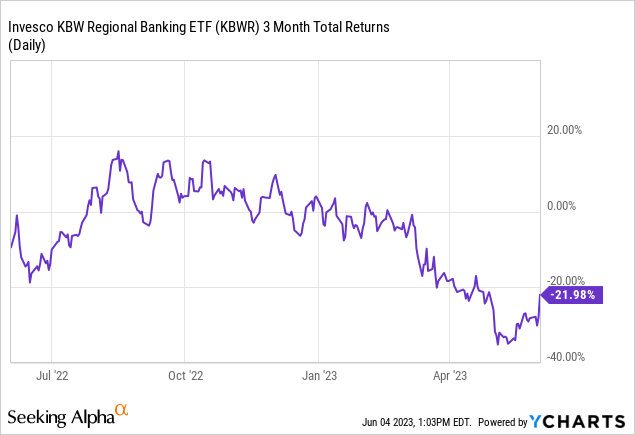

Much has been written about banks since the banking crisis began in early March. Since then, things have seemed to calm down somewhat, although bank valuations are still in the gutter. A lot of the concern is with regional banks, particularly those on the West Coast with a reliance on the tech industry, as well as other banks that either have large exposures to uninsured deposits or commercial real estate or have large losses on their fixed income investments. No bank was spared during the crisis as valuations collapsed by 22% as measured by the Invesco KBW Regional Banking ETF (KBWR) over the past 3 months.

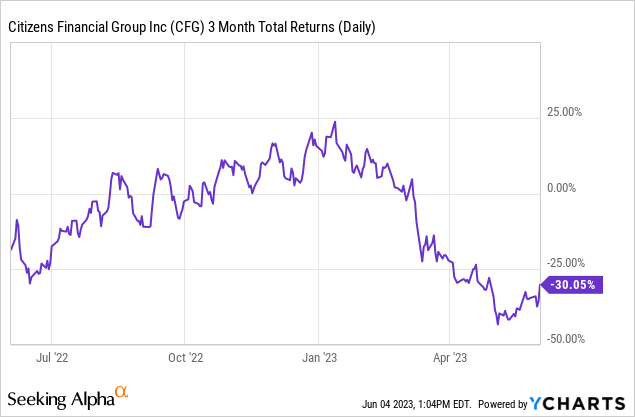

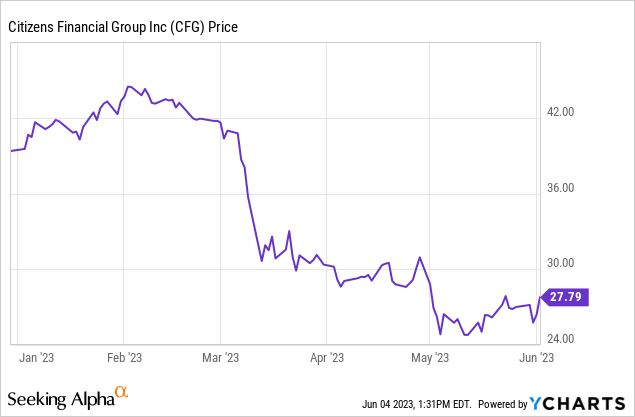

One bank in particular, Citizens Financial Group, Inc. (NYSE:CFG) has been hit particularly hard, down over 30% over the past three months.

The stock fell initially during early March in the wake of the Silicon Valley Bank failure, and then it took another leg down after its Q1 earnings report in late April. Since then, it has been rangebound between $25 and $30. Previously, I covered CFG in August 2022. I think the sell-off is overdone, and the company is in good operating shape heading into the middle of the year. This analysis will look at its Q1 earnings report, with a particular focus on profitability, deposits, liquidity, capital and credit quality.

