Adyen (OTCPK:ADYEY) is one of my highest conviction name and I have done a deep dive into the name for members of Outperforming the Market, which includes a summary of my 5-year financial forecast and my intrinsic value and entry price estimate for Adyen.

I like Adyen as a company given the strong industry tailwinds, its solid competitive position, and long-term compounding and free cash flow generation capabilities.

Brief introduction into Adyen

Adyen is one of the leading payments companies globally, and through its unified technology stack, offers customers with the unique ability to integrate both online and in-store payment processing and value-added services.

The company has led an organic growth strategy, which I will elaborate in detail later, and is led by Pieter van der Does, who is also the co-founder of Adyen.

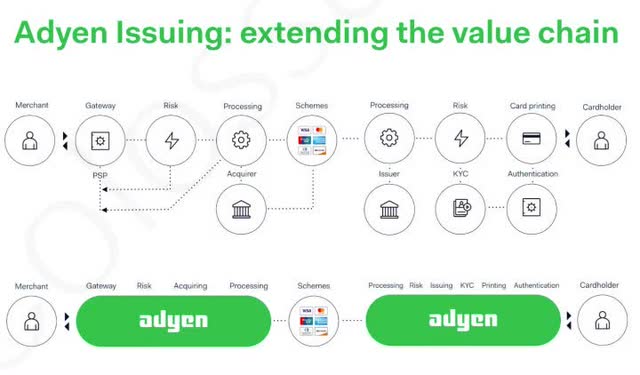

One of Adyen’s key value proposition is that it is able to handle the full payments lifecycle and provide an end-to-end solution for its customers. This includes everything from gateway, risk management, processing, acquiring and settlement.

In addition, another key value proposition is to reduce friction for businesses and to provide a payments platform that is built for speed, performance, security and innovation as Adyen has an end-to-end in-house tech stack.

Lastly, Adyen does not just focus on online payments but also on other segments like in-store payments and platforms, thereby giving the company the ability to help customers integrate their data across online and in-store formats to generate insights on engagement and loyalty.

Adyen business model and value proposition (Adyen IR)

Adyen revenue mix

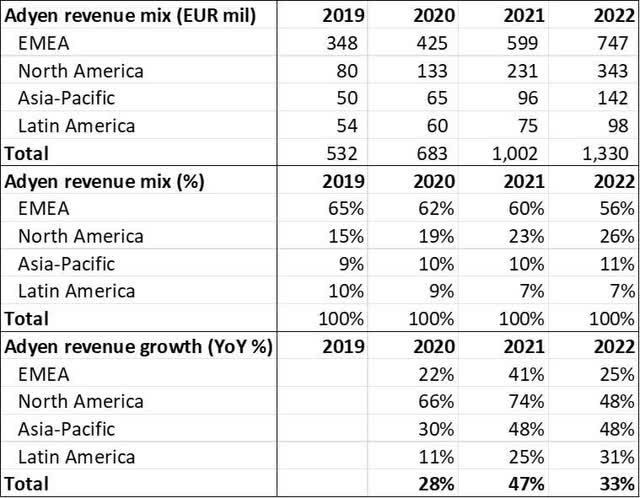

I put together the revenue break down by geographical regions of Adyen in the last four years to better understand the business.

We have seen EMEA contribution to revenues gradually fall from 65% of total revenue in 2019 to 56% of total revenue in 2022.

Revenues from North America was the fastest, with an average growth of 63% over the four-year period, while Asia-Pacific was the second fastest growing region with an average 42% growth over the four-year period. The EMEA region saw an average growth of 29% over the four-year period while the Latin America region saw an average growth of 22% over the four-year period.

Adyen Revenue Contribution and Growth (Author generated)

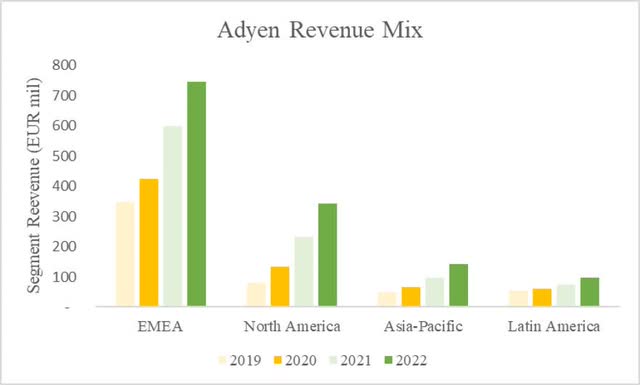

The graph illustrates the geographical mix of Adyen, with the EMEA region making up the majority of its revenues, while North America being the second largest contributor of revenues and growing rapidly.

