© Reuters

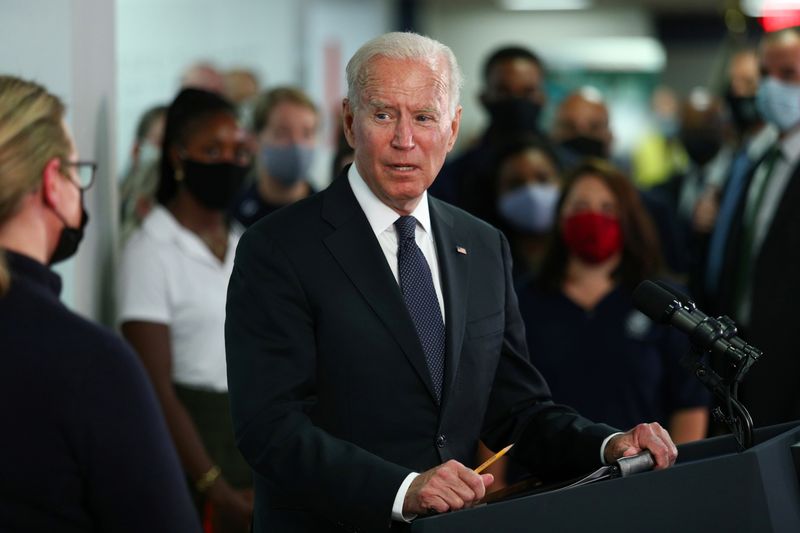

Investing.com — Chinese stock markets rebounded from recent losses on Monday, outpacing their broader Asian peers as U.S. President Joe Biden said during the G-7 summit that he sees an imminent improvement in U.S.-China relations.

Speaking at the Group of Seven summit in Japan, Biden said that the group had agreed on a united approach to China, and that he expected a thaw in relations with the country “very shortly.”

The shift in rhetoric improved sentiment toward Chinese markets, helping them recover from two straight weeks of losses. China’s and indexes rose about 0.7% and 0.4%, respectively.

Gains in Hong Kong-listed Chinese stocks pushed the up 1.7%.

Biden hinted that he could speak to Chinese President Xi Jinping soon, and that the G7 was looking at means to diversify supply chains to reduce their reliance on China.

COVID-linked disruptions in China over the past three years sent ripples across global supply chains, given the country’s key role in trade. This also saw many companies, particularly in the manufacturing sector, move to reduce their reliance on Chinese factories.

While the relaxing of most anti-COVID measures this year saw some improvement in sentiment, manufacturers have still remained cautious over China.

Biden’s comments come a few months after the U.S. shot down a Chinese balloon in U.S. airspace that it alleged was being used to conduct espionage operations. China had denied the allegations and condemned the destruction of the balloon.

The row had resulted in increased tensions between Washington and Beijing, which were in turn worsened by a clash in rhetoric over the status of Taiwan. Biden reiterated on Sunday that any action by China against Taiwan would be met with a response.

But any improvement in Sino-U.S. relations bodes well for Chinese markets, which were battered by a slew of weak economic signals in May.

While the Chinese economy grew more than expected in the first quarter, indicators for April showed a more difficult start to the second quarter. China has also presented a modest outlook for its full-year gross domestic product, at 5%.

Read the full article here