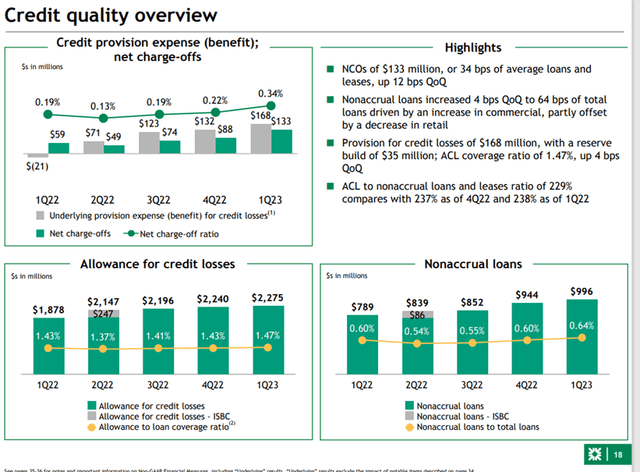

From a profitability perspective, the first quarter was fairly strong, given the circumstances. While non-interest revenues declined 2.6% from the first quarter of 2022 due to reduced capital markets activity and mortgage banking, net interest income increased 43% from a year ago. As a result, net revenues increased 29% from the year ago period, but were slightly below the fourth quarter. The provision for loan losses was $168 million for the quarter, compared to $3 million and $132 million in the first and fourth quarters of 2022, respectively. This reflects management’s assessment of increased net charge-off levels and increased focus on the CRE general office portfolio.

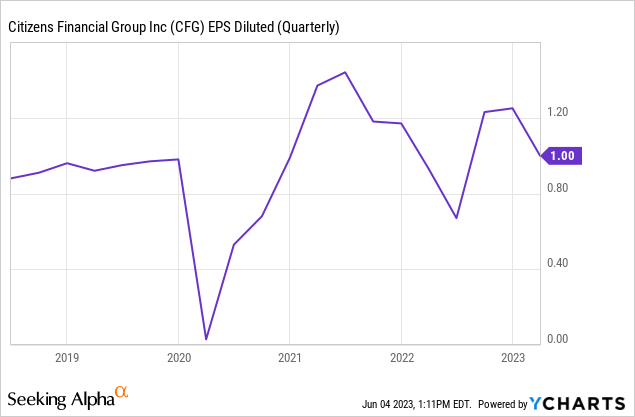

Non-interest expenses were 17% higher than in the year-ago period, driven by higher occupancy and equipment and software. Some of the increase in expense is related to the acquisitions of HSBC and Investors, both of which closed in February and April 2022, respectively. Compensation expense was 31% of net revenues, which is consistent with the historical average. The efficiency ratio was 60.9%, slightly above the historical average. I would like to see this drift downward over the next few quarters toward the five-year average of 59.7%. At the bottom line, net income was up 23% from the year-ago period and EPS increased 7.5%. It should be noted that the net income and EPS were both down about 21% from the fourth quarter numbers, but that is not uncommon in CFG’s operating history.

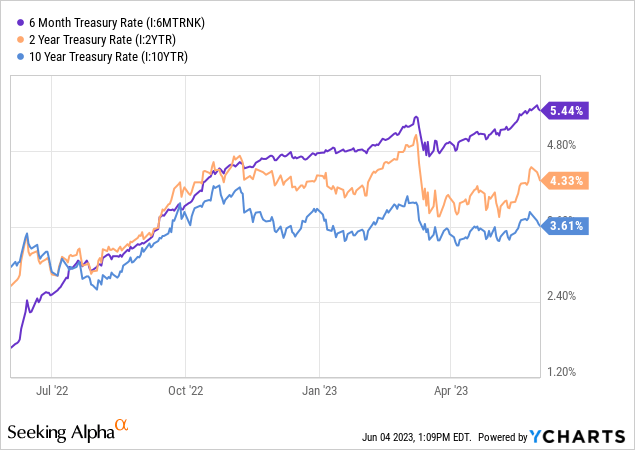

One comment on the net interest margin – the net interest spread between total earning assets and total interest-bearing liabilities decreased to 2.67% in the quarter, from 2.82% in the fourth quarter and 2.70% in the year-ago period. The big driver here is the increase in average rates paid on interest bearing deposits. A year ago, the average rate was 0.10%; it was 1.74% during the latest quarter. That is a huge jump, but it is what happens in a rising interest rate environment. The challenge for CFG and all banks is to obviously maximize the spread between assets and liabilities, something that is extremely difficult in a rising interest rate and inverted yield curve environment.