Adyen Revenue Mix (Author generated)

I would like to monitor Adyen’s growth in the North America and Asia-Pacific regions over time as these are strong drivers for growth for Adyen, on top of its consistent, core growth driver, the EMEA region.

Favorable tailwinds in the global payments market

Now, we will look at the industry tailwinds for Adyen. This comes not only from a growing payments market, but also from its continuing market share gain from incumbents in the segment.

Growth of the payments market

The payments market is expected to continue to grow in the next few years.

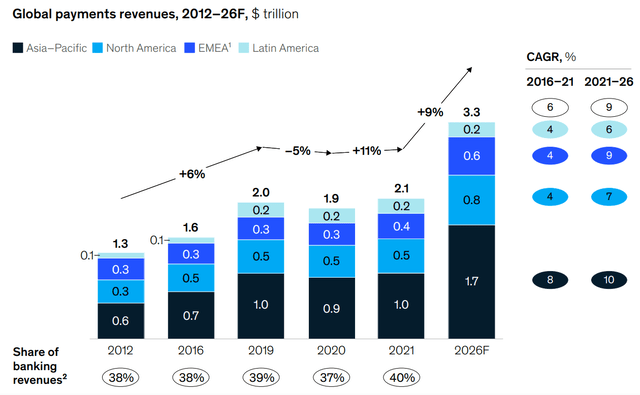

By 2026, the global payments revenue is expected to reach $3.3 trillion, growing 9% CAGR over the period. Regions poised for outsized growth include Asia-Pacific and EMEA, which is expected to grow at 10% CAGR and 9% CAGR respectively.

Global Payments Revenue (McKinsey 2022 Global Payments Report)

This growth in the global payments revenue is driven by the continued growth in digital payments, both online and offline.

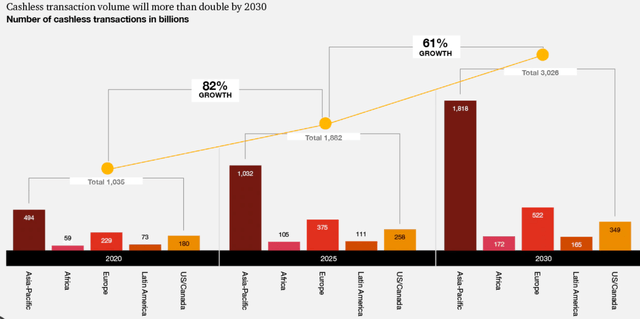

As can be seen below, cashless transaction volume is expected to more than double by 2030 across all geographies.

Cashless transaction volumes (PwC)

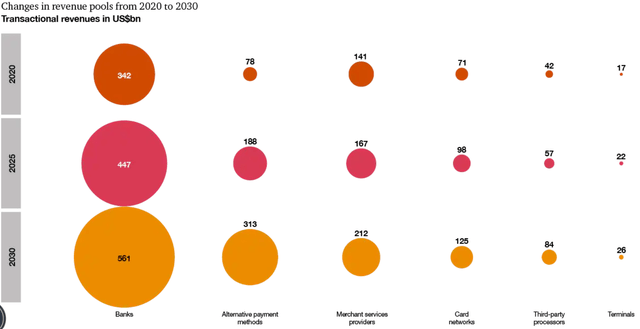

Alternatives payment methods and merchant service providers, two segments which Adyen is exposed to, continue to grow in revenues until 2030.

Change in revenue pools (PwC )

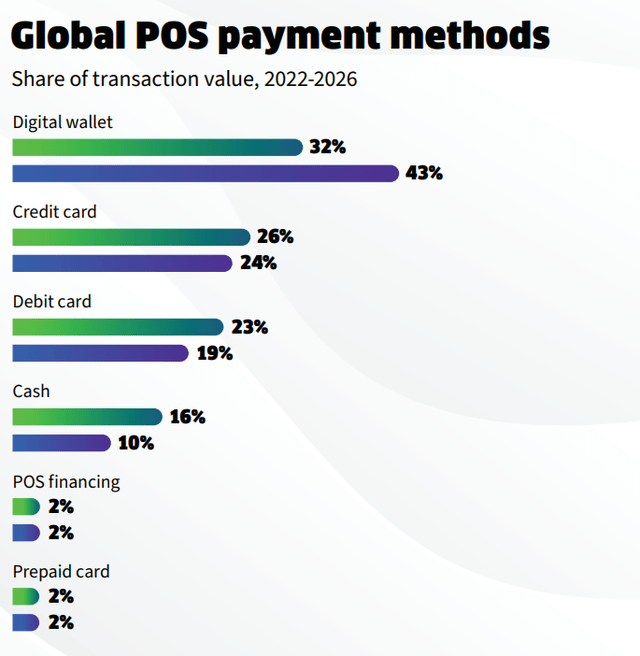

For Point of Sale (“POS”) transactions, there is a trend moving away from cash and cards towards digital wallets, which Adyen is exposed to.

