Nvidia

became the first chip company and the seventh U.S. firm to briefly join the trillion-dollar club on Tuesday. Its recent surge is all about artificial intelligence.

Nvidia (ticker: NVDA) jumped as high as $419 in intraday trading, putting Nvidia just above $1 trillion in market value. But the stock needed to remain above $404.86 to remain in the 13-figure club. Instead, shares closed the day up 3% at roughly $401.

Still, shares of the chip maker were up for the third straight day and closed at a new high.

Nvidia’s recent rally has been fueled by excitement over AI. Last week, the company forecast that its revenue in the current quarter is expected to exceed analysts’ expectation by roughly $4 billion thanks to a boost in demand for chips that power AI.

The news lifted the stock, adding roughly $184 billion in market value in a single day on Thursday.

And the rally has kept going. As of Tuesday’s close, Nvidia shares are having their best three-day stretch in more than two decades, according to Dow Jones Market Data.

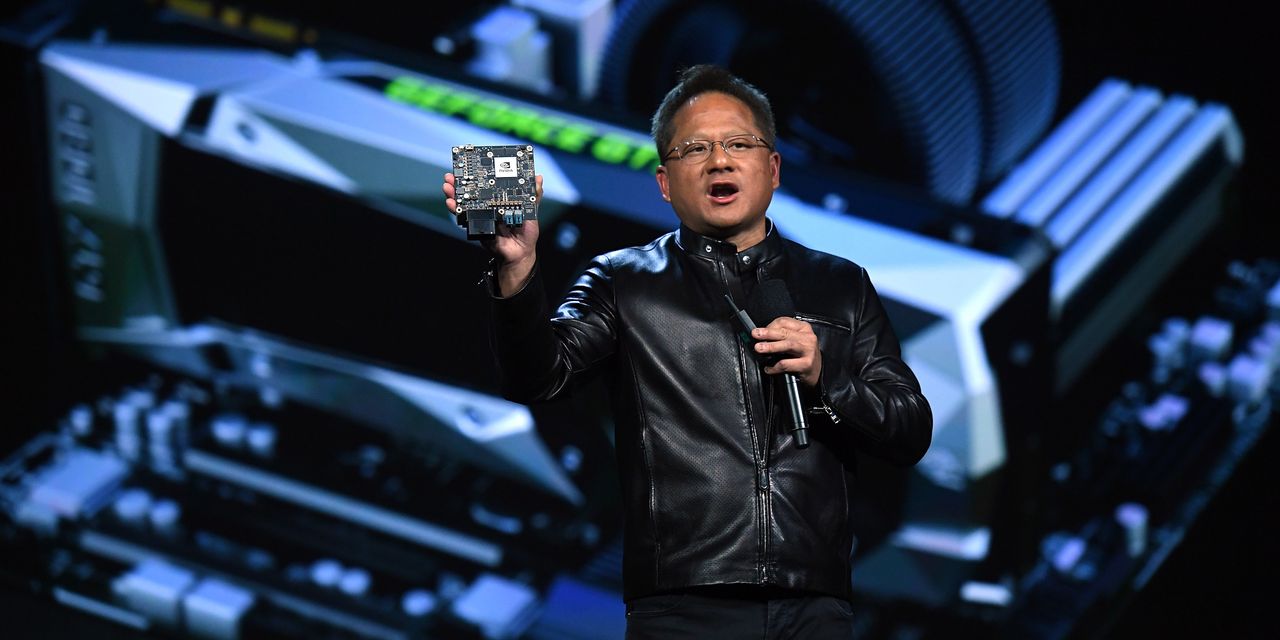

Additional enthusiasm has been generated by a series of announcements made by Nvidia at the COMPUTEX conference in Taipei, including a new supercomputer that is expected to enable the next wave of generative AI applications.

That all comes on top of an already impressive 2023 surge. Shares of Nvidia have more than doubled this year.

Whether Nvidia can stay at its current levels depends on a few things.

It isn’t uncommon for newly minted trillion-dollar companies to lose their status after entering the elusive trillion-dollar club. Both

Tesla

(TSLA) and

Facebook

-parent Meta Platforms (META) have crossed the threshold, and have since dropped in value.

Apple

(AAPL),

Amazon.

com (AMZN), Google-parent

Alphabet

(GOOGL), and

Microsoft

(MSFT) each fell after hitting the level, and have since regained their market values. Nvidia appears to be no different from these other examples, with its market cap just $10 billion shy of the $1 trillion mark based on Tuesday’s close.

Nvidia stock isn’t cheap, either: It’s the third-most expensive stock to cross the $1 trillion line. Shares trade for about 51 times estimated 2024 calendar year earnings. By comparison, Tesla traded north of 140 times when it crossed and Apple traded at a relatively meager 17 times when it first crossed.

Wall Street expects Nvidia to make roughly $9.70 earnings per share in 2024, according to FactSet. That number has climbed since last week’s earnings and forecast. Coming into the report, Wall Street was projecting closer to $6 a share. Reaching those projections will depend heavily on how long other companies continue to spend big on AI.

Nvidia’s move comes alongside a broad rally in AI-based stocks. C3.ai (AI) rose 33% and Palantir Technologies (PLTR) climbed 7.8% Tuesday.

AI-related stocks in general have provided a big boost to the

Nasdaq Composite.

The tech-heavy index is up about 24% this year. By way of comparison, the

Dow Jones Industrial Average

—which has fewer AI plays—is down about 0.3%.

Write to Adam Clark at [email protected] and Al Root at [email protected]

Read the full article here