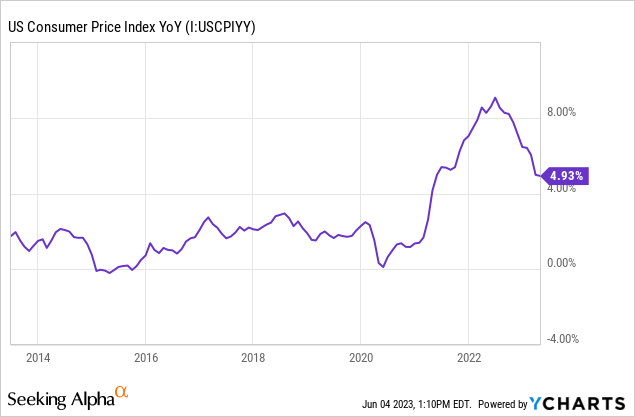

It would seem that the US Federal Reserve is near the end of its tightening cycle, so, perhaps, we have seen the worst of the carnage due to the dramatic increase in interest rates to ward off high inflation. Now, inflation has reduced, but is still well-above the Fed’s target inflation rate of 2% annually.

Overall, the company exhibited strong results given the challenging economic and financial market environments. Higher revenue, higher expenses, higher earnings per share than a year ago – I would say the profitability report for CFG looked pretty good in the first quarter.

Let’s turn to deposits, since they were at the crux of the crisis back in March. CFG reported deposits of $172 billion at the end of the first quarter, up 8.5% from a year ago, but down about 5% from the end of the year. Management noted that consumer deposits represent about 67% of total deposits and that 68% of deposits are insured by the FDIC or secured. Deposits were generally stable during the month of March. As shown in the table below, CFG compares favorably to its peer banks in both metrics:

| Q1 2003 | Total deposits (B) | Consumer % | Insured % |

| RF | $128.5 | 71% | 64% |

| CFG | $172.2 | 67% | 68% |

| FITB | $163.0 | 62% | 60% |

| KEY | $144.1 | 59% | 56% |

| HBAN | $145.3 | 56% | 69% |

| MTB | $159.1 | 53% | 64% |

Source: Company 10-Ks, company presentations

The table below shows the change in deposits for CFG and its peer companies. Year over year, the company has done well. However, compared to its peers, the sequential change in deposits was the lowest.

| Q1 2003 | YoY Deposit Growth | QoQ Deposit Growth |

| MTB | 25.9% | (2.7%) |

| CFG | 8.5% | (4.7%) |

| HBAN | (1.1%) | (1.8%) |

| KEY | (3.0%) | 1.1% |

| FITB | (4.5%) | (0.4%) |

| RF | (8.9%) | (2.5%) |

Source: Company 10-Ks, company presentations

Most of the deposit outflows were seasonal and rate-related and occurred in January and February. By March, deposits had stabilized. The company has a number of initiatives planned to help bolster its deposit base, particularly in the New York City region across both Consumer and Commercial markets.

Despite deposits declining from the end of 2022, I think that CFG is in a relatively strong position regarding the worries about sticky deposits and insured deposits. As we will see below, deposits are one component of a bank’s liquidity, and CFG has ample liquidity to weather this environment.

