Grain markets have rallied over the past two weeks on fears that dryness in parts of the U.S. grain belt will persist well into July, which could negatively affect corn pollination and reduce yields. To be sure, timely rains could turn markets around and quickly push prices to lows not yet seen in 2023, but each day without rain at this time of year could negatively affect the amount of grain, especially corn, ultimately produced this growing season.

In its latest World Agricultural Supply and Demand Estimates (WASDE) report issued June 9, 2023 the USDA predicted a record corn yield of 181.5 bushels per acre, resulting in a large estimated increase in ending corn inventories versus last year of 805 million bushels, to 2.257 billion bushels, a stunning 55 percent increase in end of crop year corn stocks.

But there’s a catch to the prediction: the weather has to be nearly perfect to achieve what’s known in the trade as “trendline yield.” Because there have been nearly constant long term increases in corn yields over time (with occasional decreases usually caused by drought) the USDA calculates and uses trendline yields at the beginning of each season in its predictive models. Since the trendline is rising, the first WASDE estimates of the year use a higher yield than the prior year, which, by virtue of simple math, means the first trendline yield predictions each year are almost always the highest in history. Markets feel comfortable, at least for a while.

However, as the crop year progresses and actal growing conditions become apparent, the trendline yield estimate is replaced using data gathered from actual observations on farms. If the weather cooperates, yield estimates can match or even exceed the USDA’s trendline yield calculations, but if growing conditions are less than optimal for whatever reason, yield estimates are adjusted downward. The USDA publishes it’s WASDE report monthly, but farmers, private analysts, traders, and market participants of all kinds are adjusting their own yield estimates constantly; the combined result of these estimates is reflected in the price of grains and grain futures in real time every day by virtue of the free market system.

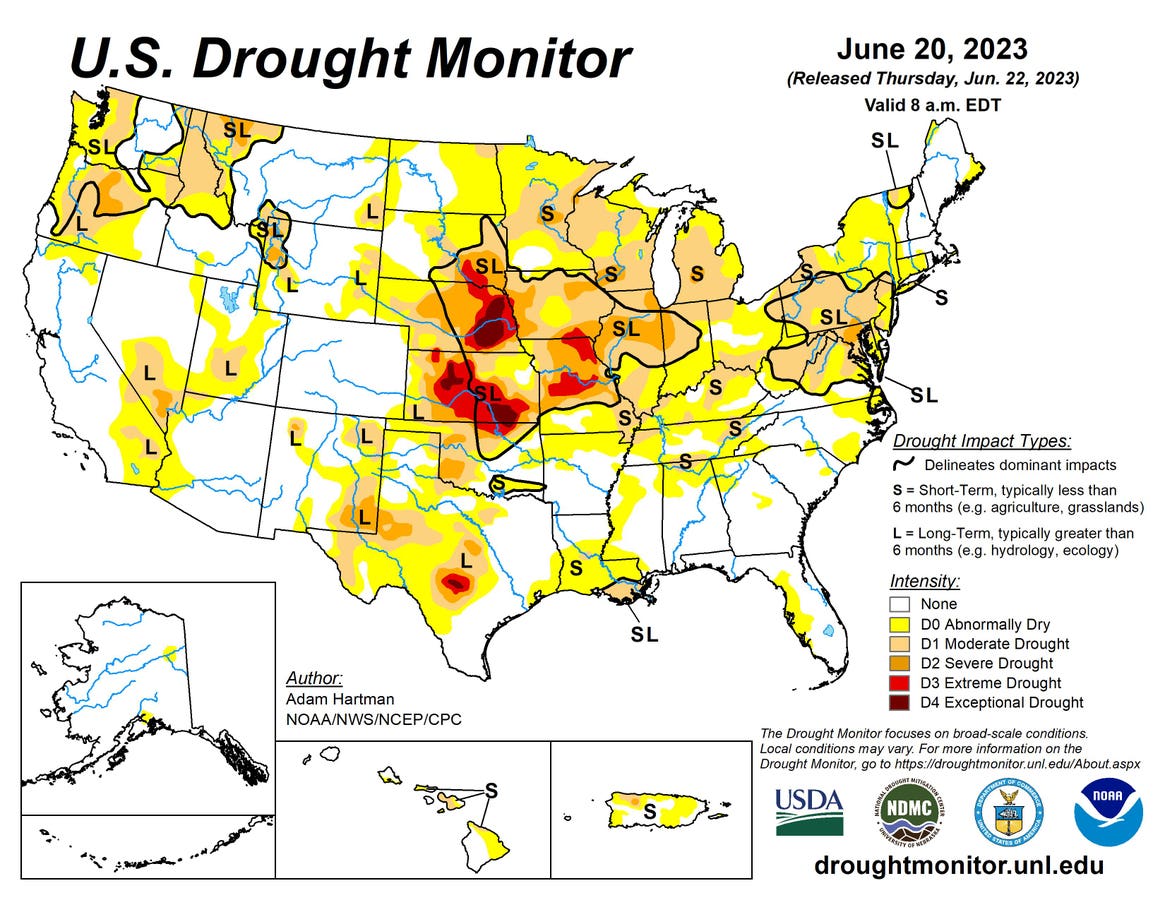

Markets are currently signalling a reduction in corn yield estimates, hence rising grain prices of late. (Corn often directionally leads grain prices, both up and down, due to its status as the largest agricultural crop grown in the U.S.) This anticipated yield reduction is a direct result of dry weather in some key growing areas of the midwest just as the corn crop is approaching the pollination stage of its growth cycle.

Currently, some corn conditions are the worst they’ve been in decades, which has corn prices rallying out of concern for the crop. In fact, the USDA says that 64% of U.S. corn production is in areas now experiencing drought.

But conditions can change rapidly; rains at the right time in the right places can turn markets around much like happened in 2012 when it didn’t look like it would rain in time for corn pollination; corn futures prices rallied to all time highs in the beginning of July 2012 and then…it rained. At that point prices began a two year bear market that sent corn futures prices back to their cost of production equivalent trading range.

The same could happen again this year; it’s not raining enough now but it could start raining and turn markets around, but it has to rain soon, that is, within the next two to four weeks as corn begins to pollinate across the corn belt. With 92 million acres of corn projected to be planted, each one bushel decrease in the predicted trendline yield of 181.5 bushels per acre theoretically shaves 92 million bushels off of this year’s corn production. For reference, last year’s yield per acre was 173.3, the year prior was 176.7. Markets are currently forecasting lower yields because weather forecasts as of this writing aren’t predicting much rain.

If things change, the old adage that “rain makes grain” will be the mantra of traders and farmers alike, and a repeat of the July 2012 price peak could be in the cards. With rain, prices will fall sharply and quickly, and corn consumers will collectively breath a sigh of relief. Without adequate rain, grain markets will likely become more volatile, and USDA corn yield and inventory predictions will be revised lower as the summer progresses. The next several weeks will be decisive for grain prices, with rain being the main determinant of direction either up or down.

Read the full article here