Key Takeaways

- Nasdaq Stocks Continue To Rally

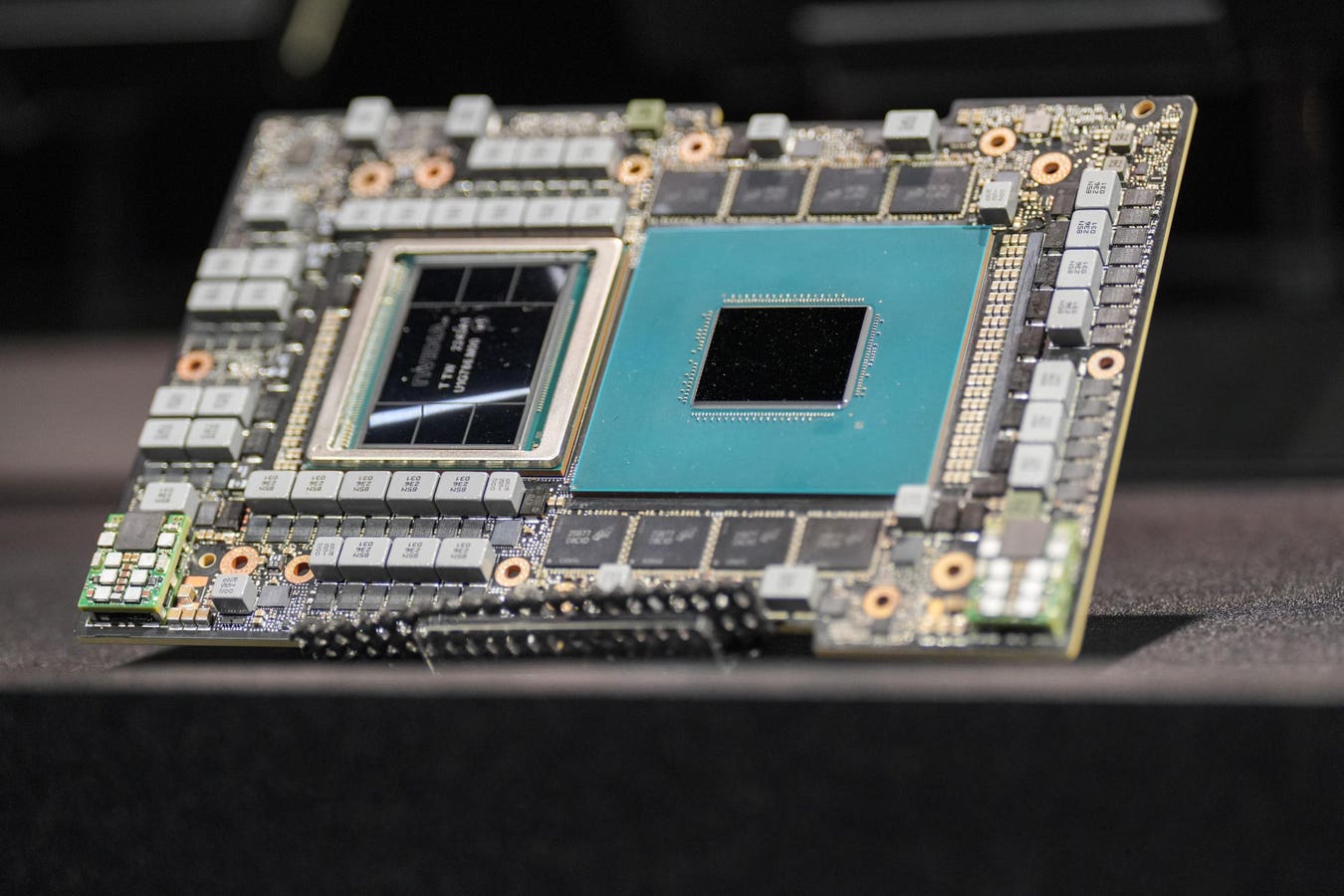

- New Restrictions Could Hamper Chip Makers

- Microsoft and Activision Merger Challenged In Court

Stocks feel like they are, as the great 60’s band “The Animals” said, in the House of the Rising Sun as they’re on pace to close the first half of the year with solid gains. Yesterday, the S&P 500 tacked on an additional 1%, putting its gains for the year at 14%. Meanwhile, the Nasdaq Composite continued its torrid pace, closing up 1.6% on the day and 30% year-to-date. However, some potential headwinds could dampen the mood today.

The Biden Administration is considering additional restrictions on chip makers and their ability to sell advanced technologies to China. Restrictions were put in place last year; however, chip makers began making alternative chips that were compliant with the restrictions, essentially exploiting a loophole. The new regulations would close that loophole. The proposed additional restrictions has shares of Nvidia down 3% premarket. Shares of Advanced Micro Devices

AMD

Elsewhere today, Microsoft

MSFT

ATVI

Also, Fed Chairman Jerome Powell is speaking today and tomorrow. I have little reason to think he will say anything new with respect to interest rates. As things currently stand, there is about a 75% probability the Fed will raise rates by a quarter point when they meet in July.

Finally, as we near the holiday weekend, market volume will likely begin drying up. Summer can often bring lower volume levels beginning around July 4th. But it’s when things are most quiet that something which would otherwise go unnoticed has potential to shake things up. Therefore, as always, I would stick with your investing plan and long term objectives.

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here