Liquidity can be defined as a company’s ability to meet its cash flow obligations. Banks, like CFG, have access to the banking system to provide liquidity during stressful periods. CFG has access to the Federal Reserve and the Federal Home Loan Bank, as well as through the capital markets. The company reported total available liquidity of $66 billion:

Contingent liquidity was $40.7 billion, consisting of unencumbered high-quality liquid securities of $27.3 billion, unused FHLB capacity of $6.8 billion, and our cash balances at the FRB of $6.6 billion; and

Available discount window capacity was $25.3 billion, defined as available total borrowing capacity from the FRB based on identified collateral, which is primarily secured by non-mortgage commercial and retail loans.

This available liquidity is down from the reported $72 billion at the end of 2022, with a drop in FHLB capacity and cash balances at the FRB being the largest decliners. Despite the drop in available liquidity, I still think the company is in good shape here.

This leads to the concern about capital as it pertains to banks and CFG in particular. At the end of the quarter, the company’s Common Equity Tier 1 (CET1) ratio was 10.0%, unchanged from the end of 2022. As a reminder, the CET1 ratio is common equity tier 1 capital divided by total risk-weighted assets. The company is required to have a CET1 ratio of 4.5% under the current U.S. Basel III capital framework. The ratio including losses on available-for-sale and held-to maturity securities was 8.7%

| CET1 Ratio | Q1 2023 | Q4 2022 |

| MTB | 11.5% | 11.2% |

| RF | 10.7% | 10.8% |

| HBAN | 10.2% | 10.0% |

| CFG | 10.0% | 10.0% |

| FITB | 9.3% | 9.3% |

| KEY | 9.1% | 9.1% |

Source: Company 10-Ks, company presentations

Here you can see that CFG is middle of the pack among the peer group, and unchanged from the end of the year. However, all are above the “well-capitalized” level of 6.5%.

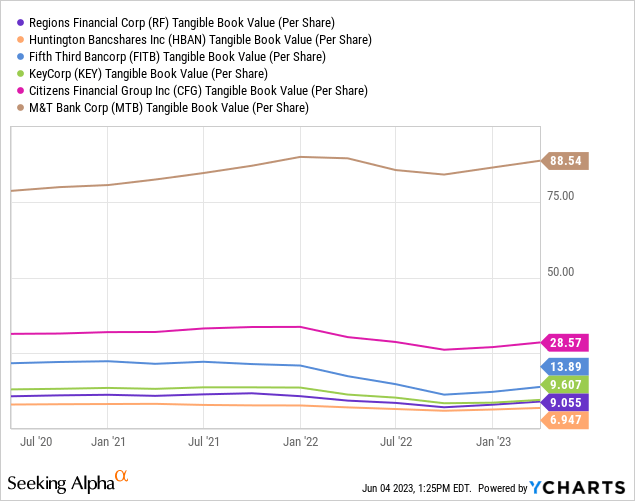

Related to capital is the book value of the company. It is hard to see in the chart below, but it appears that the book value for these banks bottomed out at the end of Q3 last year. So, hopefully, the worst is behind us for these companies. But another extended period of rising interest rates would further hinder the banks as the value of their fixed income investments would continue to fall.

Additionally, within Accumulated Other Comprehensive Income on the balance sheet, CFG reported net unrealized gains on debt securities of $347 million during the quarter, compared to a loss of $1.1 billion in the year-ago period. The company’s net unrealized losses on debt securities were $2.4 billion at the end of the quarter, compared to $2.8 billion at the end of the year. So, perhaps as interest rates stabilize, we will see an improvement among the company’s capital position and book value.

The other area of concern among bank investors is that of credit quality. There has been a drumbeat of worries about an impending recession and whether or not it will be mild or severe, short in duration or lasting many months. So far, however, this has not been the case. The latest GDP data showed a gain of 1.3% in the first quarter of 2023, following a gain of 2.1% in 2022.

