Back in late March, I wrote that Western Midstream (NYSE:WES) had an attractive position in the Delaware Permian and that it was one of the cheapest stocks in the midstream space despite its strong characteristics. Since then, the stock has returned over 11%, keeping close pace to the S&P over the same time period. Let’s catch up on the name.

Company Profile

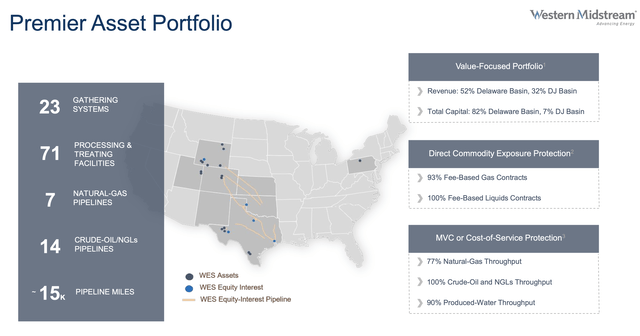

As a refresher, WES is a gatherer and processor (G&P) primarily for its Occidental Petroleum (OXY). It primarily operates in the Delaware and the DJ basins. For 2022, about 55% of its EBITDA came from its operations in the Delaware, while 29% came from the DJ. Other assets contributed about 8% of EBITDA last year, while equity investments in other systems that are operated by other midstream companies made up approximately 8% of EBITDA.

Almost all of WES’ contracts are fee-based, while over 80% of its cash flows are supported by minimum volume commitments (MVCs) or cost-of-service contracts. In the Delaware, its contracts have a remaining weighted average life of about 10 years for gas, oil, and water. In the DJ, meanwhile, its remaining weighted average life is about 6 years for both oil and gas.

Company Presentation

Steady Performance

As I discussed in my original article, the Delaware Permian basin is the big growth driver for WES. On that front, the company continued to see solid throughput volumes on its system in Q1. Natural gas throughput in the basin rose nearly 3% sequentially to 1,559 MMcf/d, while crude throughput increased 1% sequentially to 205 MBbls/d. Water volumes, meanwhile, jumped over 12.5% sequentially to 977 MBbls/d in the basin.

After the quarter, the company also amended and extended its natural gas gathering contract with OXY in the Delaware basin. The new agreement increases its firm capacity up to 800 MMCf/d and extends the contract by 3 years until 2035. That’s a 300 MMCf/d increase that will come with a corresponding minimum volume commitments.

Not everything was positive with the Delaware, though, as the company did lower its expectation for the number of wells it expected to come online this year. It now anticipates 320 wells coming online in the Delaware versus a prior outlook of 340 wells. In 2022, it had 246 wells coming online, so that is still a 30% increase year over year. The company said the lowered wells forecast comes from updates from producers, rig schedules, and associated completion timing. However, it does expect this to be offset by drilling efficiencies and type curves.

Given its still expected strong growth in the Delaware, the company did indicate during its Q1 call that it may need to build a new processing plant in the Delaware. And at the end of May, it announced a new 250 MMcf/d cryogenic processing plant in West Texas. The plant will added $125 million to Capex this year, and reduce free cash flow by a corresponding amount to $1.0-1.1 billion. The plant is projected to come online at the end of Q4 2024. Together with its Methone III plant, scheduled to come online later this year, it will increase its West Texas processing capacity from 1.54 Bcf/d to 2.09 BCf/d at the end of 2024.

In my initial write-up, I also noted that the DJ was still a risk, and the basin did see sequential volume declines. Natural gas throughput in the basin fell nearly -3% sequentially to 1,306 MMcf/d, while crude throughput decreased over -10% sequentially to 69 MBbls/d.

WES does expect the declines in crude to stop later this year as more wells come online, while it anticipates a similar decline in natural gas volumes as last year. On the latter front, it thinks that natural gas base declines will offset increased activity. However, it noted that due to MVCs there will be little impact to adjusted EBITDA this year.

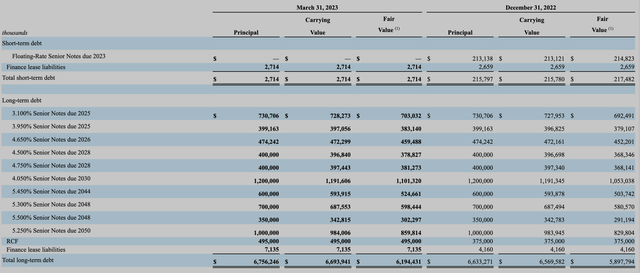

One thing that WES continues to be very good at is capital allocation. During the quarter, the company retired $213.1 million in floating rate notes and then after obtaining investment grade status, it turned around and issued $750 million in 6.15% senior notes due 2033, which is a pretty good rate in the current environment. One of the strengths of WES remains its termed out balance sheet, with a lot of long-term debt not due until 10-30 years at some pretty attractive rates.

WES Debt (10-Q)

The company currently pays a base distribution of 50 cents a unit, but also will pay out an enhanced distribution over that amount as well. In Q1, the company paid out a total distribution of 85.6 cents. It also bought back around $7 million in stock.

Valuation

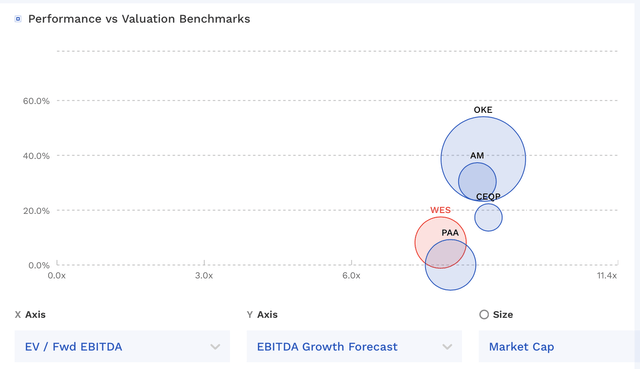

WES stock currently trades at about 7.8x the 2023 EBITDA consensus of $2.08 billion, and 7.4x the ’24 consensus of $2.19 billion.

Its FCF yield is over 10.5% for 2023. The stock yields 7.4% based off its base distribution.

WES is among the cheapest stocks in its peer group, despite its strong recent performance.

WES Valuation Vs Peers (FinBox)

Conclusion

I continue to think the midstream space as a whole is undervalued, and WES is one of the most undervalued within that space. The company is heavily tied to the best basin in the U.S., has a strong parent in OXY with favorable contracts, and has one of the most rock-solid balance sheets in the space with low leverage (3.2x) and termed out debt at attractive rates.

The company continues to do a great job on the capital allocation front, taking a balanced approach of paying out supplement distributions; executing growth projects, such as the new West Texas processing plants; doing buybacks, and reducing debt. The stock remains a “Buy.” A $35 price target would be a modest sub 9x multiple on 2024 EBITDA.

Read the full article here