Global POS payment methods (FIS Global Payments Report)

Business strategy

Adyen employs a land-and-expand strategy, and it mainly grows along with its customers.

Since its IPO, Adyen has found that a large majority of growth each year comes from the businesses that are already on its platform. On top of that, Adyen has seen consistently low volume churn of less than 1%.

Thus, Adyen’s ability to continue to gain wallet share from existing customers is its main growth engine to continues to drive future growth.

The aim at the beginning when onboarding new customers into its platform is to show the strong value proposition that Adyen can deliver and from there, expand its scope of work as trust is built and a partnership is born.

This ability comes from the top tier sales teams at Adyen that looks to secure potential customers, advance them and drive penetration after.

The sales teams are there to provide this collaboration between Adyen and existing customers to determine what their challenges are and how to overcome them. In addition, Adyen is structured into solutions like Payments, Data, Platform Engineering and Platforms & Financial Services. This means that there are technical and product teams that can work to meet the demands and solve challenges that Adyen faces.

Another part of Adyen’s business strategy includes its three commercial pillars.

Adyen has three commercial pillars, which are Digital, United Commerce and Platforms. I think that this is a great way for Adyen to continue to innovate in each pillar and continue to evolve with the times in each pillar and provide the best possible solutions.

Adyen started off in Digital, with its origins in online payments. The idea here is for Adyen to reduce friction in online payments to ensure that customers experience a payment platform that is engineered for speed and an end-to-end in-house built tech stack that enables Adyen to have full control and agility. This gives Adyen full control over the technology, which can then lead to Adyen releasing new products to enable a customer’s growth, change functionality or implement new payment methods.

Adyen’s Unified Commerce offering ensures that its platform is able to enable businesses of today operate both online and in-store, thereby enabling customers to use Adyen as a single multi-channel solution and one where customers can have a integrated view of all transactions happening. This helps customers understand customer behavior better on a blended perspective, including both online and in-store, enabling customers to have better engagement and loyalty with their own customers.

Last but not least, Adyen’s Platform offering was created from its current product offering as the needs of enterprises started becoming more complex. The enterprise platforms that Adyen work hosts small and medium size businesses, which Adyen can also work with through these enterprise platforms.

To continue to innovate on its offerings, Adyen launched its embedded financial product suite. This product offering is meant to offer Adyen’s platform businesses the ability to bring to their users a superior financial experience. Some of its innovative products in the product suite includes card issuing, business bank accounts and cash advances.

Market share

Adyen is one of the tech-enabled disruptors in the global payments market.

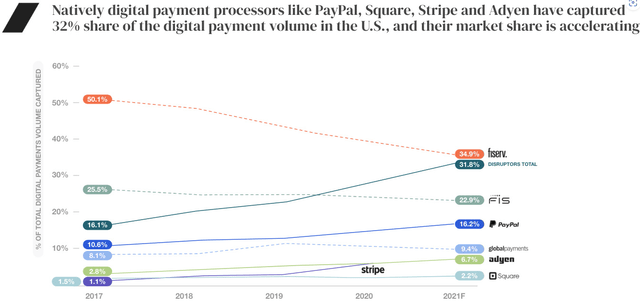

As can be seen below, traditional incumbents like Fiserv (FI), FIS and Global Payments (GPN) are losing market share, with a combined market share of 84% in 2017 falling to a combined market share of 67% in 2021. This comes as the disruptors market share grew from 16% in 2017 to 32%. During the period, Adyen’s market share more than doubled.

Disrupters in digital payment processing (F-Prime State of Fintech)

It is expected that the incumbent market share will continue to fall as the disruptors continue to innovate on technology and bring improved offerings, reduced friction and complexity and better integration.