The idea is that as the economy falls into a recession, bank credit quality will begin to deteriorate, resulting in banks increasing reserves and taking charges. So far, however, that has not yet been the case, and CFG is no exception. Credit quality at CFG remains in good shape and continue to normalize off of the lows hit during the pandemic years. Net charge-offs increased to 34 bps of average loans. Higher, yes, but still at a reasonable level. The Allowance for Credit Losses was fairly consistent with the past quarter, as well as the allowance to loan coverage ratio. Finally, the nonaccrual loans increased very slightly to 0.64% of total loans.

Citizens Financial Group

To me, these metrics look okay at this particular time. Sure, if the economy continues to weaken, one would expect charge-offs and nonaccrual loans to increase much more dramatically. So far, we are not yet at that point.

Lastly, the company did highlight their commercial real estate sector in their first quarter presentation. At the end of Q1, CFG had $29 billion in CRE loans, or 18.7% of the total loan portfolio. The CRE portfolio is well diversified across sectors and geographically. Also, the company is increasing its reserves, particularly in the general office space.

| CRE % of total loans | |

| FITB | 8% |

| HBAN | 14% |

| RF | 15% |

| KEY | 16% |

| CFG | 19% |

| MTB | 26% |

Source: Company 10-Ks, company presentations

CFG has a relatively high proportion of commercial real estate in their loan portfolio. Most of this is multi-family and co-op space, while the more concerning office space is only about 4% of the total loan portfolio. This is a bit of a risk in the current interest rate environment. However, CFG has a diversified loan portfolio well beyond just the higher risk office space.

As mentioned earlier, the stock has taken a pretty big hit this year:

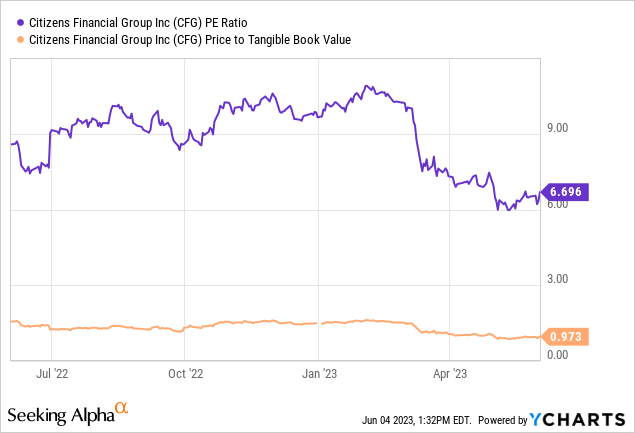

At a recent price of $27.79, CFG is trading at a P/E ratio of 6.7x and a P/TBV ratio of less than 1.0.

