Biotech investing is full of surprises, sometimes because analysts have an unsophisticated view as to how challenging doing new stuff can be. Seres (NASDAQ:MCRB) has just obtained FDA approval for the first oral (tablet) treatment for preventing recurrence of a major hospital (and aged care facility) bacterial infection. Here I look at the Seres share price fall in response to FDA approval. It makes no sense to me.

Tracking Seres share price

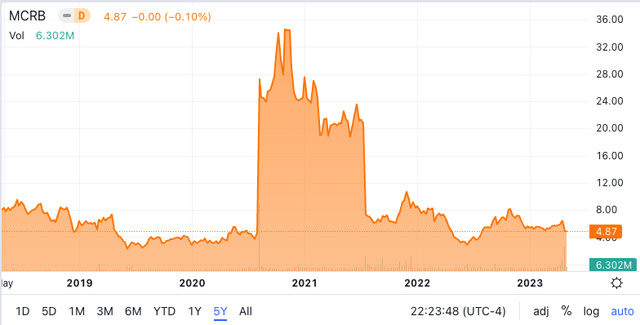

Seres 5 year share price chart (Seeking Alpha)

The above 5-year share price chart for Seres shows two dramatic events that strongly influenced the share price.

The first was in August 2020 when, after an unsuccessful Phase 2 trial in 2016 which caused the share price to fall below $10, SER-109 finally achieved success with its Ecospor III Phase 3 trial. This dramatic share price increase from ~$4 to ~$25 was followed by further share price rise to $32 on further announcements concerning success of the Phase 3 study for SER-109 in October 2020.

The second dramatic event was in July 2021, this time a dramatic fall in share price from $21 to below $7 on the failure of Seres’ Phase 2 trial concerning its microbiomic treatment for Ulcerative Colitis (UC). A lot of commentary on this result represented pessimism about Seres’ ability to develop a microbiomic treatment for this massive unsolved inflammatory bowel condition. The commentary overlooked the fact that Seres failed previously in its development of SER-109 to treat C.diff recurrence, before ultimately succeeding. The jury is still out on Seres UC microbiomic drug approach, but Seres indicates that it continues that program.

The above two critical events are key to the current Seres share price. It has been stuck between $5 and $10 since mid-2021.

Why has the share price gone down with FDA approval?

There were 6.18 million Seres shares traded on the day of the FDA approval and the share price finished at $6.40. The day after FDA approval 20.76 million shares were traded and the share price ended at $5.30. Overall in the four days since approval, 41.83 million shares have been traded, with the share price falling to $4.67 on volume of 4.7 million on Tuesday. The share price may be stabilising at approximately $1 above its trading price before the successful Phase 3 trial for SER-109 that put the company on a trajectory for FDA approval of SER-109.

I’ve noticed some commentary that seems to think that Seres is stuck at the beginning of the microbiomic revolution with a product that is derived from processed fecal samples at a time when others are exploring more defined products comprising cultured bacteria. For this reason it seems the logic is to ignore Seres because better investments are coming, if you accept that microbiomics is going to become a significant part of the biotech treatment profile. This is a perhaps an extreme example of buy on hope and sell on reality. The point is that Seres has an initial fecal-derived product that has had two very successful Phase 3 trials for treating recurrence of the most significant bacterial infection in hospitals (and aged care facilities) and the product will be ready for sale in June (less than 30 days). The analyst view seems to be to ignore the advance and upcoming revenue because some time in the future there will be better solutions.

I think the above view needs help from technical experts who know about the difficulties of culturing anaerobic bacteria and indeed culturing organisms that are only known from their DNA sequence. Then there is the issue of which bacteria to put in the final product. This is about as close to rocket science that biotech gets. Seres is a leader in this area and it is already evaluating two defined products comprising cultured bacteria (i.e. not from processed fecal material).

Perhaps those with a negative view of Seres may not even be aware that Seres is a leader in defining microbiomic products based cultured bacteria? Seres has SER-155 in Phase 1b clinical trial for complex bacterial infections. SER-155 has been designed based on findings from their SER-109 program.

A second cultured product SER-301 has a more complex history. It is a defined cultured group of bacteria developed from the fecal-derived SER-287. Ulcerative Colitis is a huge opportunity, but also a very tough challenge. Currently Seres is reviewing its biomarker data from SER-287 and SER-301 to explore the next steps of its UC program. Development in uncharted territory is never a straight line.

As far as I am aware, no company has a defined product in Phase 3 trials yet. This means that validation of clinical effectiveness is a long way from being realised. This includes the defined products from the Seres portfolio.

Of course I may be missing the way the market thinks and the falling share price may be all about a possible “miss” in the upcoming Q1 earnings expectations, which in my view has almost no relevance to the company’s future performance.

My take on the current Seres share price

The interesting thing is that, notwithstanding the continued progress with the successful VOWST (SER-109) C.diff program, the share price has been stuck below $10 since mid-2021. A successful Phase 3 trial concerning SER-109 took the share price up to $32 and a subsequent failed early (Phase 2) trial with SER-287 on UC brought the share price below $10. Since then Seres (and Nestle (OTCPK:NSRGY)) have progressed the SER-109 program with a second successful Phase 3 trial, but the share price has remained largely ~$6. Presumably the market remained skeptical about Seres ability to achieve FDA approval because a number of other microbiomic companies have faltered in programs moving towards FDA approval.

Because of the above I assumed that achieving FDA approval for its tablet form of SER-109, a big milestone for any microbiomic product, would lead to a share price increase, noting that the initial successful Phase 3 trial led to a $32 share price spike.

Instead the share price fell below $5 on the recent FDA approval to give Seres an enterprise value of just $604 million. This is very odd, especially when Seres and Nestle have announced that VOWST (formerly SER-109) will be available for patients in June 2023!! Clearly Seres and Nestle took positive signals from the FDA earlier this year to indicate that approval would come on April 26 (as it did) and they have been actively involved with manufacture of VOWST and preparing for market release. I suggest June will be a good time to revisit the Seres share price. Investors with an appetite for risk might think about the above. Of course VOWST has to be effective, but the two successful Phase 3 trials and FDA approval are promising signals.

I am not a financial advisor but I’ve lived the biotech industry for a long time. My comments represent my own conclusions. I hope that they are of interest to you and your financial advisor as you consider the risky end of your investment portfolio. It is clear to me that biotech isn’t for everyone!

Read the full article here