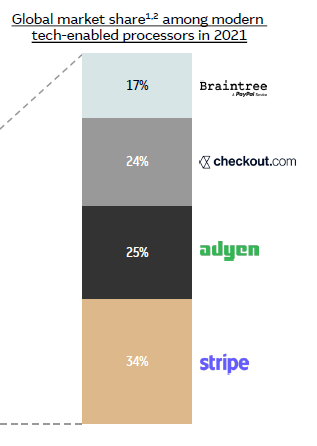

As can be seen below, the tech-enabled players are consolidated by four key players, with Adyen and Stripe being the most competitive out of the four. On top of that, Adyen focuses on the Europe market and enterprises while Stripe focuses on the North American market and small, medium businesses.

Market share of disruptors in the global payments market (CB Insights)

I think the reality for Adyen is as such: Stripe will continue to be a competitor in the long-term, but the global payments market continues to grow, as shown above, and also, these disruptors will continue to gain share from the incumbents as a result of their competitive positioning.

Management team

Pieter van der Does is Adyen’s co-founder and CEO. He currently has 922k shares in Adyen, which amounts to $1.5 billion today. His base salary and remuneration received in 20221 and 2022 amount to $629k and $692k, and this makes up less than 1% of his shareholding in Adyen. This makes him inclined to be aligned to shareholders to Adyen.

Ingo Jeroen Uytdehaage is the CFO of Adyen and been with the company for the past 12 years. In 2023, he was appointed as co-CEO of Adyen and he will oversee the Product and Operations teams. His CFO role will be taken over by Ethan Tandowsky while Roelant Prins, the current CCO, while oversee the Account Management teams. These changes come as Adyen’s current COO is stepping down in 2023.

Free cash flow machine and long-term compounder

Adyen has a net cash balance of 6.3 billion euros, which makes up about 14% of its market capitalization today.

On top of that, Adyen has strong free cash flow generation abilities.

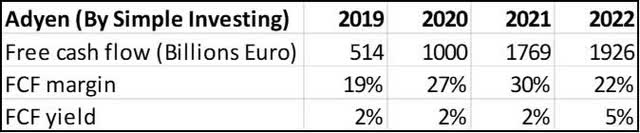

As can be seen below, Adyen’s free cash flow margins are solid between 19% to 30% while free cash flow yields have ranged between 2% and 5%.

Adyen free cash flow generation (Author generated)

The Adyen business model is a highly profitable one, with ROE in the past four years being between 24% and 31% and its ROIC being in the range of 23% and 30%. What this means is that the capital being reinvested into the business continues to grow at a rapid clip and businesses like these are long-term compounders.

Adyen ROE and ROIC (Author generated)

What this means for Adyen is that its free cash flow generation enables it to continue to grow its surplus of cash flow, which can then be either re-invested into the company, or even used to acquire other companies. On top of that, its high return on equity means that for each dollar reinvested into the business, this helps grow the returns of the business further as compounding takes place.

Solid financial goals

Adyen has three main financial objectives that it hopes to achieve either in the medium term or the long-term.

Firstly, net revenue growth is expected to grow at a CAGR range of mid-twenties and low thirties in the medium term.

Secondly, Adyen expects to improve EBITDA margin through improvements in operating leverage. The long-term goal for EBITDA margin is 65%.

Thirdly and lastly, Adyen expects to maintain a sustainable capital expenditure rate of up to 5% of its net revenue.

I think that these objectives can be met, as shown by the strong industry tailwinds for Adyen, the capital efficient business model and continued EBITDA margin.

Valuation

I forecasted Adyen to achieve a 28% CAGR for its revenues, which is in-line with its targets, while I expect EBITDA to improve to 60 with improving operating leverage. The detailed 5-year financial model can be found in my Adyen deep dive article.

Based on that 5-year financial model, I also reiterate my intrinsic value derived for Adyen that is also found in the deep dive, which is based on the discounted cash flow model for the 5-year period.

My 1-year price target for Adyen is $20.40, implying 21% upside from current levels. The 1-year price target imply 60x 2024 P/E. I think that this valuation multiple is justified for Adyen given its strong industry tailwinds, quality management team, resilient and profitable business model and solid business strategy.

Conclusion

There are favorable industry tailwinds in the global payments market that favors Adyen as the trend continues to move towards cashless transactions.

Adyen’s land-and-expand strategy has proven to be effective in growing the business organically and cost effectively, while it continues to innovate across different commercial pillars like digital, unified commerce and platforms segment.

Adyen, as a disruptor in the global payments market, will not only continue to gain share from incumbents, but also grow along with the global payments market.

On top of that, Adyen is run by its co-founder who has lots of skin in the game and it has a highly profitable business model that has solid free cash flow generation and high returns on equity.

My 1-year price target for Adyen is $20.40, implying 21% upside from current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here