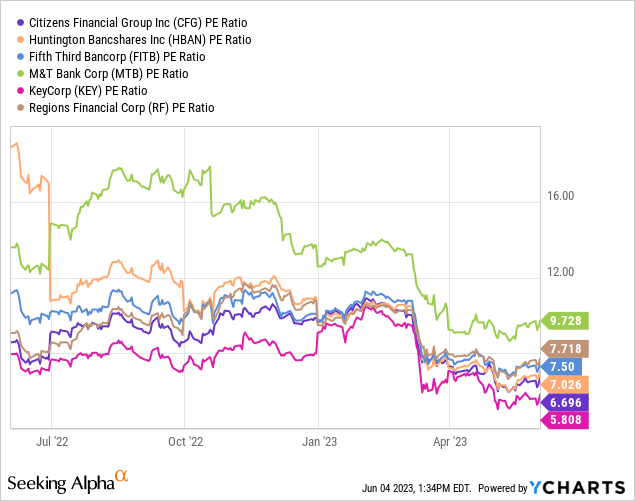

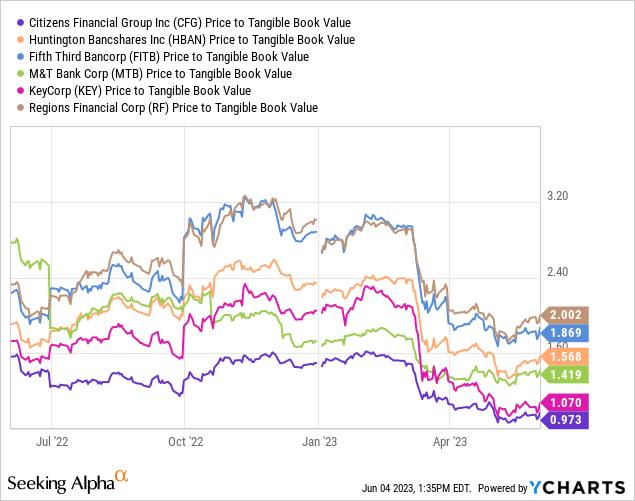

Both of these metrics compare favorably the peer companies:

Note how the valuations collapsed during March.

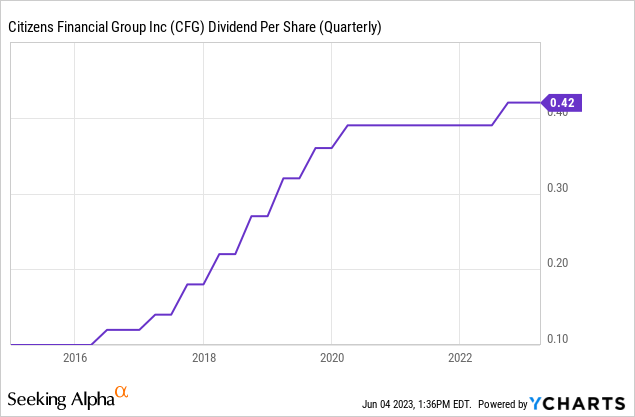

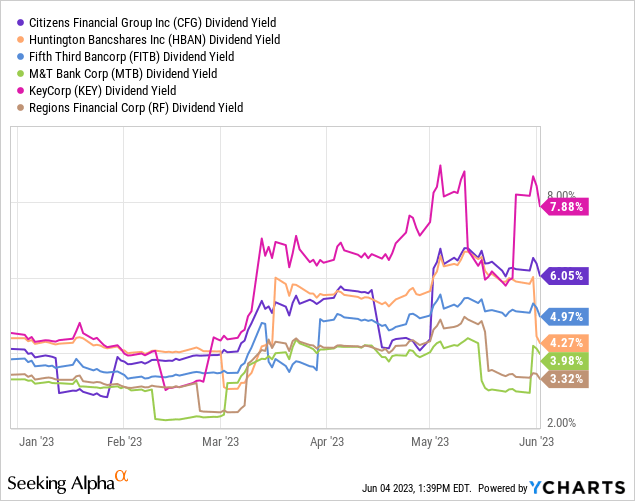

Finally, CFG has been a good dividend payer over the years.

Prior to the pandemic, the company provided steady increases each year. Since the pandemic, however, the company has been more reserved, increasing the quarterly dividend payment just once. I am hopeful that as interest rates and inflation moderate, the company will resume it’s regular dividend increases on an annual basis. Nevertheless, the dividend yield is quite attractive at these levels.

Using conservative projections, I see the stock having a value closer to about $35 per share. Based on the recent price of $27.79, this would represent a gain of 26%, plus the 6% yield on the stock. Investing in banks is not for everyone. For an industry that is so highly regulated, it is overwhelmingly volatile. But, we live in challenging times and banks are going to bear the brunt of every hiccup in our economy. CFG is a quality company, with a good operating history and solid management. If you believe that the banking landscape will stabilize and you can stomach some gyrations in the stocks, it might be a good time to add CFG to your portfolio. I would say that the banking industry presents greater risks than probably five years ago. But for those who can tolerate an elevated level of risk, CFG is probably one good bank for your portfolio.

Read the full article here