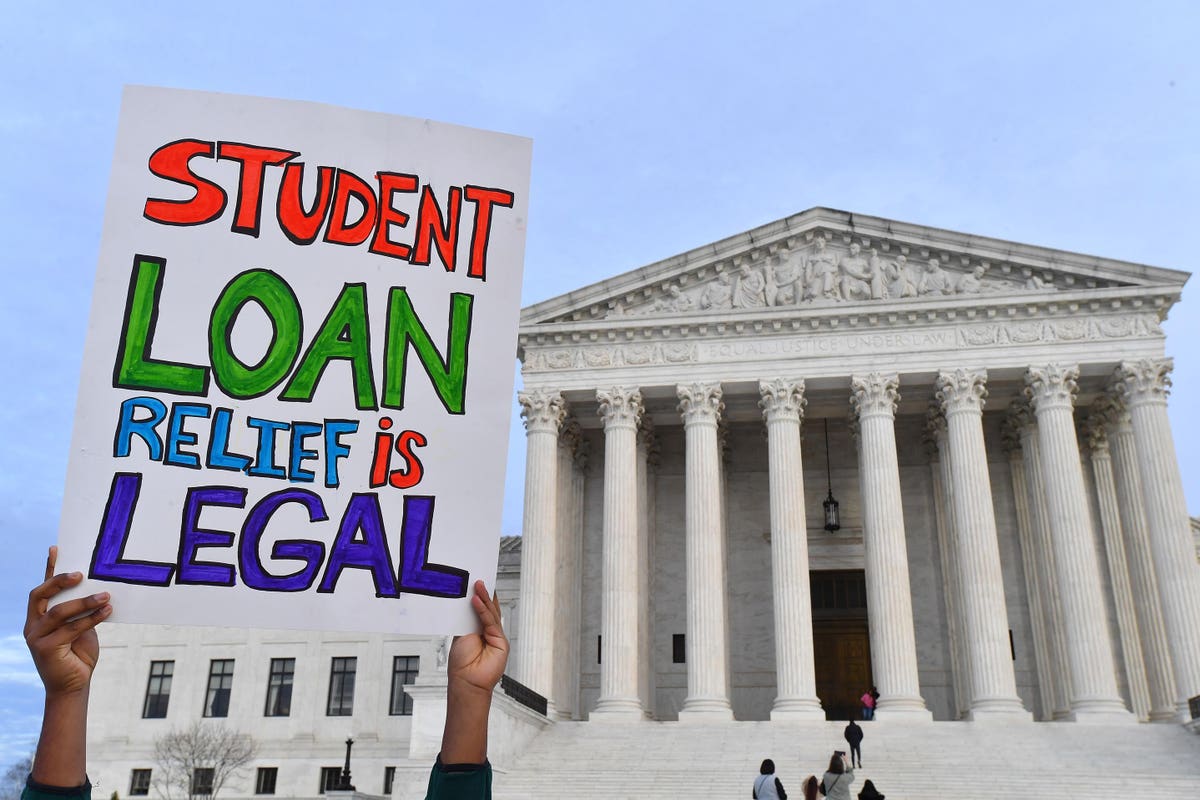

The U.S. Supreme Court is expected to rule on student loan forgiveness imminently in Biden v. Nebraska and Department of Education v. Brown. On the line is the Biden administration’s plan to forgive $400 billion in student debt, impacting 40 million Americans.

However, regardless of that decision, and as a result of the recent debt ceiling negotiations, student loan debt repayments are expected to resume in October after a pause of over 3 years. The resumption of these payments, with interest accruing from September, could become a drag on the U.S. consumer, potentially slowing growth slightly in the final quarter of 2023.

Assessing The Implications

During the pause in student loan payments, it appears that many consumers have been spending that money on other things. If so, then when student loan repayments resume, then impacted households will have a little less to spend on goods and services. Estimates vary as to how large this impact will be, but depending on the state of the economy, it could be sufficient to bring economic growth down slightly.

Running The Numbers

The total annual cost of student loan payments for consumers may be in the region of $70 billion. Of course there are moving parts here in terms of the subset of the population who must make repayments and substantially higher interest rates than 3 years ago increasing the cost of some student loans with a variable rate component, though most are fixed rate.

Nonetheless, if we take the $70 billion expense at face value that compares to annual consumer spending of $19 trillion as of April 2023. Hence if the resumption of student loan payments causes consumer spending to drop by the same amount as the cost of student loan servicing, then that could be a drag on consumer spending of around 0.4%.

That’s a small move in absolute terms, but is potentially enough to knock growth in consumer spending off course. The ruling on student loan forgiveness matters too, as if forgiveness occurs it would lessen the impact of student loan payments resuming.

The Economic Impact

The economic impact will be felt in Q4 of 2023. Student loans will start accruing interest again in September with payments being made in October with the exact dates depending on different loan service providers. Hence we’ll start to see real-time assessments of the consumer impact in October, but with most official statistics starting to formerly measure the impact in November.

Either way, the impact will be somewhat marginal, but if the U.S. consumer were weakening in October already, then student loans may have the potential to worsen the situation. Even if the economy remains robust, the resumption of student loan payments could be enough to cause a slight speed bump in growth in the fall.

The U.S economy is performing well currently, but the resumption of student loans is a potential dark cloud for the economy and markets as 2023 draws to a close.

Read the full article here