest rates are higher, the shares appear overvalued.

Fast Graphs

Opportunities

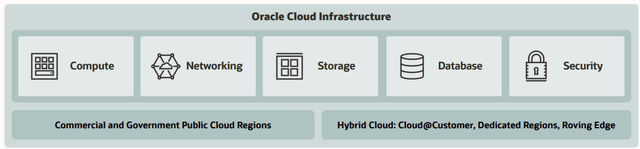

Oracle Cloud is the company’s infrastructure on which it builds its entire value proposition. The company has worked hard and invested significantly to shift its business from product sales to subscription sales. It reduces churn and reduces investments in sales and marketing. Oracle offers data security, storage, and databases through its cloud computing capabilities. Oracle can deploy its infrastructure on-premise, fully on the cloud, and in a hybrid cloud, allowing it to offer a cloud for every client.

Oracle

In addition to the company’s cloud, Oracle offers fusion applications that allow clients to control and manage their countless information streams within one layer. Moreover, the company has unique applications for different industries enabling it to be highly diversified and not rely on a single business segment. The diversification is a great opportunity, as cloud migration in every industry is a possibility for Oracle to capitalize on.

Oracle

The value proposition combines infrastructure, data management, and unique applications, making Oracle a one-stop shop for many clients. Therefore, the stickiness level is higher than average. Replacing Oracle is complex as the company operates the business infrastructure and the apps thousands of employees use. Therefore, Oracle has a wide moat once it acquires a client. That stickiness allows the company to become more efficient as churn is lower.

Risks

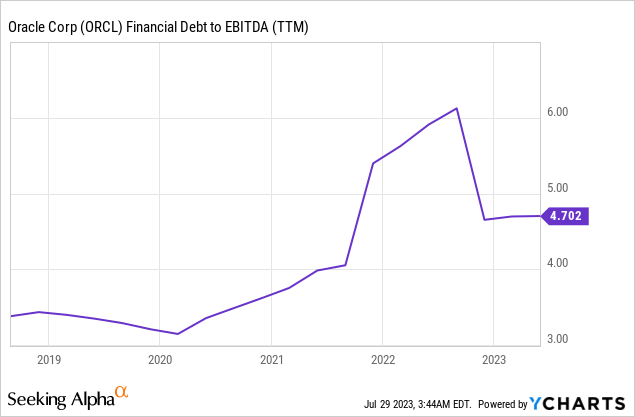

Leverage is the first risk for Oracle. Following Oracle’s acquisitions in the last several years, the debt to EBITDA level is almost 5. Acquisitions such as the Cerner acquisition are beneficial to Oracle’s value proposition. However, the current debt level limits the company’s ability to initiate another significant acquisition, and it also means that with higher rates, the interest expenses will increase and pressure the EPS.

The company is well positioned to grow with its robust value proposition and software as a service model. However, Oracle must prove it can achieve that growth following a very slow decade. The company already enjoys the valuation of a growing company. Yet, its past decade showed almost a stagnation in growth, especially considering the inflation we have seen during that time. Management must prove its ability to drive sales growth faster to alleviate the risk.

Moreover, the company’s current valuation leaves investors without a margin of safety. This is a significant short- and medium-term risk as the company is valued for perfect execution. The challenge is that Oracle struggled to execute as analysts expected in the last twelve months. A year ago, when I analyzed the company, the EPS expectation for the previous year was $5.29, and the actual EPS was $5.12. The exception for the current year was $5.81, which now stands at $5.56. Therefore, while the company is priced for perfection, we already see the risk of imperfect execution, which may result in a short-term price decrease.

Conclusions

To conclude, Oracle is a blue-chip software company that offers investors a broad client base that allows it to grow sales and EPS steadily. The company has several growth opportunities as it provides cloud infrastructure and applications to various clients. Despite the competition in the cloud business, Oracle has room to grow as it offers a one-stop-shop value proposition appealing to many companies.

However, there are risks to the investment in Oracle-mainly execution risks as the company attempts to capitalize on its growth opportunities. The current valuation, though, is pricing a complete success in achieving growth and leaving no margin of safety. I believe that the shares are a HOLD for that reason, and I will change them back to BUY when the P/E ratio is around 16, which aligns with its historical valuation.

Read the full article here